IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

1. Daily RaRe Series (RRS) Videos on High Probable Topics (Monday – Saturday)

- In video discussions, special focus is given to topics which have high probability to appear in UPSC Prelims Question Paper.

- Each session will be of 20 mins to 30 mins, which would cover rapid revision of 15 high probable topics (both static and current affairs) important for Prelims Exam this year according to the schedule.

Note – The Videos will be available only in English.

2. Rapid Revision (RaRe) Notes

- Right material plays important role in clearing the exam and Rapid Revision (RaRe) Notes will have Prelims specific subject-wise refined notes.

- The main objective is to help students revise most important topics and that too within a very short limited time frame.

Note – PDFs of Daily Tests & Solution and ‘Daily Notes’ will be updated in PDF Format which are downloadable in both English & हिंदी.

3. Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule and in the RaRe videos.

- It will ensure timely and streamlined revision of your static subjects.

4. Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

5. Daily CSAT Quiz (Monday – Satur)

- CSAT has been an achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 5 current affairs, and 5 CSAT questions. (30 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis in Both English and हिंदी.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

Download 60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

Download 60 Day Rapid Revision (RaRe) Series Notes & Solutions DAY 25– CLICK HERE

Note –

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

Important Note

- Don’t forget to post your marks in the comment section. Also, let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 30 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

Information

The following Test is based on the syllabus of 60 Days Plan-2022 for UPSC IAS Prelims 2022.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 30 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- Answered

- Review

-

Question 1 of 30

1. Question

1) Which of the following are qualifications for a person to be chosen as a member of the Parliament laid down by the Constitution?

- He must be a citizen of India.

- He must make and subscribe to an oath or affirmation before the person authorised by the election commission for this purpose.

- He must be registered as an elector for a parliamentary constituency.

Which of the above given statements are correct?

Correct

Solution (b)

Basic Info:

The Constitution lays down following qualifications for a person to be chosen a member of the Parliament:

- He must be a citizen of India.

2. He must make and subscribe to an oath or affirmation before the person authorised by the election commission for this purpose.

3. He must be not less than 30 years of age in the case of the Rajya Sabha and not less than 25 years of age in the case of the Lok Sabha.

4. He must posses other qualifications prescribed by Parliament.

The Parliament has laid down the following additional qualifications in the Representation of People Act (1951):

- He must be registered as an elector for a parliamentary constituency. This is same in the case of both, the Rajya Sabha and the Lok Sabha.

- He must be a member of a scheduled caste or scheduled tribe in any state or union territory, if he wants to contest a seat reserved for them. However, a member of scheduled castes or scheduled tribes can also contest a seat not reserved for them.

Incorrect

Solution (b)

Basic Info:

The Constitution lays down following qualifications for a person to be chosen a member of the Parliament:

- He must be a citizen of India.

2. He must make and subscribe to an oath or affirmation before the person authorised by the election commission for this purpose.

3. He must be not less than 30 years of age in the case of the Rajya Sabha and not less than 25 years of age in the case of the Lok Sabha.

4. He must posses other qualifications prescribed by Parliament.

The Parliament has laid down the following additional qualifications in the Representation of People Act (1951):

- He must be registered as an elector for a parliamentary constituency. This is same in the case of both, the Rajya Sabha and the Lok Sabha.

- He must be a member of a scheduled caste or scheduled tribe in any state or union territory, if he wants to contest a seat reserved for them. However, a member of scheduled castes or scheduled tribes can also contest a seat not reserved for them.

-

Question 2 of 30

2. Question

Consider the following differences between Adjournment Sine Die and Prorogation:

- Adjournment sine die terminates a sitting of Parliament for a definite period whereas Prorogation not only terminates a sitting but also a session of the House.

- Adjournment sine die is done by presiding officer of the House.

- Prorogation brings to an end all bills or any other business pending before the House.

Which of the following statements are incorrect?

Correct

Solution (c)

Basic Info:

Adjournment Sine Die

Adjournment sine die means terminating a sitting of Parliament for an indefinite period.It only terminates a sitting and not a session of the House.

It is done by presiding officer of the House.

It does not affect the bills or any other business pending before the House and the same can be

resumed when the House meets again.Prorogation

The presiding officer (Speaker or Chairman) declares the House adjourned sine die, when the business of a session is completed. Within the next few days, the President issues a notification for prorogation of the session. However, the President can also prorogue the House while in session.It not only terminates a sitting but also a session of the House.

It also does not affect the bills or any other business pending before the House.

Only pending notices (other than those for introducing bills) lapse on prorogation and fresh notices have to be given for the next session.

In Britain, prorogation brings to an end all bills or any other business pending before the House.

Incorrect

Solution (c)

Basic Info:

Adjournment Sine Die

Adjournment sine die means terminating a sitting of Parliament for an indefinite period.It only terminates a sitting and not a session of the House.

It is done by presiding officer of the House.

It does not affect the bills or any other business pending before the House and the same can be

resumed when the House meets again.Prorogation

The presiding officer (Speaker or Chairman) declares the House adjourned sine die, when the business of a session is completed. Within the next few days, the President issues a notification for prorogation of the session. However, the President can also prorogue the House while in session.It not only terminates a sitting but also a session of the House.

It also does not affect the bills or any other business pending before the House.

Only pending notices (other than those for introducing bills) lapse on prorogation and fresh notices have to be given for the next session.

In Britain, prorogation brings to an end all bills or any other business pending before the House.

-

Question 3 of 30

3. Question

Consider the position with respect to certain bills which are to be examined by the Committee on Government Assurances on the dissolution of the Lok Sabha:

- A bill pending in the Lok Sabha does not lapse

- A bill pending in the Rajya Sabha but not passed by the Lok Sabha does not lapse.

- A bill passed by both Houses but pending assent of the president does not lapse.

- A bill reserved for joint sitting before the dissolution of Lok Sabha, does not lapse.

Which of the following statements is/are correct?

Correct

Solution (b)

Basic Info:

When the Lok Sabha is dissolved, all business including bills, motions, resolutions, notices, petitions and so on pending before it or its committees lapse.

They must be reintroduced in the newly constituted Lok Sabha. However, some pending bills and all pending assurances that are to be examined by the Committee on Government

Assurances do not lapse on the dissolution of the Lok Sabha.The position with respect to lapsing of bills is as follows:

- A bill pending in the Lok Sabha lapses (whether originating in the Lok Sabha or transmitted to it by the Rajya Sabha).

2. A bill passed by the Lok Sabha but pending in the Rajya Sabha lapses.

3. A bill not passed by the two Houses due to disagreement and if the president has notified the holding of a joint sitting before the dissolution of Lok Sabha, does not lapse.

4. A bill pending in the Rajya Sabha but not passed by the Lok Sabha does not lapse.

5. A bill passed by both Houses but pending assent of the president does not lapse.

6. A bill passed by both Houses but returned by the president for reconsideration of Houses does not lapse.

Incorrect

Solution (b)

Basic Info:

When the Lok Sabha is dissolved, all business including bills, motions, resolutions, notices, petitions and so on pending before it or its committees lapse.

They must be reintroduced in the newly constituted Lok Sabha. However, some pending bills and all pending assurances that are to be examined by the Committee on Government

Assurances do not lapse on the dissolution of the Lok Sabha.The position with respect to lapsing of bills is as follows:

- A bill pending in the Lok Sabha lapses (whether originating in the Lok Sabha or transmitted to it by the Rajya Sabha).

2. A bill passed by the Lok Sabha but pending in the Rajya Sabha lapses.

3. A bill not passed by the two Houses due to disagreement and if the president has notified the holding of a joint sitting before the dissolution of Lok Sabha, does not lapse.

4. A bill pending in the Rajya Sabha but not passed by the Lok Sabha does not lapse.

5. A bill passed by both Houses but pending assent of the president does not lapse.

6. A bill passed by both Houses but returned by the president for reconsideration of Houses does not lapse.

-

Question 4 of 30

4. Question

Consider the following pairs regarding Parliamentary Motions:

- Substantive Motion: It is a self-contained independent proposal dealing with a very important matter.

- Substitute Motion: It is a motion that has no meaning and cannot state the decision of the House without reference to the original motion.

- Subsidiary Motion: It is a motion that is moved in place of an original motion and proposes an alternative to it.

Which of the following statements are correct?

Correct

Solution (a)

Basic Info regarding Motions:

No discussion on a matter of general public importance can take place except on a motion made with the consent of the presiding officer.

The motions moved by the members to raise discussions on various matters fall into three principal categories:

- Substantive Motion: It is a self-contained independent proposal dealing with a very important matter like impeachment of the President or removal of Chief Election Commissioner.

- Substitute Motion: It is a motion that is moved in substitution of an original motion and proposes an alternative to it. If adopted by the House, it supersedes the original motion.

- Subsidiary Motion: It is a motion that, by itself, has no meaning and cannot state the decision of the House without reference to the original motion or proceedings of the House.

It is divided into three subcategories:

(a) Ancillary Motion: It is used as the regular way of proceeding with various kinds of business.

(b) Superseding Motion: It is moved in the course of debate on another issue and seeks to supersede that issue.

(c) Amendment: It seeks to modify or substitute only a part of the original motion.Incorrect

Solution (a)

Basic Info regarding Motions:

No discussion on a matter of general public importance can take place except on a motion made with the consent of the presiding officer.

The motions moved by the members to raise discussions on various matters fall into three principal categories:

- Substantive Motion: It is a self-contained independent proposal dealing with a very important matter like impeachment of the President or removal of Chief Election Commissioner.

- Substitute Motion: It is a motion that is moved in substitution of an original motion and proposes an alternative to it. If adopted by the House, it supersedes the original motion.

- Subsidiary Motion: It is a motion that, by itself, has no meaning and cannot state the decision of the House without reference to the original motion or proceedings of the House.

It is divided into three subcategories:

(a) Ancillary Motion: It is used as the regular way of proceeding with various kinds of business.

(b) Superseding Motion: It is moved in the course of debate on another issue and seeks to supersede that issue.

(c) Amendment: It seeks to modify or substitute only a part of the original motion. -

Question 5 of 30

5. Question

With respect to Parliament which of the following Motions can be moved in Lok Sabha only?

- Privilege Motion

- Censure Motion

- Calling Attention Motion

- No-Day-Yet-Named Motion

- Cut Motions

Select from the codes given below:

Correct

Solution (c)

Basic Info:

Censure Motion: It is moved to censure the council of ministers for specific policies and actions. It can be moved only in Lok Sabha.

Call-Attention Motion: It is introduced in the Parliament by a member to call the attention of a minister to a matter of urgent public importance, and to seek an authoritative statement from him on that matter. It can be moved in Rajya Sabha as well as Lok Sabha.

Privilege Motion: It is moved by a member when he feels that a minister has committed a breach of privilege of the House or one or more of its members by withholding facts of a case or by giving wrong or distorted facts. It can be moved in Rajya Sabha as well as Lok Sabha.

Adjournment Motion: It is introduced in the Lok Sabha to draw the attention of the House to a definite matter of urgent public importance. It involves an element of censure against the government. It can be moved only in Lok Sabha.

No-Day-Yet-Named Motion: It is a motion that has been admitted by the Speaker but no date has been fixed for its discussion. It can be moved in Rajya Sabha and Lok Sabha.

No Confidence Motion: Article 75 of the Constitution says that the council of ministers shall be collectively responsible to the Lok Sabha. The motion needs the support of 50 members to be admitted. It can be moved only in Lok Sabha.

Cut Motions: A cut motion is a special power vested in members of the Lok Sabha to oppose a demand being discussed for specific allocation by the government in the Finance Bill as part of the Demand for Grants. It can be moved only in Lok Sabha.

Motion of Thanks: The first session after each general election and the first session of every fiscal year is addressed by the president. This address of the president is discussed in both the Houses of Parliament on a motion called the ‘Motion of Thanks’. This motion must be passed in the House. Otherwise, it amounts to the defeat of the government.

Incorrect

Solution (c)

Basic Info:

Censure Motion: It is moved to censure the council of ministers for specific policies and actions. It can be moved only in Lok Sabha.

Call-Attention Motion: It is introduced in the Parliament by a member to call the attention of a minister to a matter of urgent public importance, and to seek an authoritative statement from him on that matter. It can be moved in Rajya Sabha as well as Lok Sabha.

Privilege Motion: It is moved by a member when he feels that a minister has committed a breach of privilege of the House or one or more of its members by withholding facts of a case or by giving wrong or distorted facts. It can be moved in Rajya Sabha as well as Lok Sabha.

Adjournment Motion: It is introduced in the Lok Sabha to draw the attention of the House to a definite matter of urgent public importance. It involves an element of censure against the government. It can be moved only in Lok Sabha.

No-Day-Yet-Named Motion: It is a motion that has been admitted by the Speaker but no date has been fixed for its discussion. It can be moved in Rajya Sabha and Lok Sabha.

No Confidence Motion: Article 75 of the Constitution says that the council of ministers shall be collectively responsible to the Lok Sabha. The motion needs the support of 50 members to be admitted. It can be moved only in Lok Sabha.

Cut Motions: A cut motion is a special power vested in members of the Lok Sabha to oppose a demand being discussed for specific allocation by the government in the Finance Bill as part of the Demand for Grants. It can be moved only in Lok Sabha.

Motion of Thanks: The first session after each general election and the first session of every fiscal year is addressed by the president. This address of the president is discussed in both the Houses of Parliament on a motion called the ‘Motion of Thanks’. This motion must be passed in the House. Otherwise, it amounts to the defeat of the government.

-

Question 6 of 30

6. Question

Which of the following parameters are used to define “Office of Profit”?

- Office in which control over appointment, removal, and performance of the functions is done by the government.

- Office in which the government has powers of releasing the money, allotment of land, granting licenses, etc.

Select from the codes given below:

Correct

Solution (c)

Basic Info:

Office of Profit: An office of profit has been interpreted to be a position that brings to the office-holder some financial gain, or advantage, or benefit.

Four broad principles have evolved for determining whether an office attracts the constitutional disqualification on the basis of Office of Profit:

- Whether the government exercises control over appointment, removal, and performance of the functions of the office.

- Whether the office has any remuneration attached to it.

iii. Whether the body in which the office is held has government powers (releasing money, allotment of land, granting licenses etc.)

- Whether the office enables the holder to influence by way of patronage.

Incorrect

Solution (c)

Basic Info:

Office of Profit: An office of profit has been interpreted to be a position that brings to the office-holder some financial gain, or advantage, or benefit.

