Indian Polity & Constitution

Context: The Supreme Court will hear a review of its judgment upholding key provisions of the Prevention of Money Laundering Act (PMLA), 2002.

What was the Supreme Court ruling on PMLA?

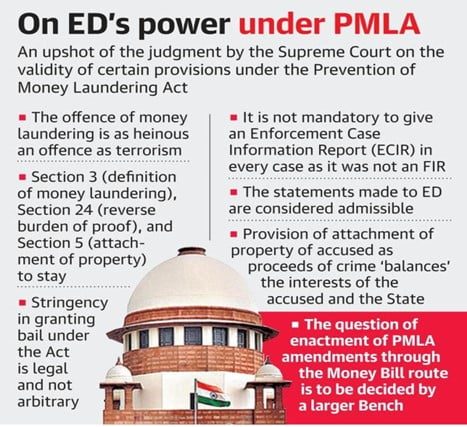

- In Vijay Madanlal Choudhary & Ors v Union of India, the Supreme Court upheld the key provisions of the PMLA.

How is a judgment reviewed?

- A ruling by the Supreme Court is final and binding.

- However, Article 137 of the Constitution grants the SC the power to review its judgments or orders.

- A review petition must be filed within 30 days of pronouncement of the judgment.

- Except in cases of death penalty, review petitions are heard through “circulation” by judges in their chambers, and not in an open court.

- The judges who passed the verdict decide on the review petition as well.

- The SC rarely entertains reviews of its rulings.

- A review is allowed on narrow grounds to correct grave errors that have resulted in a miscarriage of justice.

- “A mistake apparent on the face of record” is one of the grounds on which a case for review is made. This mistake, the court has said, must be glaring and obvious — such as relying on case law that is invalid.

Why is the PMLA verdict under review?

The key grounds on which review is sought are:

Amendments introduced as Money Bills: In 2015, 2016, 2018, and 2019, amendments including on bail and classification of predicate offences were made to the PMLA through the Finance Act.

- The PMLA amendments do not qualify as a Money Bill as defined under Article 110 of the Constitution.

- While the Court agreed that this could be a valid contention, it did not decide on the issue since the question of what qualifies as a Money Bill has been referred to a larger seven-judge Bench in another case.

Interpretation of Section 3 of the PMLA:

Section 3 of the law defines the offence of money laundering in terms of who is punishable.

- It states: “Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.”

- The SC in its verdict, accepted the government’s submission that a drafting error had crept in, and said that the expression “and” should be read as “or” in Section 3.

- This interpretation would expand the scope of the provision.

Retrospective application of the offence of money laundering:

- In its ruling, the SC said the offence of money laundering, i.e., enjoying the “proceeds of crime”, is a “continuous one”, and can be acted upon independent of when the scheduled offence was committed.

- This means holding property that is derived from an offence which may not have been a scheduled offence at the time of commission of the offence, will also be defined as money laundering.

- This is a retrospective reading of the law, and violates the fundamental right under Article 20(1) of the Constitution.

Enforcement Directorate distinct from “police”:

- The SC verdict upheld Section 50 of PMLA that empowers ED officials to record statements on oath from any person.

- This is admissible in court, unlike statements or confessions made to the police.

- The SC also said that the ED need not supply a copy of the Enforcement Case Information Report (ECIR) with an arrested person.

- This gives penal powers to the ED.

Bail provisions:

- The SC verdict, citing a compelling interest in imposing stringent bail conditions for economic offences, upheld the bail provisions under PMLA that impose a reverse burden of proof on the accused.

- But in the absence of an FIR (or equivalent), Complaint and documents relied upon by the prosecution, no accused can present facts and submissions to persuade the Special Court to believe that he is not guilty of such offence.

Must Read: Supreme Court upholds PMLA

Source: Indian Express