Economics, Governance

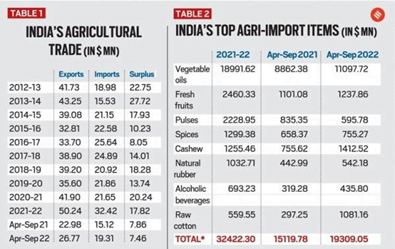

Context: India’s agriculture exports have grown 16.5% year-on-year in April-September, and look set to surpass the record $50.2 billion achieved in 2021-22 (April-March).

- Interestingly, even commodities whose exports have been subjected to curbs — wheat, rice and sugar have shown significant rise in export.

Key Facts about India’s Exports:

- The government had, on May 13, banned the export of wheat. Yet, according to Commerce Ministry data, wheat exports, at 45.90 lakh tonnes during the April-September period, were nearly twice the 23.76 lakh tonnes for the same period last year.

- On May 24, sugar exports were moved from the “free” to “restricted” list. Also, total exports for the 2021-22 sugar year (October-September) were capped at 100 lt. On September 8, exports of broken rice were prohibited, and a 20% duty slapped on all other non-parboiled non-basmati shipments.

- Despite these measures, non-basmati exports have risen alongside that of basmati rice (from 19.46 to 21.57 lakh tonnes). Sugar exports, likewise, grew 45.5% in value terms to $2.65 billion during April-September.

However, imports surging even more:

- The impressive growth in exports is, however, offset somewhat by imports that have surged even more.

- The surplus in agricultural trade matters because this is one sector, apart from software services, where India has some comparative advantage.

- To put things in perspective, India’s deficit in its overall merchandise trade account (exports minus imports of goods) widened from $76.25 billion in April-September 2021 to $146.55 billion in April-September this year.

- During the same period, the surplus in agriculture trade reduced only a tad, from $7.86 billion to $7.46 billion.

- The above table shows that almost 60% of India’s total Agri imports is accounted for by a single commodity: vegetable oils.

- Their imports were valued at a massive $19 billion in 2021-22, and imports have increased by more than 25% in the first half of this fiscal. Vegetable oils are today the country’s fifth biggest import item after petroleum, electronics, gold, and coal.

- In order to counter it, two major decisions taken by the government last month.

- The first is the raising of the minimum support price of mustard from Rs 5,050 to Rs 5,450 per quintal for the 2022-23 crop season.

- The second decision has been to grant clearance (“environmental release”) for commercial cultivation of genetically modified (GM) hybrid mustard.

- Seed yields from the transgenic mustard DMH-11, bred by Delhi University scientists, are claimed to be 25-30% more than from currently-grown popular varieties.

- Besides, the “barnase-barstar” GM technology is seen as a robust platform, which can be used to develop new mustard hybrids giving higher yields than DMH-11 and with better disease-resistance or oil quality traits.

- A similar approach, aimed at boosting domestic output and yields, may be required in cotton.

- Insect pest-resistant GM Bt technology helped nearly treble India’s cotton production from 140 lakh bales in 2000-01 to 398 lakh bales in 2013-14, and exports to peak at $4.33 billion in 2011-12.

Recent trends in composition of trade:

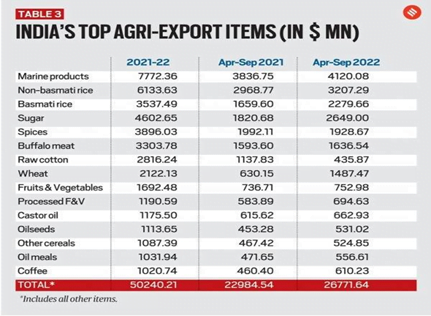

- The above table shows India’s top agriculture export items. As many as 15 of them individually grossed more than $1 billion in revenue during 2021-22.

- All barring two (cotton and spices) have posted positive growth in the first half of the current fiscal too.

- In cotton, not only have exports collapsed from over $1.1 billion in April-September 2021 to $436 million in April-September 2022, imports have soared from below $300 million to $1.1 billion.

- This has primarily been due to lower domestic production — the 2021-22 crop was estimated at just 307.05 lakh bales (of 170 kg each), as against 353 lakh bales and 365 lakh bales in the preceding two years — forcing mills to import. In the process, India has turned a net cotton importer.

- Equally interesting is spices, where India’s exports in recent times have been powered mainly by chilli, mint products, oils & oleoresins, cumin, turmeric, and ginger.

- On the other hand, in traditional plantation spices such as pepper and cardamom, the country has become as much an importer as an exporter.

- India has been out-priced by Vietnam, Sri Lanka, Indonesia, and Brazil in pepper, while it has lost market share to Guatemala in cardamom.

- Another traditional export item where India has largely turned an importer is cashew. In 2021-22, the country’s cashew exports were valued at $453.08 million, compared to imports of $1.26 billion.

- Imports have further shot up to $1.4 billion-plus during the first six months of this fiscal alone.

Way Forward:

- Therefore, diversification of export basket of agricultural commodities will lead to rise in export of agricultural commodities which will help in Balance of Payments along with rising the income of farmers.

- Along with it, use of state of art technology such as GM based crops should also be promoted in order to increase the production certain production deficit crops. So that in place of net importer, Indian become net export of those crops.

Source: Indian Express