Four broad principles have evolved for determining whether an office attracts the constitutional disqualification on the basis of Office of Profit:

- Whether the government exercises control over appointment, removal, and performance of the functions of the office.

- Whether the office has any remuneration attached to it.

iii. Whether the body in which the office is held has government powers (releasing money, allotment of land, granting licenses etc.)

- Whether the office enables the holder to influence by way of patronage.

-

Question 7 of 30

7. Question

Which of the following departments is responsible for preparation of the Annual

Financial Statement in India?Correct

Solution (d)

Basic Info:

Preparation of the Budget (Annual Financial Statement)

– The exercise of the preparation of the budget by the ministry of finance starts sometimes around in the month of September every year. There is a budget Division of the Department of Economic affair of the ministry of finance for this purpose.– The ministry of finance compiles and coordinates the estimates of the expenditure of different ministers and departments and prepare an estimate or a plan outlay.

– Estimates of plan outlay are scrutinized by the Planning Commission. The budget proposals of finance ministers are examined by the finance ministry who has the power of making changes in them with the consultation of the prime minister.

Incorrect

Solution (d)

Basic Info:

Preparation of the Budget (Annual Financial Statement)

– The exercise of the preparation of the budget by the ministry of finance starts sometimes around in the month of September every year. There is a budget Division of the Department of Economic affair of the ministry of finance for this purpose.– The ministry of finance compiles and coordinates the estimates of the expenditure of different ministers and departments and prepare an estimate or a plan outlay.

– Estimates of plan outlay are scrutinized by the Planning Commission. The budget proposals of finance ministers are examined by the finance ministry who has the power of making changes in them with the consultation of the prime minister.

-

Question 8 of 30

8. Question

Consider the following provisions of Special Majority in the Parliament:

- Special majority constitute a majority that is, more than 50% of the total membership of the House and a majority of two-thirds of the members present and voting.

- The expression ‘total membership’ means the total number of members present at the time of voting.

Which of the following statements are correct?

Correct

Solution (a)

Basic Info:

Special majority is the majority that is, more than 50 per cent of the total membership of each House and a majority of not less than two-thirds of the members present and voting in each House.The expression ‘total membership’ means the total number of members comprising the House irrespective of the fact whether there are vacancies or absentees. Therefore, total membership includes both present and absent members.

The provisions which can be amended by this majority are:

- Fundamental Rights

- Directive Principles of State Policy

- All other provisions which are not covered under the Simple majority and special majority but with the consent of half of all the State Legislatures.

Incorrect

Solution (a)

Basic Info:

Special majority is the majority that is, more than 50 per cent of the total membership of each House and a majority of not less than two-thirds of the members present and voting in each House.The expression ‘total membership’ means the total number of members comprising the House irrespective of the fact whether there are vacancies or absentees. Therefore, total membership includes both present and absent members.

The provisions which can be amended by this majority are:

- Fundamental Rights

- Directive Principles of State Policy

- All other provisions which are not covered under the Simple majority and special majority but with the consent of half of all the State Legislatures.

-

Question 9 of 30

9. Question

Consider the following statements regarding the Joint sitting of the Parliament:

- The joint sitting is governed by the Rules of Procedure of Lok Sabha and not of the Rajya Sabha.

- Provision of joint sitting is applicable to Ordinary bills, Financial bills and Constitutional amendment bills but not to Money bills.

Which of the following statements is/are correct?

Correct

Solution (a)

Statement analysis:

Joint sitting of Parliament: As per Article 108 of Constitution, a Joint session of Parliament can be summoned under certain conditions to resolve the deadlock

The Speaker of Lok Sabha presides over a joint sitting of the two Houses and the Deputy Speaker, in his absence.

If the Deputy Speaker is also absent from a joint sitting, the Deputy Chairman of Rajya Sabha presides. If he is also absent, such other person as may be determined by the members present at the joint sitting, presides over the meeting.

The joint sitting is governed by the Rules of Procedure of Lok Sabha and not of Rajya Sabha.

The quorum to constitute a joint sitting is one-tenth of the total number of members of

the two Houses.The bills are passed by simple majority of total members present and voting. In such case bill shall be considered as deemed to have been passed by both the houses of parliament.

Provision of joint sitting is applicable to ordinary bills or financial bills only and not to money bills or Constitutional amendment bills.

Incorrect

Solution (a)

Statement analysis:

Joint sitting of Parliament: As per Article 108 of Constitution, a Joint session of Parliament can be summoned under certain conditions to resolve the deadlock

The Speaker of Lok Sabha presides over a joint sitting of the two Houses and the Deputy Speaker, in his absence.

If the Deputy Speaker is also absent from a joint sitting, the Deputy Chairman of Rajya Sabha presides. If he is also absent, such other person as may be determined by the members present at the joint sitting, presides over the meeting.

The joint sitting is governed by the Rules of Procedure of Lok Sabha and not of Rajya Sabha.

The quorum to constitute a joint sitting is one-tenth of the total number of members of

the two Houses.The bills are passed by simple majority of total members present and voting. In such case bill shall be considered as deemed to have been passed by both the houses of parliament.

Provision of joint sitting is applicable to ordinary bills or financial bills only and not to money bills or Constitutional amendment bills.

-

Question 10 of 30

10. Question

Consider the following statements regarding the Public Account Committee in Indian Parliamentary System:

- This committee was set up first in 1941 under the provisions of the Government of India Act of 1935.

- It consists of 22 members from Lok Sabha.

- A minister can be elected as a member of the committee.

Which of the following statements are correct?

Correct

Solution (c)

Basic Info:

Public Accounts committee

This committee was set up first in 1921 under the provisions of the Government of India Act of 1919 and has since been in existence.

– At present, it consists of 22 members (15 from the Lok Sabha and 7 from the Rajya Sabha).

The members are elected by the Parliament every year from amongst its members according to the principle of proportional representation by means of the single transferable vote. Thus, all parties get due representation in it.

– The term of office of the members is one year.

–A minister cannot be elected as a member of the committee.

– The chairman of the committee is appointed from amongst its members by the Speaker.

– Since 1967 a convention has developed whereby the chairman of the committee is selected invariably from the Opposition.

– The function of the committee is to examine the annual audit reports of the Comptroller

and Auditor General of India (CAG), which are laid before the Parliament by the President.Incorrect

Solution (c)

Basic Info:

Public Accounts committee

This committee was set up first in 1921 under the provisions of the Government of India Act of 1919 and has since been in existence.

– At present, it consists of 22 members (15 from the Lok Sabha and 7 from the Rajya Sabha).

The members are elected by the Parliament every year from amongst its members according to the principle of proportional representation by means of the single transferable vote. Thus, all parties get due representation in it.

– The term of office of the members is one year.

–A minister cannot be elected as a member of the committee.

– The chairman of the committee is appointed from amongst its members by the Speaker.

– Since 1967 a convention has developed whereby the chairman of the committee is selected invariably from the Opposition.

– The function of the committee is to examine the annual audit reports of the Comptroller

and Auditor General of India (CAG), which are laid before the Parliament by the President. -

Question 11 of 30

11. Question

Consider the following statements regarding Parliamentary privileges:

- The Parliamentary privileges prevail in all cases if any conflict between the privileges of an MP and the fundamental rights of citizens arise.

- In case of breach of privilege committed by the members, the House can impose punishment in the form of suspension and expulsion from the House.

Which of the following statements is/are correct?

Correct

Solution (b)

Basic Info:

The term ‘parliamentary privilege’ has two significant aspects of the law in the parliamentary form of Government: the privileges and immunities of the houses of the parliament and state assembly.

-The parliamentary privileges protect the integrity and dignity of the house of parliament and state assembly.

– Members of the parliament and state assembly carry great responsibility which includes aspiration of the people who elect their representative.

– Originally, the Constitution (Article 105) expressly mentioned two privileges, that is, freedom of speech in Parliament and right of publication of its proceedings. It should be noted here that the Parliament, till now, has not made any special law to exhaustively codify all the privileges.

They are based on five sources, namely -:

* Constitutional provisions,

* Various laws made by Parliament,

* Rules of both the Houses,

* Parliamentary conventions, and

* Judicial interpretations.– The dispute between the privileges of a MP and the fundamental rights is an evolving jurisprudence. While, in M.S.M. Sharma’s case the Supreme Court held that in case of conflict between fundamental right under Article 19 (1) (a) and a privilege under Article 194 (3) the latter would prevail. However, it also held that the proposition laid down in Sharma’s case was explained not to mean that in all cases the privileges shall override the fundamental rights.

– In case of breach of privilege or contempt committed by the members, the House can impose punishment in the form of admonition, reprimand, withdrawal from the House, suspension from the service of the House, imprisonment and expulsion from the House.

Incorrect

Solution (b)

Basic Info:

The term ‘parliamentary privilege’ has two significant aspects of the law in the parliamentary form of Government: the privileges and immunities of the houses of the parliament and state assembly.

-The parliamentary privileges protect the integrity and dignity of the house of parliament and state assembly.

– Members of the parliament and state assembly carry great responsibility which includes aspiration of the people who elect their representative.

– Originally, the Constitution (Article 105) expressly mentioned two privileges, that is, freedom of speech in Parliament and right of publication of its proceedings. It should be noted here that the Parliament, till now, has not made any special law to exhaustively codify all the privileges.

They are based on five sources, namely -:

* Constitutional provisions,

* Various laws made by Parliament,

* Rules of both the Houses,

* Parliamentary conventions, and

* Judicial interpretations.– The dispute between the privileges of a MP and the fundamental rights is an evolving jurisprudence. While, in M.S.M. Sharma’s case the Supreme Court held that in case of conflict between fundamental right under Article 19 (1) (a) and a privilege under Article 194 (3) the latter would prevail. However, it also held that the proposition laid down in Sharma’s case was explained not to mean that in all cases the privileges shall override the fundamental rights.

– In case of breach of privilege or contempt committed by the members, the House can impose punishment in the form of admonition, reprimand, withdrawal from the House, suspension from the service of the House, imprisonment and expulsion from the House.

-

Question 12 of 30

12. Question

Parliament can make laws on any matter in the State List for the implementation of international agreements:

Correct

Solution (c)

Basic Info:

Legislative Powers of the Parliament

– The Constitution empowers the Parliament to make laws on any matter enumerated in the State List without consent of any State under the following extraordinary circumstances:

When Rajya Sabha Passes a Resolution: If the Rajya Sabha declares that it is necessary in the national interest that Parliament should make laws on a matter in the State List, then the Parliament becomes competent to make laws on that matter

During a National Emergency: The Parliament acquires the power to legislate with respect to matters in the State List, while a proclamation of national emergency is in operation.

When States Make a Request: When the legislatures of two or more states pass resolutions requesting the Parliament to enact laws on a matter in the State List, then the Parliament can make laws for regulating that matter.

To Implement International Agreements: The Parliament can make laws on any matter in the State List for implementing the international treaties, agreements or conventions.

Incorrect

Solution (c)

Basic Info:

Legislative Powers of the Parliament

– The Constitution empowers the Parliament to make laws on any matter enumerated in the State List without consent of any State under the following extraordinary circumstances:

When Rajya Sabha Passes a Resolution: If the Rajya Sabha declares that it is necessary in the national interest that Parliament should make laws on a matter in the State List, then the Parliament becomes competent to make laws on that matter

During a National Emergency: The Parliament acquires the power to legislate with respect to matters in the State List, while a proclamation of national emergency is in operation.

When States Make a Request: When the legislatures of two or more states pass resolutions requesting the Parliament to enact laws on a matter in the State List, then the Parliament can make laws for regulating that matter.

To Implement International Agreements: The Parliament can make laws on any matter in the State List for implementing the international treaties, agreements or conventions.

-

Question 13 of 30

13. Question

A bill is deemed to be a money bill if it contains provisions dealing with all or any of the following matters:

- The regulation of the borrowing of money by the Union government

- The imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes.

- The appropriation of money out of the Consolidated Fund of India

Select from the codes given below:

Correct

Solution (d)

Basic Info:

Money Bills: Article 110 of the Constitution deals with the definition of money bills. It states that a bill is deemed to be a money bill if it contains ‘only’ provisions dealing with all or any of the following matters:

- The imposition, abolition, remission, alteration or regulation of any tax

2. The regulation of the borrowing of money by the Union government

3. The custody of the Consolidated Fund of India or the contingency fund of India, the payment of moneys into or the withdrawal of money from any such fund

4. The appropriation of money out of the Consolidated Fund of India

5. Declaration of any expenditure charged on the Consolidated Fund of India or increasing the amount of any such expenditure

6. The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state

7. Any matter incidental to any of the matters specified above.

However, a bill is not to be deemed to be a money bill by reason only that it provides for:

1. The imposition of fines or other pecuniary penalties

2. The demand or payment of fees for licenses or fees for services rendered

3. The imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes.Incorrect

Solution (d)

Basic Info:

Money Bills: Article 110 of the Constitution deals with the definition of money bills. It states that a bill is deemed to be a money bill if it contains ‘only’ provisions dealing with all or any of the following matters:

- The imposition, abolition, remission, alteration or regulation of any tax

2. The regulation of the borrowing of money by the Union government

3. The custody of the Consolidated Fund of India or the contingency fund of India, the payment of moneys into or the withdrawal of money from any such fund

4. The appropriation of money out of the Consolidated Fund of India

5. Declaration of any expenditure charged on the Consolidated Fund of India or increasing the amount of any such expenditure

6. The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state

7. Any matter incidental to any of the matters specified above.

However, a bill is not to be deemed to be a money bill by reason only that it provides for:

1. The imposition of fines or other pecuniary penalties

2. The demand or payment of fees for licenses or fees for services rendered

3. The imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes. -

Question 14 of 30

14. Question

Consider the following statements regarding Money Bill:

- A money bill can only be introduced in the Lok Sabha on the recommendation of the Speaker.

- It can be introduced only by a minister.

- When a money bill is presented to the president, he may either give his assent, withhold his assent or return the bill for reconsideration of the Houses.

Which of the following statements is/are correct?

Correct

Solution (c)

Important Points regarding Money Bill

The Constitution lays down a special procedure for the passing of money bills in the Parliament. A money bill can only be introduced in the Lok Sabha and that too on the recommendation of the president.

Every such bill is considered to be a government bill and can be introduced only by a minister.

If any question arises whether a bill is a money bill or not, the decision of the Speaker of the Lok Sabha is final. His decision in this regard cannot be questioned in any court of law or in the either House of Parliament or even the president.

However in Rojer Mathew v South Indian Bank Ltd 2019, it was held that the speaker’s decision was not beyond judicial review though the scope was extremely restricted.

When a money bill is transmitted to the Rajya Sabha for recommendation and presented to the president for assent, the Speaker endorses it as a money bill.

The Rajya Sabha has restricted powers with regard to a money bill. It cannot reject or amend a money bill. It can only make the recommendations. It must return the bill to the Lok Sabha

within 14 days, wither with or without recommendations. The Lok Sabha can either accept or reject all or any of the recommendations of the Rajya Sabha.When a money bill is presented to the president, he may either give his assent to the bill or withhold his assent to the bill but cannot return the bill for reconsideration of the Houses. Normally, the president gives his assent to a money bill as it is introduced in the Parliament with his prior permission.

Incorrect

Solution (c)

Important Points regarding Money Bill

The Constitution lays down a special procedure for the passing of money bills in the Parliament. A money bill can only be introduced in the Lok Sabha and that too on the recommendation of the president.

Every such bill is considered to be a government bill and can be introduced only by a minister.

If any question arises whether a bill is a money bill or not, the decision of the Speaker of the Lok Sabha is final. His decision in this regard cannot be questioned in any court of law or in the either House of Parliament or even the president.

However in Rojer Mathew v South Indian Bank Ltd 2019, it was held that the speaker’s decision was not beyond judicial review though the scope was extremely restricted.

When a money bill is transmitted to the Rajya Sabha for recommendation and presented to the president for assent, the Speaker endorses it as a money bill.

The Rajya Sabha has restricted powers with regard to a money bill. It cannot reject or amend a money bill. It can only make the recommendations. It must return the bill to the Lok Sabha

within 14 days, wither with or without recommendations. The Lok Sabha can either accept or reject all or any of the recommendations of the Rajya Sabha.When a money bill is presented to the president, he may either give his assent to the bill or withhold his assent to the bill but cannot return the bill for reconsideration of the Houses. Normally, the president gives his assent to a money bill as it is introduced in the Parliament with his prior permission.

-

Question 15 of 30

15. Question

Consider the following statements regarding Finance Bills:

- All money bills are financial bills but all financial bills are not money bills.

- All Finance bills are dealt under Article 110 of the Constitution.

- Finance Bills (I) can be introduced only in Lok Sabha

- There is no provision for joint sitting with respect to finance bills.

Which of the following statements are correct?

Correct

Solution (b)

Basic Info: Financial bills are those bills that deal with fiscal matters, that is, revenue or expenditure. However, the Constitution uses the term ‘financial bill’ in a technical sense. Financial bills are of three kinds:

1. Money bills—Article 110

2. Financial bills (I)—Article 117 (1)

3. Financial bills (II)—Article 117 (3)This classification implies that money bills are simply a species of financial bills. Hence, all money bills are financial bills but all financial bills are not money bills. Only those financial bills are money bills which contain exclusively those matters which are mentioned in Article 110 of the Constitution.

Financial Bills (I) Financial Bills (II) A financial bill (I) is a bill that contains not only any or all the matters mentioned in Article 110, but also other matters of general legislation. A financial bill (II) contains provisions involving expenditure from the Consolidated Fund of India, but does not include any of the matters mentioned in Article 110. It can be introduced only in Lok Sabha It can be introduced in Lok Sabha as well as Rajya Sabha It can be introduced only on the recommendation of the president. Recommendation of the President is not necessary for its introduction. Rajya Sabha has the power to amend or reject Financial Bill – I Rajya Sabha has the power to amend or reject Financial Bill – I In case of a disagreement between the two Houses over such a bill, the president can summon a joint sitting of the two Houses to resolve the deadlock. In case of a disagreement between the two Houses over such a bill, the President can summon a joint sitting of the two Houses to resolve the deadlock. When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration of the Houses. When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration of the Houses. Incorrect

Solution (b)

Basic Info: Financial bills are those bills that deal with fiscal matters, that is, revenue or expenditure. However, the Constitution uses the term ‘financial bill’ in a technical sense. Financial bills are of three kinds:

1. Money bills—Article 110

2. Financial bills (I)—Article 117 (1)

3. Financial bills (II)—Article 117 (3)This classification implies that money bills are simply a species of financial bills. Hence, all money bills are financial bills but all financial bills are not money bills. Only those financial bills are money bills which contain exclusively those matters which are mentioned in Article 110 of the Constitution.

Financial Bills (I) Financial Bills (II) A financial bill (I) is a bill that contains not only any or all the matters mentioned in Article 110, but also other matters of general legislation. A financial bill (II) contains provisions involving expenditure from the Consolidated Fund of India, but does not include any of the matters mentioned in Article 110. It can be introduced only in Lok Sabha It can be introduced in Lok Sabha as well as Rajya Sabha It can be introduced only on the recommendation of the president. Recommendation of the President is not necessary for its introduction. Rajya Sabha has the power to amend or reject Financial Bill – I Rajya Sabha has the power to amend or reject Financial Bill – I In case of a disagreement between the two Houses over such a bill, the president can summon a joint sitting of the two Houses to resolve the deadlock. In case of a disagreement between the two Houses over such a bill, the President can summon a joint sitting of the two Houses to resolve the deadlock. When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration of the Houses. When the bill is presented to the President, he can either give his assent to the bill or withhold his assent to the bill or return the bill for reconsideration of the Houses. -

Question 16 of 30

16. Question

With reference to a public bill which of the following statements is/are correct ?

- a) A public bill can be introduced only by a Minister

b) It must be first introduced in Lok Sabha.

c) It needs to be passed by special majority in both houses to become a law.

d) Its introduction in the House requires ten days notice.

Correct

Basic Info:

Public Bill: A public bill can be introduced only by a Minister, since all such bills are considered as government bills.

- It can be introduced in any either Lok Sabha or Rajya Sabha

- It is similar to an ordinary bill in that it needs to be passed by a simple majority.

- Its introduction in the House requires seven days’ notice.

- On the other hand, a private bill is introduced by members other than ministers in the Parliament. There is a separate day reserved for introducing private member’s bill.

Private Bill

- It is introduced by any member of Parliament other than a minister.

- It reflects the stand of opposition party on public matter.

- It has lesser chance to be approved by the Parliament.

- Its rejection by the House has no implication on the parliamentary confidence in the government or its resignation.

- Its introduction in the House requires one month’s notice.

- Its drafting is the responsibility of the member concerned.

Incorrect

Basic Info:

Public Bill: A public bill can be introduced only by a Minister, since all such bills are considered as government bills.

- It can be introduced in any either Lok Sabha or Rajya Sabha

- It is similar to an ordinary bill in that it needs to be passed by a simple majority.

- Its introduction in the House requires seven days’ notice.

- On the other hand, a private bill is introduced by members other than ministers in the Parliament. There is a separate day reserved for introducing private member’s bill.

Private Bill

- It is introduced by any member of Parliament other than a minister.

- It reflects the stand of opposition party on public matter.

- It has lesser chance to be approved by the Parliament.

- Its rejection by the House has no implication on the parliamentary confidence in the government or its resignation.

