Economics

In News: A critical problem faced by the Micro, Small and Medium Enterprises (MSME) sector is delayed payments.

Stats

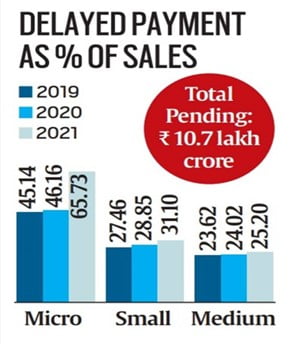

- It’s the smallest establishments — the micro and small units — which have been hit the hardest post-Covid with their pending dues touching Rs 8.73 lakh crore, almost 80 per cent of the total pending for the entire MSME sector until 2021.

- Delayed payments, as percentage of sales, have seen a sharp spike from 46.16 per cent in 2020 to 65.73 per cent in 2021 for the micro segment and from 28.85 per cent to 31.10 per cent for small units.

Reasons

- A Crisil report showed that more than a quarter of India’s MSMEs lost market share of over 3 per cent due to the pandemic.

- And half of them suffered a contraction in their earning margins because of a sharp rise in commodity prices during 2021 fiscal, compared with 2020. This is exacerbated by delayed payments.

Note:

- According to information from the Ministry of Statistics and Programme Implementation, the share of MSME in India’s manufacturing output during FY’20 was 36.9 per cent and the share of export of specified MSME-related products to all-India exportts during FY21 was 49.5 per cent.

Micro, Small and Medium Enterprises (MSME)

- Micro, Small, Medium Enterprises (MSME’s) are entities that are involved in production, manufacturing and processing of goods and commodities.

- The concept of MSME was first introduced by the government of India through the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006.

Classification of MSME’s

| Size of the Enterprise | Investment | Annual Turnover |

| Micro | Not more than Rs.1 crore | Not more than Rs. 5 crore |

| Small | Not more than Rs.10 crore | Not more than Rs. 50 crore |

| Medium | Not more than Rs.50 crore | Not more than Rs. 250 crore |

Must Read: Delayed payments – Foregoing business opportunities due to lack of liquidity

Source: Indian Express