Economics, Environment & Ecology

Context: The Government and the RBI have decided to issue sovereign green bonds during Q4 of FY23. The finance minister in her Budget 2022 speech announced the government’s promise to issue a sovereign green bond to boost green investment.

About Bond:

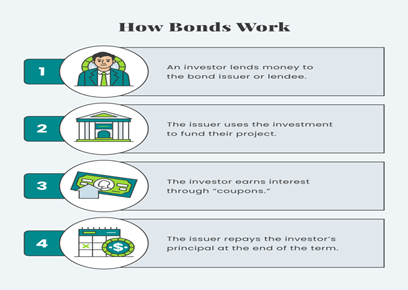

- A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).

- A bond could be thought of as an (I owe you) I.O.U. between the lender and borrower that includes the details of the loan and its payments.

- Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations.

- Owners of bonds are debtholders, or creditors, of the issuer.

About Sovereign Green Bonds:

- It is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects.

- The first green bond was issued in 2007 by the European Investment Bank, the EU’s lending arm.

- This was followed a year later by the World Bank. Since then, many governments and corporations have entered the market to finance green projects.

- As a part of the Government’s overall market borrowings in 2022-23, sovereign green bonds will be issued for mobilising resources for green infrastructure.

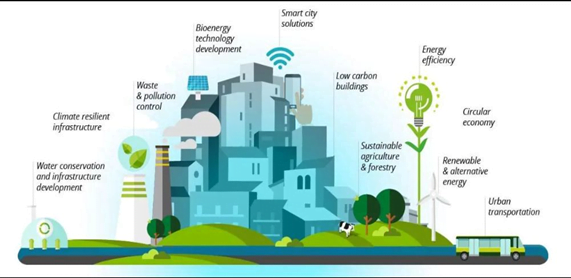

- A project is classified “green” on the basis of four key principles. These include:

- encouraging energy efficiency in resource utilisation,

- reducing carbon emissions and greenhouse gases,

- promoting climate resilience and

- improving natural ecosystems and biodiversity, especially in accordance with SDG (Sustainable Development Goals).

Aims and Objectives of SGB:

- They are aimed at energy efficiency, pollution prevention, sustainable agriculture, fishery and forestry, the protection of aquatic and terrestrial ecosystems, clean transportation, clean water, and sustainable water management.

- They also finance the cultivation of environmentally friendly technologies and the mitigation of climate change.

How are they different from conventional government bonds?

- Government bonds or government securities (G-Secs) are normally categorised into two — Treasury Bills and Dated or Long-Term Securities.

- Treasury Bills have a maturity of less than one year and they do not carry coupon rates. These are issued at a discount, while redeemed at face value.

- Dated Or Long-term securities are issued for a period above 1 year and up to 40 years. These bonds carry coupon rates and are tradable in the securities market.

- SGB is one form of dated security. It will have a tenor and interest rate. Money raised through SGrB is part of overall government borrowing.

- SGB may carry lower interest rate than that for regular government borrowings.

- The government and the RBI decided to borrow ₹5.92 lakh crore in H2 FY23 through dated securities, including ₹16,000 crore through issuance of SGBs.

Benefits of investing in Sovereign green bonds:

- Environmental causes: green bonds provide a way to help environmental causes through investing.

- Buying a green bond might be too costly for retail investors: Still there are green bonds that make it easy to invest in baskets of green bonds.

- Exemption from taxes: green bonds provide you with a way to earn income that is exempt from taxes.

- No Harm: The money that is being invested is being used in a way that is not harmful.

- Fight climate change: The green angle attracts a growing number of people who are more aware of and want to act to help fight climate change.

- Higher demand for green bonds equals lower cost of money which means reduced spending for business: These savings are passed on to the investor in the form of a dividend or used to lower the cost of funds thus increasing profitability.

- Some issuers also use the money to help restore water habitats and biomes and to take steps to reduce carbon output: These bonds tend to carry the same credit rating as other debts issued by the same firm.

- Longer maturities can lower the borrowing cost for green projects: Sovereign green bonds have been issued with an average tenor of 14 years the longest being 40 years issued by the Chilean government in 2021 drawing long-term investors like pension funds, insurers and those with a focus on environmental, social and governance (ESG) issues.

Challenges associated with Sovereign Green Bonds:

- Borrowing programme: The government has a gross borrowing programme of around 14.95-lakh crore. But in this case, there will be earmarking of the amount raised to specific targeted projects. Therefore, the crux is that the recipients of such funds should be compliant.

- Monitoring challenge: There would be a challenge with respect to monitoring how this green grading performs. This will be a challenge until such time the system of evaluation is streamlined as deviations from the norm are hard to capture.

- Pricing issue: Should they be lower than the regular bond or higher is the major question here. Ideally, it needs to be higher; this is because investors need to be rewarded for choosing to promote ESG goals.

- On the other side it can be argued that the rates can be lower than normal because investors like to reward green projects, anyway.

- Overseas launch: The downside is that once the government goes global, then credit rating will matter a lot as all bonds issued globally need to be rated.

- Once one is rated by them, there is constant scrutiny on domestic policies. Presently, this does not matter because the government of India does not borrow from the overseas market.

Way Forward:

- Centre’s approval to the framework for sovereign green bonds will definitely solidify India’s commitment towards its Nationally Determined Contribution targets.

- The flows from green bonds could be derailed for some time due to the war between Ukraine and Russia but over the long term we should be moving ahead fast in reshaping the climate debate and ensuring more funding for climate friendly initiatives.

- Developing markets, including Serbia, Nigeria, Egypt, Colombia, Fiji, Indonesia and Benin, have also issued sovereign green bonds.

- The proceeds were allocated to climate mitigation or adaptation projects.

Source: The Hindu

Previous Year Question

Q.1) With reference to the India economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

- Government can reduce the coupon rates on its borrowing by way of IIBs.

- IIGs provide protection to the investors from uncertainty regarding inflation.

- The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct? (2022)

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3