- Its introduction in the House requires one month’s notice.

- Its drafting is the responsibility of the member concerned.

- a) A public bill can be introduced only by a Minister

-

Question 17 of 30

17. Question

Consider the following statements regarding the Representation of People Act (RPA), 1951:

- Registration of Political parties is governed by the provisions of Section 29A under the RPA, 1951.

- Section 126A of the RPA deals with the prohibition of conduct of exit poll during

the period mentioned therein. - Section 8 deals with Disqualification of representatives on conviction for certain offences

Which of the following statements is/are correct?

Correct

Solution (d)

Salient Features of the Representation of People Act 1951

- Conduct of elections of the Houses of Parliament and to the House or Houses of the Legislature of each State.

- Details about the structure of administrative machinery for the conduct of elections

- Qualifications and disqualifications for membership of those Houses

- Corrupt practices and other offences at or in connection with such elections

- The decision of doubts and disputes arising out of or in connection with such elections

- By-elections to the vacant seats

- Registration of political parties

Registration of Political parties is governed by the provisions under Section 29A of the Representation of the People Act, 1951.

Section 126A of the Representation of the People Act, 1951 prohibits the conduct of exit poll and dissemination of their results during the period mentioned therein, i.e., the hour fixed for

commencement of polls in the first phase and half hour after the time fixed for close of poll for the last phase in all the States and Union TerritoriesSection 8 deals with Disqualification of representatives on conviction for certain offences

Incorrect

Solution (d)

Salient Features of the Representation of People Act 1951

- Conduct of elections of the Houses of Parliament and to the House or Houses of the Legislature of each State.

- Details about the structure of administrative machinery for the conduct of elections

- Qualifications and disqualifications for membership of those Houses

- Corrupt practices and other offences at or in connection with such elections

- The decision of doubts and disputes arising out of or in connection with such elections

- By-elections to the vacant seats

- Registration of political parties

Registration of Political parties is governed by the provisions under Section 29A of the Representation of the People Act, 1951.

Section 126A of the Representation of the People Act, 1951 prohibits the conduct of exit poll and dissemination of their results during the period mentioned therein, i.e., the hour fixed for

commencement of polls in the first phase and half hour after the time fixed for close of poll for the last phase in all the States and Union TerritoriesSection 8 deals with Disqualification of representatives on conviction for certain offences

-

Question 18 of 30

18. Question

Consider the following statements regarding Parliamentary Forums:

- They provide a platform for members to have interactions with experts and key

officials from nodal ministries. - Speaker of Lok Sabha is ex-officio President of all Parliamentary forums.

- Each Forum consists of not more than 30 members.

Which of the following statements is/are incorrect?

Correct

Solution (b)

Basic Info:

Parliamentary Forums

The first Parliamentary Forum on Water Conservation and Management was constituted in the year 2005.The objectives behind the constitution of the Parliamentary forums are:

- To provide a platform to the members to have interactions with the ministers concerned, experts and key officials from the nodal ministries with a view to have a focused and meaningful discussion on critical issues

- To sensitize members about the key areas of concern and also about the ground level situation and equip them with the latest information, knowledge, technical know-how and valuable inputs from experts both from the country and abroad

- To prepare a data-base through collection of data on critical issues from ministries concerned, reliable NGOs, newspapers, United Nations, Internet, etc.

The Speaker of Lok Sabha is the exofficio President of all the Forums except the Parliamentary Forum on Population and Public Health wherein the Chairman of Rajya Sabha is the exofficio President and the Speaker is the ex-officio Co-President.

The Deputy Chairman of Rajya Sabha, the Deputy Speaker of Lok Sabha, the concerned Ministers and the Chairmen of Departmentally-Related Standing Committees are the ex-officio Vice Presidents of the respective Forums.

Each Forum consists of not more than 31 members (excluding the President, Co President and Vice-Presidents) out of whom not more than 21 are from the Lok Sabha and not more than 10 are from the Rajya Sabha.

The meetings of the forums are held from time to time, as may be necessary, during Parliament sessions

Incorrect

Solution (b)

Basic Info:

Parliamentary Forums

The first Parliamentary Forum on Water Conservation and Management was constituted in the year 2005.The objectives behind the constitution of the Parliamentary forums are:

- To provide a platform to the members to have interactions with the ministers concerned, experts and key officials from the nodal ministries with a view to have a focused and meaningful discussion on critical issues

- To sensitize members about the key areas of concern and also about the ground level situation and equip them with the latest information, knowledge, technical know-how and valuable inputs from experts both from the country and abroad

- To prepare a data-base through collection of data on critical issues from ministries concerned, reliable NGOs, newspapers, United Nations, Internet, etc.

The Speaker of Lok Sabha is the exofficio President of all the Forums except the Parliamentary Forum on Population and Public Health wherein the Chairman of Rajya Sabha is the exofficio President and the Speaker is the ex-officio Co-President.

The Deputy Chairman of Rajya Sabha, the Deputy Speaker of Lok Sabha, the concerned Ministers and the Chairmen of Departmentally-Related Standing Committees are the ex-officio Vice Presidents of the respective Forums.

Each Forum consists of not more than 31 members (excluding the President, Co President and Vice-Presidents) out of whom not more than 21 are from the Lok Sabha and not more than 10 are from the Rajya Sabha.

The meetings of the forums are held from time to time, as may be necessary, during Parliament sessions

- They provide a platform for members to have interactions with experts and key

-

Question 19 of 30

19. Question

With reference to Departmental Standing Committees, consider the following statements:

- A minister cannot be a member of any of the departmental standing committee.

- Recommendations of departmental standing committees are binding on Parliament.

- The term of office of each standing committee is one year from the date of its constitution.

Which of the following statements is/are correct?

Correct

Solution (b)

Basic Info:

Departmental Standing Committees:

The main objective of the standing committees is to secure more accountability of the Executive (i.e., the Council of Ministers) to the Parliament, particularly financial accountability.The 24 standing committees cover under their jurisdiction all the ministries/ departments of the Central Government.

Each standing committee consists of 31 members (21 from Lok Sabha and 10 from Rajya Sabha). The members of the Lok Sabha are nominated by the Speaker from amongst its own members, just as the members of the Rajya Sabha are nominated by the Chairman from amongst its members.

A minister is not eligible to be nominated as a member of any of the standing committees. In case a member, after his nomination to any of the standing committees, is appointed a minister, he then ceases to be a member of the committee.

The term of office of each standing committee is one year from the date of its constitution.

Recommendations of these committees are advisory in nature and hence not binding on the

Parliament.Incorrect

Solution (b)

Basic Info:

Departmental Standing Committees:

The main objective of the standing committees is to secure more accountability of the Executive (i.e., the Council of Ministers) to the Parliament, particularly financial accountability.The 24 standing committees cover under their jurisdiction all the ministries/ departments of the Central Government.

Each standing committee consists of 31 members (21 from Lok Sabha and 10 from Rajya Sabha). The members of the Lok Sabha are nominated by the Speaker from amongst its own members, just as the members of the Rajya Sabha are nominated by the Chairman from amongst its members.

A minister is not eligible to be nominated as a member of any of the standing committees. In case a member, after his nomination to any of the standing committees, is appointed a minister, he then ceases to be a member of the committee.

The term of office of each standing committee is one year from the date of its constitution.

