Economics

Context:

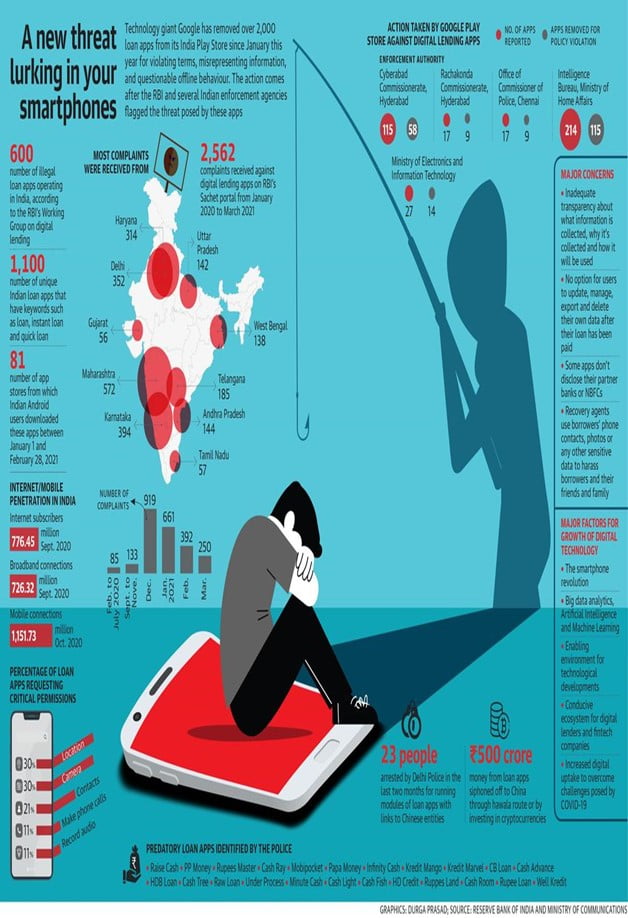

- Several Indians have ended their lives owing to harassment by recovery agents of unregulated digital lending apps mostly linked to entities based in China.

- The apps offering quick loans without much documentation or collateral to unsuspecting borrowers mushroomed in the country during the COVID-19 pandemic.

- It became a popular option for borrowing money, especially for cash-strapped families and people facing joblessness.

- However, their high interest rates, short repayment windows, coercive recovery methods and misuse of personal information have prompted the Reserve Bank of India (RBI) and Central probe agencies to crack down on the entities that run these loan apps and the payment gateways and crypto exchanges used by them to transfer overseas the money extracted from borrowers.

How it works

- The apps offer loans, ranging from ₹2,000 to ₹20,000, to thousands of customers with minimum KYC requirements and based only on online verification.

- According to the police, to provide a loan, the apps ask customers to upload their Aadhaar card, PAN card and a live photograph.

- Customers are also asked to share a One Time Password (OTP) that is generated.

- The borrowers give various permissions while activating the app, giving it complete access to their contact list, location, chats, photo gallery and camera.

- This information is then uploaded to servers hosted in China and other parts of the world.

- And the loan recovery agents operate from call centres situated in different parts of the country that have access to the data stored in these servers.

- The catch is that at the time of sanctioning the loan, 15%-25% of the amount is deducted as processing fee and the remaining sum carries an interest rate ranging from 182% to 365% per annum.

- A steep rate of penalty is added to the total repayable amount in case of default.

- The rate of recovery of loans is as high as 90%. The net profit is 25% or more.

Measures taken

- On August 10, the RBI issued its first set of guidelines to crack down on illegal activities in the digital lending industry.

- As per the new norms, all loan disbursals and repayments will be required to be executed only between the bank accounts of the borrower and the regulated entities — such as a bank or an NBFC — without any pass-through or pool account of the lending service providers or any third party.

- The norms are designed to end regulatory arbitrage and protect customers, and puts the onus on the regulated entities on behalf of whom the apps do the lending.

Going forward the passage of a law banning lending by unauthorised entities and the creation of a self-regulatory organisation for digital lenders will bring transparency to the industry.

Must Read: Digital lending – Comprehensively covered

Source: The Hindu