IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS Focus)

Category: Environment and Ecology

Context:

- The 20th meeting of the Conference of the Parties (CoP20) to CITES has concluded in Samarkand, Uzbekistan, marking the 50th anniversary of the Convention.

About CITES Convention:

-

- Full Form: CITES stands for ‘Convention on International Trade in Endangered Species of Wild Fauna and Flora.’

- Nature: It is an international agreement to which States and regional economic integration organizations adhere voluntarily.

- Adoption: It was adopted in 1973 and entered into force in 1975.

- Objective: It aims to ensure that international trade in wild animals and plants does not threaten their survival.

- Membership: Presently, there are 185 member parties, and trade is regulated in more than 38,000 species.

- Legally binding: Although CITES is legally binding on the Parties (they have to implement the Convention), it does not take the place of national laws.

- Secretariat: The CITES Secretariat is administered by the United Nations Environment Programme (UNEP) and is located in Geneva, Switzerland.

- Governance: The Conference of the Parties to CITES, is the supreme decision-making body of the Convention and comprises all its Parties.

- Meeting: Representatives of CITES nations meet every two to three years at a Conference of the Parties (or COP) to review progress and adjust the lists of protected species, which are grouped into three categories with different levels of protection:

- Collaboration: CITES brings together law enforcement officers from wildlife authorities, national parks, customs, and police agencies to collaborate on efforts to combat wildlife crime targeted at animals such as elephants and rhinos.

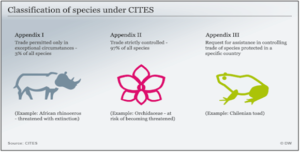

- 3 Appendices:

-

- Appendix I: It includes species threatened with extinction and provides the greatest level of protection, including a prohibition on commercial trade.

- Appendix II: It includes species that are not currently threatened with extinction but may become so without trade controls. Regulated trade is allowed if the exporting country issues a permit based on findings that the specimens were legally acquired and the trade will not be detrimental to the survival of the species.

- Appendix III: It includes species for which a country has asked other CITES parties to help control international trade. Trade in Appendix III species is regulated using CITES export permits (issued by the country that listed the species in Appendix III) and certificates of origin (issued by all other countries).

Source:

Category: Geography

Context:

- In an effort to revive the nearly defunct Royal Bird Sanctuary at Majuli island, the Charaichung Festival has been organised in the island district for the second time.

About Majuli Island:

- Location: It is the world’s largest river island located in Assam.

- Formation: The island is formed by the Brahmaputra River in the south and the Kherkutia Xuti, a branch of the Brahmaputra, joined by the Subansiri River in the north.

- Landscape: The island’s landscape is characterised by lush greenery, water bodies, and paddy fields.

- Uniqueness: It became India’s first river island district in 2016.

- Livelihood: Rice cultivation is the primary livelihood for the residents of Majuli, with several unique varieties of rice, such as Komal Saul and Bao Dhan, grown in the region.

- Tribes: Most of the islanders belong to three tribes-Mishing, Deori, and Sonowal Kachari, with the non-tribal Assamese comprising the rest.

- Historical significance: It is often called the soul of Assam. It has been recognized as the cultural capital of Assam since the 16th century.

- Associated with neo-Vaishnavite culture: The island has been the hub of Assamese neo-Vaishnavite culture, initiated around the 16th century by the great Assamese saint-reformer Srimanta Sankerdeva and his disciple Madhavdeva.

- Cultural richness: They initiated the tradition of Satras (monastic institutions), and these Satras have preserved Sattriya dance, literature, bhaona (theatre), dance forms, mask making, and boat-making. Apart from Satras or Vaishnavite monasteries, Majuli is famous for mask-making and has a tradition of pottery making.

About Charaichung Festival:

- Legacy: The festival commemorates the 392-year-old legacy of Asia’s first protected Royal Bird Sanctuary, ‘Charaichung’, established in 1633 AD by Ahom king Swargadeu Pratap Singha.

- Objective: The four-day festival, being held from December 7 to 10, has been organised under the initiative of Majuli Sahitya and locals, with the aim of placing Charaichung on the global map and rejuvenating its bird habitat.

- Exhibition: The festival also features a special exhibition highlighting forest conservation efforts. The display sheds light on ongoing initiatives to protect Majuli’s biodiversity and reflects the collective commitment to safeguarding the island’s natural heritage.

Source:

Category: Government Schemes

Context:

- Controller General of Communication Accounts recently inaugurated the onboarding of all MTNL employees retiring in November 2025 onto the SAMPANN portal at Delhi.

About SAMPANN Portal:

- Nature: SAMPANN stands for “System for Accounting and Management of Pension,” and it is a Comprehensive Pension Management System (CPMS).

- Nodal ministry: It is an initiative undertaken by the Controller General of Communication Accounts (CGCA), Department of Telecommunications, Ministry of Communications.

- Launch: It was launched on 29th December, 2018.

- Objective: It aims to bring the pension processing, sanctioning, authorisation, and payment units under a common platform. It also provides direct credit of pension into the bank accounts of pensioners.

- Significance: The system has helped the Department in faster settlement of pension cases, improved reconciliation, and ease of accounting. It also provides online grievance management for the pensioners and faster processing of arrears and revision of pension.

- Use of DBT: Pensions are disbursed directly into the bank accounts of pensioners, ensuring timely and secure payments.

- Single-Window System: It serves as a unified platform for all aspects of the pension process, including online grievance management and tracking of pension status.

- Enhanced transparency: Pensioners can track their pension status from home and access key information like payment history and e-PPOs (electronic Pension Payment Orders) through a personalized dashboard.

Source:

Category: History and Culture

Context:

- Recently, Deepavali, the festival of lights, was inscribed on UNESCO’s List of the Intangible Cultural Heritage of Humanity.

About UNESCO’s Intangible Cultural Heritage List:

-

- Definition: Intangible heritage refers to “living heritage” passed across generations. It includes oral traditions, performing arts, social practices, rituals, festive events, knowledge/practices concerning nature, and traditional craftsmanship.

- Objective: The list aims to ensure the safeguarding, promotion, and transmission of these traditions for future generations, raise global awareness of their importance, and foster cultural diversity and international cooperation.

- Administration: The list is managed under the 2003 UNESCO Convention for the Safeguarding of the Intangible Cultural Heritage. The Intergovernmental Committee makes decisions on inscriptions based on nominations submitted by member states.

- 5 Domains: The UNESCO’s 2003 proposes five broad ‘domains’ in which intangible cultural heritage is manifested:

- Oral traditions and expressions, including language as a vehicle of the intangible cultural heritage;

- Performing arts;

- Social practices, rituals and festive events;

- Knowledge and practices concerning nature and the universe;

- Traditional craftsmanship.

- List of 16 elements on the List (after inclusion of Deepavali):

-

- Tradition of Vedic chanting – 2008

- Kutiyattam (Sanskrit theatre) – 2008

- Ramlila (traditional performance of the Ramayana) – 2008

- Ramman (festival & ritual theatre of Garhwal Himalayas) – 2009

- Mudiyettu (ritual dance drama of Kerala) – 2010

- Kalbelia folk songs & dances of Rajasthan – 2010

- Chhau dance – 2010

- Buddhist chanting of Ladakh – 2012

- Sankirtana (ritual singing & drumming of Manipur) – 2013

- Traditional brass & copper craft of Thatheras, Punjab – 2014

- Yoga – 2016

- Kumbh Mela – 2017

- Durga Puja of Kolkata – 2021

- Garba of Gujarat – 2023

- Navroz/Nowruz – 2024

- Deepavali (Diwali) – 2025

Source:

Category: Science and Technology

Context:

- Recently, NewSpace India Limited (NSIL) signed 70 Technology Transfer Agreements to transfer technologies developed at ISRO to Industry.

About NewSpace India Limited (NSIL):

-

- Establishment: NewSpace India Limited (NSIL) was incorporated on 6 March 2019 under the Companies Act, 2013.

- Administrative control: It is a wholly owned Government of India company, under the administrative control of Department of Space (DOS).

- Headquarters: Its headquarters is located in Bengaluru.

- Association with ISRO: It is the commercial arm of Indian Space Research Organisation (ISRO).

- Difference from Antrix Corporation: NSIL is India’s second commercial space entity after Antrix Corporation, established in 1992. While Antrix primarily handled exports and marketing to international customers, NSIL focuses on capacity building within the domestic industry and commercializing technologies.

- Relationship with IN-SPACe: The Indian National Space Promotion and Authorization Centre (IN-SPACe), established in 2020, is an independent nodal agency that promotes and authorizes private non-governmental entities in space activities, acting as an interface with ISRO.

- Significance: NSIL (along with IN-SPACe) is part of broader reforms under the Indian Space Policy 2023 aimed at increasing private sector participation and India’s share in the global space economy.

- Primary responsibilities:

-

-

- Enabling Indian industries to take up high technology space related activities.

- Promotion and commercial exploitation of the products and services emanating from the Indian space programme.

-

- Major business areas:

-

- Production of Polar Satellite Launch Vehicle (PSLV) and Small Satellite Launch Vehicle (SSLV) through industry.

- Building of Satellites (both Communication and Earth Observation) as per user requirements.

- Transfer of technology developed by ISRO centres/units and constituent institutions of the Dept. of Space.

- Marketing spinoff technologies and products/services emanating out of ISRO activities.

- Consultancy services.

Source:

(MAINS Focus)

(UPSC GS Paper II – Education Policy, Social Justice, Welfare Schemes, Inequality)

Context (Introduction)

Despite Article 21A guaranteeing free and compulsory education and NEP 2020 expanding universalisation up to Class 12, NSS 80th Round (2025) reveals rising reliance on private schools and coaching, escalating household expenditure and deepening inequality in basic schooling.

Main Arguments: What the NSS 80th Round Reveals About Schooling Costs in India ?

- Rising Private School Enrolment: Private schools now account for 31.9% of national enrolment, with urban enrolment at 51.4%—double that of rural areas. Since the 75th NSS Round (2017–18), private enrolment has risen across all levels, especially primary and middle schooling, signalling declining confidence in government schools.

- High Fee Burden Across School Types: Even in government schools, 25–35% of students report paying course fees. Annual government school fees range from ₹823–7,704, while private school fees rise steeply from ₹17,988–49,075. Monthly private schooling costs in urban India (₹2,182–4,089) are comparable to monthly income of the bottom 5–10% households, making schooling a major financial strain.

- Private Tuition as a Parallel System: Private coaching has become widespread: 25.5% of rural children and 30.7% of urban children take private tuition. The incidence rises sharply at secondary and higher secondary levels. Tuition costs range from ₹3,980 to ₹22,394 per year, with urban families bearing double the rural expenditure.

- Socio-Economic Drivers of Coaching Dependence: Higher household income, better parental education, and private school enrolment correlate positively with tuition demand. Despite high fees, many private schools employ underpaid and underqualified teachers, pushing children toward coaching to compensate for poor school quality.

- Contradiction with Constitutional Promise: NEP 2020 and Article 21A envision free, equitable schooling, yet India’s education landscape has shifted toward privatised access. This creates a financial contradiction where families pay for what the State is mandated to provide.

Challenges / Criticisms

- Unaffordable Schooling for Lower-Income Families: Private school fees for pre-primary and primary levels are equivalent to the MPCE (Monthly Per Capita Expenditure) of the poorest 5–10% of households—pushing basic education beyond reach.

- Deepening Learning Inequalities: High-income households use tuition to supplement learning, while poor students rely solely on school quality. This widens learning gaps, undermining the goal of equitable education.

- Segmentation of Schooling by Class: Government schools now cater predominantly to the poorest households. Middle-class flight toward private schools strips public schools of social capital, accountability, and community engagement.

- Tuition Culture Undermining School Quality: Studies (Agrawal, Gupta & Mondal, 2024) show that higher private tuition correlates with poorer school quality indicators, implying systemic underperformance of both government and low-fee private schools.

- Urban–Rural Divide in Spending and Access: Urban households spend significantly more on both schooling and tuition, reinforcing structural advantages in college admissions, competitive exams, and long-term opportunities.

Way Forward

- Strengthening Government Schools: Improve teacher training, infrastructure, learning assessments, and governance. Kerala and Himachal Pradesh show that high-quality public schools can reduce private school dependence.

- Regulating Private Schools and Tuition Markets: Introduce transparent fee regulation, mandatory disclosure norms, and stronger enforcement of the Clinical Establishments Act-style frameworks adapted for education governance.

- Revisiting NEP 2020 Implementation: Focus on foundational learning, teacher availability, school consolidation strategy, and reducing administrative burden. Ensure government schools do not become residual options for the poor.

- Reducing Dependence on Private Tuition: Adopt models like Finland and Estonia, where strong in-school learning eliminates tuition culture through personalised attention and continuous assessment.

- Targeted Subsidies for Low-Income Students: Introduce vouchers or DBT-based support for schooling-related expenses, as used in Chile and Brazil, ensuring the poorest are not excluded.

- Community and Local Government Engagement: School Management Committees (SMCs), panchayats, and urban local bodies must be empowered to monitor performance, ensure accountability, and reflect ground realities.

Conclusion

NSS 80th Round data exposes the contradiction between constitutional guarantees and lived realities. As private schooling and coaching costs surge, education risks becoming a commodity rather than a right. Strengthening public schools, regulating private providers, and reducing tuition dependence are essential to ensure equitable, inclusive, and financially accessible education for all.

Mains Question

- Rising private schooling and coaching dependence in India indicate deep structural inequities in the education system. In this context, suggest reforms for ensuring universal and equitable school education (250 words, 15 marks)

Source: The Hindu

(UPSC GS Paper III – Indian Economy: Mobilisation of Resources, Capital Market, Inclusive Growth, Financial Stability)

Context (Introduction)

India’s capital markets are undergoing a structural shift as domestic household savings increasingly replace Foreign Portfolio Investors (FPIs). While this boosts market stability and reduces external vulnerability, it poses new risks involving participation inequality, investor protection gaps, and rising exposure to high-risk assets.

Main Arguments: What Is Driving the Shift Toward Domestic Savings?

- Rise of Domestic Market Power: NSE Market Pulse shows FPI ownership down to 16.9%, while domestic mutual funds and direct investors now own nearly 19%, the highest in two decades. Systematic Investment Plans (SIPs) have become the market’s anchor.

- Reduced External Vulnerability: Domestic inflows help buffer volatility, allowing the Reserve Bank of India (RBI) greater policy space. With CPI inflation at 0.3% (Oct 2025) and strong GST/direct tax receipts, macroeconomic stability has improved.

- Booming Primary Markets: FY25 saw 71 IPOs raising ₹1 lakh crore, backed by investment announcements exceeding ₹32 lakh crore. Private sector participation in new investments has risen to ~70%, signalling renewed domestic confidence.

- Shift in Monetary Policy Space: With declining dependence on volatile foreign capital, the RBI can prioritise credit growth, rather than defend the rupee. This aligns with India’s long-term growth goals.

- Household Savings as New Market Drivers: India’s financialisation of savings—through MFs, SIPs, online brokers, and UPI-enabled platforms—is reshaping retail participation, marking a deeper integration of households into capital markets.

Challenges / Criticisms

- Uneven Participation and Wealth Concentration: Equity ownership is concentrated in higher-income, financially literate urban groups. Retail losses—such as the recent ₹2.6 lakh crore wealth erosion—hit vulnerable investors disproportionately.

- Performance Problem in Active Funds: Only a small share of active fund managers beat the market after accounting for risk and fees. With active funds holding 9% and passive funds only 1%, retail investors are often exposed to high costs and low returns.

- IPO Overvaluation Risks: High-profile IPOs (Lenskart, Mamaearth, Nykaa) reveal stretched valuations, raising concerns that retail investors are being pulled into exuberant, high-risk segments without adequate safeguards.

- Access Asymmetry: Large sections—women, rural households, informal workers—lack financial literacy and advisory support. Market deepening without parallel investor capacity building risks long-term exclusion.

- Corporate Governance Concerns: Promoter holdings in NIFTY 50 have fallen to a 23-year low of 40%, raising questions about whether dilution is driven by capital-raising or opportunistic disinvestment.

Way Forward

- Correcting Access Asymmetry: Shift from mere disclosures to proactive investor protection, risk warnings, suitability norms, and easily understandable product classification (EU-style traffic-light model).

- Promoting Low-Cost Passive Investing: Global evidence (U.S., U.K., Japan) shows passive index funds deliver higher long-term returns for retail investors. India must expand ETF penetration, reduce costs, and incentivise index investing.

- Improving Market Governance: Strengthen SEBI oversight on IPO pricing, related-party transactions, and promoter dilution. Adopt stricter stewardship codes similar to the U.K. and Australia.

- Financial Literacy at Scale: Leverage post office networks, digital literacy missions, and women’s SHGs to democratise financial capability—similar to Brazil’s Bolsa Família-linked financial education model.

- Data-Driven Inclusion: Use gender, geography, and income-based data to tailor interventions—modelled on Canada’s Financial Consumer Agency approach.

- Strengthening Advisory Standards: Create a clear distinction between agents and fiduciary advisors (U.S. SEC model). Require lower-cost advisory channels for small investors.

Conclusion

India’s shift from foreign-driven to domestically anchored capital markets marks a major structural strengthening. Yet stability built on unequal participation, low financial literacy, and overexposure to high-risk products can create long-term vulnerabilities. For markets to genuinely support inclusive growth and “Viksit Bharat 2047,” India must address access asymmetry, strengthen investor protection, expand passive low-cost products, and deepen market governance.

Mains Question

- India’s capital markets are increasingly driven by domestic household savings. Discuss how this shift enhances stability but also creates new vulnerabilities. (250 words, 15 marks)

Source: The Hindu