Economics

Syllabus

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-3: Science & Technology

Context: On January 10, the National Payments Corporation of India (NPCI) paved the way for international (phone) numbers to be able to transact using UPI.

- A day later, the Union Cabinet chaired by Prime Minister Narendra Modi approved an incentive scheme for promotion of RuPay debit Cards and low-value BHIM-UPI transactions (person-to-merchant) in FY 2022-23. The scheme has an outlay of Rs 2,600 crore.

- These measures could prove significant for the UPI-based payment ecosystem which has largely witnessed a sequential rise in the previous calendar year.

What is UPI?

- Unified Payments Interface (UPI) is a common platform through which a person can transfer money from his bank account to any other bank account in the country instantly using nothing but his/her UPI ID.

- It was launched in 2016 as Mobile First digital payments platform

- It enables immediate money transfer through mobile device round the clock 24*7 and 365 days based on the Immediate Payment Service (IMPS) platform so as to make cashless payments faster, easier and smoother.

- UPI is completely interoperable and as such, it is unique in the world, where you have an interoperable system on the ‘send’ and ‘receive’ side

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

- Developed by: National Payments Corporation of India (NPCI) under the guidance from RBI.

- NPCI, an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

- It is a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013), with an intention to provide infrastructure to the entire Banking system in India for physical as well as electronic payment and settlement systems.

- According to the Reserve Bank of India’s Payment Vision 2025, UPI is expected to register an average annualised growth of 50 per cent

How is it unique?

- Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

- Virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

- QR Code

- Best answer to Cash on Delivery hassle, running to an ATM or rendering exact amount.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments.

- Donations, Collections, Disbursements Scalable.

- Raising Complaint from Mobile App directly.

The popularity of UPI is evident — from tiny roadside shops to large brands, many merchants accept UPI-based payments. The primary reasons for this penetration are:

- UPI accepts transactions as small as one rupee and for merchants, the absence of Merchant Discount Rate that they have to pay to their banks that acts as a significant incentive to accept UPI payments.

- The presence of high-speed internet in many parts of the country, technologies that power a smartphone, cloud computing and modern software engineering technologies that fulfil a transaction in a few seconds.

What are the benefits of UPI to the Ecosystem participants?

For Banks

- Single click Two Factor authentication

- Universal Application for transaction

- Leveraging existing infrastructure

- Safer, Secured and Innovative

- Payment basis Single/ Unique Identifier

- Enable seamless merchant transactions

For Merchants

- Seamless fund collection from customers – single identifiers

- No risk of storing customer’s virtual address like in Cards

- Tap customers not having credit/debit cards

- Suitable for e-Com & m-Com transaction

- Resolves the Cash On Delivery collection problem

For Customers

- Round the clock availability

- Single Application for accessing different bank accounts

- Use of Virtual ID is more secure, no credential sharing

- Single click authentication

- Raise Complaint from Mobile App directly

How is UPI placed in our overall payment ecosystem?

- As of January 17, 3,192.70 million transactions approximately worth Rs 5.52 lakh crore have been facilitated using UPI in the ongoing month, as per NPCI data.

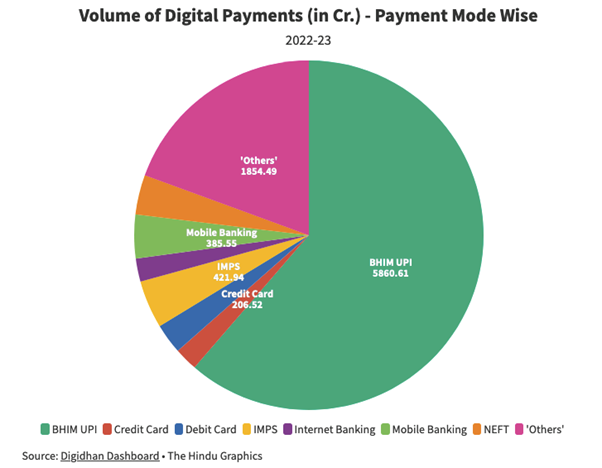

- As per the DigiDhan dashboard maintained by the Ministry of Electronics and Information Technology (MeitY), BHIM-UPI accounted for 52% of all digital payments in FY 2021-22. At present, it stands at 61.38%.

- The Bharat Interface for Money (BHIM) is a payment app that lets the user make digital transactions using the Unified Payments Interface (UPI).

What is the significance of UPI?

