Economics

Context: Recently, government of India informed that Russian banks have opened Special Rupee Vostro Accounts (SRVA) with partner banks in India.

About Special Rupee Vostro Accounts (SRVA):

- The SRVA is an additional arrangement to the existing system that uses freely convertible currencies.

- It works as a complimentary system to facilitate transactions that cannot be executed through the existing banking setup.

About Vostro Accounts:

- A Vostro account is an account that domestic banks hold for foreign banks in the former’s domestic currency.

- In this, a foreign bank acts as an agent providing financial services on behalf of a domestic bank.

- It enables domestic banks to provide international banking services to their clients who have global banking needs.

- Domestic banks use Vostro accounts to facilitate transfers, conduct business transactions, accept deposits, and gather documents on behalf of the foreign bank.

Significance:

- The system could reduce the “net demand for foreign exchange, the U.S. dollar in particular, for the settlement of trade flows”

- It will reduce the dependence on foreign currencies.

- It can make the country less vulnerable to external shocks.

- Ensure timely payments.

- This helps domestic banks to gain wider access to foreign financial markets and serve international clients without having to be physically present abroad.

- Vostro accounts are not restricted to banks, they can be used by other entities such as insurance companies and business entities to keep funds with another entity.

- When Vostro accounts are used by corresponding banks, the domestic bank can execute transfers, deposits, and withdrawals on behalf of the corresponding bank.

Functioning :

- The framework entails three important components, namely, invoicing, exchange rate and settlement.

- Invoicing entails that all exports and imports must be denominated and invoiced in INR.

- The exchange rate between the currencies of the trading partner countries would be market-determined.

- The final settlement also takes place in Indian National Rupee (INR).

- Domestic importers are required to make payment in INR into the SRVA account of the correspondent bank against the invoices.

- Domestic exporters are to be paid the export proceeds in INR from the balances in the designated account of the correspondent bank of the partner country.

Legal framework:

- All reporting of cross-border transactions are to be done in accordance with the extant guidelines under the Foreign Exchange Management Act (FEMA), 1999.

Eligibility criteria of banks:

- Banks from partner countries are required to approach an authorised domestic dealer bank for opening the SRVA.

- The domestic bank would then seek approval from the apex banking regulator providing details of the arrangement.

- Domestic banks should ensure that the correspondent bank is not from a country mentioned in the updated Financial Action Task Force (FATF) Public Statement on High Risk & Non-Co-operative jurisdictions.

- Authorised banks can open multiple SRV accounts for different banks from the same country.

- Balances in the account can be repatriated in freely convertible currency and/or currency of the beneficiary partner country depending on the underlying transaction, that is, for which the account was credited.

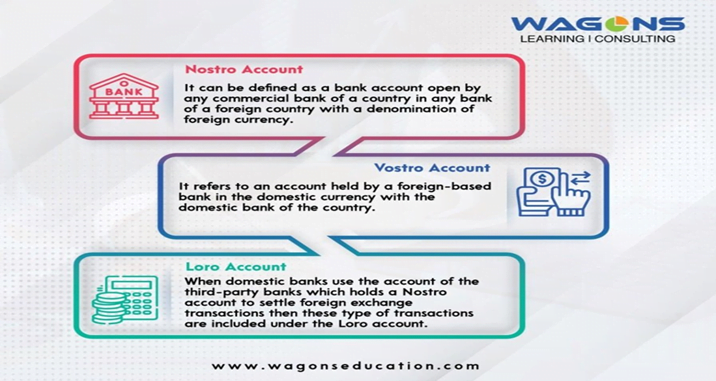

There are 3 types of accounts : Vostro, Nostro and Loro Accounts

- Vostro accounts -are maintained in the domestic currency.

- Nostro accounts- are maintained in foreign currency.

- A Loro account -is a current account that is maintained by one domestic bank for another domestic bank in the form of a third-party account, unlike nostro and vostro which is bilateral correspondence.

The Foreign Exchange Management Act, 1999 (FEMA):

- It is a civil law dealing with foreign exchange market in India.

- Under it the Central Government can regulate the flow of payments to and from a person situated outside the country.

- Financial transactions concerning foreign securities or exchange cannot be carried out without the approval of FEMA.

- The Act empowers RBI to place restrictions on transactions from capital Account even if it is carried out via an authorized individual.

SOURCE: THE HINDU

Previous year Questions

Q.1) Rapid Financing Instruments” and “Rapid Credit Facilities” are related to the provisions of lending by which of the following: (2022)

- Asian Development Bank

- International Monetary Fund

- United Nations Environment Programme Finance Initiative

- World Bank

Q.2) ‘European Stability Mechanism’, sometimes seen in the news, is an : (2016)

- the agency created by the EU to deal with the impact of millions of refugees arriving from the Middle East

- agency of the EU that provides financial assistance to eurozone countries

- agency of the EU to deal with all the bilateral and multilateral agreements on trade

- agency of the EU to deal with the conflicts arising among the member countries