Economics

Context: Last week, CSO released the inflation data, it showed that in January, India’s retail inflation surged by 6.5%.

- In other words, the general price level facing the consumers in January 2023 turned out to be 6.5% higher than the price level in January 2022; this is called a year-on-year (or y-o-y) growth rate.

About Inflation:

- Inflation refers to a sustained increase in the general price level of goods and services in an economy over a period of time.

- It is the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc.

- Inflation measures the average price change in a basket of commodities and services over time.

- The opposite and rare fall in the price index of this basket of items is called ‘deflation’.

- Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency.

- This is measured in percentage.

Measures of Inflation in India:

- In India, the Ministry of Statistics and Programme Implementation measures inflation.

- There are two main set of inflation indices for measuring price level changes in India

- the Wholesale Price Index (WPI) and the Consumer Price Index (CPI).

- GDP deflator is also used to measure inflation.

Significance of Inflation spike in recent times:

- The headline retail inflation rate was 7.4% in September 2022 but since then it was fast losing steam every month and fell to 5.7% in December.

- This moderation had convinced many to demand that the RBI should avoid raising interest rates — something the RBI did not do when it met on February 8.

- In fact, the RBI raised the repo rate the interest rate at which it lends money to the banking system by 25 basis points (100 basis points make up a full percentage point).

- RBI raises the repo rate when it believes that inflation is not in control.

- Higher interest rates drag down overall demand for goods and services by making loans costlier.

- Lower demand is expected to cool down inflation.

- The recent surge was also an unexpected event — most economists and observers expected inflation to rise by just 6% and it has renewed the apprehensions of the RBI raising the interest when it meets again in April.

- RBI’s Monetary Policy Committee (MPC) meets every two months to reconsider its monetary policy stance.

- As increase in interest rate, while doing its bit towards containing inflation, impacts on India’s economic growth.

- To be sure, there is a constant trade-off between maintaining price stability (read containing inflation) and boosting growth (which hopefully creates jobs and reduces unemployment)

Therefore, if inflation stays persistently high (‘sticky’), it would necessitate the RBI to keep raising interest rates or, at the very least, keep them at a high level for a longer period and, in doing so, hurt India’s economic recovery out of the twin shocks of the Covid pandemic and the Russia-Ukraine war.

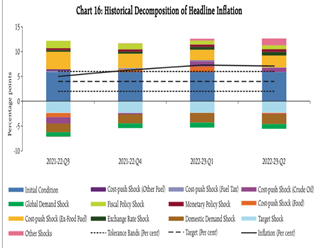

Reasons for recent Inflation trends:

- Inflation being sticky essentially means that inflation is taking longer than expected to fall.

- Essentially, higher food and fuel prices have seeped into the broader economy and made other things costlier.

- “A deeper dive into the core inflation basket suggests that firms continued to pass on higher input costs to consumers, while inflation is moderating in the services sector.

- Core goods inflation continued to inch up to 6% y-o-y in January from 7.5% in December and 7.1% six months back.

- Core services inflation, by contrast, has progressively been moderating from 5.5% in September to 5.0% in January

- Rise in food and fuel prices got increasingly generalised over ensuing months. This was reflected in highly elevated and sticky core inflation.

- Unprecedented input cost pressures got translated to output prices, particularly goods prices, in spite of muted demand conditions and pricing power.

- As the direct effects of the conflict waned and international commodity prices softened, the strengthening domestic recovery and rising demand enabled pass-through of pent-up input costs, especially in services, adding persistence to elevated inflationary pressures.

However, for what it is worth, India is not the only country facing sticky inflation; many others such as the US and countries in the euro zone — are also struggling to extricate themselves from sticky inflation.

Way Forward:

Both the government and Reserve Bank of India try to tackle inflation with their policies which are known as Fiscal and Monetary Policies respectively. Fiscal policies correspond to tax related measures taken by government to control inflation (money supply). RBI through its various monetary policies limit the money supply by altering rates like CRR, Repo, Reverse Repo etc. Administrative measures taken by government like strengthening of Public Distribution System also plays a crucial role in curbing inflation.

Source: Indian Express

Previous Year Questions

Q.1) With reference to the Indian economy, consider the following statements:

- If the inflation is too high, Reserve Bank of India (RBI) is likely to buy government securities.

- If the rupee is rapidly depreciating, RBI is likely to sell dollars in the market.

- If interest rates in the USA or European Union were to fall, that is likely to induce RBI to buy dollars.

Which of the statements given above are correct? (2022)

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Q.2) With reference to the India economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

- Government can reduce the coupon rates on its borrowing by way of IIBs.

- IIGs provide protection to the investors from uncertainty regarding inflation.

- The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct? (2022)

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3