Economics

Syllabus

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development.

Context: The Indian Goods and Services Tax came into force on July 1, 2017 and completes its five years of implementation. In this context, we need to analyse if it has delivered on its objective and what changes are required in the future to make it more efficient.

What is GST? How does it work?

- GST is one indirect tax for the whole nation, which will make India one unified common market.

- GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

- In the earlier indirect tax regime, the Centre could tax goods up to the production or manufacturing stage, while States collected taxes on the sale or distribution of goods. The right to tax services was vested with the Centre alone.

- Under the GST, both the Centre and the States can tax the entire supply chain in both goods as well as services – right from production to distribution.

- Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage.

- The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

- The system was supposed to be simpler with most goods falling within the tax slabs of 0, 5, 12, 18 and 28 per cent.

What are the benefits of GST?

For business and industry

- Easy compliance: A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

- Uniformity of tax rates and structures: GST will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business. In other words, GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

- Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of

This would reduce hidden costs of doing business. - Improved competitiveness: Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade (exports) and industry.

For Central and State Governments

- Simple and easy to administer: Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a robust end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

- Better controls on leakage: GST will result in better tax compliance due to a robust IT infrastructure. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an in-built mechanism in the design of GST that would incentivize tax compliance by traders.

- Higher revenue efficiency: GST is expected to decrease the cost of collection of tax revenues of the Government, and will therefore, lead to higher revenue efficiency.

For the consumer:

- Single and transparent tax proportionate to the value of goods and services: Due to multiple indirect taxes being levied by the Centre and State, with incomplete or no input tax credits available at progressive stages of value addition, the cost of most goods and services in the country today are laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Relief in overall tax burden: Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

Which taxes at the Centre and State level are being subsumed into GST?

- At the Central level, the following taxes are being subsumed:

- Central Excise Duty,

- Additional Excise Duty,

- Service Tax,

- Additional Customs Duty commonly known as Countervailing Duty, and

- Special Additional Duty of Customs.

- At the State level, the following taxes are being subsumed:

- Subsuming of State Value Added Tax/Sales Tax,

- Entertainment Tax (other than the tax levied by the local bodies),

- Central Sales Tax (levied by the Centre and collected by the States),

- Octroi and Entry tax,

- Purchase Tax,

- Luxury tax, and

- Taxes on lottery, betting and gambling

How would GST be administered in India?

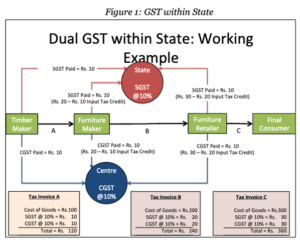

- Keeping in mind the federal structure of India, there will be two components of GST – Central GST (CGST) and State GST (SGST). Both Centre and States will simultaneously levy GST across the value chain.

- Tax will be levied on every supply of goods and services.

- Centre would levy and collect Central Goods and Services Tax (CGST), and States would levy and collect the State Goods and Services Tax (SGST) on all transactions within a State.

- The input tax credit of CGST would be available for discharging the CGST liability on the output at each stage. Similarly, the credit of SGST paid on inputs would be allowed for paying the SGST on output.

- No cross utilization of credit would be permitted.

- In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services under Article 269A (1) ofthe Constitution.

- The IGST would roughly be equal to CGST plus SGST.

- The inter-State seller would pay IGST on the sale of his goods to the Central Government. The exporting State will transfer to the Centre the credit of SGST used in payment of IGST.

- The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST.

- Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State.

How will IT be used for the implementation of GST?

- For the implementation of GST in the country, the Central and State Governments have jointly registered Goods and Services Tax Network (GSTN) as a not-for-profit, non-Government Company to provide shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders.

- The key objectives of GSTN are to provide a standard and uniform interface to the taxpayers, and shared infrastructure and services to Central and State/UT governments.

- The Government of India holds 24.5% equity in GSTN and all States of the Indian Union, including NCT of Delhi and Puducherry, and the Empowered Committee of State Finance Ministers (EC), together hold another 24.5%.

