IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS Focus)

Category: Government Schemes

Context:

- In a bid to promote local talent, the Indian Railways will patronise the newly launched ‘Aabhar’ online store that will showcase a range of exquisite gift items manufactured under the ambit of One District One Product (ODOP).

About One District One Product (ODOP):

- Nodal ministry: One District One Product (ODOP) was launched by the Ministry of Food Processing Industries in 2018.

- Objective: it aims to help districts reach their full potential, foster economic and socio-cultural growth, and create employment opportunities, especially, in rural areas.

- Every district as export hub: This initiative is carried out with the ‘Districts as Exports Hub’ initiative by the Directorate General of Foreign Trade (DGFT), Department of Commerce. It aims to turn every district in India, into an export hub through promotion of the product in which the district specialises.

- In line with Atmanirbhar Bharat: The initiative plans to accomplish this by scaling manufacturing, supporting local businesses, finding potential foreign customers and so on, thus helping to achieve the ‘Atmanirbhar Bharat’ vision.

- Process of selection: Under the ODOP initiative, all products have been selected by States/UTs by taking into consideration the existing ecosystem on the ground, products identified under Districts as Export Hubs (DEH), and GI-tagged products.

Source:

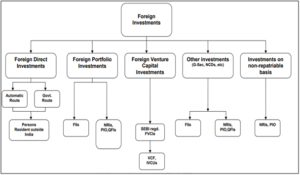

Category: Economy

Context:

- Foreign Portfolio Investors net bought equities worth ₹14,610 crore in October after three consecutive months of selling, the strongest inflow since July this year.

About Foreign Portfolio Investment (FPI):

- Definition: Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- Composition: FPIs include stocks, bonds, mutual funds, exchange traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

- Part of capital account: FPI is part of a country’s capital account and is shown on its Balance of Payments (BOP). The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- Regulated by SEBI: The Securities and Exchange Board of India (SEBI) brought new FPI Regulations, 2019, replacing the erstwhile FPI Regulations of 2014.

- Hot money: FPI is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an economy. FPI is more liquid, volatile and therefore riskier than FDI.

- Key features: Investors do not participate in the management of the company. It aims for capital appreciation rather than long-term strategic interests. Further, it provides capital flow into financial markets, increasing efficiency and investment potential.

- Difference with FDI: A foreign investor can hold up to 10% of the total paid-up capital of an Indian company without being classified as an FDI. If the holding exceeds 10%, it is reclassified as Foreign Direct Investment (FDI).

About FOREX Reserves:

- Nature: Foreign exchange (FOREX) reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- Dominated by dollars: It needs to be noted that most foreign exchange reserves are held in US dollars.

- India’s Forex Reserve include:

- Foreign Currency Assets

- Gold reserves

- Special Drawing Rights

- Reserve Tranche Position with the International Monetary Fund (IMF).

Source:

Category: International Relations

Context:

- Chinese President Xi Jinping takes centre stage at Asia-Pacific Economic Cooperation (APEC) meet and promises to defend global free trade.

About Asia-Pacific Economic Cooperation (APEC):

- Nature: The Asia-Pacific Economic Cooperation is a regional economic forum and was formed in 1989.

- Objective: The aim of the grouping is to “leverage the growing interdependence of the Asia-Pacific and create greater prosperity for the people of the region through regional economic integration.”

- Focus: The focus of APEC has been on trade and economic issues and hence, it terms the countries as “economies.”

- Non-binding commitments: APEC operates based on no binding commitments or treaty obligations. Commitments are undertaken voluntarily and capacity-building projects help members implement APEC initiatives.

- Member Countries: Currently, APEC has 21 members, which includes Australia, Brunei, Hong Kong, New Zealand, Papua New Guinea, the Philippines, Indonesia, China, Japan, South Korea, Russia, Canada, the United States, Mexico, Peru, Chile, Malaysia, Vietnam, Singapore, Thailand and Taiwan.

- Membership criterion: The criterion for membership, however, is that each member must be an independent economic entity, rather than a sovereign state.

- India as member: India was not its member till 1997 as it still had too many rules and restrictions. Further, the group decided to stop accepting new members in 1997, to focus on improving the existing cooperation among the current members. So, India is not its member and currently has the ‘observer’ status.

- Significance: Since its formation, the grouping championed the lowering of trade tariffs, free trade, and economic liberalisation. In the Seoul Declaration (1991), APEC member economies proclaimed the creation of a liberalised free trade area around the Pacific Rim as the principal objective of the organisation.

- Contribution in world trade: APEC accounts for approximately 62% of world GDP and about half of world trade. It is one of the oldest and most influential multilateral platforms in the Asia-Pacific region.

Source:

Category: Environment and Ecology

Context:

- Madhya Pradesh Chief Minister said that Nauradehi Sanctuary will become the third home for cheetahs in the state after Kuno National Park and Gandhi Sagar Sanctuary.

About Nauradehi Wildlife Sanctuary:

- Location: It is spread across three districts, i.e., Sagar, Damoh, and Narsinghpur, of Madhya Pradesh. The entire Sanctuary is situated on a plateau, forming part of the upper Vindhyan range.

- Area: It covers nearly 1197 sq.km. area.

- Declaration as wildlife sanctuary: It was declared a wildlife sanctuary in 1975. It is the largest wildlife sanctuary in Madhya Pradesh.

- Acts as a natural corridor: It acts as a corridor for Panna Tiger Reserve and Satpura Tiger Reserve while indirectly connecting Bandhavgarh Tiger Reserve via Rani Durgawati Wildlife Sanctuary.

- Drainage: Three-fourths of the wildlife sanctuary falls in the basin of the Ganges tributary, the Yamuna River, of which the Ken River is a tributary, and one-fourth of the sanctuary falls in the Narmada basin.

- Major rivers: The north-flowing Kopra River, Bamner River, Vyarma River, and Bearma River, which are tributaries of the Ken River, are the major rivers of this protected area.

- Vegetation: It is mainly a dry mixed-deciduous forest type.

- Flora: Major trees found are teak, saja, dhawda, sal, tendu (Coromandel ebony), bhirra (East Indian satinwood), and mahua.

- Fauna: The chief faunal elements include Nilgai, Chinkara, Chital, Sambhar, Black Buck, Barking deer, Common Langur, Rhesus Macaque, Freshwater Turtles, Spotted Grey Creeper, Cranes, Egrets, Lapwings, etc.

Source:

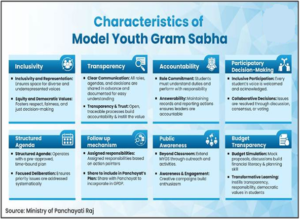

Category: Government Schemes

Context:

- The Ministry of Panchayati Raj, in collaboration with the Ministry of Education (Department of School Education & Literacy) and the Ministry of Tribal Affairs, launched the Model Youth Gram Sabha (MYGS) initiative today in New Delhi.

About Model Youth Gram Sabha Initiative:

- Nature: Model Youth Gram Sabha Initiative is a simulated forum for school children to participate in mock Gram Sabha sessions.

- Objective: It is a pioneering initiative to strengthen Janbhagidari and promote participatory local governance by engaging students in simulated Gram Sabha sessions.

- Based on model UN: It is an initiative based on the Model UN – an educational simulation of the United Nations – in schools across the country.

- Nodal ministry: It is an initiative of the Ministry of Panchayati Raj, in collaboration with the Ministry of Education and the Ministry of Tribal Affairs.

- Implementation: It will be rolled out across more than 1,000 schools nationwide, including Jawahar Navodaya Vidyalayas, Eklavya Model Residential Schools (EMRSs), and State Government Schools.

- Key features: Students from classes 9-12 will play the roles of sarpanch, ward members, and village-level officials, including village secretary, Anganwadi worker etc. They will hold mock meetings of the Gram Sabha, discuss various issues, and prepare the village budget and development plans.

- Funding support: The Panchayati Raj Ministry will also provide a support of Rs 20,000 to each school for holding the mock Gram Sabha.

Source:

(MAINS Focus)

(GS Paper 3: Agriculture – Issues of Farm Subsidies, Post-Harvest Management, and Value Addition in Agriculture)

Context (Introduction)

India suffers annual post-harvest losses of nearly ₹92,000 crore, particularly in perishables. To address inefficiencies across the supply chain, the Integrated Cold Chain and Value Addition Infrastructure (ICCVAI) scheme under PM Kisan SAMPADA Yojana (PMKSY) ensures farm-to-market connectivity and farmer income stability.

Objectives and Rationale of ICCVAI

- Reducing losses: Designed to minimize wastage in perishables — fruits, vegetables, dairy, meat, poultry, and fish — through an integrated cold chain network.

- Enhancing farmer returns: Enables producers to realize better prices by linking farm-level infrastructure to processing and retail.

- Comprehensive infrastructure: Promotes pre-cooling, pack houses, processing, refrigerated transport, and retail-level preservation.

- Employment generation: Supports agro-industrial linkages, creating over 1.7 lakh jobs (as of 2025).

- Value addition: Encourages processing and packaging that enhance shelf life, quality, and competitiveness in domestic and export markets.

Key Components and Eligibility

- Farm Level Infrastructure (FLI): Includes pre-cooling units, collection centers, and primary processing facilities.

- Distribution Hubs (DH): Centralized units for storage and dispatch with temperature-controlled systems.

- Transport linkage: Refrigerated/insulated vehicles ensure cold chain continuity.

- Eligible entities (PIAs): Individuals, FPOs, cooperatives, SHGs, NGOs, firms, PSUs, and companies can implement projects.

Complementary Government Schemes

- Mission for Integrated Development of Horticulture (MIDH): Supports cold storages up to 5,000 MT with 35% subsidy in general areas and 50% in hilly/North-Eastern states.

- Promotes horticulture infrastructure through State Horticulture Missions.

- Operation Greens: Started in 2018–19 for Tomato, Onion, Potato (TOP) value chain; later extended to more fruits, vegetables, and shrimp.

- Aims at price stabilization and integrated value-chain development.

- National Horticulture Board (NHB): Offers 35–50% subsidy for construction/modernization of cold storages (5,000–20,000 MT capacity).

- Focuses on Controlled Atmosphere (CA) and scientific storage systems.

- Agriculture Infrastructure Fund (AIF): Corpus of ₹1 lakh crore; provides collateral-free loans up to ₹2 crore with 3% interest subvention.

- Funds post-harvest management and community infrastructure like warehouses and cold stores.

Policy Revisions and Modernization Efforts

- June 2022: Fruits and vegetables shifted to Operation Greens for specialized focus.Prevented duplication and improved resource targeting.

- August 2024: Introduced multi-product food irradiation units for enhanced shelf life and food safety. Encouraged adoption of ionizing radiation as a non-chemical preservation method.

- May 2025: Strengthened end-to-end value addition; expanded coverage to non-horticulture perishables. Reinforced fair price realization for farmers through efficient market linkages.

- Technology inclusion: Focus on IoT-based cold monitoring, energy-efficient refrigeration, and AI-enabled logistics for optimization.

- Administrative simplification: Standardized guidelines, digital monitoring, and EOI-based selection enhanced transparency and speed.

Challenges and Limitations

- Fragmented infrastructure: Uneven distribution of facilities across states, with concentration in industrial belts.

- Energy inefficiency: High operational costs due to unreliable power supply and obsolete technology.

- Limited awareness: Small farmers lack knowledge or capital to access the scheme.

- Coordination gaps: Overlap with horticulture schemes causes duplication and administrative delay.

- Environmental concerns: Refrigerant gases and energy-intensive systems raise sustainability issues.

Reforms and Way Forward

- Integrated policy alignment: Greater convergence between ICCVAI, AIF, and e-NAM for holistic agri-logistics.

- Cluster-based models: Focused development in agri-export and FPO clusters to maximize utilization.

- Technology infusion: Promotion of IoT sensors, solar cold rooms, and blockchain traceability for efficiency and transparency.

- Capacity building: Training programs for FPOs and SHGs to manage cold chain assets sustainably.

- Sustainability thrust: Adoption of green refrigeration and renewable energy-powered systems to reduce carbon footprint.

Conclusion

The ICCVAI scheme reflects adaptive and technology-driven governance aimed at bridging the post-harvest gap from farm to consumer. Ensuring inclusion of smallholders, energy efficiency, and integration with digital agri-platforms will determine its future success in achieving a sustainable, remunerative, and resilient food system.

Mains Question

- “Post-harvest management is not merely about storage but about creating a value chain from farm to consumer.” Discuss in light of the ICCVAI scheme under Pradhan Mantri Kisan SAMPADA Yojana. (150 words, 10 marks)

Source: Press Information Bureau

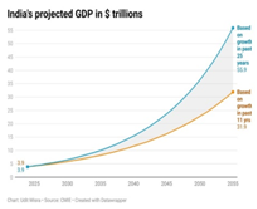

(GS Paper 3 – Economy: Growth and Development, External Sector)

Context (Introduction)

India’s Commerce and Industry Minister Piyush Goyal, at the Berlin Global Dialogue (2025), projected that India could become a $30 trillion economy in the next 20–25 years.

- The statement underscores India’s long-term economic confidence amidst ongoing global economic turbulence.

- Currently, India’s nominal GDP stands at $3.9 trillion (FY 2024) — about one-eighth of the US economy ($29.2 trillion). Goyal’s assertion draws attention to India’s growth potential, exchange rate dynamics, and economic resilience in a multipolar trading order.

Understanding the Economic Size and Context

- Nominal GDP Basis: India’s GDP, measured in nominal terms, represents the total market value of goods and services produced domestically without adjusting for inflation.

- Comparative Scale: As of 2024, California’s economy ($4.1 trillion) exceeds India’s total GDP, reflecting the gap India aims to bridge by 2050.

- Global Heft: The size of GDP determines global economic influence, trade negotiation leverage, and investment attractiveness.

- Exchange Rate Factor: In 2014, the rupee-dollar rate was ₹65; by 2024 it depreciated to ₹84, impacting the dollar value of India’s GDP.

- Conversion Significance: A rupee-denominated GDP of ₹330 trillion would translate into a $5 trillion economy only if the exchange rate stabilizes — illustrating the interplay of growth and currency strength.

The Basis of Goyal’s $30 Trillion Projection

- Historical Growth Trend: Between 2000–2024, India’s nominal GDP grew at a CAGR of 11.9%, while the rupee depreciated at 2.7% per annum.

- Forward Projection (25-year horizon): If these trends persist, India could achieve a $30 trillion economy by 2048, aligning with Goyal’s 20–25-year window.

- Exchange Rate Impact: Moderate depreciation aids export competitiveness but erodes dollar-based GDP valuation.

- Nominal vs. Real GDP: Projections use nominal growth rates; real GDP (inflation-adjusted) growth would be substantially lower but still indicative of productive expansion.

- Long-Term Vision: The projection assumes policy continuity, demographic dividends, and sustained capital formation.

Recent Slowdown: A Reality Check

- Post-2014 Performance: Nominal GDP growth slowed to 10.3% CAGR (2014–2025), while rupee depreciation accelerated to 3.08% annually.

- Revised Outcome: Under current growth-depreciation trends, India would reach the $30 trillion mark only by 2055 — about 7–8 years later than Goyal’s timeline.

- Structural Constraints: Slow manufacturing growth, export dependency, and productivity bottlenecks remain critical concerns.

- Fiscal Moderation: Fiscal consolidation efforts and inflation control have moderated nominal expansion.

- Policy Sensitivity: Marginal changes in growth rates, even by 1–1.5%, can alter long-term outcomes by several trillion dollars.

Long-Term Implications and Lessons

- Compounding Effect: Over 25 years, small growth differentials (11.9% vs 10.3%) yield vast divergences — up to 75% larger GDP by 2055 under higher growth

- Decadal Momentum: Each decade’s performance significantly affects cumulative GDP — emphasizing the need for sustained high growth

- Exchange Rate Stability: Maintaining currency stability is vital for credible dollar-denominated GDP growth

- Investment Cycle Revival: Sustaining 8%+ real growth will require investment in infrastructure, digitalization, and green industries

- Demographic Dividend: Harnessing India’s working-age population (68% share) remains a core enabler for productivity-driven expansion.

The Way Forward

- Structural Reforms: Deepening labour, land, and capital market reforms to boost total factor productivity.

- Trade Competitiveness: Diversifying export markets, joining global value chains, and negotiating balanced FTAs aligned with long-term interests.

- Fiscal & Monetary Coordination: Ensuring prudent fiscal policy alongside accommodative but inflation-aware monetary stance.

- Technological Leap: Leveraging AI, digital governance, and renewable technologies to create high-value sectors.

- Sustainable Growth Path: Balancing high GDP expansion with environmental and social sustainability, as underscored by SDG-linked economic strategies.

Conclusion

Piyush Goyal’s projection is economically plausible but conditionally dependent — achievable only through consistent double-digit nominal growth, moderate rupee depreciation, and robust structural reforms.

- While India’s economic fundamentals remain strong, the difference between $30 trillion by 2048 and by 2055 illustrates how even minor policy slippages can reshape long-term outcomes.

- The path to $30 trillion is not merely a numeric goal but a test of India’s institutional resilience, reform credibility, and demographic execution in a rapidly changing global order.

Mains Question

- Examine the structural and policy reforms necessary for India to sustain double-digit nominal growth required to achieve a $30 trillion economy by mid-century. (150 words, 10 marks)

Source: The Indian Express