UPSC Articles

Fuel Friction between States vs Centre

Context: The Centre and the states are at loggerheads over taxes and duties on petrol and diesel.

What is the issue?

-

- As fuel prices soared in November 2021, the Centre, for the first time in over three years, cut central excise duties on petrol by Rs 5 per litre and diesel by Rs 10 per litre.

- Along with the Centre, 21 states then cut VAT in the range of Rs 1.80-10 per litre for petrol and Rs 2-7 per litre for diesel.

- The revenue loss to states due to this is estimated at 0.08% of GDP, as per the RBI’s State Finances report for 2021-22

- But the relief these moves provided was outweighed by a series of 14 price hikes in 16 days, following the lifting of a 137-day freeze after state elections in March.

- While the Centre feels the states are not reducing VAT in line with the Centre’s cut in excise duty, the states have expressed concerns over their fiscal cushion, especially with the GST compensation regime due to end in June 2022.

What is the importance of fuel taxes?

- Excise duty on fuel makes up about 18.4% of the Centre’s gross tax revenues.

- Petroleum and alcohol, on an average, account for 25-35% of states’ own tax revenue, as per the RBI’s Study of Budgets 2020-21.

- Of the revenue receipts of states, central tax transfers comprise 25-29%, and own tax revenues 45-50%.

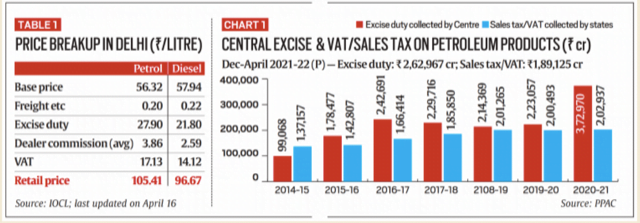

- During April-December 2021, taxes on crude oil and petroleum products had yielded Rs 3.10 lakh crore to the central exchequer, including Rs 2.63 lakh crore as excise duty, and Rs 11,661 crore as cess on crude.

- For the same period, Rs 2.07 lakh crore accrued to the states’ exchequer, of which Rs 1.89 lakh crore was through VAT.

- In 2020-21, the total central excise duty (including cesses) collected from petrol and diesel was Rs 3.72 lakh crore.

- The total tax devolved to state governments from the corpus collected under the central excise duty was Rs 19,972 crore.

- Central and state taxes currently account for about 43% and 37% of the retail price of petrol and diesel respectively in Delhi.

Why States are reluctant to centre’s call to cut taxes?

- The levies on fuel and liquor have also become an important source of revenue for states as other indirect tax revenue is routed through the GST regime.

- The switch to GST has severely curtailed the states’ flexibility to adjust revenues according to the situation. So at the moment, the only components which they can adjust are the fuel tax and excise duty on liquor. This is why states are not willing to accept interference from the Centre on these taxes.

How fuel is taxed and shared?

- States apply an ad valorem VAT or sales tax on the base price, freight charges, excise duty and dealer commission on petrol and diesel. Therefore, state collections also rise as the Centre hikes excise duties.

- Prior to the cut in excise duties on November 4, the Centre had increased excise duties by a total of Rs 13 per litre on petrol and Rs 16 per litre on diesel compared to pre-pandemic levels.

- Delhi imposes 19.4% VAT on petrol while Karnataka levies a 25.9% sales tax on petrol and 14.34% on diesel.

- Certain other states impose an ad valorem tax in addition to a flat tax per litre. Andhra Pradesh, for instance, levies Rs 4 per litre VAT and Rs 1 per litre road development cess on autofuels in addition to VAT (31% on petrol; 22.5% on diesel).

- While state VAT collections have risen along with higher fuel prices and previous hikes in excise duties, the states’ share of excise duties on fuel was reduced in the FY2022 Budget.

- It cut the Basic Excise Duty (BED) on petrol and diesel by Rs 1.6 and Rs 3 per litre respectively, cut the special additional excise duty on both by Rs 1 per litre, and introduced an Agriculture Infrastructure and Development Cess (AIDC) of Rs 2.5 per litre on petrol and Rs 4 on diesel.

- While reducing the states’ share, this did not impact pump prices since collections from cesses are not part of the shareable pool.

- Every rupee hike in excise duty roughly yields Rs 13,000-14,000 crore annually, conditional on global prices and consumption levels.

What has been the trend in oil prices?

- Ordinarily, the prices of petrol and diesel are revised daily in line with a 15-day rolling average of benchmark prices.

- However, OMCs had held prices constant starting from the excise cut on November 4, until the end of elections in five states in March.

- Since the revisions began in March, OMCs have hiked petrol prices by Rs 12 per litre and diesel prices by Rs 10 per litre.

- The price of LPG too has increased: a 15 kg cylinder now costs Rs 949.50 (up Rs 50) in Delhi.

- The price of Brent crude has increased by about $25.53 per barrel since November 4 to $106.48 per barrel. India imports about 85% of its crude oil requirements.

Connecting the dots: