IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule.

- It will ensure timely and streamlined revision of your static subjects.

Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

Daily CSAT Quiz (Monday – Friday)

- CSAT has been an Achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 10 current affairs, and 5 CSAT questions. (35 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

Important Note

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

- Let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 35 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

Information

The following Test is based on the syllabus of 60 Days Plan-2025 for UPSC IAS Prelims 2025.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 35 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- Answered

- Review

-

Question 1 of 35

1. Question

Which of the following entities is not eligible to invest in Sovereign Gold Bonds?

Correct

Solution (c)

Explanation

- SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Any candidate under Foreign Exchange Management Act (FEMA) can invest in SGBs. An individual, HUF (Hindu Undivided Family), trusts a public or private, and universities can invest in SGBs and an guardians can invest on behalf of a minor. (Hence option a, b and d are correct)

- An NRI cannot invest in these bonds, but they are eligible for bonds received as a resident investor’s nominee. KYC documents such as Voter ID, Aadhaar card/PAN, or TAN /Passport must be needed for buying the SGB. (Hence option c is incorrect)

Incorrect

Solution (c)

Explanation

- SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Any candidate under Foreign Exchange Management Act (FEMA) can invest in SGBs. An individual, HUF (Hindu Undivided Family), trusts a public or private, and universities can invest in SGBs and an guardians can invest on behalf of a minor. (Hence option a, b and d are correct)

- An NRI cannot invest in these bonds, but they are eligible for bonds received as a resident investor’s nominee. KYC documents such as Voter ID, Aadhaar card/PAN, or TAN /Passport must be needed for buying the SGB. (Hence option c is incorrect)

-

Question 2 of 35

2. Question

Which of the following statements is correct about Sovereign Gold Bond Scheme?

- The scheme was launched in the Union Budget 2015-16.

- The scheme has a term of 8 years, which cannot be withdrawn before maturity.

- The gold bonds invested by the Investors can be transferred to others eligible for the scheme.

Select the answer using the code given below:

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct The Sovereign Gold Bond Scheme was launched in the Union Budget 2015-16. The scheme was launched to reduce the demand for physical gold. It aims to invest a part in physical gold bars and coins, which are purchased every year as a part of financial savings in the form of gold bonds. The Sovereign Gold Bond Scheme aims to invest a part in physical gold bars and coins, which are purchased every year as a part of financial savings in the form of gold bonds. The Sovereign Gold Bond Scheme has a term of 8 years, which can be withdrawn before maturity after five years starting from the interest payment dates. The gold bonds invested by the Investors can be gifted or transferred to others eligible for the scheme. These bonds can also trade on stock exchanges as per the notifications of the Reserve Bank of India. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct The Sovereign Gold Bond Scheme was launched in the Union Budget 2015-16. The scheme was launched to reduce the demand for physical gold. It aims to invest a part in physical gold bars and coins, which are purchased every year as a part of financial savings in the form of gold bonds. The Sovereign Gold Bond Scheme aims to invest a part in physical gold bars and coins, which are purchased every year as a part of financial savings in the form of gold bonds. The Sovereign Gold Bond Scheme has a term of 8 years, which can be withdrawn before maturity after five years starting from the interest payment dates. The gold bonds invested by the Investors can be gifted or transferred to others eligible for the scheme. These bonds can also trade on stock exchanges as per the notifications of the Reserve Bank of India. -

Question 3 of 35

3. Question

Which of the following statements is correct about Gold Monetization Scheme?

- Under the scheme, the maximum deposit limit is 30 grams of any purity gold.

- The scheme’s short-term bank deposit does not pay interest in the form of money.

- Profits earned through the gold monetization plan are not subject to capital gains tax.

Select the answer using the code given below:

Correct

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct The Gold Monetisation Scheme is a relatively new initiative launched by the Central Government in 2015-16. The minimum deposit is 30 grams of any purity in a gold monetization plan. There is no such thing as a maximum limit. The Gold Monetisation Scheme’s short-term bank deposit does not pay interest in the form of money. It provides you gold in grams as a type of interest. So, if the interest rate is 1% each year, you will get 1 gram on 100 grams. Profits earned through the gold monetization plan are not subject to capital gains tax. Capital gains are excluded from both wealth and income taxes. Incorrect

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct The Gold Monetisation Scheme is a relatively new initiative launched by the Central Government in 2015-16. The minimum deposit is 30 grams of any purity in a gold monetization plan. There is no such thing as a maximum limit. The Gold Monetisation Scheme’s short-term bank deposit does not pay interest in the form of money. It provides you gold in grams as a type of interest. So, if the interest rate is 1% each year, you will get 1 gram on 100 grams. Profits earned through the gold monetization plan are not subject to capital gains tax. Capital gains are excluded from both wealth and income taxes. -

Question 4 of 35

4. Question

Which of the following statements are correct about current account?

- India had surplus current accounts for three consecutive years from 2005-2009.

- The current account consists of external assistance, external commercial borrowings.

Select the correct answer using the code given below:

Correct

Solution (d)

Explanation

Statement 1 Statement 2 Incorrect Incorrect Current transactions of an economy in foreign currency all over the world are— export, import, interest payments, private remittances and transfers. India had surplus current accounts for three consecutive years (2000—03) – the only such period in Indian economic history. The capital account records all international purchases and sales of assets such as money, stocks, bonds, etc. It consists of external assistance, external commercial borrowings, short term credit, banking capital which includes non-resident deposits, foreign investments which include FDI and portfolio investments and other Flows. Incorrect

Solution (d)

Explanation

Statement 1 Statement 2 Incorrect Incorrect Current transactions of an economy in foreign currency all over the world are— export, import, interest payments, private remittances and transfers. India had surplus current accounts for three consecutive years (2000—03) – the only such period in Indian economic history. The capital account records all international purchases and sales of assets such as money, stocks, bonds, etc. It consists of external assistance, external commercial borrowings, short term credit, banking capital which includes non-resident deposits, foreign investments which include FDI and portfolio investments and other Flows. -

Question 5 of 35

5. Question

Consider the following statements.

- A Global Depository Receipt is a financial instrument held by a custodian bank in the home country.

- Using Global Depository Receipt, companies can raise capital from investors in countries around the world.

Which of the following statements given above is/are correct?

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct A Global Depository Receipt (GDR) is a financial instrument issued by a foreign company and held by a custodian bank in the home country. GDRs make it possible for a company (the issuer) to access investors in capital markets beyond the borders of its own country. Using Global Depository Receipt, companies can raise capital from investors in countries around the world. GDRs can in theory be denominated in any currency, but are nearly always in U.S. dollars. Since GDRs are negotiable certificates, they trade in multiple markets and can provide arbitrage opportunities to investors. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct A Global Depository Receipt (GDR) is a financial instrument issued by a foreign company and held by a custodian bank in the home country. GDRs make it possible for a company (the issuer) to access investors in capital markets beyond the borders of its own country. Using Global Depository Receipt, companies can raise capital from investors in countries around the world. GDRs can in theory be denominated in any currency, but are nearly always in U.S. dollars. Since GDRs are negotiable certificates, they trade in multiple markets and can provide arbitrage opportunities to investors. -

Question 6 of 35

6. Question

With reference to FDI flows in India, consider the following statements.

- Singapore and USA have emerged as top 2 sourcing nations in FDI equity flows into India in FY 2023-24.

- The Services Sector received the highest FDI Equity Inflow during FY 2023-24.

- Among all Indian states, Karnataka received the highest FDI Equity Inflow during FY 2023-24.

How many of the above statements are correct?

Correct

Solution (a)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect Total FDI inflows in the country in the FY 2023-24 is $70.95 Bn and total FDI equity inflows stands at $44.42 Bn. Mauritius (25%), Singapore (23%), USA (9%), Netherland (7%) and Japan (6%) emerge as top 5 countries for FDI equity inflows into India FY 2023-24. Top 5 sectors receiving highest FDI Equity Inflow during FY 2023-24 are Services Sector (Finance, Banking, Insurance, Non Fin/ Business, Outsourcing, R&D, Courier, Tech. Testing and Analysis, Other) (16%), Computer Software & Hardware (15%), Trading (6%), Telecommunications (6%) and Automobile Industry (5%). Top 5 States receiving highest FDI Equity Inflow during FY 2023-24 are Maharashtra (30%), Karnataka (22%), Gujarat (17%), Delhi (13%), and Tamil Nadu (5%). Incorrect

Solution (a)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect Total FDI inflows in the country in the FY 2023-24 is $70.95 Bn and total FDI equity inflows stands at $44.42 Bn. Mauritius (25%), Singapore (23%), USA (9%), Netherland (7%) and Japan (6%) emerge as top 5 countries for FDI equity inflows into India FY 2023-24. Top 5 sectors receiving highest FDI Equity Inflow during FY 2023-24 are Services Sector (Finance, Banking, Insurance, Non Fin/ Business, Outsourcing, R&D, Courier, Tech. Testing and Analysis, Other) (16%), Computer Software & Hardware (15%), Trading (6%), Telecommunications (6%) and Automobile Industry (5%). Top 5 States receiving highest FDI Equity Inflow during FY 2023-24 are Maharashtra (30%), Karnataka (22%), Gujarat (17%), Delhi (13%), and Tamil Nadu (5%). -

Question 7 of 35

7. Question

The balance of trade of a country refers to:

Correct

Solution (a)

Explanation

The balance of trade is the difference between a country’s exports and imports of goods. A numerically positive balance of trade, also known as a trade surplus, occurs when a country exports more goods than it imports. This means that the country is earning more from its exports than it is spending on its imports, and it is generally seen as a sign of economic strength. Although, it’s not an indicator of economic health on its own. (Hence option a is correct)

Incorrect

Solution (a)

Explanation

The balance of trade is the difference between a country’s exports and imports of goods. A numerically positive balance of trade, also known as a trade surplus, occurs when a country exports more goods than it imports. This means that the country is earning more from its exports than it is spending on its imports, and it is generally seen as a sign of economic strength. Although, it’s not an indicator of economic health on its own. (Hence option a is correct)

-

Question 8 of 35

8. Question

Which of the following statement is correct about National Payments Corporation of India (NPCI)?

- It has been incorporated as a “Not for Profit Company under the provisions of Companies Act 1956.

- NPCI is promoted by State Bank of India and ICICI Bank.

- Under Payment and Settlement Systems Act, 2007, NPCI can operate the payment systems of the country.

Select the answer using the code given below:

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Correct Correct Correct NPCI is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment and Settlement Infrastructure in India. Considering the utility nature of the objects of NPCI, it has been incorporated as a “Not for Profit Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013). Presently, NPCI is promoted by ten major promoter banks: State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank, HSBC. Under the PSS Act, 2007 as per the authorisation of RBU, NPCI can operate the following payment systems: National Financial Switch (NFS), Immediate Payment System (IMPS), Affiliation of RuPay Cards (debit cards/ prepaid cards) issued by banks and cobranded credit cards issued by nonbanking financial companies (NBFCs) or any other entity approved by the RBI, National Automatic Clearing House (ACH), Aadhaar Enabled Payments System (AEPS), Operation of Cheque Truncation System. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Correct Correct Correct NPCI is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment and Settlement Infrastructure in India. Considering the utility nature of the objects of NPCI, it has been incorporated as a “Not for Profit Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013). Presently, NPCI is promoted by ten major promoter banks: State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank, HSBC. Under the PSS Act, 2007 as per the authorisation of RBU, NPCI can operate the following payment systems: National Financial Switch (NFS), Immediate Payment System (IMPS), Affiliation of RuPay Cards (debit cards/ prepaid cards) issued by banks and cobranded credit cards issued by nonbanking financial companies (NBFCs) or any other entity approved by the RBI, National Automatic Clearing House (ACH), Aadhaar Enabled Payments System (AEPS), Operation of Cheque Truncation System. -

Question 9 of 35

9. Question

Consider the following statements.

- RBI gives licenses to Co-operative Banks under Reserve Bank of India Act, 1934.

- FDI in public sector banks is permitted up to 20% through government approval route.

Which of the following statements given above is/are correct?

Correct

Solution (b)

Explanation

Statement 1 Statement 2 Incorrect Correct Banks that are included in the Second Schedule of the Reserve Bank of India Act, 1934 are considered to be scheduled commercial banks. Other than public sector banks and regional rural banks, all other scheduled commercial banks are granted banking licenses by RBI under Banking Regulation Act, 1949. In addition, RBI also gives licenses to Co-operative Banks for providing banking services under Banking Regulation Act, 1949. Within the banking sector, Foreign Direct Investment (FDI) in private sector banks is permitted up to 49% through automatic route, and beyond that up to 74% through government approval route. FDI in public sector banks is permitted up to 20% through government approval route. Incorrect

Solution (b)

Explanation

Statement 1 Statement 2 Incorrect Correct Banks that are included in the Second Schedule of the Reserve Bank of India Act, 1934 are considered to be scheduled commercial banks. Other than public sector banks and regional rural banks, all other scheduled commercial banks are granted banking licenses by RBI under Banking Regulation Act, 1949. In addition, RBI also gives licenses to Co-operative Banks for providing banking services under Banking Regulation Act, 1949. Within the banking sector, Foreign Direct Investment (FDI) in private sector banks is permitted up to 49% through automatic route, and beyond that up to 74% through government approval route. FDI in public sector banks is permitted up to 20% through government approval route. -

Question 10 of 35

10. Question

Which of the following statement is correct about External Debt of India?

- India’s external debt data is quarterly released by Ministry of Finance.

- The external debt includes a debt a country owes to foreign creditors, complemented by internal debt owed to domestic lenders.

- Holding foreign currencies reserve provides liquidity and enables the country to pay for international trade transactions.

Select the correct answer using the code given below:

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct India’s external debt data is quarterly released by RBI. India’s external debt refers to the total debt that India as a country owes to foreign creditors. The debtors in this case can be the GOI, State Governments, corporations or citizens of India. The debt includes money owed to private commercial banks, foreign Governments. or even IMF and World Bank. Most of the external debt is sourced from multilateral agencies such as International Development Agency (IDA), International Bank for Reconstruction and Development (IBRD), Asian Development Bank (ADB), etc. and official bilateral agencies. External debt (or foreign debt) is the total debt a country owes to foreign creditors, complemented by internal debt owed to domestic lenders. The debtors can be the government, corporations or citizens of that country. The foreign currencies reserve is the most significant component of the Indian forex reserves. It includes major currencies like the US Dollar, the Euro, and the British Pound. Holding these currencies provides liquidity and enables the country to pay for international trade transactions. Major Currencies Held: USD, EUR, GBP. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct India’s external debt data is quarterly released by RBI. India’s external debt refers to the total debt that India as a country owes to foreign creditors. The debtors in this case can be the GOI, State Governments, corporations or citizens of India. The debt includes money owed to private commercial banks, foreign Governments. or even IMF and World Bank. Most of the external debt is sourced from multilateral agencies such as International Development Agency (IDA), International Bank for Reconstruction and Development (IBRD), Asian Development Bank (ADB), etc. and official bilateral agencies. External debt (or foreign debt) is the total debt a country owes to foreign creditors, complemented by internal debt owed to domestic lenders. The debtors can be the government, corporations or citizens of that country. The foreign currencies reserve is the most significant component of the Indian forex reserves. It includes major currencies like the US Dollar, the Euro, and the British Pound. Holding these currencies provides liquidity and enables the country to pay for international trade transactions. Major Currencies Held: USD, EUR, GBP. -

Question 11 of 35

11. Question

With reference to Special Drawing Rights, consider the following statements.

- They are an international reserve asset created by the International Monetary Fund.

- The value of the SDR is based on a basket of five major currencies including Indian rupee.

- SDR’s are distributed among all IMF member states based on their quota of IMF dues.

How many of the above statements given above is/are correct?

Correct

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct Special Drawing Rights (SDRs) are international reserve assets the IMF has created in 1969. They supplement the foreign exchange reserves of the member countries. SDRs provide additional liquidity and are part of the global effort to stabilise the international monetary system. The value of the SDR is based on a basket of five major currencies: the US dollar, the euro, the Chinese renminbi (RMB), the Japanese yen, and the British pound sterling. Indian rupee not included. SDRs have characteristics of money, such as being interest-bearing assets, store of value, and means of settling indebtedness. They are distributed among all IMF member states based on each member’s quota of IMF dues, which is related to the member’s GNP. Incorrect

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct Special Drawing Rights (SDRs) are international reserve assets the IMF has created in 1969. They supplement the foreign exchange reserves of the member countries. SDRs provide additional liquidity and are part of the global effort to stabilise the international monetary system. The value of the SDR is based on a basket of five major currencies: the US dollar, the euro, the Chinese renminbi (RMB), the Japanese yen, and the British pound sterling. Indian rupee not included. SDRs have characteristics of money, such as being interest-bearing assets, store of value, and means of settling indebtedness. They are distributed among all IMF member states based on each member’s quota of IMF dues, which is related to the member’s GNP. -

Question 12 of 35

12. Question

Which of the following is not a typical use of official reserve assets?

Correct

Solution (b)

Explanations

The official reserve assets are assets denominated in foreign currency, readily available to and controlled by monetary authorities for meeting balance of payments financing needs, intervening in exchange markets to affect the currency exchange rate, and for other related purposes (such as maintaining confidence in the currency and the economy, and serving as a basis for foreign borrowing). Official reserves transactions are common in Fixed and Managed Floating exchange rate system, where Central Bank like RBI has to make transactions to manage monetary policy. (Hence option b is correct)

Incorrect

Solution (b)

Explanations

The official reserve assets are assets denominated in foreign currency, readily available to and controlled by monetary authorities for meeting balance of payments financing needs, intervening in exchange markets to affect the currency exchange rate, and for other related purposes (such as maintaining confidence in the currency and the economy, and serving as a basis for foreign borrowing). Official reserves transactions are common in Fixed and Managed Floating exchange rate system, where Central Bank like RBI has to make transactions to manage monetary policy. (Hence option b is correct)

-

Question 13 of 35

13. Question

Consider the following statements.

- Before 1948, Indian rupee was linked with British Pound Sterling.

- Devaluation and revaluation both takes place under a fixed exchange rate system.

Which of the following statements given above is/are correct?

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct Before 1948, Indian rupee was linked with British Pound Sterling. After coming up of IMF, India shifted to the fixed currency system. India wanted to keep rupee’s external value (i.e., exchange rate) in terms of gold or the US ($Dollar). In 1975 – rupee was delinked from the British Pound and the RBI started determining rupee’s exchange rate with respect to the exchange rate movements of the basket of world currencies. In 1992-93 – India moved to floating currency regime. (with its own method of ‘dual exchange rate’) In the foreign exchange market, devaluation occurs when a government intentionally reduces the exchange rate of its domestic currency against one or more foreign currencies. This action is taken by the government under a fixed exchange rate system, where the value of the currency is pegged to a specific foreign currency or a basket of currencies. Revaluation is a term used in the foreign exchange market when a government officially increases the exchange rate of its currency against one or more foreign currencies. Like devaluation, revaluation also takes place under a fixed exchange rate system. Revaluation is less common than devaluation and is often used to correct an overvalued currency. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct Before 1948, Indian rupee was linked with British Pound Sterling. After coming up of IMF, India shifted to the fixed currency system. India wanted to keep rupee’s external value (i.e., exchange rate) in terms of gold or the US ($Dollar). In 1975 – rupee was delinked from the British Pound and the RBI started determining rupee’s exchange rate with respect to the exchange rate movements of the basket of world currencies. In 1992-93 – India moved to floating currency regime. (with its own method of ‘dual exchange rate’) In the foreign exchange market, devaluation occurs when a government intentionally reduces the exchange rate of its domestic currency against one or more foreign currencies. This action is taken by the government under a fixed exchange rate system, where the value of the currency is pegged to a specific foreign currency or a basket of currencies. Revaluation is a term used in the foreign exchange market when a government officially increases the exchange rate of its currency against one or more foreign currencies. Like devaluation, revaluation also takes place under a fixed exchange rate system. Revaluation is less common than devaluation and is often used to correct an overvalued currency. -

Question 14 of 35

14. Question

With reference to balance of payments, consider the following statements.

- The balance of trade is the largest component of the country’s balance of payments.

- Balance of trade account maintains records of transactions in foreign currencies resulting out of export and import of services.

- Transactions including those on the current account is referred as capital account transactions.

How many of the statements given above is/are correct?

Correct

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct The balance of trade (BOT) is the difference between a country’s imports and its exports for a given time period. The balance of trade is the largest component of the country’s balance of payments (BOP). Note: Terms of trade (TOT) represent the ratio between a country’s export prices and its import prices.

Just as there are imports and exports of goods, there are also imports and exports of services such as banking, shipping, insurance, software, consultancy, etc. Balance on invisibles (BOI) account maintains records of transactions in foreign currencies resulting out of export and import of services. Transactions other than those on the current account is referred as capital account transactions and would comprise of the following: (1) Foreign Investment—this will be discussed separately later. However, this inflows of foreign currencies into the economy for investment purposes. (2) Deposits—many of the Indian diaspora settled abroad maintain deposits currencies in India known as NRI (3) Borrowings—private sector can borrow in the international currency and so can the government bilaterally or from multilateral institutions such as the IMF, World Bank, etc. (4) External Assistance and Grant Incorrect

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct The balance of trade (BOT) is the difference between a country’s imports and its exports for a given time period. The balance of trade is the largest component of the country’s balance of payments (BOP). Note: Terms of trade (TOT) represent the ratio between a country’s export prices and its import prices.

Just as there are imports and exports of goods, there are also imports and exports of services such as banking, shipping, insurance, software, consultancy, etc. Balance on invisibles (BOI) account maintains records of transactions in foreign currencies resulting out of export and import of services. Transactions other than those on the current account is referred as capital account transactions and would comprise of the following: (1) Foreign Investment—this will be discussed separately later. However, this inflows of foreign currencies into the economy for investment purposes. (2) Deposits—many of the Indian diaspora settled abroad maintain deposits currencies in India known as NRI (3) Borrowings—private sector can borrow in the international currency and so can the government bilaterally or from multilateral institutions such as the IMF, World Bank, etc. (4) External Assistance and Grant -

Question 15 of 35

15. Question

What is the primary purpose of a current account maintained by a government?

Correct

Solution (c)

Explanation

Account maintained by every government in which every kind of current transaction is shown. This account is maintained by central bank of the country. Current transactions of an economy in foreign currency all over the world are— export, import, interest payments, private remittances and transfers. All transactions in current account are shown as either inflow or outflow (credit or debit). At the end of the year, the current account might be positive or negative. (Hence option c is correct)

Incorrect

Solution (c)

Explanation

Account maintained by every government in which every kind of current transaction is shown. This account is maintained by central bank of the country. Current transactions of an economy in foreign currency all over the world are— export, import, interest payments, private remittances and transfers. All transactions in current account are shown as either inflow or outflow (credit or debit). At the end of the year, the current account might be positive or negative. (Hence option c is correct)

-

Question 16 of 35

16. Question

Which of the following statement is correct about convertibility?

- Indian government introduced full convertibility in Trade account and current account in 1990’s.

- Current Account Convertibility involves the freedom to invest in financial assets of other countries.

- The rupee was made fully convertible for current account for all trading activities in mid 1990’s.

Select the correct answer using the code given below:

Correct

Solution (d)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct Current account convertibility refers to the freedom of converting home currency into foreign currency with respect to transactions in current account. Budget 1992-93 introduced Liberalized Exchange Rate Management System (LERMS). In this system, 60% of foreign exchange earnings are convertible at open market rate, and remaining 40% at RBI fixed rate. In 1993-94, government introduced full convertibility in Trade account. In 1994-95 budget, full convertibility in current account was introduced. Capital Account Convertibility refers to the freedom to convert local financial assets into foreign financial assets and vice versa at market determined rates of exchange. It is associated with changes of ownership in foreign/domestic financial assets and liabilities and embodies the creation and liquidation of claims on, or by, the rest of the world.” Capital account convertibility is thus the freedom of foreign investors to purchase Indian financial assets (shares, bonds etc.) and that of the domestic citizens to purchase foreign financial assets. In the beginning of reforms, the rupee was made partially convertible for goods, services and merchandise only. During mid-1990s, the rupee was made fully convertible for current account for all trading activities, remittances and indivisibles. Incorrect

Solution (d)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Correct Current account convertibility refers to the freedom of converting home currency into foreign currency with respect to transactions in current account. Budget 1992-93 introduced Liberalized Exchange Rate Management System (LERMS). In this system, 60% of foreign exchange earnings are convertible at open market rate, and remaining 40% at RBI fixed rate. In 1993-94, government introduced full convertibility in Trade account. In 1994-95 budget, full convertibility in current account was introduced. Capital Account Convertibility refers to the freedom to convert local financial assets into foreign financial assets and vice versa at market determined rates of exchange. It is associated with changes of ownership in foreign/domestic financial assets and liabilities and embodies the creation and liquidation of claims on, or by, the rest of the world.” Capital account convertibility is thus the freedom of foreign investors to purchase Indian financial assets (shares, bonds etc.) and that of the domestic citizens to purchase foreign financial assets. In the beginning of reforms, the rupee was made partially convertible for goods, services and merchandise only. During mid-1990s, the rupee was made fully convertible for current account for all trading activities, remittances and indivisibles. -

Question 17 of 35

17. Question

Which factor contributes to a currency becoming a hard currency?

Correct

Solution (c)

Explanation

Hard currency is the international currency in which the highest faith is shown and is needed by every economy. The strongest currency of the world is one which has a high level of liquidity. Basically, the economy with the highest as well as highly diversified exports that are compulsive imports for other countries (as of high-level technology, defence products, lifesaving medicines and petroleum products) will also create high demand for its currency in the world and become the hard currency. It is always scarce. (Hence option c is correct)

Incorrect

Solution (c)

Explanation

Hard currency is the international currency in which the highest faith is shown and is needed by every economy. The strongest currency of the world is one which has a high level of liquidity. Basically, the economy with the highest as well as highly diversified exports that are compulsive imports for other countries (as of high-level technology, defence products, lifesaving medicines and petroleum products) will also create high demand for its currency in the world and become the hard currency. It is always scarce. (Hence option c is correct)

-

Question 18 of 35

18. Question

The concept of “race to the bottom” in relation to globalization refers to:

Correct

Solution (a)

Explanation

A race to the bottom refers to heightened competition between nations, states, or companies, where product quality or rational economic decisions are sacrificed in order to gain a competitive advantage or reduction in product manufacturing costs. It is most often used within the context of grabbing market share or in labor markets. It refers to efforts by companies to move manufacturing and operations to areas with lower labor costs and fewer worker rights. However, this can result in tit-for-tat competition that spirals out of control. A race to the bottom can often have a negative impact on those competing, often with disastrous consequences. (Hence option a is correct)

Incorrect

Solution (a)

Explanation

A race to the bottom refers to heightened competition between nations, states, or companies, where product quality or rational economic decisions are sacrificed in order to gain a competitive advantage or reduction in product manufacturing costs. It is most often used within the context of grabbing market share or in labor markets. It refers to efforts by companies to move manufacturing and operations to areas with lower labor costs and fewer worker rights. However, this can result in tit-for-tat competition that spirals out of control. A race to the bottom can often have a negative impact on those competing, often with disastrous consequences. (Hence option a is correct)

-

Question 19 of 35

19. Question

Which of the following are the effects of globalisation on the Indian economy?

- It has expanded the size of the Indian market.

- Development of Capital Market.

- Exploitation of Labour and increase in income inequalities.

Select the answer using the code given below:

Correct

Solution (d)

Explanation

Statement 1 Statement 2 Statement 3 Correct Correct Correct Globalization has expanded the size of the market, it has permitted Indian business unit to expand their business in the whole world. Now multinational corporations have no national boundaries. Indian companies like Infosys, Tata consultancy, Wipro, Tata Steel, reliance etc., are doing their business in many countries of the world. Globalization has helped in Indian capital market development. Now many foreign investors invest in the Indian capital market recently there has been substantial increase in inflow of foreign. Globalization is exploiting unskilled workers by giving lower wages, less job security, long working hours and worse working conditions. Globalization has benefited MNCs and big industrial units but small and cottage industries are adversely hit by it. Problem of Unemployment as a result of globalization foreign companies or even some Indian companies use capital intensive technology. With the increasing use of capital-intensive technology, the employment opportunities are reduced and increase the problem of unemployment in the Indian economy. Thus, globalisation has increased inequalities in India.

Incorrect

Solution (d)

Explanation

Statement 1 Statement 2 Statement 3 Correct Correct Correct Globalization has expanded the size of the market, it has permitted Indian business unit to expand their business in the whole world. Now multinational corporations have no national boundaries. Indian companies like Infosys, Tata consultancy, Wipro, Tata Steel, reliance etc., are doing their business in many countries of the world. Globalization has helped in Indian capital market development. Now many foreign investors invest in the Indian capital market recently there has been substantial increase in inflow of foreign. Globalization is exploiting unskilled workers by giving lower wages, less job security, long working hours and worse working conditions. Globalization has benefited MNCs and big industrial units but small and cottage industries are adversely hit by it. Problem of Unemployment as a result of globalization foreign companies or even some Indian companies use capital intensive technology. With the increasing use of capital-intensive technology, the employment opportunities are reduced and increase the problem of unemployment in the Indian economy. Thus, globalisation has increased inequalities in India.

-

Question 20 of 35

20. Question

Consider the following statements.

- The reinvestment of earnings between a parent company and its subsidiary does not constitute a part of Foreign Direct Investment calculations.

- Foreign Portfolio Investment does not represent a controlling stake in an enterprise.

- Foreign Institutional Investment results in the increase in the country’s productivity.

Which of the following statements given above is/are correct?

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect FDI is calculated to include all kinds of capital contributions, such as the purchases of stocks, as well as the reinvestment of earnings by a wholly owned company incorporated abroad (subsidiary), and the lending of funds to a foreign subsidiary or branch. The reinvestment of earnings and transfer of assets between a parent company and its subsidiary often constitutes a significant part of FDI calculations. Foreign Portfolio Investment (FPI), on the other hand, is a category of investment instruments that is more easily traded, may be less permanent, and does not represent a controlling stake in an enterprise. These include investments via equity instruments (stocks) or debt (bonds) of a foreign enterprise which does not necessarily represent a long-term interest. Foreign Institutional Investment is a subcategory of FPI. It refers to investments made by foreign institutional investors as mutual funds, pension funds, insurance companies, and hedge funds. These institutional investors pool money from multiple sources for investments. FII may bring long or short-term capital in the country. FDI results in the increase in the country’s productivity. As opposed to FII that results in the increase in the country’s capital. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Incorrect FDI is calculated to include all kinds of capital contributions, such as the purchases of stocks, as well as the reinvestment of earnings by a wholly owned company incorporated abroad (subsidiary), and the lending of funds to a foreign subsidiary or branch. The reinvestment of earnings and transfer of assets between a parent company and its subsidiary often constitutes a significant part of FDI calculations. Foreign Portfolio Investment (FPI), on the other hand, is a category of investment instruments that is more easily traded, may be less permanent, and does not represent a controlling stake in an enterprise. These include investments via equity instruments (stocks) or debt (bonds) of a foreign enterprise which does not necessarily represent a long-term interest. Foreign Institutional Investment is a subcategory of FPI. It refers to investments made by foreign institutional investors as mutual funds, pension funds, insurance companies, and hedge funds. These institutional investors pool money from multiple sources for investments. FII may bring long or short-term capital in the country. FDI results in the increase in the country’s productivity. As opposed to FII that results in the increase in the country’s capital. -

Question 21 of 35

21. Question

With reference to the findings of the Devolution to Panchayats in States 2024 Report, consider the following states:

- Karnataka

- Uttar Pradesh

- Tamil Nadu

- Maharashtra

- Kerala

Arrange the given states in increasing order based on devolution to rural local bodies:

Correct

Solution (c)

Explanation:

Context: The Report titled “Status of Devolution to Panchayats in States – An Indicative Evidence Based Ranking” was unveiled by Union Minister of State, Prof. S. P. Singh Baghel, Ministry of Panchayati Raj and Ministry of Fisheries, Animal Husbandry & Dairying in New Delhi.

- The Devolution to Panchayats in States 2024 Report is also referred to as the Panchayat Devolution Index 2024 which evaluates the autonomy and empowerment of Panchayati Raj Institutions (PRIs) by assessing the devolution of powers and resources across Indian states and Union Territories.

- It assesses six critical dimensions i.e., Framework, Functions, Finances, Functionaries, Capacity Building, and Accountability of the Panchayats.

- The overall devolution to rural local bodies increased from 39.9% in 2013-14 to 43.9% in 2021-22.

- Top five states are Karnataka (1st), Kerala (2nd), Tamil Nadu (3rd), Maharashtra (4th) and Uttar Pradesh (5th). Hence option c is correct.

- The lowest-ranked states/UTs are Dadra & Nagar Haveli and Daman & Diu (13.62), Puducherry (16.16), and Ladakh (16.18).

Source: https://pib.gov.in/PressReleasePage.aspx?PRID=2102965

Incorrect

Solution (c)

Explanation:

Context: The Report titled “Status of Devolution to Panchayats in States – An Indicative Evidence Based Ranking” was unveiled by Union Minister of State, Prof. S. P. Singh Baghel, Ministry of Panchayati Raj and Ministry of Fisheries, Animal Husbandry & Dairying in New Delhi.

- The Devolution to Panchayats in States 2024 Report is also referred to as the Panchayat Devolution Index 2024 which evaluates the autonomy and empowerment of Panchayati Raj Institutions (PRIs) by assessing the devolution of powers and resources across Indian states and Union Territories.

- It assesses six critical dimensions i.e., Framework, Functions, Finances, Functionaries, Capacity Building, and Accountability of the Panchayats.

- The overall devolution to rural local bodies increased from 39.9% in 2013-14 to 43.9% in 2021-22.

- Top five states are Karnataka (1st), Kerala (2nd), Tamil Nadu (3rd), Maharashtra (4th) and Uttar Pradesh (5th). Hence option c is correct.

- The lowest-ranked states/UTs are Dadra & Nagar Haveli and Daman & Diu (13.62), Puducherry (16.16), and Ladakh (16.18).

Source: https://pib.gov.in/PressReleasePage.aspx?PRID=2102965

-

Question 22 of 35

22. Question

Consider the following statements about IN-SPACe:

It functions as an autonomous agency in the Department of Space (DOS).

It acts as an interface between ISRO and Non-Governmental Entities (NGEs).

It is headquartered in Bengaluru, Karnataka.Choose the correct answer using the code below:

Correct

Solution (c)

Explanation:

Context: The Indian National Space Promotion and Authorization Centre (IN-SPACe), an independent body under the Department of Space to regulate and promote the private space industry in India, has identified at least 166 technologies developed for various ISRO missions that can be shared with industry to be utilized for other purposes.

- IN-SPACe functions as an autonomous agency in the Department of Space (DOS). Hence statement 1 is correct.

- It was formed following the space sector reforms in 2020 to enable and facilitate the participation of private players.

- IN-SPACe promotes, authorizes, and supervises space activities of non-governmental entities, including building launch vehicles, providing space services, sharing ISRO’s infrastructure, and establishing new space facilities.

- It acts as an interface between ISRO and Non-Governmental Entities (NGEs). Hence statement 2 is correct.

- It is responsible for promoting, enabling authorizing, and supervising various space activities of non-governmental entities including

- building launch vehicles & satellites and providing space-based services;

- sharing space infrastructure and premises under the control of DOS/ISRO;

- and establishing of new space infrastructure and facilities;

- It also assesses the needs and demands of private players, including educational and research institutions, and explores ways to accommodate these requirements in consultation with ISRO.

- It is headquartered in Bopal, Ahmedabad, Gujarat. Hence statement 3 is incorrect.

Source: https://indianexpress.com/article/long-reads/chandrayaan-software-cars-anti-corrosive-paints-tech-isro-missions-daily-lives-9833952/

Incorrect

Solution (c)

Explanation:

Context: The Indian National Space Promotion and Authorization Centre (IN-SPACe), an independent body under the Department of Space to regulate and promote the private space industry in India, has identified at least 166 technologies developed for various ISRO missions that can be shared with industry to be utilized for other purposes.

- IN-SPACe functions as an autonomous agency in the Department of Space (DOS). Hence statement 1 is correct.

- It was formed following the space sector reforms in 2020 to enable and facilitate the participation of private players.

- IN-SPACe promotes, authorizes, and supervises space activities of non-governmental entities, including building launch vehicles, providing space services, sharing ISRO’s infrastructure, and establishing new space facilities.

- It acts as an interface between ISRO and Non-Governmental Entities (NGEs). Hence statement 2 is correct.

- It is responsible for promoting, enabling authorizing, and supervising various space activities of non-governmental entities including

- building launch vehicles & satellites and providing space-based services;

- sharing space infrastructure and premises under the control of DOS/ISRO;

- and establishing of new space infrastructure and facilities;

- It also assesses the needs and demands of private players, including educational and research institutions, and explores ways to accommodate these requirements in consultation with ISRO.

- It is headquartered in Bopal, Ahmedabad, Gujarat. Hence statement 3 is incorrect.

Source: https://indianexpress.com/article/long-reads/chandrayaan-software-cars-anti-corrosive-paints-tech-isro-missions-daily-lives-9833952/

-

Question 23 of 35

23. Question

Consider the following pairs:

India’s Major Overseas Port Country - Duqm Port

Israel - Sittwe Port

Myanmar - Mongla Port

Sri Lanka - Haifa Port

Oman - Chabahar Port

Iran How many above pair/s is/are correctly matched?

Correct

Solution (b)

Explanation:

Context: Donald Trump issued a Presidential National Security Memorandum (PNSM-2), calling for “maximum pressure” on Iran, as what he called the “world’s leading state sponsor of terror”, his decision to name the Chabahar Port in particular sent shock waves through New Delhi.

India’s Major Overseas Port Country - Duqm Port

Oman - Sittwe Port

Myanmar - Mongla Port

Bangladesh - Haifa Port

Israel - Chabahar Port

Iran Hence option b is correct.

Source: https://www.thehindu.com/news/international/chabahar-port-port-of-contention/article69197056.ece

Incorrect

Solution (b)

Explanation:

Context: Donald Trump issued a Presidential National Security Memorandum (PNSM-2), calling for “maximum pressure” on Iran, as what he called the “world’s leading state sponsor of terror”, his decision to name the Chabahar Port in particular sent shock waves through New Delhi.

India’s Major Overseas Port Country - Duqm Port

Oman - Sittwe Port

Myanmar - Mongla Port

Bangladesh - Haifa Port

Israel - Chabahar Port

Iran Hence option b is correct.

Source: https://www.thehindu.com/news/international/chabahar-port-port-of-contention/article69197056.ece

-

Question 24 of 35

24. Question

With reference to Cooperative Banks, consider the following statements:

- They are constituted by a uniform act passed by the parliament.

- They can open branches in foreign countries.

- They are owned and operated by members, who are its customers.

How many of the above-given statement/s is/are correct?

Correct

Solution (a)

Explanation:

Context: Days after imposing several restrictions on New India Co-operative Bank, the RBI relaxed the conditions and permitted customers to withdraw up to ₹25,000 from their deposit accounts with effect from February 27.

- Cooperative Banks are constituted by different states under different acts. Hence statement 1 is incorrect.

- A cooperative bank is a cooperative society, either registered under the State Cooperative Societies Acts or the Multi-State Cooperative Societies Act, of 2002, engaged in banking business.

- Cooperative banks in India are classified into Urban Cooperative Banks (UCBs), and Rural Cooperative Banks (RCBs).

- They cannot open branches in foreign countries. Hence statement 2 is incorrect.

- They are regulated by RBI, NABARD, and Registrar of Co-operative Societies.

- They provide rural financing and micro-financing primarily to support agriculture, small-scale industries, and self-employed workers.

- They are owned and operated by members, who are its customers. Hence statement 3 is correct.

- Members usually have equal voting rights, according to the cooperative principle of “one person, one vote”.

Source: https://www.thehindu.com/news/national/maharashtra/rbi-allows-withdrawal-of-up-to-25000-per-depositor-of-new-india-co-op-bank-from-february-27/article69258924.ece

Incorrect

Solution (a)

Explanation:

Context: Days after imposing several restrictions on New India Co-operative Bank, the RBI relaxed the conditions and permitted customers to withdraw up to ₹25,000 from their deposit accounts with effect from February 27.

- Cooperative Banks are constituted by different states under different acts. Hence statement 1 is incorrect.

- A cooperative bank is a cooperative society, either registered under the State Cooperative Societies Acts or the Multi-State Cooperative Societies Act, of 2002, engaged in banking business.

- Cooperative banks in India are classified into Urban Cooperative Banks (UCBs), and Rural Cooperative Banks (RCBs).

- They cannot open branches in foreign countries. Hence statement 2 is incorrect.

- They are regulated by RBI, NABARD, and Registrar of Co-operative Societies.

- They provide rural financing and micro-financing primarily to support agriculture, small-scale industries, and self-employed workers.

- They are owned and operated by members, who are its customers. Hence statement 3 is correct.

- Members usually have equal voting rights, according to the cooperative principle of “one person, one vote”.

Source: https://www.thehindu.com/news/national/maharashtra/rbi-allows-withdrawal-of-up-to-25000-per-depositor-of-new-india-co-op-bank-from-february-27/article69258924.ece

-

Question 25 of 35

25. Question

Konda Reddi Tribe is recognized as a Particularly Vulnerable Tribal Group in which of the following state?

Correct

Solution (d)

Explanation:

Context: Konda Reddi women set out on a quest for tender shoots of a species of bamboo that grows exclusively in Godavari Valley forests during the monsoon.

- Konda Reddi Tribe is recognized as a Particularly Vulnerable Tribal Group in Andhra Pradesh. Hence option d is correct.

- They follow Folk Hinduism (worship of local deities, and household deities).

- The family structure is patriarchal and patrilocal, with socially accepted marriage practices such as love and exchange.

- They are governed by a Kula Panchayat and led by hereditary headmen, their livelihood relies on shifting cultivation.

Note:

- Konda Veduru Bamboo is native to the Eastern Ghats, primarily found in the Godavari river valley that spreads across Andhra Pradesh, Telangana, Odisha, and Chhattisgarh.

- Konda Veduru bamboo shoots are a staple food for the Konda Reddi tribe. It is known for its nutritional benefits, rich in proteins, amino acids, vitamins, and iron, with women traditionally harvesting the Bamboo shoots.

Source: https://www.thehindu.com/news/national/andhra-pradesh/guardians-of-green-gold-in-godavari-valley/article69215320.ece

Incorrect

Solution (d)

Explanation:

Context: Konda Reddi women set out on a quest for tender shoots of a species of bamboo that grows exclusively in Godavari Valley forests during the monsoon.

- Konda Reddi Tribe is recognized as a Particularly Vulnerable Tribal Group in Andhra Pradesh. Hence option d is correct.

- They follow Folk Hinduism (worship of local deities, and household deities).

- The family structure is patriarchal and patrilocal, with socially accepted marriage practices such as love and exchange.

- They are governed by a Kula Panchayat and led by hereditary headmen, their livelihood relies on shifting cultivation.

Note:

- Konda Veduru Bamboo is native to the Eastern Ghats, primarily found in the Godavari river valley that spreads across Andhra Pradesh, Telangana, Odisha, and Chhattisgarh.

- Konda Veduru bamboo shoots are a staple food for the Konda Reddi tribe. It is known for its nutritional benefits, rich in proteins, amino acids, vitamins, and iron, with women traditionally harvesting the Bamboo shoots.

Source: https://www.thehindu.com/news/national/andhra-pradesh/guardians-of-green-gold-in-godavari-valley/article69215320.ece

-

Question 26 of 35

26. Question

With reference to Sovereign Green Bonds, consider the following statements:

- They are debt securities issued by private entities.

- The proceeds from these bonds are exclusively allocated to green initiatives.

Which of the given statement/s is/are correct?

Correct

Solution (b)

Explanation:

Context: Like several emerging markets, India also turned to sovereign green bonds to help fund its transition to a low-carbon economy, but investor demand remains weak.

- Sovereign Green Bonds (SGrBs) are debt securities issued by a national government to fund projects that have positive environmental benefits. Hence statement 1 is incorrect.

- These bonds are a way for governments to raise capital while promoting environmental sustainability.

- The proceeds from these bonds are exclusively allocated to green initiatives, which can include renewable energy projects, sustainable agriculture, waste management, and more. Hence statement 2 is correct.

- The framework for the SGrBs was issued by the government on November 9, 2022.

- The government said the bonds’ proceeds will be used for green projects that:

- Encourage energy efficiency

- Reduce carbon emissions and greenhouse gases

- Promote climate resilience and/or adaptation

- Improve natural ecosystems and biodiversity, especially in accordance with the principles of sustainable development goals

- The framework listed investments in solar, wind, biomass, and hydro energy projects, and urban mass transportation projects such as metro rail, green buildings, pollution prevention and control projects.

Source: https://indianexpress.com/article/explained/explained-economics/sovereign-green-bonds-weak-india-9837469/

Incorrect

Solution (b)

Explanation:

Context: Like several emerging markets, India also turned to sovereign green bonds to help fund its transition to a low-carbon economy, but investor demand remains weak.

- Sovereign Green Bonds (SGrBs) are debt securities issued by a national government to fund projects that have positive environmental benefits. Hence statement 1 is incorrect.

- These bonds are a way for governments to raise capital while promoting environmental sustainability.

- The proceeds from these bonds are exclusively allocated to green initiatives, which can include renewable energy projects, sustainable agriculture, waste management, and more. Hence statement 2 is correct.

- The framework for the SGrBs was issued by the government on November 9, 2022.

- The government said the bonds’ proceeds will be used for green projects that:

- Encourage energy efficiency

- Reduce carbon emissions and greenhouse gases

- Promote climate resilience and/or adaptation

- Improve natural ecosystems and biodiversity, especially in accordance with the principles of sustainable development goals

- The framework listed investments in solar, wind, biomass, and hydro energy projects, and urban mass transportation projects such as metro rail, green buildings, pollution prevention and control projects.

Source: https://indianexpress.com/article/explained/explained-economics/sovereign-green-bonds-weak-india-9837469/

-

Question 27 of 35

27. Question

With reference to the NAKSHA Programme, consider the following statements:

- It is a geospatial technology-driven city survey initiative under the existing Digital India Land Records Modernisation Programme (DILRMP).

- It aims to create and update land records in urban areas to ensure accurate and reliable documentation of land ownership.

- It is implemented by the Department of Land Resources, in collaboration with the Survey of India, and National Informatics Centre Services Inc. (NICSI).

How many of the above-given statement/s is/are correct?

Correct

Solution (c)

Explanation:

Context: Union Minister of Rural Development and Agriculture & Farmers’ Welfare Shri Shivraj Singh Chouhan will inaugurate the National Geospatial Knowledge-based Land Survey of Urban Habitations (NAKSHA) in 152 Urban Local Bodies (ULBs) across 26 States and 3 Union Territories (UTs) at Raisen, Madhya Pradesh.

- The NAKSHA Programme is a geospatial technology-driven city survey initiative under the existing Digital India Land Records Modernisation Programme (DILRMP). Hence statement 1 is correct.

- It will empower citizens, improve ease of living, enhance urban planning, and reduce land-related disputes.

- The IT-based system for property record administration will foster transparency, and efficiency and support sustainable development.

- It aims to create and update land records in urban areas to ensure accurate and reliable documentation of land ownership. Hence statement 2 is correct.

- States and Union Territory governments are scheduled to conduct field surveys and ground truthing using the orthorectified imagery, ultimately leading to the final publication of urban and semi-urban land records.

- It is implemented by the Department of Land Resources, in collaboration with the Survey of India, and National Informatics Centre Services Inc. (NICSI). Hence statement 3 is correct.

- The Survey of India is the technical partner for the NAKSHA programme which is responsible for conducting aerial surveys and providing orthorectified imagery, through third-party vendors, to state and Union Territory governments.

- The end-to-end web-GIS platform will be developed by the Madhya Pradesh State Electronic Development Corporation (MPSEDC) and storage facilities will be provided by the National Informatics Centre Services Inc. (NICSI).

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2104028#:~:text

Incorrect

Solution (c)

Explanation:

Context: Union Minister of Rural Development and Agriculture & Farmers’ Welfare Shri Shivraj Singh Chouhan will inaugurate the National Geospatial Knowledge-based Land Survey of Urban Habitations (NAKSHA) in 152 Urban Local Bodies (ULBs) across 26 States and 3 Union Territories (UTs) at Raisen, Madhya Pradesh.

- The NAKSHA Programme is a geospatial technology-driven city survey initiative under the existing Digital India Land Records Modernisation Programme (DILRMP). Hence statement 1 is correct.

- It will empower citizens, improve ease of living, enhance urban planning, and reduce land-related disputes.

- The IT-based system for property record administration will foster transparency, and efficiency and support sustainable development.

- It aims to create and update land records in urban areas to ensure accurate and reliable documentation of land ownership. Hence statement 2 is correct.

- States and Union Territory governments are scheduled to conduct field surveys and ground truthing using the orthorectified imagery, ultimately leading to the final publication of urban and semi-urban land records.

- It is implemented by the Department of Land Resources, in collaboration with the Survey of India, and National Informatics Centre Services Inc. (NICSI). Hence statement 3 is correct.

- The Survey of India is the technical partner for the NAKSHA programme which is responsible for conducting aerial surveys and providing orthorectified imagery, through third-party vendors, to state and Union Territory governments.

- The end-to-end web-GIS platform will be developed by the Madhya Pradesh State Electronic Development Corporation (MPSEDC) and storage facilities will be provided by the National Informatics Centre Services Inc. (NICSI).

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2104028#:~:text

-

Question 28 of 35

28. Question

Project Waterworth uses artificial intelligence to enhance subsea cable infrastructure to improve global connectivity. It is launched by which of the following company?

Correct

Solution (b)

Explanation:

Context: Meta announced its most ambitious subsea cable endeavour ever – Project Waterworth.

- Project Waterworth uses artificial intelligence to enhance subsea cable infrastructure to improve global connectivity. It is launched by Meta. Hence option b is correct.

- It stretches over 50,000 km long cable which connects India, the US, Brazil, South Africa, and other “key regions”.

- Project Waterworth, by leveraging advanced machine learning models, aims to predict and mitigate potential disruptions, enhancing the resilience of subsea networks. Its cable will reach depths of up to 7,000 meters in deep waters.

Source: https://indianexpress.com/article/technology/artificial-intelligence/meta-project-waterworth-ai-driven-subsea-cable-infra-9837582/

Incorrect

Solution (b)

Explanation:

Context: Meta announced its most ambitious subsea cable endeavour ever – Project Waterworth.

- Project Waterworth uses artificial intelligence to enhance subsea cable infrastructure to improve global connectivity. It is launched by Meta. Hence option b is correct.

- It stretches over 50,000 km long cable which connects India, the US, Brazil, South Africa, and other “key regions”.

- Project Waterworth, by leveraging advanced machine learning models, aims to predict and mitigate potential disruptions, enhancing the resilience of subsea networks. Its cable will reach depths of up to 7,000 meters in deep waters.

Source: https://indianexpress.com/article/technology/artificial-intelligence/meta-project-waterworth-ai-driven-subsea-cable-infra-9837582/

-

Question 29 of 35

29. Question

The Quality of Public Expenditure Index is a framework that assesses the efficiency of government spending developed by the Reserve Bank of India.

In this context, consider the following indicators:

- Capital Outlay to Gross Domestic Product Ratio

- Interest Payments to Total Expenditure Ratio

- Revenue Expenditure to Capital Outlay Ratio

- Development Expenditure as Share of Total Government Expenditure

How many of the given indicator/s is/are part of the Quality of Public Expenditure Index?

Correct

Solution (d)

Explanation:

Context: The RBI has used data since 1991 to create the ‘Quality of Public Expenditure’ index to assess how well the government is spending its money.

The Quality of Public Expenditure Index is a framework that assesses the efficiency of government spending developed by the Reserve Bank of India. The index is based on five major indicators:

- Capital Outlay to Gross Domestic Product Ratio measures the share of Gross Domestic Product (GDP) allocated to infrastructure (roads, railways, power, etc.).

- Interest Payments to Total Expenditure Ratio measures the financial burden of past borrowings.

- Revenue Expenditure to Capital Outlay Ratio measures comparison of spending on salaries, pensions, and subsidies vs. infrastructure and asset creation.

- Development Expenditure as a Share of Total Government Expenditure measures the proportion of the total budget dedicated to development sectors.

- Development Expenditure to GDP Ratio measures spending on education, healthcare, R&D, and public infrastructure.

Hence option d is correct.

Source: https://indianexpress.com/article/explained/explained-economics/explainspeaking-india-qualityof-govt-expenditure-rbi-9848686/

Incorrect

Solution (d)

Explanation:

Context: The RBI has used data since 1991 to create the ‘Quality of Public Expenditure’ index to assess how well the government is spending its money.

The Quality of Public Expenditure Index is a framework that assesses the efficiency of government spending developed by the Reserve Bank of India. The index is based on five major indicators:

- Capital Outlay to Gross Domestic Product Ratio measures the share of Gross Domestic Product (GDP) allocated to infrastructure (roads, railways, power, etc.).

- Interest Payments to Total Expenditure Ratio measures the financial burden of past borrowings.

- Revenue Expenditure to Capital Outlay Ratio measures comparison of spending on salaries, pensions, and subsidies vs. infrastructure and asset creation.

- Development Expenditure as a Share of Total Government Expenditure measures the proportion of the total budget dedicated to development sectors.

- Development Expenditure to GDP Ratio measures spending on education, healthcare, R&D, and public infrastructure.

Hence option d is correct.

Source: https://indianexpress.com/article/explained/explained-economics/explainspeaking-india-qualityof-govt-expenditure-rbi-9848686/

-

Question 30 of 35

30. Question

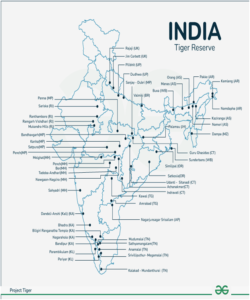

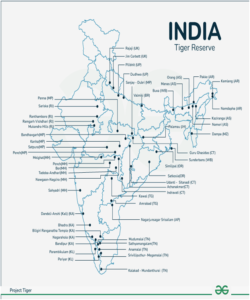

It is a protected area located in the Palakkad and Thrissur districts of Kerala. It was declared a Tiger Reserve in 2009 under Project Tiger. It covers an area of 391 sq.km. Sholayar and Thekkady rivers flow through the reserve, supporting its rich biodiversity. It is home to the four different tribes of Kadar, Malasar, Muduvar, and Mala Malasar which are settled in six different colonies inside the protected reserve.

The above paragraph describes which of the following Tiger Reserve?

Correct

Solution (c)

Explanation:

Context: A faunal survey by the Forest Department at the Parambikulam Tiger Reserve in Palakkad has added 15 new species to the protected area’s checklist.

Parambikulam Tiger Reserve is a protected area located in the Palakkad and Thrissur districts of Kerala. It was declared a Tiger Reserve in 2009 under Project Tiger. It covers an area of 391 sq.km. Sholayar and Thekkady rivers flow through the reserve, supporting its rich biodiversity. It is home to the four different tribes of Kadar, Malasar, Muduvar, and Mala Malasar which are settled in six different colonies inside the protected reserve. Hence option c is correct.

Source: https://www.thehindu.com/news/national/kerala/parambikulam-tiger-reserve-adds-15-new-species-to-its-biodiversity-checklist/article69230515.ece

Incorrect

Solution (c)

Explanation:

Context: A faunal survey by the Forest Department at the Parambikulam Tiger Reserve in Palakkad has added 15 new species to the protected area’s checklist.

Parambikulam Tiger Reserve is a protected area located in the Palakkad and Thrissur districts of Kerala. It was declared a Tiger Reserve in 2009 under Project Tiger. It covers an area of 391 sq.km. Sholayar and Thekkady rivers flow through the reserve, supporting its rich biodiversity. It is home to the four different tribes of Kadar, Malasar, Muduvar, and Mala Malasar which are settled in six different colonies inside the protected reserve. Hence option c is correct.

Source: https://www.thehindu.com/news/national/kerala/parambikulam-tiger-reserve-adds-15-new-species-to-its-biodiversity-checklist/article69230515.ece

-

Question 31 of 35

31. Question

Passage – 1

The world is urbanizing more rapidly than ever before, and cities in developing countries are growing at an even higher pace. While cities contribute to global economic growth, they are also drivers of environmental degradation. Cities consume 80% of global energy, are responsible for 70% of greenhouse gas emissions, generate huge amounts of waste and pollution, and are rapidly encroaching into natural habitats. Urban sprawl is leading to poor living conditions, making cities highly vulnerable to climate change, and threatening the biodiversity of surrounding cities.

Q.31) Based on the above passage, the following assumptions have been made:

- Cities contribute more to economic growth than rural areas.

- Some urban areas may represent a less sustainable model of living.

Which of the above assumptions is/are valid?

Correct

Solution (b)

Explanation:

Assumption 1 is incorrect: The passage nowhere compares the contribution of cities and rural areas to economic growth. The line, “While cities contribute to global economic growth, they are also drivers of environmental degradation” indicate that cities do contribute to economic growth, but how much do they contribute or whether it is more than rural areas cannot be assumed. So, this assumption is not correct as per the passage.

Assumption 2 is correct: The lines “Cities consume 80% of global energy, are responsible for 70% of greenhouse gas emissions, generate huge amounts of waste and pollution, and are rapidly encroaching into natural habitats. Urban sprawl is leading to poor living conditions, making cities highly vulnerable to climate change, and threatening the biodiversity of surrounding cities.” from the passage show that urban areas consume way more energy, emit a lot of GHGs, etc. Therefore, as per the passage, it would be correct to assume that urban areas present a less (if not the least) sustainable model of living.

Incorrect

Solution (b)

Explanation:

Assumption 1 is incorrect: The passage nowhere compares the contribution of cities and rural areas to economic growth. The line, “While cities contribute to global economic growth, they are also drivers of environmental degradation” indicate that cities do contribute to economic growth, but how much do they contribute or whether it is more than rural areas cannot be assumed. So, this assumption is not correct as per the passage.