Recommendations of these committees are advisory in nature and hence not binding on the

Parliament. -

Question 20 of 30

20. Question

Consider the following pairs regarding types of Central Government Funds in India:

- Consolidated Fund of India: This fund was established by the legislature to address unexpected emergencies and is at the president’s disposal

- Contingency Fund of India: The government must obtain parliamentary authorization before withdrawing the money from this fund.

- Public Account: Deposits from provident funds, judicial deposits, savings bank deposits, departmental deposits, and remittances are all credited here.

Which of the following pairs is/are correct?

Correct

Solution (c)

Basic Info:

Consolidated Fund of India (Article 266)

- This fund receives all revenues credited to the government, all loans obtained, and all payments received as payback of loans issued. Except as provided by law, no money can be issued or withdrawn.

- This fund is generated by the following sources: direct and indirect taxes, Borrowings made by the Indian government.

- Return of loans/interests on loans to the government by anyone or any entity that has taken them.

- This fund covers all of the government’s expenses.

- The government must obtain parliamentary authorization before withdrawing the money from this fund.

- The provision for this fund is stated in Article 266(1) of the Indian Constitution.

- Each state may have its own state Consolidated Fund with the same provisions.

- The Comptroller and Auditor General of India audit these funds and report on their management to the relevant legislatures.

Contingency Fund of India (Article 267)

- This fund was established by the legislature to address unexpected emergencies.

- It is at the president’s disposal. Money can be issued pending parliamentary approval.

- The finance secretary is in charge of it, and it is run by executive order. The Secretary of the Finance Ministry manages this money on behalf of the President of India.

- The provision for this fund is contained in Article 267(1) of the Indian Constitution.

- It has a corpus of Rs 500 crores. It is in the form of an imprest (money maintained for a specific purpose).

- This fund is meant to cover unexpected or unforeseen expenses.

- Article 267(2) allows each state to create its own contingency fund of state.

Public Accounts of India (Article 266)

- Payments are normally made from this account in the form of financial transactions; it is administered by executive action, therefore parliament’s approval is not required.

- Deposits from provident funds, judicial deposits, savings bank deposits, departmental deposits, and remittances are all credited here.

- This is specified under Article 266(2) of the Constitution.

- Other than those covered by the Consolidated Fund of India, all other public money received by or on behalf of the Indian Government is credited to this account/fund.

- This is comprised of the following components:

- National defense fund, as well as a national small savings fund.

- Various ministries/departments have bank savings accounts.

- Disaster Management National Calamity & Contingency Fund (NCCF).

- Provident fund, postal insurance, and so on.

National Investment Fund (money earned from disinvestment

Incorrect

Solution (c)

Basic Info:

Consolidated Fund of India (Article 266)

- This fund receives all revenues credited to the government, all loans obtained, and all payments received as payback of loans issued. Except as provided by law, no money can be issued or withdrawn.

- This fund is generated by the following sources: direct and indirect taxes, Borrowings made by the Indian government.

- Return of loans/interests on loans to the government by anyone or any entity that has taken them.

- This fund covers all of the government’s expenses.

- The government must obtain parliamentary authorization before withdrawing the money from this fund.

- The provision for this fund is stated in Article 266(1) of the Indian Constitution.

- Each state may have its own state Consolidated Fund with the same provisions.

- The Comptroller and Auditor General of India audit these funds and report on their management to the relevant legislatures.

Contingency Fund of India (Article 267)

- This fund was established by the legislature to address unexpected emergencies.

- It is at the president’s disposal. Money can be issued pending parliamentary approval.

- The finance secretary is in charge of it, and it is run by executive order. The Secretary of the Finance Ministry manages this money on behalf of the President of India.

- The provision for this fund is contained in Article 267(1) of the Indian Constitution.

- It has a corpus of Rs 500 crores. It is in the form of an imprest (money maintained for a specific purpose).

- This fund is meant to cover unexpected or unforeseen expenses.

- Article 267(2) allows each state to create its own contingency fund of state.

Public Accounts of India (Article 266)

- Payments are normally made from this account in the form of financial transactions; it is administered by executive action, therefore parliament’s approval is not required.

- Deposits from provident funds, judicial deposits, savings bank deposits, departmental deposits, and remittances are all credited here.

- This is specified under Article 266(2) of the Constitution.

- Other than those covered by the Consolidated Fund of India, all other public money received by or on behalf of the Indian Government is credited to this account/fund.

- This is comprised of the following components:

- National defense fund, as well as a national small savings fund.

- Various ministries/departments have bank savings accounts.

- Disaster Management National Calamity & Contingency Fund (NCCF).

- Provident fund, postal insurance, and so on.

National Investment Fund (money earned from disinvestment

-

Question 21 of 30

21. Question

Consider the following statements with respect to ‘Public Accounts Committee’

- It is the oldest Parliamentary Committee and was constituted under the provisions of the Government of India Act of 1919

- The committee has no representation from Rajya Sabha

- It is constituted by Parliament each year for examination of accounts

Which of the given statement(s) above is /are correct

Correct

Solution (b)

Statement Analysis:

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct It is the oldest Parliamentary Committee and was first constituted in 1921 under the provisions of the Government of India Act of 1919 Public Accounts Committee consists of 22 Members; 15 Members are elected from Lok Sabha and 7 Members from the Rajya Sabha are associated with it It is constituted by Parliament each year for examination of accounts showing the appropriation of sums granted by Parliament for expenditure of Government of India, the annual Finance Accounts of Government of India, and such other accounts laid before Parliament as the Committee may deem fit Context – Hundred years of establishment of Public Accounts Committee.

Incorrect

Solution (b)

Statement Analysis:

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct It is the oldest Parliamentary Committee and was first constituted in 1921 under the provisions of the Government of India Act of 1919 Public Accounts Committee consists of 22 Members; 15 Members are elected from Lok Sabha and 7 Members from the Rajya Sabha are associated with it It is constituted by Parliament each year for examination of accounts showing the appropriation of sums granted by Parliament for expenditure of Government of India, the annual Finance Accounts of Government of India, and such other accounts laid before Parliament as the Committee may deem fit Context – Hundred years of establishment of Public Accounts Committee.

-

Question 22 of 30

22. Question

Consider the following statements regarding Dispute Settlement Mechanism of WTO

- Settling disputes is the responsibility of the General Council which consists of all the developed countries.

- The decision of the Appellate Body is final on the dispute

- Rulings are automatically adopted unless there is a consensus to reject a ruling

Choose the correct statements

Correct

Solution (c)

Statement Analysis:

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct Settling disputes is the responsibility of the Dispute Settlement Body (the General Council in another guise), which consists of all WTO members. The Dispute Settlement Body has the sole authority to establish “panels” of experts to consider the case, and to accept or reject the panels’ findings or the results of an appeal. The WTO Appellate Body’s decision will be considered final on the dispute. In case a country refuses to comply with the decision, it might have to face retaliatory action from other countries. This could be in the form of additional tariffs and other stringent measures. The Uruguay Round agreement also made it impossible for the country losing a case to block the adoption of the ruling. Under the previous GATT procedure, rulings could only be adopted by consensus, meaning that a single objection could block the ruling. Now, rulings are automatically adopted unless there is a consensus to reject a ruling — any country wanting to block a ruling has to persuade all other WTO members (including its adversary in the case) to share its view Context – WTO’s dispute settlement panel ruled against India regarding subsidies provided to sugarcane

Incorrect

Solution (c)

Statement Analysis:

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct Settling disputes is the responsibility of the Dispute Settlement Body (the General Council in another guise), which consists of all WTO members. The Dispute Settlement Body has the sole authority to establish “panels” of experts to consider the case, and to accept or reject the panels’ findings or the results of an appeal. The WTO Appellate Body’s decision will be considered final on the dispute. In case a country refuses to comply with the decision, it might have to face retaliatory action from other countries. This could be in the form of additional tariffs and other stringent measures. The Uruguay Round agreement also made it impossible for the country losing a case to block the adoption of the ruling. Under the previous GATT procedure, rulings could only be adopted by consensus, meaning that a single objection could block the ruling. Now, rulings are automatically adopted unless there is a consensus to reject a ruling — any country wanting to block a ruling has to persuade all other WTO members (including its adversary in the case) to share its view Context – WTO’s dispute settlement panel ruled against India regarding subsidies provided to sugarcane

-

Question 23 of 30

23. Question

‘Global Minimum Tax Rate’ is being contemplated by

Correct

Solution (a)

The global minimum corporate tax rate, abbreviated GMCT or GMCTR, is an agreement between national leaders which proposes to reduce tax competition between countries and the avoidance of corporate taxes by setting a world-wide minimum corporate tax rate. In 2019, the OECD, an intergovernmental association of mostly rich countries, began proposing a global minimum corporate tax rate.

Context – Organisation for Economic Co-operation and Development (OECD) released Pillar Two model rules for of 15% global minimum tax.

Incorrect

Solution (a)

The global minimum corporate tax rate, abbreviated GMCT or GMCTR, is an agreement between national leaders which proposes to reduce tax competition between countries and the avoidance of corporate taxes by setting a world-wide minimum corporate tax rate. In 2019, the OECD, an intergovernmental association of mostly rich countries, began proposing a global minimum corporate tax rate.

Context – Organisation for Economic Co-operation and Development (OECD) released Pillar Two model rules for of 15% global minimum tax.

-

Question 24 of 30

24. Question

Consider the following statements regarding ‘Stand-off Anti-Tank(SANT) Missile’

- It is a surface to surface missile developed indigeneously by DRDO

- It has a striking capability within a range of 50 kilometres and is equipped with a millimeter wave seeker

Select the correct statement(s)

Correct

Solution (d)

Statement Analysis:

Statement 1 Statement 2 Incorrect Incorrect Defence Research and Development Organisation (DRDO) and Indian Air Force (IAF) flight-tested the indigenously designed and developed Helicopter launched SANT Missile SANT missile is equipped with a state-of-the-art millimetre wave (MMW) seeker which provides high precision strike capability within a range of 10 kilometres. Context – SANT missile was flight tested

Incorrect

Solution (d)

Statement Analysis:

Statement 1 Statement 2 Incorrect Incorrect Defence Research and Development Organisation (DRDO) and Indian Air Force (IAF) flight-tested the indigenously designed and developed Helicopter launched SANT Missile SANT missile is equipped with a state-of-the-art millimetre wave (MMW) seeker which provides high precision strike capability within a range of 10 kilometres. Context – SANT missile was flight tested

-

Question 25 of 30

25. Question

With reference to ‘Global Methane Initiative’, consider the following statements

- It is a voluntary Government created to achieve global reduction in anthropogenic methane emission

- It was established at the recently concluded COP session of UNFCCC

Select the correct statement(s)

Correct

Solution (a)

Statement Analysis:

Statement 1 Statement 2 Correct Incorrect GMI is a voluntary Government and an informal international partnership created to achieve global reduction in anthropogenic methane emission through partnership among developed and developing countries having economies in transition It was created in 2004 and has membership from 45 countries Context – India recently chaired a meeting of GMI.

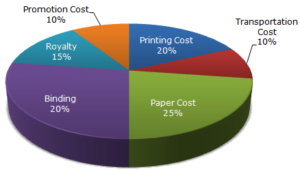

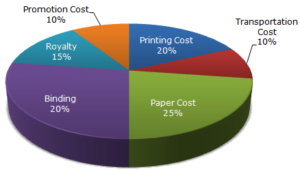

The following pie-chart shows the percentage distribution of the expenditure incurred in publishing a book. Study the pie-chart and the answer the questions based on it.

Incorrect

Incorrect

Solution (a)

Statement Analysis:

Statement 1 Statement 2 Correct Incorrect GMI is a voluntary Government and an informal international partnership created to achieve global reduction in anthropogenic methane emission through partnership among developed and developing countries having economies in transition It was created in 2004 and has membership from 45 countries Context – India recently chaired a meeting of GMI.

The following pie-chart shows the percentage distribution of the expenditure incurred in publishing a book. Study the pie-chart and the answer the questions based on it.

-

Question 26 of 30

26. Question

If for a certain quantity of books, the publisher has to pay Rs. 27,800 as printing cost, then what will be amount of royalty to be paid for these books?

Correct

Solution (c)

Let the amount of royalty to be paid for these books be ‘r’.

Then, 20 : 15 : 27800 : r

r = (15 * 27800) / 20

r = 20850

Incorrect

Solution (c)

Let the amount of royalty to be paid for these books be ‘r’.

Then, 20 : 15 : 27800 : r

r = (15 * 27800) / 20

r = 20850

-

Question 27 of 30

27. Question

What is the central angle of the sector corresponding to the expenditure incurred on Royalty?

Correct

Solution (b)

Central angle corresponding to royalty = ( 15 degrees of 360 )

= (15/100) * 360

= 54 degrees.

Incorrect

Solution (b)

Central angle corresponding to royalty = ( 15 degrees of 360 )

= (15/100) * 360

= 54 degrees.

-

Question 28 of 30

28. Question

If the difference between the two expenditures are represented by 18° in the pie-chart, then these expenditures possibly are

Correct

Solution (d)

Central angle of 18° = (18/360 x 100 ) = 5% of the total expenditure

From the given chart it is clear that:

Out of the given combinations, only in combination (d) the difference is 5% i.e.

Paper Cost – Printing Cost = (25% – 20%) of the total expenditure = 5% of the total expenditure.

Incorrect

Solution (d)

Central angle of 18° = (18/360 x 100 ) = 5% of the total expenditure

From the given chart it is clear that:

Out of the given combinations, only in combination (d) the difference is 5% i.e.

Paper Cost – Printing Cost = (25% – 20%) of the total expenditure = 5% of the total expenditure.

-

Question 29 of 30

29. Question

The price of the book is marked 20% above the C.P. If the marked price of the book is Rs. 180, then what is the cost of the paper used in a single copy of the book?

Correct

Solution (b)

Clearly, marked price of the book = 120% of C.P.

Also, cost of paper = 25% of C.P

Let the cost of paper for a single book be Rs. n.

Then, 120 : 25 = 180 : n

n = Rs. (25 x 180)/120))

n= Rs. 37.50 .

Incorrect

Solution (b)

Clearly, marked price of the book = 120% of C.P.

Also, cost of paper = 25% of C.P

Let the cost of paper for a single book be Rs. n.

Then, 120 : 25 = 180 : n

n = Rs. (25 x 180)/120))

n= Rs. 37.50 .

-