- Convenience to All stakeholders: It created interoperability between all sources and recipients of funds (consumers, businesses, fintechs, wallets, 140 member banks). It allows for instant settlement in fiat money – Convenience to consumers and merchants.

- Promotes Formalisation and Digital Banking: UPI has now become the most dominant way to pay in the offline and online place especially for retail payments, and has thus helped in driving the digital banking.

- Move towards less-cash Economy: UPI manages to materially reduce the need for the public to deal in cash. If the demand for paper currency diminishes, banks would save on the logistics costs involved in safely storing and transporting paper currency and regularly refilling their ATMs.

- Increasing tax revenue: With digitalization, the market’s black money can be diminished, increasing compliance and increasing tax revenue.

- Strengthen Banking Health: UPI’s use prompts bank account holders to hold larger balances in their savings accounts, providing banks with a low-cost source of funds.

- Blunted data monopolies – Big tech payment firms have strong autonomy but weak fiduciary responsibilities over customer data. UPI which is based on open framework thus enables any new startup to easily launch their payment solution.

- Soft Power: It enables India to emerge as frontrunner in fintech & payment solutions across world. In 2020, Google requested the U.S. Federal Reserve to develop a solution similar to India’s UPI citing the thoughtful planning, design and implementation behind it.

What about international on-boarding?

- In a nutshell, non-resident accounts such as non-resident external accounts (NRE) and non-resident ordinary accounts (NRO), having international numbers, will now be allowed into the UPI payment system.

- NPCI had allowed UPI transactions to and from NRO/NRE accounts linked to Indian numbers back in October 2018.

- NRE accounts are those used by non-residents to transfer earnings from foreign soil to India while NRO accounts are used to manage income earned in India by non-residents.

- At present, users from ten countries will be able to avail the facility— Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the United States of America, Saudi Arabia, United Arab Emirates, United Kingdom and Hong Kong. More inclusions are likely in the future.

- All members of the interface, such as banks and payments platforms, have till April 30 to comply with the guidelines.

- The development would allow NRIs to use the payment method for making utility bill payments for their families (or themselves) in India, make purchases from e-commerce or online platforms and make payments to physical merchants who accept UPI QR based payments when they travel to India.

- Currently, all the internal systems as well as ecosystem players such as banks, NPCI, etc only understand India-based mobile numbers for UPI transactions. With this enablement, a significant number of systems will need to start understanding the same. This might also require changes in integration with SMS service providers and international telecom networks.

What incentives are being offered?

- Under the scheme, acquiring banks will be given financial incentives for promoting point-of-sale and e-commerce transactions using RuPay debit Cards and low-value BHIM-UPI transactions (person-to-merchant) for the ongoing financial year.

- Acquiring banks are those which install and manage apoint-of-sale terminal (or the hardware system required to process payments) at retail outlets. The issuing bank is responsible for issuing the card to the customer.

- This scheme has been formulated in compliance with Finance Minister’s FY 2022-23 budgetary endeavour to continue financial support for digital payments, focusing on promoting the use of payment platforms that are economical and user-friendly.

- The incentive scheme would reduce cash-carrying and storage risk. It would also eliminate the costs associated with small denomination notes and coins, among other things.

What is the discussion on Merchant Discount Rate (MDR)?

- Merchant Discount Rate (MDR or Merchant Service Fee) is the charge recovered by the acquirer from the final recipient of the payment, that is, the merchant. It is collected by the acquirer to compensate the varied service providers and intermediaries in the payment system.

- Presently, there is no MDR levied for RuPay-based debit card and UPI transactions. Stakeholders are hence concerned over cost recovery for the services they provide.

- In August 2022, the Finance Ministry tweeted that it was not planning to levy any charges for UPI services, adding, “The concerns of the service providers for cost recovery have to be met through other means.”

- The Reserve Bank of India (RBI) expressed concerns about the potential adverse impact of the zero MDR regime on the growth of the digital payments’ ecosystem.

- The National Payments Corporation of India (NPCI)requested the incentivisation of BHIM-UPI and RuPay debit card transactions to create “cost-effective value proposition for ecosystem stakeholders, increase merchant acceptance footprints and faster migration from cash payments to digital payments.”

- Ideally innovation needs to be sustained. There could be a staggered approach to pricing (slab wise/ depending on transaction size) and it could be significantly lower than MDR.

Main Practice Question: Do you think international on-boarding for UPI is going to create more challenges than opportunities?

Note: Write answer his question in the comment section.