IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule.

- It will ensure timely and streamlined revision of your static subjects.

Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

Daily CSAT Quiz (Monday – Friday)

- CSAT has been an Achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 10 current affairs, and 5 CSAT questions. (35 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

Important Note

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

- Let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 34 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

Information

The following Test is based on the syllabus of 60 Days Plan-2023 for UPSC IAS Prelims 2022.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 34 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- Answered

- Review

-

Question 1 of 34

1. Question

Consider the following statements regarding deficit financing

- External grants are the best means to finance the deficit.

- External borrowings are preferred over internal borrowings due to the ‘crowding out effect’.

- Internal borrowings to finance the deficit might hamper the economy’s investment level.

How many of the above statements are correct?

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct External Grants are the best mode to finance the deficit as they do not create any obligation- neither interest payments nor any repayment. They are essentially free. External borrowings are preferred over internal borrowings due to the ‘crowding out effect’. If the government goes on borrowing from the banks within the country, the liquidity with banks reduces. Less liquidity with banks leaves private entities with limited money. This further leads to depression in the level of investment. Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct External Grants are the best mode to finance the deficit as they do not create any obligation- neither interest payments nor any repayment. They are essentially free. External borrowings are preferred over internal borrowings due to the ‘crowding out effect’. If the government goes on borrowing from the banks within the country, the liquidity with banks reduces. Less liquidity with banks leaves private entities with limited money. This further leads to depression in the level of investment. -

Question 2 of 34

2. Question

Consider the following statements regarding the Balance of Payment:

- The balance of payments (BOP) is a statement of all transactions made between residents in one country and the rest of the world over a defined period.

- The industrial revolution increased international economic integration, and balance-of-payment crises became more frequent.

Select the correct answer using the code given below.

Correct

Solution (c)

Statement 1 Statement 2 Correct Correct The outcome of the total transactions of an economy with the outside world in one year is known as the balance of payment (BoP) of the economy. Basically, it is the net outcome of the current and capital accounts of an economy. Before the 19th century, international transactions were denominated in gold, providing little flexibility for countries experiencing trade deficits. Growth was low, so stimulating a trade surplus was the primary method of strengthening a nation’s financial position. National economies were not well integrated, however, so steep trade imbalances rarely provoked crises. The industrial revolution increased international economic integration, and balance-of-payment crises began to occur more frequently. Incorrect

Solution (c)

Statement 1 Statement 2 Correct Correct The outcome of the total transactions of an economy with the outside world in one year is known as the balance of payment (BoP) of the economy. Basically, it is the net outcome of the current and capital accounts of an economy. Before the 19th century, international transactions were denominated in gold, providing little flexibility for countries experiencing trade deficits. Growth was low, so stimulating a trade surplus was the primary method of strengthening a nation’s financial position. National economies were not well integrated, however, so steep trade imbalances rarely provoked crises. The industrial revolution increased international economic integration, and balance-of-payment crises began to occur more frequently. -

Question 3 of 34

3. Question

Consider the following statements concerning Capital Account Convertibility:

- It refers to the removal of restraints on international flows on a country’s capital account.

- S. Tarapore committee examined the feasibility of capital account convertibility in India.

Select the correct answer using the code given below.

Correct

Solution (c)

Statement 1 Statement 2 Correct Correct Capital Account Convertibility refers to the removal of restraints on international flows on a country’s capital account, enabling full currency convertibility and opening the financial system. Presently, India has current account convertibility. This means one can import and export goods or receive or make payments for services rendered. However, investments and borrowings are restricted. The term Capital Account Convertibility was coined by RBI and this term is almost synonymous with the RBI committee headed by SS Tarapore.

The SS Tarapore Committee on Capital Account Convertibility was an experts’ committee to study the feasibility of capital account convertibility in India. It submitted its report in 1997. Incorrect

Solution (c)

Statement 1 Statement 2 Correct Correct Capital Account Convertibility refers to the removal of restraints on international flows on a country’s capital account, enabling full currency convertibility and opening the financial system. Presently, India has current account convertibility. This means one can import and export goods or receive or make payments for services rendered. However, investments and borrowings are restricted. The term Capital Account Convertibility was coined by RBI and this term is almost synonymous with the RBI committee headed by SS Tarapore.

The SS Tarapore Committee on Capital Account Convertibility was an experts’ committee to study the feasibility of capital account convertibility in India. It submitted its report in 1997. -

Question 4 of 34

4. Question

Consider the following statements regarding Nominal Effective Exchange Rates (NEER)

- NEER is a measure of the value of a currency against a weighted average of several foreign currencies.

- An increase in NEER indicates an appreciation of the local currency against the weighted basket of currencies of its trading partners.

- The basket of foreign currencies is selected based on an international standard set by the IMF.

How many of the above statements are correct?

Correct

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Correct Incorrect The Nominal Effective Exchange Rate (NEER) of the rupee is an unadjusted weighted average of exchange rates before the currencies of India’s major trading partners. An increase in NEER indicates an appreciation of the local currency against the weighted basket of currencies of its trading partners. The basket of foreign currencies basket is chosen based on the domestic country’s most important trading partners as well as other major currencies. There is no international standard for selecting a basket of currencies. Rather it depends upon weighted average of currencies of India’s major trading partners However, many different institutions rely on International Financial Statistics (IFS) published by the IMF Incorrect

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Correct Incorrect The Nominal Effective Exchange Rate (NEER) of the rupee is an unadjusted weighted average of exchange rates before the currencies of India’s major trading partners. An increase in NEER indicates an appreciation of the local currency against the weighted basket of currencies of its trading partners. The basket of foreign currencies basket is chosen based on the domestic country’s most important trading partners as well as other major currencies. There is no international standard for selecting a basket of currencies. Rather it depends upon weighted average of currencies of India’s major trading partners However, many different institutions rely on International Financial Statistics (IFS) published by the IMF -

Question 5 of 34

5. Question

Consider the following statements regarding Foreign Direct Investment (FDI) in India

- FDI in India was allowed after the BoP crisis of 1991.

- FDI inflows are a component of the current account of BoP.

- In India, FDI is not allowed in the real estate sector.

How many of the above statements are correct?

Correct

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct FDI was introduced in India in 1991 after the LPG reforms which opened the economy to the world. India passed Foreign Exchange Management Act (FEMA), 1999 to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and promoting the orderly development and maintenance of the foreign exchange market in India.

FDI inflows are reported under the capital account of the Balance of payments (BoP) The prohibited sectors include Betting, Gambling, Lottery; Chit funds; Nidhi Company; Real Estate, etc. FDI for most cases can be brought through Automatic Route and for the remaining case through Government approval.

Incorrect

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct FDI was introduced in India in 1991 after the LPG reforms which opened the economy to the world. India passed Foreign Exchange Management Act (FEMA), 1999 to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and promoting the orderly development and maintenance of the foreign exchange market in India.

FDI inflows are reported under the capital account of the Balance of payments (BoP) The prohibited sectors include Betting, Gambling, Lottery; Chit funds; Nidhi Company; Real Estate, etc. FDI for most cases can be brought through Automatic Route and for the remaining case through Government approval.

-

Question 6 of 34

6. Question

Concerning FDI and FII, consider the following statements:

- Both are types of foreign investments, but there is a stark difference in how they are operated, whom they target, and the returns that can be derived from both.

- Through FDI, the investors have a good amount of management control over the operations of the business in the host country.

- Through FII, the investors generally have no control of any companies or banks in the host country in which they are investing.

How many of the above statements are correct?

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct Both are types of foreign investments, there is, however, a stark difference in the way they are operated, whom they target, and the returns that can be derived from both. FDI being a direct form of investment into a foreign company, the investors are more interested and even get to enjoy a higher control on the management of the company, even if it is in a foreign country. FII just allows for funds to be invested into the financial market of the host country and therefore doesn’t have much hold onto the managerial decisions, or rather are referred to as just passive investors Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct Both are types of foreign investments, there is, however, a stark difference in the way they are operated, whom they target, and the returns that can be derived from both. FDI being a direct form of investment into a foreign company, the investors are more interested and even get to enjoy a higher control on the management of the company, even if it is in a foreign country. FII just allows for funds to be invested into the financial market of the host country and therefore doesn’t have much hold onto the managerial decisions, or rather are referred to as just passive investors -

Question 7 of 34

7. Question

Consider the following statements regarding Forex Reserve:

- Forex Reserves comprise foreign currency assets and Special Drawing Rights only.

- The adequacy of Forex Reserves can be measured by Import Cover.

- An economy’s Reserve Tranche in the IMF is not a part of its forex reserve.

How many of the above statements are correct?

Correct

Solution (a)

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect Forex Reserves comprise foreign currency assets added with its gold reserves, SDRs (Special Drawing Rights), and Reserve Tranche in the IMF. The adequacy of Forex Reserves is measured by Import Cover. A reserve tranche is a portion of the required quota of currency each member country must provide to the International Monetary Fund (IMF) that can be utilized for its purposes—without a service fee or economic reform conditions. Reserve Tranche in IMF also comprises the forex reserves.

Incorrect

Solution (a)

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect Forex Reserves comprise foreign currency assets added with its gold reserves, SDRs (Special Drawing Rights), and Reserve Tranche in the IMF. The adequacy of Forex Reserves is measured by Import Cover. A reserve tranche is a portion of the required quota of currency each member country must provide to the International Monetary Fund (IMF) that can be utilized for its purposes—without a service fee or economic reform conditions. Reserve Tranche in IMF also comprises the forex reserves.

-

Question 8 of 34

8. Question

Consider the following statements about types of exchange rates and interventions.

Exchange rate – Interventions

- Flexible Exchange Rate – Interventions by the Government

- Managed Exchange Rate – Market-Driven Interventions

- Fixed Exchange Rate – Currency Pegged system

How many of the above pairs are correctly matched?

Correct

Solution (a)

Statement 1 Statement 2 Statement 3 Incorrect Incorrect Correct Floating/Flexible Exchange Rates are also called market-driven or based exchange rates, which are regulated by factors such as the demand and supply of the domestic and foreign currencies in the concerned economy. In the floating exchange rate system, a domestic currency is left free to float against a number of foreign currencies in its foreign exchange market and determine its value. Failure of the gold standard and the Bretton Woods Agreement led to the increased popularity of this system.

Managed Exchange Rate: A managed-exchange-rate system is a hybrid or mixture of the fixed and flexible exchange rate systems in which the government of the economy attempts to affect the exchange rate directly by buying or selling foreign currencies or indirectly, through monetary policy (by lowering/raising interest rates on foreign currency bank accounts, etc. Fixed Exchange Rate: In this system, the government or central bank ties the country’s currency official exchange rate to another country’s currency (currency peg) or the price of gold (gold standard). Fixed rates provide greater certainty for exporters and importers and also help the government maintain low inflation.

The purpose of a fixed exchange rate system is to keep a currency’s value within a narrow band.

Incorrect

Solution (a)

Statement 1 Statement 2 Statement 3 Incorrect Incorrect Correct Floating/Flexible Exchange Rates are also called market-driven or based exchange rates, which are regulated by factors such as the demand and supply of the domestic and foreign currencies in the concerned economy. In the floating exchange rate system, a domestic currency is left free to float against a number of foreign currencies in its foreign exchange market and determine its value. Failure of the gold standard and the Bretton Woods Agreement led to the increased popularity of this system.

Managed Exchange Rate: A managed-exchange-rate system is a hybrid or mixture of the fixed and flexible exchange rate systems in which the government of the economy attempts to affect the exchange rate directly by buying or selling foreign currencies or indirectly, through monetary policy (by lowering/raising interest rates on foreign currency bank accounts, etc. Fixed Exchange Rate: In this system, the government or central bank ties the country’s currency official exchange rate to another country’s currency (currency peg) or the price of gold (gold standard). Fixed rates provide greater certainty for exporters and importers and also help the government maintain low inflation.

The purpose of a fixed exchange rate system is to keep a currency’s value within a narrow band.

-

Question 9 of 34

9. Question

Which of the following are the possible risk of rising external debt on the Indian economy?

- Risk due to interest rate fluctuations.

- Risk due to exchange rate fluctuations.

- Government will have less flexibility to manipulate currency to boost exports.

How many of the above statements are correct?

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct There are certain major risks involved in foreign borrowings. One is that, like in the case of domestic borrowings, there could be unexpected changes in the interest rates charged on these loans. This can, for instance, cause widespread default when rates rise as borrowers may not be able to make higher interest payments, thus raising the risks of a systemic crisis. A major risk is unexpected changes in the exchange rates of currencies. An unexpected fall in the value of the rupee (depreciation of the rupee) can cause severe difficulties for Indian companies that need to pay back dollar-denominated loans as they will now have to shell out more rupees than they had previously estimated to buy the necessary dollars. This eventually results in higher debt on the balance sheet which may affect many financial ratios adversely. The government loses the flexibility to manipulate currency to lower levels to boost exports as it will further worsen the debt payment requirements. High levels of government borrowing from international sources can also hamper the domestic industry by crowding out their sources of funds. Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct There are certain major risks involved in foreign borrowings. One is that, like in the case of domestic borrowings, there could be unexpected changes in the interest rates charged on these loans. This can, for instance, cause widespread default when rates rise as borrowers may not be able to make higher interest payments, thus raising the risks of a systemic crisis. A major risk is unexpected changes in the exchange rates of currencies. An unexpected fall in the value of the rupee (depreciation of the rupee) can cause severe difficulties for Indian companies that need to pay back dollar-denominated loans as they will now have to shell out more rupees than they had previously estimated to buy the necessary dollars. This eventually results in higher debt on the balance sheet which may affect many financial ratios adversely. The government loses the flexibility to manipulate currency to lower levels to boost exports as it will further worsen the debt payment requirements. High levels of government borrowing from international sources can also hamper the domestic industry by crowding out their sources of funds. -

Question 10 of 34

10. Question

Consider the following statements concerning External Commercial Borrowings (ECBs):

- These are loans availed by an Indian entity from a non-resident lender in foreign currency.

- ECBs can be procured from foreign sources for a minimum average maturity period of 8 years.

- The proceeds from ECB cannot be utilised for real estate and equity investment.

How many of the above statements are correct?

Correct

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct External Commercial Borrowings (ECBs) are basically loans availed by an Indian entity from a non-resident lender. Most of these loans are provided by foreign commercial banks and other institutions in foreign currency. It is a loan availed from non-resident lenders with a minimum average maturity of 3 years. It includes commercial bank loans, buyers’ credit, suppliers’ credit, securitized instruments such as Floating Rate Notes and Fixed Rate Bonds, etc., credit from official export credit agencies, and commercial borrowings from Multilateral Financial Institutions. The External Commercial Borrowing (ECB) policy is regularly reviewed by the Ministry of Finance in consultation with the Reserve Bank of India (RBI) to keep it in tune with the evolving macroeconomic situation, changing market conditions, sectoral requirements, etc. The RBI has decided to keep the minimum average maturity period at 3 years (earlier 5 years) for all ECBs, irrespective of the amount of borrowing, except for borrowers specifically permitted to borrow for a shorter period, like manufacturing companies. The ECB proceeds cannot be utilized for real estate activities, investment in the capital market, equity investment, working capital purposes (except foreign equity holder), and repayment of Rupee loans (except foreign equity holder). Incorrect

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct External Commercial Borrowings (ECBs) are basically loans availed by an Indian entity from a non-resident lender. Most of these loans are provided by foreign commercial banks and other institutions in foreign currency. It is a loan availed from non-resident lenders with a minimum average maturity of 3 years. It includes commercial bank loans, buyers’ credit, suppliers’ credit, securitized instruments such as Floating Rate Notes and Fixed Rate Bonds, etc., credit from official export credit agencies, and commercial borrowings from Multilateral Financial Institutions. The External Commercial Borrowing (ECB) policy is regularly reviewed by the Ministry of Finance in consultation with the Reserve Bank of India (RBI) to keep it in tune with the evolving macroeconomic situation, changing market conditions, sectoral requirements, etc. The RBI has decided to keep the minimum average maturity period at 3 years (earlier 5 years) for all ECBs, irrespective of the amount of borrowing, except for borrowers specifically permitted to borrow for a shorter period, like manufacturing companies. The ECB proceeds cannot be utilized for real estate activities, investment in the capital market, equity investment, working capital purposes (except foreign equity holder), and repayment of Rupee loans (except foreign equity holder). -

Question 11 of 34

11. Question

Which of the following statements is/are correct about Foreign Exchange Management Act (FEMA)?

- In FEMA If there was a need for transferring of funds for external operations, then prior approval of the Reserve Bank of India (RBI) was required.

- FEMA was repealed in 1998 by Vajpayee Government.

- In FEMA there is no provision for Special Director (Appeals) and Special Tribunal.

How many of the above statements are correct?

Correct

Solution (d)

Statement 1 Statement 2 Statement 3 Incorrect Incorrect Incorrect For External trade and remittances, there is no need for prior approval from the Reserve Bank of India (RBI) FERA was repealed in 1998 by the government of Atal Bihari Vajpayee and replaced by the Foreign Exchange Management Act, which liberalised foreign exchange controls and restrictions on foreign investment. Section 17 of the FEMA Act provides for the appointment of Special Director (Appeals). Section 17(1) provides that the Central Government shall, by notification, appoint one or more Special Directors (Appeals) to hear appeals against the orders of the Adjudicating Authorities. Hence there is a provision Incorrect

Solution (d)

Statement 1 Statement 2 Statement 3 Incorrect Incorrect Incorrect For External trade and remittances, there is no need for prior approval from the Reserve Bank of India (RBI) FERA was repealed in 1998 by the government of Atal Bihari Vajpayee and replaced by the Foreign Exchange Management Act, which liberalised foreign exchange controls and restrictions on foreign investment. Section 17 of the FEMA Act provides for the appointment of Special Director (Appeals). Section 17(1) provides that the Central Government shall, by notification, appoint one or more Special Directors (Appeals) to hear appeals against the orders of the Adjudicating Authorities. Hence there is a provision -

Question 12 of 34

12. Question

If external debt vis-s-vis internal debt in the government’s total debt increases, what would be its likely impact on the Indian economy?

- It may bring down the interest that the government pays on its debt.

- In the short term, it may lead to the rupee depreciating against the dollar.

- It may have a negative impact on the Make in India initiative.

- It can hamper countries’ ability to invest in social and physical infrastructure.

How many of the above statements are correct?

Correct

Solution (c)

Sovereign borrowing means raising money from foreign markets by issuing government bonds by the government/central bank of a country.

Statement 1 Statement 2 Statement 3 Statement 4 Correct Incorrect Correct Correct Global interest rates are at historic lows, so the government should tap the potential and allocate needed money for the country’s growth and development. Borrowing in dollars is expected to be cheaper, and hence, bring down the interest that the government pays on its debt. It may lead to the rupee appreciating against the dollar, at least in the short run. When the bonds are sold and the dollars (or any other foreign currency for that matter) are brought back to India, they will have to be converted into rupees. This will push up the demand for rupees and eventually lead to the rupee appreciating in value against the dollar. In the short term, an appreciating rupee will hurt India’s exports, which are struggling already. It will make imports cheaper and hurt domestic producers competing against them. The government of India launched the “Make in India” scheme to promote manufacturing in India. But with the appreciation of the rupee, imports will be cheaper and it may impact the Make-in-India initiative. Excessive levels of foreign debt can hamper countries’ ability to invest in their economic future—whether it be via infrastructure, education, or health care—as their limited revenue goes to servicing their loans. This thwarts long-term economic growth. The United Nations has also linked high levels of foreign debt and a government’s dependency on foreign assistance to human rights abuses. Economic distress causes governments to cut social spending and reduces the resources it has to enforce labour standards and human rights.

Incorrect

Solution (c)

Sovereign borrowing means raising money from foreign markets by issuing government bonds by the government/central bank of a country.

Statement 1 Statement 2 Statement 3 Statement 4 Correct Incorrect Correct Correct Global interest rates are at historic lows, so the government should tap the potential and allocate needed money for the country’s growth and development. Borrowing in dollars is expected to be cheaper, and hence, bring down the interest that the government pays on its debt. It may lead to the rupee appreciating against the dollar, at least in the short run. When the bonds are sold and the dollars (or any other foreign currency for that matter) are brought back to India, they will have to be converted into rupees. This will push up the demand for rupees and eventually lead to the rupee appreciating in value against the dollar. In the short term, an appreciating rupee will hurt India’s exports, which are struggling already. It will make imports cheaper and hurt domestic producers competing against them. The government of India launched the “Make in India” scheme to promote manufacturing in India. But with the appreciation of the rupee, imports will be cheaper and it may impact the Make-in-India initiative. Excessive levels of foreign debt can hamper countries’ ability to invest in their economic future—whether it be via infrastructure, education, or health care—as their limited revenue goes to servicing their loans. This thwarts long-term economic growth. The United Nations has also linked high levels of foreign debt and a government’s dependency on foreign assistance to human rights abuses. Economic distress causes governments to cut social spending and reduces the resources it has to enforce labour standards and human rights.

-

Question 13 of 34

13. Question

Consider the following pairs:

Types of Currency – Characteristics

- Hard Currency – High level of liquidity in the international currency market

- Heated Currency – Domestic currency which is under the pressure of depreciation

- Soft Currency – Currency has very high demand in the Forex market

How many of the above pairs are correctly matched?

Correct

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Correct Incorrect Hard currency is the international currency in which the highest faith is shown and is needed by every economy. The strongest currency in the world is one that has a high level of liquidity. The economy with the highest as well as highly diversified exports that are compulsive imports for other countries (as of high-level technology, defense products, lifesaving medicines, and petroleum products) will also create high demand for its currency in the end become the hard currency. It is always scarce.

Heated currency is a term used in the forex market to denote the domestic currency which is under enough pressure (heat) of depreciation due to a hard currency’s high tendency of exiting the economy (since it has become hot). It is also known as currency under heat or hammering. A soft currency is one with a value that fluctuates because there is less demand for that currency in the forex markets. This lack of demand may be driven by a variety of factors, but is most often a result of the country’s political or economic uncertainty. Soft currencies are unlikely to be held by central banks as foreign reserves. Incorrect

Solution (b)

Statement 1 Statement 2 Statement 3 Correct Correct Incorrect Hard currency is the international currency in which the highest faith is shown and is needed by every economy. The strongest currency in the world is one that has a high level of liquidity. The economy with the highest as well as highly diversified exports that are compulsive imports for other countries (as of high-level technology, defense products, lifesaving medicines, and petroleum products) will also create high demand for its currency in the end become the hard currency. It is always scarce.

Heated currency is a term used in the forex market to denote the domestic currency which is under enough pressure (heat) of depreciation due to a hard currency’s high tendency of exiting the economy (since it has become hot). It is also known as currency under heat or hammering. A soft currency is one with a value that fluctuates because there is less demand for that currency in the forex markets. This lack of demand may be driven by a variety of factors, but is most often a result of the country’s political or economic uncertainty. Soft currencies are unlikely to be held by central banks as foreign reserves. -

Question 14 of 34

14. Question

Consider the following statements with reference to the foreign exchange market

- Depreciation in a currency can only take place if the economy follows the floating exchange rate system.

- Appreciation rates for different assets are not fixed by any government as they depend upon market mechanisms.

- Devaluation is the value loss of the domestic currency against a foreign currency, mainly driven by market forces.

- Revaluation is the official appreciation of domestic currency against any foreign currency.

How many of the above statements are correct?

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Statement 4 Correct Correct Incorrect Correct In the foreign exchange market, it is a situation when a domestic currency loses its value in front of a foreign currency if it is market-driven. It means depreciation in a currency can only take place if the economy follows the floating exchange rate system. If a free-floating domestic currency increases its value against the value of a foreign currency, it is appreciated. In the domestic economy, if a fixed asset has seen an increase in its value, it is also known as appreciation. Appreciation rates for different assets are not fixed by any government as they depend upon market mechanisms. When the exchange rate of a domestic currency is cut down by its government (and not driven by market forces) against any foreign currency, it is called devaluation. It means official depreciation is devaluation. Revaluation is when a government increases the exchange rate of its currency against any foreign currency. It is official appreciation. Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Statement 4 Correct Correct Incorrect Correct In the foreign exchange market, it is a situation when a domestic currency loses its value in front of a foreign currency if it is market-driven. It means depreciation in a currency can only take place if the economy follows the floating exchange rate system. If a free-floating domestic currency increases its value against the value of a foreign currency, it is appreciated. In the domestic economy, if a fixed asset has seen an increase in its value, it is also known as appreciation. Appreciation rates for different assets are not fixed by any government as they depend upon market mechanisms. When the exchange rate of a domestic currency is cut down by its government (and not driven by market forces) against any foreign currency, it is called devaluation. It means official depreciation is devaluation. Revaluation is when a government increases the exchange rate of its currency against any foreign currency. It is official appreciation. -

Question 15 of 34

15. Question

Current account of the country includes:

- Export and Import.

- Interest payments

- Private remittances and transfers.

- Foreign currency deposits of banks

Which of the above statements is/are correct?

Correct

Solution (c)

Foreign currency deposits of banks are included in the capital accounts.

In the external sector, it refers to the account maintained by every government of the world in which every kind of current transaction is shown—basically this account is maintained by the central banking body of the economy on behalf of the government. Current transactions of an economy in foreign currency all over the world are—export, import, interest payments, private remittances, and transfers. All transactions are shown as either inflow or outflow (credit or debit). At the end of the year, the current account might be positive or negative. The positive one is known as a surplus current account, and the negative one is known as a deficit current account.

Incorrect

Solution (c)

Foreign currency deposits of banks are included in the capital accounts.

In the external sector, it refers to the account maintained by every government of the world in which every kind of current transaction is shown—basically this account is maintained by the central banking body of the economy on behalf of the government. Current transactions of an economy in foreign currency all over the world are—export, import, interest payments, private remittances, and transfers. All transactions are shown as either inflow or outflow (credit or debit). At the end of the year, the current account might be positive or negative. The positive one is known as a surplus current account, and the negative one is known as a deficit current account.

-

Question 16 of 34

16. Question

Which of the following transactions would be related to the BoP account of the economy?

- Joint production of helicopters by India and Japan.

- Transfer of technology by Russia to India.

- USA’s investment in Indian treasury bills.

How many of the above statements are correct?

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct A joint production of helicopters by India and Japan would involve sharing and transferring of money and other resources across nations. Transfer of technology would also involve money and the transfer of other resources. It is essentially a BoP account transaction of the economy. Investment in treasury bills or government bonds of a country is a kind of Foreign Institutional Investment. So it will come under external sector transactions. Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct A joint production of helicopters by India and Japan would involve sharing and transferring of money and other resources across nations. Transfer of technology would also involve money and the transfer of other resources. It is essentially a BoP account transaction of the economy. Investment in treasury bills or government bonds of a country is a kind of Foreign Institutional Investment. So it will come under external sector transactions. -

Question 17 of 34

17. Question

Which of the following would lead to a depreciation of the Indian rupee?

- Increase in the import bill.

- Higher fiscal deficit.

- Increase in interest rates by US federal reserve.

Select the correct answer using the codes given below:

Correct

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct Currency depreciation is a fall in the value of a currency in a floating exchange rate system. The higher import bill could lead to the outflow of the dollar in the economy and increase the value of the dollar as compared to the Indian rupee in the market economy which could lead to the depreciation of the Indian rupee.

A higher fiscal deficit would lead to a depreciation of the Indian rupee. A country running a large fiscal deficit is always at risk of seeing the value of the currency fall. If there are insufficient capital flows to finance the deficit, the exchange rate will fall to reflect the imbalance of foreign flows of funds. An increase in interest rates by US federal reserve leads to a depreciation of the Indian rupee. When the Federal Reserve increases the federal funds rate, it increases interest rates throughout the economy. The higher yields attract investment capital from investors abroad seeking higher returns on bonds and interest-rate products. This results in a stronger exchange rate in favor of the U.S. dollar and a weaker exchange rate in the favor of Indian rupee, which could lead to the depreciation of the Indian rupee. Incorrect

Solution (c)

Statement 1 Statement 2 Statement 3 Correct Correct Correct Currency depreciation is a fall in the value of a currency in a floating exchange rate system. The higher import bill could lead to the outflow of the dollar in the economy and increase the value of the dollar as compared to the Indian rupee in the market economy which could lead to the depreciation of the Indian rupee.

A higher fiscal deficit would lead to a depreciation of the Indian rupee. A country running a large fiscal deficit is always at risk of seeing the value of the currency fall. If there are insufficient capital flows to finance the deficit, the exchange rate will fall to reflect the imbalance of foreign flows of funds. An increase in interest rates by US federal reserve leads to a depreciation of the Indian rupee. When the Federal Reserve increases the federal funds rate, it increases interest rates throughout the economy. The higher yields attract investment capital from investors abroad seeking higher returns on bonds and interest-rate products. This results in a stronger exchange rate in favor of the U.S. dollar and a weaker exchange rate in the favor of Indian rupee, which could lead to the depreciation of the Indian rupee. -

Question 18 of 34

18. Question

Consider the following statements with reference to External commercial borrowings in India:

- ECB can be raised only in Indian Rupees

- It includes trade credits beyond three years.

- It includes commercial bank loans

- It includes Investment in the stock market

How many of the above statements are correct?

Correct

Solution (b)

Statement 1 Statement 2 Statement 3 Statement 4 Incorrect Correct Correct Incorrect ECB can be raised in any freely convertible foreign currency as well as in Indian Rupees or any other currency as specified by the Reserve Bank of India in consultation with the Government of India. It includes trade credits beyond three years, floating/ fixed-rate notes/ bonds/ debentures (other than fully and compulsorily convertible instruments), loans including bank loans, financial leases, and plain vanilla Rupee denominated bonds issued overseas. ECBs include commercial bank loans, buyers’ credit, suppliers’ credit, securitized instruments such as floating rate notes and fixed rate bonds, etc., credit from official export credit agencies, and commercial borrowings from the private sector window of multilateral financial Institutions such as International Finance Corporation (Washington), ADB, AFIC, CDC, etc. ECBs cannot be used for investment in the stock market or speculation in real estate. The DEA (Department of Economic Affairs), Ministry of Finance, Government of India along with the Reserve Bank of India, monitors and regulates ECB guidelines and policies. Incorrect

Solution (b)

Statement 1 Statement 2 Statement 3 Statement 4 Incorrect Correct Correct Incorrect ECB can be raised in any freely convertible foreign currency as well as in Indian Rupees or any other currency as specified by the Reserve Bank of India in consultation with the Government of India. It includes trade credits beyond three years, floating/ fixed-rate notes/ bonds/ debentures (other than fully and compulsorily convertible instruments), loans including bank loans, financial leases, and plain vanilla Rupee denominated bonds issued overseas. ECBs include commercial bank loans, buyers’ credit, suppliers’ credit, securitized instruments such as floating rate notes and fixed rate bonds, etc., credit from official export credit agencies, and commercial borrowings from the private sector window of multilateral financial Institutions such as International Finance Corporation (Washington), ADB, AFIC, CDC, etc. ECBs cannot be used for investment in the stock market or speculation in real estate. The DEA (Department of Economic Affairs), Ministry of Finance, Government of India along with the Reserve Bank of India, monitors and regulates ECB guidelines and policies. -

Question 19 of 34

19. Question

Which of the following is correct about the ‘impossible trinity?

Correct

Solution (b)

The impossible trinity also called the Mundell-Fleming trilemma or simply the trilemma expresses the limited options available to countries in setting monetary policy.

The impossible trinity (also known as the impossible trilemma or the Unholy Trinity) is a concept in international economics that states that it is impossible to have all three of the following at the same time:

- A fixed foreign exchange rate

- Free capital movement (absence of capital controls)

- An independent monetary policy

According to the impossible trinity, a central bank can only pursue two of the above-mentioned three policies simultaneously

Incorrect

Solution (b)

The impossible trinity also called the Mundell-Fleming trilemma or simply the trilemma expresses the limited options available to countries in setting monetary policy.

The impossible trinity (also known as the impossible trilemma or the Unholy Trinity) is a concept in international economics that states that it is impossible to have all three of the following at the same time:

- A fixed foreign exchange rate

- Free capital movement (absence of capital controls)

- An independent monetary policy

According to the impossible trinity, a central bank can only pursue two of the above-mentioned three policies simultaneously

-

Question 20 of 34

20. Question

Which one of the following groups of items is included in India’s foreign-exchange reserves?

Correct

Solution (b)

The Foreign Exchange Reserves of India consists of below four categories:

- Foreign Currency Assets

- Gold

- Special Drawing Rights (SDRs)

- Reserve Tranche Position

Incorrect

Solution (b)

The Foreign Exchange Reserves of India consists of below four categories:

- Foreign Currency Assets

- Gold

- Special Drawing Rights (SDRs)

- Reserve Tranche Position

-

Question 21 of 34

21. Question

It is located in the Mandla and Balaghat districts of Madhya Pradesh. It is nestled in the Maikal range of Satpuras, the heart of India, that forms the central Indian highlands. It is characterized mainly by forested shallow undulations, and hills with varying degrees of slopes, plateaus, and valleys. It is the first tiger reserve in India to officially introduce a mascot, “Bhoorsingh the Barasingha”. It is the largest national park in Madhya Pradesh.

The above paragraph describes which of the following?

Correct

Solution (d)

Kanha National Park is located in the Mandla and Balaghat districts of Madhya Pradesh. It is nestled in the Maikal range of Satpuras, the heart of India, that forms the central Indian highlands. It is characterized mainly by forested shallow undulations, and hills with varying degrees of slopes, plateaus, and valleys. It is the first tiger reserve in India to officially introduce a mascot, “Bhoorsingh the Barasingha”. It is the largest national park in Madhya Pradesh. Hence option d is correct.

Incorrect

Solution (d)

Kanha National Park is located in the Mandla and Balaghat districts of Madhya Pradesh. It is nestled in the Maikal range of Satpuras, the heart of India, that forms the central Indian highlands. It is characterized mainly by forested shallow undulations, and hills with varying degrees of slopes, plateaus, and valleys. It is the first tiger reserve in India to officially introduce a mascot, “Bhoorsingh the Barasingha”. It is the largest national park in Madhya Pradesh. Hence option d is correct.

-

Question 22 of 34

22. Question

Consider the following statements regarding the Kosi River:

- It is formed by the confluence of the Sun Kosi, the Arun Kosi, and the Tamur Kosi in the Himalayan region of Nepal and Tibet.

- It is a transboundary river that flows through China, Nepal, and India.

- It is known as the “Sorrow of Bihar”, as it has caused widespread human suffering in the past due to flooding.

How many of the above statements are correct?

Correct

Solution (c)

- The Kosi River is formed by the confluence of the Sun Kosi, the Arun Kosi, and the Tamur Kosi in the Himalayan region of Nepal and Tibet. Hence statement 1 is correct.

- About 30 miles (48 km) north of the Indian-Nepalese frontier, the Kosi is joined by several major tributaries and breaks southward through the Siwalik Hills at the narrow Chatra Gorge.

- The river then emerges on the great plain of northern India in Bihar state on its way to the Ganges River, which it enters south of Purnea after a course of about 450 miles (724 km).

- It has seven major tributaries – Sun Koshi, Tama Koshi or Tamba Koshi, Dudh Koshi, Indravati, Likhu, Arun, and Tamore or Tamar.

- It is a transboundary river that flows through China, Nepal, and India. Hence statement 2 is correct.

- It is a prominent tributary of the Ganges.

- It drains an area of 74,500 sq. km, of which only 11,070 sq. km lie within Indian Territory.

- The Kosi River valley is bounded by steep margins that disconnect it from the Yarlung Zangbo River to the north, the Mahananda River to the east, the Gandaki to the west, and the Ganga to the south.

- It is well known for its tendency to change course generally in a westward direction.

- It is known as the “Sorrow of Bihar”, as it has caused widespread human suffering in the past due to flooding. Hence statement 3 is correct.

Incorrect

Solution (c)

- The Kosi River is formed by the confluence of the Sun Kosi, the Arun Kosi, and the Tamur Kosi in the Himalayan region of Nepal and Tibet. Hence statement 1 is correct.

- About 30 miles (48 km) north of the Indian-Nepalese frontier, the Kosi is joined by several major tributaries and breaks southward through the Siwalik Hills at the narrow Chatra Gorge.

- The river then emerges on the great plain of northern India in Bihar state on its way to the Ganges River, which it enters south of Purnea after a course of about 450 miles (724 km).

- It has seven major tributaries – Sun Koshi, Tama Koshi or Tamba Koshi, Dudh Koshi, Indravati, Likhu, Arun, and Tamore or Tamar.

- It is a transboundary river that flows through China, Nepal, and India. Hence statement 2 is correct.

- It is a prominent tributary of the Ganges.

- It drains an area of 74,500 sq. km, of which only 11,070 sq. km lie within Indian Territory.

- The Kosi River valley is bounded by steep margins that disconnect it from the Yarlung Zangbo River to the north, the Mahananda River to the east, the Gandaki to the west, and the Ganga to the south.

- It is well known for its tendency to change course generally in a westward direction.

- It is known as the “Sorrow of Bihar”, as it has caused widespread human suffering in the past due to flooding. Hence statement 3 is correct.

-

Question 23 of 34

23. Question

Consider the following statements regarding the SOFIA (Stratospheric Observatory for Infrared Astronomy):

- It was a telescope mounted on a Boeing 747 SP aircraft that studied ultraviolet light.

- It is operated jointly by the National Aeronautics and Space Administration and the Indian Space Research Organisation.

- It is the world’s largest airborne astronomical observatory.

How many of the above statements are correct?

Correct

Solution (a)

- The SOFIA (Stratospheric Observatory for Infrared Astronomy) was a telescope mounted on a Boeing 747 SP aircraft that studied infrared light, essentially heat, emitted by objects in the universe. Hence statement 1 is incorrect.

- The observatory, fitted with an 8.9-foot-wide (2.7 meter) telescope with a nearly 20-ton mirror, used a door in the side of the aircraft to peer at the sky.

- The airplane is capable of ten-hour flights, with flight paths chosen to keep ahead of the sunrise and maximize the amount of darkness.

- Flying into the stratosphere at 38,000-45,000 feet put SOFIA above 99 percent of Earth’s infrared-blocking atmosphere, allowing astronomers to study the solar system and beyond in ways that are not possible with ground-based telescopes.

- It is operated jointly by the National Aeronautics and Space Administration and the German Space Agency. Hence statement 2 is incorrect.

- The observatory’s mobility allowed researchers to observe from almost anywhere in the world and enabled studies of transient events that often take place over oceans, where there are no telescopes.

- It is the world’s largest airborne astronomical observatory, complementing NASA’s space telescopes as well as major Earth-based telescopes. Hence statement 3 is correct.

- The SOFIA project was prematurely ended in 2022 after operating for 12 years.

Incorrect

Solution (a)

- The SOFIA (Stratospheric Observatory for Infrared Astronomy) was a telescope mounted on a Boeing 747 SP aircraft that studied infrared light, essentially heat, emitted by objects in the universe. Hence statement 1 is incorrect.

- The observatory, fitted with an 8.9-foot-wide (2.7 meter) telescope with a nearly 20-ton mirror, used a door in the side of the aircraft to peer at the sky.

- The airplane is capable of ten-hour flights, with flight paths chosen to keep ahead of the sunrise and maximize the amount of darkness.

- Flying into the stratosphere at 38,000-45,000 feet put SOFIA above 99 percent of Earth’s infrared-blocking atmosphere, allowing astronomers to study the solar system and beyond in ways that are not possible with ground-based telescopes.

- It is operated jointly by the National Aeronautics and Space Administration and the German Space Agency. Hence statement 2 is incorrect.

- The observatory’s mobility allowed researchers to observe from almost anywhere in the world and enabled studies of transient events that often take place over oceans, where there are no telescopes.

- It is the world’s largest airborne astronomical observatory, complementing NASA’s space telescopes as well as major Earth-based telescopes. Hence statement 3 is correct.

- The SOFIA project was prematurely ended in 2022 after operating for 12 years.

-

Question 24 of 34

24. Question

Consider the following statements about the Sangam: Digital Twin Initiative:

- It is a Proof of Concept (PoC) distributed in two stages to be conducted in one of the major cities of India.

- It is launched by the Department of Telecommunications (DoT).

- It symbolizes a collaborative leap towards reshaping infrastructure planning and design, combining the prowess of next-gen computational technologies.

How many of the above statements are correct?

Correct

Solution (c)

- The Sangam: Digital Twin Initiative is a Proof of Concept (PoC) distributed in two stages to be conducted in one of the major cities of India. Hence statement 1 is correct.

- The first stage is exploratory for clarity of horizon and creative exploration to unleash potential.

- The second stage is for practical demonstration of specific use cases generating a future blueprint that may serve as a roadmap to scale and replicate successful strategies in future infrastructure projects through collaboration.

- It is launched by the Department of Telecommunications (DoT). Hence statement 2 is correct.

- The initiative aims to demonstrate the practical implementation of innovative infrastructure planning solutions, to develop a model framework for facilitating faster and more effective collaboration, and to provide a future blueprint that may serve as a roadmap to scale and replicate successful strategies in future infrastructure projects.

- It symbolizes a collaborative leap towards reshaping infrastructure planning and design, combining the prowess of 5G, IoT, AI, AR/VR, AI native 6G, Digital Twin, and next-gen computational technologies with the collective intelligence of public entities, infrastructure planners, tech giants, start-ups, and academia to break the silos and engage in a whole-of-nation approach. Hence statement 3 is correct.

- Sangam brings all stakeholders on one platform aiming to transform innovative ideas into tangible solutions, bridging the gap between conceptualization and realization, ultimately paving the way for ground-breaking infrastructure advancements.

Incorrect

Solution (c)

- The Sangam: Digital Twin Initiative is a Proof of Concept (PoC) distributed in two stages to be conducted in one of the major cities of India. Hence statement 1 is correct.

- The first stage is exploratory for clarity of horizon and creative exploration to unleash potential.

- The second stage is for practical demonstration of specific use cases generating a future blueprint that may serve as a roadmap to scale and replicate successful strategies in future infrastructure projects through collaboration.

- It is launched by the Department of Telecommunications (DoT). Hence statement 2 is correct.

- The initiative aims to demonstrate the practical implementation of innovative infrastructure planning solutions, to develop a model framework for facilitating faster and more effective collaboration, and to provide a future blueprint that may serve as a roadmap to scale and replicate successful strategies in future infrastructure projects.

- It symbolizes a collaborative leap towards reshaping infrastructure planning and design, combining the prowess of 5G, IoT, AI, AR/VR, AI native 6G, Digital Twin, and next-gen computational technologies with the collective intelligence of public entities, infrastructure planners, tech giants, start-ups, and academia to break the silos and engage in a whole-of-nation approach. Hence statement 3 is correct.

- Sangam brings all stakeholders on one platform aiming to transform innovative ideas into tangible solutions, bridging the gap between conceptualization and realization, ultimately paving the way for ground-breaking infrastructure advancements.

-

Question 25 of 34

25. Question

Consider the following statements about the Gulf Stream:

- It is a cold ocean current that flows along the eastern coast of North America.

- It carries warm water from the tropics to higher latitudes.

- It keeps the coastal areas warmer in winter and cooler in summer compared to inland regions at the same latitudes on the eastern coast of North America.

How many of the above statements are correct?

Correct

Solution (b)

- The Gulf Stream is a warm ocean current that flows along the eastern coast of North America. Hence statement 1 is incorrect.

- It originates in the Gulf of Mexico. It then travels northward along the eastern coast of the United States. It follows a north-eastward path across the western North Atlantic Ocean.

- The two equatorial sources of the Gulf Stream are the North Equatorial Current (NEC), which flows generally westward along the Tropic of Cancer, and the South Equatorial Current (SEC), which flows westward from southwestern Africa to South America and then northward to the Caribbean Sea. Together, these two warm currents, along with waters from the Gulf of Mexico, form the Gulf Stream.

- It carries warm water from the tropics (around 25 to 28°C or 77 to 82°F) to higher latitudes. Hence statement 2 is correct.

- The Gulf Stream is several hundred kilometres wide and can flow at an average speed of about four miles per hour (6.4 kilometers per hour). However, its speed can vary depending on the location and other factors.

- The current is also very deep, extending to depths of up to 1,000 meters.

- It moderates the temperatures along the eastern coast of North America, keeping the coastal areas warmer in winter and cooler in summer compared to inland regions at the same latitudes. Since the Gulf Stream also extends toward Europe, it warms Western European countries as well. Hence statement 3 is correct.

- The warm and moist air above the Gulf Stream can lead to the formation of low-pressure systems, which may develop into storms or hurricanes. It can also contribute to the formation of fog in certain areas.

Incorrect

Solution (b)

- The Gulf Stream is a warm ocean current that flows along the eastern coast of North America. Hence statement 1 is incorrect.

- It originates in the Gulf of Mexico. It then travels northward along the eastern coast of the United States. It follows a north-eastward path across the western North Atlantic Ocean.

- The two equatorial sources of the Gulf Stream are the North Equatorial Current (NEC), which flows generally westward along the Tropic of Cancer, and the South Equatorial Current (SEC), which flows westward from southwestern Africa to South America and then northward to the Caribbean Sea. Together, these two warm currents, along with waters from the Gulf of Mexico, form the Gulf Stream.

- It carries warm water from the tropics (around 25 to 28°C or 77 to 82°F) to higher latitudes. Hence statement 2 is correct.

- The Gulf Stream is several hundred kilometres wide and can flow at an average speed of about four miles per hour (6.4 kilometers per hour). However, its speed can vary depending on the location and other factors.

- The current is also very deep, extending to depths of up to 1,000 meters.

- It moderates the temperatures along the eastern coast of North America, keeping the coastal areas warmer in winter and cooler in summer compared to inland regions at the same latitudes. Since the Gulf Stream also extends toward Europe, it warms Western European countries as well. Hence statement 3 is correct.

- The warm and moist air above the Gulf Stream can lead to the formation of low-pressure systems, which may develop into storms or hurricanes. It can also contribute to the formation of fog in certain areas.

-

Question 26 of 34

26. Question

Consider the following statements regarding the Young Scientist Programme (YUVIKA):

- It is a learning and awareness-creating programme regarding space science by the Ministry of Education.

- It encourages more students to pursue Science, Technology, Engineering, and Mathematics (STEM) based careers.

- Students who have finished class 5 and are currently studying in class 6 can apply for the programme.

How many of the above statements are correct?

Correct

Solution (a)

- The Young Scientist Programme (YUVIKA) is a learning and awareness-creating programme regarding space science by the Indian Space Research Organisation(ISRO). Hence statement 1 is incorrect.

- It aims to impart basic knowledge of space technology, space science, and space applications to younger students with a preference for rural areas.

- It is a two-week residential programme offered by ISRO. It will include invited talks, experience sharing by eminent scientists, facility and lab visits, exclusive sessions for discussions with experts, and practical and feedback sessions.

- It encourages more students to pursue Science, Technology, Engineering, and Mathematics (STEM) based careers. Hence statement 2 is correct.

- It is aimed at creating awareness about the emerging trends in science and technology amongst the youngsters, who are the future building blocks of our nation. ISRO has chalked out this programme to “Catch them young”.

- Students who have finished class 8 and are currently studying in class 9 can apply for the programme. Hence statement 3 is incorrect.

- Three students from each state/Union Territory will participate in this programme every year, covering CBSE, ICSE, and state-board syllabus.

- The selection is based on 8th Standard academic performance and extracurricular activities.

- Students belonging to the rural areas have been given special weightage in the selection criteria.

Incorrect

Solution (a)

- The Young Scientist Programme (YUVIKA) is a learning and awareness-creating programme regarding space science by the Indian Space Research Organisation(ISRO). Hence statement 1 is incorrect.

- It aims to impart basic knowledge of space technology, space science, and space applications to younger students with a preference for rural areas.

- It is a two-week residential programme offered by ISRO. It will include invited talks, experience sharing by eminent scientists, facility and lab visits, exclusive sessions for discussions with experts, and practical and feedback sessions.

- It encourages more students to pursue Science, Technology, Engineering, and Mathematics (STEM) based careers. Hence statement 2 is correct.

- It is aimed at creating awareness about the emerging trends in science and technology amongst the youngsters, who are the future building blocks of our nation. ISRO has chalked out this programme to “Catch them young”.

- Students who have finished class 8 and are currently studying in class 9 can apply for the programme. Hence statement 3 is incorrect.

- Three students from each state/Union Territory will participate in this programme every year, covering CBSE, ICSE, and state-board syllabus.

- The selection is based on 8th Standard academic performance and extracurricular activities.

- Students belonging to the rural areas have been given special weightage in the selection criteria.

-

Question 27 of 34

27. Question

Consider the following statements regarding the European Free Trade Association:

- It is an intergovernmental organisation established by the Stockholm Convention.

- Its member countries are Iceland, Liechtenstein, Norway, and Switzerland.

- It aims to promote free trade and economic integration between its members within Europe and globally.

How many of the above statements are correct?

Correct

Solution (c)

- The European Free Trade Association is an intergovernmental organisation established in 1960 by the Stockholm Convention. Hence statement 1 is correct.

- The members of this organization are all open, competitive economies committed to the progressive liberalisation of trade in the multinational arena as well as in free trade agreements.

- Its member countries are Iceland, Liechtenstein, Norway, and Switzerland. Hence statement 2 is correct.

- Its highest governing body is the EFTA Council. It generally meets 8 times a year at the ambassadorial level and twice a year at the ministerial level.

- EFTA Surveillance Authority (ESA) monitors compliance with European Economic Area (EEA) rules in Iceland, Liechtenstein, and Norway.

- EFTA Court is based in Luxembourg and has the competence and authority to settle internal and external disputes regarding the implementation, application, or interpretation of the EEA agreement.

- It aims to promote free trade and economic integration between its members within Europe and globally. Hence statement 3 is correct.

Incorrect

Solution (c)

- The European Free Trade Association is an intergovernmental organisation established in 1960 by the Stockholm Convention. Hence statement 1 is correct.

- The members of this organization are all open, competitive economies committed to the progressive liberalisation of trade in the multinational arena as well as in free trade agreements.

- Its member countries are Iceland, Liechtenstein, Norway, and Switzerland. Hence statement 2 is correct.

- Its highest governing body is the EFTA Council. It generally meets 8 times a year at the ambassadorial level and twice a year at the ministerial level.

- EFTA Surveillance Authority (ESA) monitors compliance with European Economic Area (EEA) rules in Iceland, Liechtenstein, and Norway.

- EFTA Court is based in Luxembourg and has the competence and authority to settle internal and external disputes regarding the implementation, application, or interpretation of the EEA agreement.

- It aims to promote free trade and economic integration between its members within Europe and globally. Hence statement 3 is correct.

-

Question 28 of 34

28. Question

Consider the following statements regarding the Cash Reserve Ratio (CRR):

- It is the percentage of cash required to be kept in reserves with the Reserve Bank of India as against the bank’s total deposits.

- The bank can use CRR for lending and investment purposes and gets interest from the RBI.

- In a high inflation environment, the RBI can increase CRR which helps to control inflation.

How many of the above statements are correct?

Correct

Solution (b)

- The Cash Reserve Ratio (CRR) is the percentage of cash required to be kept in reserves with the Reserve Bank of India as against the bank’s total deposits. Hence statement 1 is correct.

- Under CRR, commercial banks have to hold a certain minimum amount of deposits as reserves with the RBI.

- The RBI decides the CRR and is kept with them for financial security.

- The bank cannot use CRR for lending and investment purposes and does not get any interest from the RBI. Hence statement 2 is incorrect.

- The CRR applies to scheduled commercial banks, while regional rural banks and NBFCs are excluded.

- In a high inflation environment, the RBI can increase CRR which helps to control inflation. Hence statement 3 is correct.

- It ensures banks have a minimum amount of funds readily available to customers, even during huge demand.

- CRR serves as the reference rate for loans. Also known as the base rate for loans, banks cannot offer loans below this rate.

Incorrect

Solution (b)

- The Cash Reserve Ratio (CRR) is the percentage of cash required to be kept in reserves with the Reserve Bank of India as against the bank’s total deposits. Hence statement 1 is correct.

- Under CRR, commercial banks have to hold a certain minimum amount of deposits as reserves with the RBI.

- The RBI decides the CRR and is kept with them for financial security.

- The bank cannot use CRR for lending and investment purposes and does not get any interest from the RBI. Hence statement 2 is incorrect.

- The CRR applies to scheduled commercial banks, while regional rural banks and NBFCs are excluded.

- In a high inflation environment, the RBI can increase CRR which helps to control inflation. Hence statement 3 is correct.

- It ensures banks have a minimum amount of funds readily available to customers, even during huge demand.

- CRR serves as the reference rate for loans. Also known as the base rate for loans, banks cannot offer loans below this rate.

-

Question 29 of 34

29. Question

Consider the following statements regarding Diphtheria:

- It is a serious contagious fungal infection of the nose and throat.

- It can spread from person to person, usually through respiratory droplets.

- It is treated by neutralization of unbound toxin with Diphtheria Antitoxin (DAT).

How many of the above statements are correct?

Correct

Solution (b)

- Diphtheria is a serious contagious bacterial infection of the nose and throat. Hence statement 1 is incorrect.

- It is caused by strains of bacteria called Corynebacterium diphtheriae that make a toxin.

- Its symptoms include a thick, gray membrane covering the throat and tonsils, sore throat and hoarseness, swollen glands (enlarged lymph nodes) in the neck, difficulty breathing, etc.

- It can spread from person to person, usually through respiratory droplets. Hence statement 2 is correct.

- People can also get sick from touching infected open sores or ulcers.

- The bacteria can also infect the skin, causing open sores or ulcers. However, diphtheria skin infections rarely result in severe disease.

- It is treated by neutralization of unbound toxin with Diphtheria Antitoxin (DAT). Hence statement 3 is correct.

- Although diphtheria can be treated with medications, in advanced stages, the bacterial infection can damage the heart, kidneys, and nervous system.

Incorrect

Solution (b)

- Diphtheria is a serious contagious bacterial infection of the nose and throat. Hence statement 1 is incorrect.

- It is caused by strains of bacteria called Corynebacterium diphtheriae that make a toxin.

- Its symptoms include a thick, gray membrane covering the throat and tonsils, sore throat and hoarseness, swollen glands (enlarged lymph nodes) in the neck, difficulty breathing, etc.

- It can spread from person to person, usually through respiratory droplets. Hence statement 2 is correct.

- People can also get sick from touching infected open sores or ulcers.

- The bacteria can also infect the skin, causing open sores or ulcers. However, diphtheria skin infections rarely result in severe disease.

- It is treated by neutralization of unbound toxin with Diphtheria Antitoxin (DAT). Hence statement 3 is correct.

- Although diphtheria can be treated with medications, in advanced stages, the bacterial infection can damage the heart, kidneys, and nervous system.

-

Question 30 of 34

30. Question

Mutualism is an association between organisms of two different species in which each benefit. Which of the following exhibit mutualism?

Correct

Solution (c)

- Mutualism is an association between organisms of two different species in which each benefit. It is exhibited by a Golden-backed frog and Bonnet mushroom. Hence option c is correct.

- Golden-backed Frog is endemic to the Western Ghats of Karnataka and Kerala. They are primarily insectivorous and feed on a range of small insects and arthropods such as ants, beetles, and crickets.

- Bonnet mushroom is commonly found as a saprotroph (an organism that feeds on non-living organic matter) on rotting wood. It belongs to the Mycena genus.

Incorrect

Solution (c)

- Mutualism is an association between organisms of two different species in which each benefit. It is exhibited by a Golden-backed frog and Bonnet mushroom. Hence option c is correct.

- Golden-backed Frog is endemic to the Western Ghats of Karnataka and Kerala. They are primarily insectivorous and feed on a range of small insects and arthropods such as ants, beetles, and crickets.

- Bonnet mushroom is commonly found as a saprotroph (an organism that feeds on non-living organic matter) on rotting wood. It belongs to the Mycena genus.

-

Question 31 of 34

31. Question

What is the missing number ‘X’ of the series 7, 11, 19, 35, X?

Correct

Solution (b)

Second number of series = [(2 × first number)− 3]

11 = (2 × 7)− 3

19 = (2 × 11) − 3

35 = (2 × 19) − 3

X = (2 × 35)− 3

= 70 − 3 = 67

Incorrect

Solution (b)

Second number of series = [(2 × first number)− 3]

11 = (2 × 7)− 3

19 = (2 × 11) − 3

35 = (2 × 19) − 3

X = (2 × 35)− 3

= 70 − 3 = 67

-

Question 32 of 34

32. Question

A man purchased 50 pens for Rs. 3000, and sold 15 of them at a gain of 5%. He wants to sell the remaining so as to gain 15% on the whole. What should the approximate selling price of each pen be?

Correct

Solution (b)

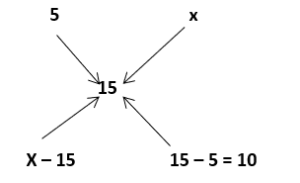

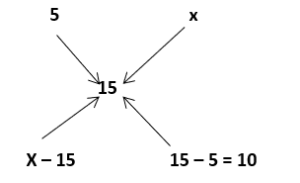

(x – 15) : 10 = 15 : 35

7x – 105 = 30

X = 20

Required selling price = 60 * (120/100 ) = 72

Incorrect

Solution (b)

(x – 15) : 10 = 15 : 35

7x – 105 = 30

X = 20

Required selling price = 60 * (120/100 ) = 72

-

Question 33 of 34

33. Question

The monthly average salary paid to all the employees of a company was Rs. 12000. The monthly average salary paid to male and female employees was Rs. 14000 and Rs. 10000 respectively. Then the percentage of males employed in the company is:

Correct

Solution (c)

Let total no of the male employee be x

Total no of the female be y

Then total salary of all male = 14000 × x

The total salary of all female =10000 × y

But as per question total salary of all the employee = 12000(x + y)