- Balance 51% equity is with non-Government financial institutions

- GSTN is responsible for developing a state-of-the-art comprehensive IT infrastructure including the common GST portal providing frontend services of registration, returns and payments to all taxpayers, as well as the backend IT modules that include processing of returns, registrations, audits, assessments, appeals, etc.

- There would no manual filing of returns. All taxes can also be paid online. All mis-matched returns would be auto- generated, and there would be no need for manual interventions. Most returns would be self-assessed.

How will imports be taxed under GST?

- The Additional Duty of Excise or CVD and the Special Additional Duty or SAD presently being levied on imports will be subsumed under GST. As per explanation to clause (1) of article 269A of the Constitution, IGST will be levied on all imports into the territory of India.

- Unlike in the present regime, the States where imported goods are consumed will now gain their share from this IGST paid on imported goods.

What is GST Council?

- GST Council is a constitutional bodyunder Article 279A and was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- It makes recommendations to the Union and State Government on issues related toGoods and Service Tax.

Members of GST Council:

- Union Finance Minister (Chairperson of Council)

- Centre’s minister of state in-charge of revenue or Finance

- Minister of revenue or finance of all the states.

Functions of GST Council:

- To recommend the tax rates

- To recommend the exemption to tax rates – some states, natural calamities, etc.

- Quorum – 50 per cent

- Weightage of votes – 1/3 for center and 2/3rd for states

- Majority – 3/4th of weighted votes.

- Also, has power to set up mechanisms to adjudicate disputes.

What was 101st Constitutional Amendment about?

- Insertion of new articles, namely, Article 246 A, Article 269 A, and Article 279A ;

- Amendment of Union List and State List contained in the Seventh Schedule of the Constitution by deleting or modified certain entries.

Article 246A:

- Power of union and state legislative to make laws for the Central and State GSTs.

- As per the recommendation of GST Council

Article 269A:

- GST on inter-state trade and commerce shall be levied and collected by centre.

- And appropriated between centre and states as recommended by GST council.

How has GST evolved with time and incorporated new measures to improve the efficiency of the system?

The last five years of the GST have seen many policy changes along with procedural and technological overhauls, some of which have completely changed the face of the tax system.

- E-invoice: The introduction of the e-invoice system in India on October 1, 2020 was an ambitious change, requiring the assessee to validate every tax invoice through the GST government portal before issuance.

- The government took a segmented approach toward the law, starting with companies having turnover above ₹500 crore.

- Currently, all companies with a turnover above ₹20 crore are included, giving the law wide coverage.

- While initially the companies faced technology-related issues, the law has been accepted as a way of doing business in India.

- E-way Bill: The government introduced the E-way Bill System on April 1, 2018, to track the movement of goods by the issuance of an electronically generated document.

- The concept of tracking of movement of goods by way of a document was not a new feature and the electronic generation of the same was seen as a positive development in the right direction.

- The IT backbone for the generation of e-way bills, after certain teething issues, has been able to sustain and the country has seen a steady increase in the number of e-way bills.

- Rate rationalisation: One of the fundamental tenets of the GST legislation is a simplified rate structure.

- The government has made steady efforts in the rationalisation of rates with the number of goods in the 28 per cent and 5 per cent brackets coming down significantly in the last five years.

- However, the presence of multiple tax rates defies the government’s objective of a simplified tax structure.

In the last five years, has GST achieved its objective?

- There are still many niggling issues, but the objective of achieving a unified indirect tax system has largely been achieved.

- Implementing a unified tax system for a country as large and as densely populated as India was a mammoth task. The on-boarding of taxpayers from the old tax regime to GST was done very efficiently.

- As on April 30, 2022, there were 1.36 crore tax payers registered on the GSTN, of which 1.17 crore are normal taxpayers and 16 lakh are composition taxpayers (paying taxes at a lower rate).

- The taxpayer base has expanded after GST implementation, with many companies asking their suppliers to register themselves to receive input tax credit seamlessly.

- Tax collections were impaired by the economic slowdown in FY20 and the pandemic, but it has improved since then to achieve record growth of over 27 per cent in FY22.

- GST revenues have scaled fresh highs in three of the first four months of 2022, going past ₹1.67 lakh crore in April.

- The requirement for filing e-invoices and the implementation of e-way bills has fortified the self-policing mechanism in the GST system.

- Digitisation of the entire system has made it easier to spot and check tax evasion.

Then, why are some states unhappy with the way GST is administered?

- GST is a destination-based tax wherein tax is collected by the State where the goods and services are sold, rather than the State where the producer is based. Some States which produce minerals, goods or agri commodities which are shipped to other States have lost a part of their revenue due to this transition.

- The GST compensation cess, which guaranteed 14 per cent growth in GST revenue over the base year of 2015-16, for the first 5 years, was to help States tide over the transition period.

- But the pandemic and the recession in FY20 has impacted State finances, making many States ask for extension of compensation payment beyond the June 30, 2022 deadline.

The amount of compensation to be distributed to each state is calculated as follows:

- Step 1:Base revenue = Tax revenue of the state in FY 2016-17.

- Step 2:Assume growth rate as 14% and calculate projected revenue for each financial year.

- The implication of projected revenue is that this would be the revenue that a state could have earned if GST were not implemented. This calculation is done for a period of five years since compensation cess is intended to be in effect for the transition period of five years.

- Step 3:Calculate the Compensation payable for each FY as follows

| Projected Revenue for that particular financial year | xxx | |

| (-) | Actual Revenue earned by the state | yyy |

| = | Compensation payable to the state | (xxx-yyy) |

- GST Compensation Cess is levied in addition to regular GST on notified goods, mostly belonging to the luxury and demerit categories. Ex Tobacco, Pan Masala, Coal, automobiles, aerated waters.

- The GST Act states that the cess collected on recommendation by the GST Council would be credited to the Cess Compensation fund.

- The proceeds will be distributed to loss-incurring States on the basis of a prescribed formula as compensation.

What more needs to be done?

- Simplification and strengthening of the GST compliance system: The GST in India continues to be compliance heavy with multiple filing requirements and lengthy return formats. This has led to high compliance costs and efforts.

- The need of the hour is to have a streamlined and limited compliance requirement with ample scope for corrections/amendments to ensure that accurate disclosure can be made with little or no difficulty/time cost.

- Further rate rationalisation: There are five broad tax rates of zero, 5%, 12%, 18% and 28%, with a cess levied over and above the 28% on some ‘sin’ goods. Special lower rates are levied on items like precious stones and diamonds. Tax experts have been flagging that these are far too many rates and do not necessarily constitute a Good and Simple Tax. Therefore, much work is required to achieve this goal.

- Need for Increased realisation: For the government, the top priority, is to rake in more revenues from simplified regime. Union govt. had stressed that the new indirect tax system was premised on a revenue-neutral tax rate of 15.5%, but actual revenues have been steadily going down taking the effective tax rate to 11.6%. The need to shore up revenues is required by enhancing tax compliance.

- Clarity on historical issues: While GST legislation was built on the service tax and value added tax frameworks, various historical issues like those about intermediary, real estate, etc., continue to persist even today.

- Constitution of the GST Appellate Tribunal: Even after five years of GST implementation, the GST Appellate Tribunal is yet to be constituted. This has led to piling of litigation, leading to high interest costs and GST refunds being stuck.

- Further, in the absence of an alternative remedy, High Courts are flooded with writ petitions

- Increased investment in technology: With technology touching all aspects of business, increased investment in technology for streamlining user interface and making it easier to use especially for small and medium enterprises may help keep Indian GST at par with the rest of the world and to fulfil the larger goal of ease of doing business.

Mains Practice Question –GST was envisaged as transformation of economic structure of the country. In its working of five years, critically examine if it has been able to achieve its stated objectives.

Note: Write answers to this question in the comment section.