UPSC Articles

INTERNATIONAL/ ECONOMY

- GS-2: International Relations

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests.

Russia-Ukraine War impact, beyond oil

Context: The current Russian invasion of Ukraine — unlike previous wars in Iraq and Libya or sanctions against Iran — is having an impact not just on energy prices.

- The effects of shipping disruptions through the Black and Azov Seas, plus Russian banks being cut off from the international payments system, are extending even to the global agri-commodities markets.

Russia and global commodity market

Russia is

- world’s third biggest oil (after the US and Saudi Arabia)

- second biggest natural gas (after the US) producer,

- No. 3 coal exporter (behind Australia and Indonesia).

- Second largest exporter of wheat after EU.

- Russia and its next-door ally Belarus are the world’s No. 2 and No. 3 producers of muriate of potash (MOP) fertiliser, at 13.8 mt and 12.2 mt in 2020, respectively, behind Canada (22 mt).

Ukraine and global commodity market

- At No. 4 position in wheat exports, after EU, Russia and Australia (26 mt), is Ukraine, at 24 mt.

- Ukraine, moreover, is the world’s third largest exporter of corn/maize, with a projected 33.5 mt in 2021-22, after the US (61.5 mt) and Argentina (42 mt)

- Ukraine and Russia are also the top two exporters of sunflower oil, at 6.65 mt and 3.8 mt, respectively in 2021-22

How global commodity prices have moved?

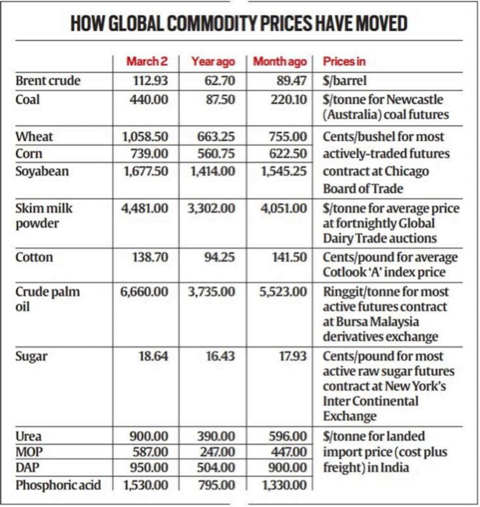

- It should not surprise, therefore, that Russia’s war on Ukraine hasn’t stopped at driving up Brent crude to $110-15/barrel and international coal prices to unprecedented $440/tonne levels.

- The shutting down of ports in the Black Sea have also sent prices of wheat and corn.

- The Ukraine crisis has also led to prices of vegetable oils and oilseeds skyrocketing. That includes not just sunflower and its immediate competitor, soyabean.

How it can benefit India?

- Skyrocketing global prices have made Indian wheat exports very competitive and in a position to at least partially fill the void left by Russia and Ukraine.

- High export demand for wheat – India has already shipped out 5.04 mt of the cereal in April-December 2021 – could result in lower government procurement this time.

- 43.34 mt and 38.99 mt of wheat was procured by government in 2020-21 and 2019-20 respectively.

- A lot of wheat from western and central India may end up getting exported rather than in the Food Corporation of India’s godowns.

- The benefits of rising vegetable oils should flow to mustard growers in Rajasthan and UP, who are set to market their crops in international market.

- Brent at $110-115/barrel is also helping lift the prices of cotton (because of synthetic fibres becoming costlier) and agri-commodities that can be diverted for production of ethanol (sugar and corn) or bio-diesel (palm and soyabean oil).

- High prices (above MSP) and a good monsoon (hopefully) can act as an inducement for farmers to expand acreages under cotton, soyabean, groundnut, sesamum and sunflower in the upcoming kharif planting season.

- That will serve the cause of crop diversification – especially weaning farmers away from paddy, if not sugarcane.

Are there any other challenge for India apart from increase in crude oil prices?

- The ongoing Black Sea tensions are impacting fertiliser prices. Out of the total 5.09 mt that was imported in 2020-21, nearly a third came from Belarus (0.92 mt) and Russia (0.71 mt). With supplies from there virtually choked, more quantities would have to be procured from other origins such as Canada, Jordan and Israel.

- International prices of other fertilisers (urea, di-ammonium phosphate and complexes) and their raw materials/intermediates (ammonia, phosphoric acid, sulphur and rock phosphate), too, have gone up.

Conclusion

- In short, the challenges that Ukraine will present in the coming days are going to be vastly different from those in the aftermath of Corona. And this war and the associated sanctions are also different from those experienced vis-à-vis Iraq, Libya and Iran. The effects are not confined to oil.

Connecting the dots: