IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule.

- It will ensure timely and streamlined revision of your static subjects.

Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

Daily CSAT Quiz (Monday – Friday)

- CSAT has been an Achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 10 current affairs, and 5 CSAT questions. (35 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

Important Note

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

- Let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 35 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

Information

The following Test is based on the syllabus of 60 Days Plan-2025 for UPSC IAS Prelims 2025.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 35 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- Answered

- Review

-

Question 1 of 35

1. Question

Which of the following best defines “Effective Revenue Deficit”?

Correct

Solution (d)

Explanation:

- Effective Revenue Deficit is the difference between revenue deficit and grants for the creation of capital assets.

- Effective Revenue Deficit = Revenue Deficit – Grants in aid for capital assets. Hence option d is correct.

- The concept of effective revenue deficit has been suggested by the Rengarajan Committee on Public Expenditure. It is aimed to deduct the money used out of borrowing to finance capital expenditure.

- It was introduced in the Union Budget 2011-12 and was later on given statutory status by an amendment to the Fiscal Responsibility and Budget Management (FRBM) Act by the Finance Act of 2012.

Incorrect

Solution (d)

Explanation:

- Effective Revenue Deficit is the difference between revenue deficit and grants for the creation of capital assets.

- Effective Revenue Deficit = Revenue Deficit – Grants in aid for capital assets. Hence option d is correct.

- The concept of effective revenue deficit has been suggested by the Rengarajan Committee on Public Expenditure. It is aimed to deduct the money used out of borrowing to finance capital expenditure.

- It was introduced in the Union Budget 2011-12 and was later on given statutory status by an amendment to the Fiscal Responsibility and Budget Management (FRBM) Act by the Finance Act of 2012.

-

Question 2 of 35

2. Question

With reference to the Mahalanobis Model of Development, consider the following statements:

- It emphasized rapid industrialization with a focus on heavy industries and capital goods.

- The Mahalanobis model was employed in the Fifth Five-Year Plan which laid the blueprint for industrialization in India.

Which of the above statements is/are correct?

Correct

Solution (a)

Explanation:

- The second five-year plan targeted the Industrial growth of the country and was implemented in the period from April 1956 to March 1961. This plan was also known as the Mahalanobis Plan as it was the brainchild of Statistician Prashant Chandra Mahalanobis.

- The strategy of growth of this model emphasized rapid industrialization with a focus on heavy industries and capital goods. Hence statement 1 is correct.

- The fundamental assumptions in the Mahalanobis model are as follows:

- the saving-investment equilibrium is maintained

- the production processes in respective sectors are always operated under the full capacity situation.

The Mahalanobis model was employed in the Second Five Year Plan. The model laid the blueprint for industrialization and development in India. Hence statement 2 is incorrect.

Incorrect

Solution (a)

Explanation:

- The second five-year plan targeted the Industrial growth of the country and was implemented in the period from April 1956 to March 1961. This plan was also known as the Mahalanobis Plan as it was the brainchild of Statistician Prashant Chandra Mahalanobis.

- The strategy of growth of this model emphasized rapid industrialization with a focus on heavy industries and capital goods. Hence statement 1 is correct.

- The fundamental assumptions in the Mahalanobis model are as follows:

- the saving-investment equilibrium is maintained

- the production processes in respective sectors are always operated under the full capacity situation.

The Mahalanobis model was employed in the Second Five Year Plan. The model laid the blueprint for industrialization and development in India. Hence statement 2 is incorrect.

-

Question 3 of 35

3. Question

Consider the following:

- Disinvestment proceeds

- Foreign government grants

- Loans received from international organizations

- Loan recoveries from States and Union Territories

How many of the above constitute Capital Receipts of the Government of India?

Correct

Solution (c)

Explanation:

- The Capital Budget is an account of the assets as well as liabilities of the central government, which takes into consideration changes in capital.

- It consists of capital receipts and capital expenditure of the government.

The main items of Capital Receipts are:

- Loans raised by the government from the public are called market borrowings

- Borrowings by the government from the Reserve Bank of India and commercial banks through the sale of treasury bills

- Loans received from foreign governments and international organizations

- Recoveries of loans granted by the central government

- Small savings (Post-Office Savings Accounts, National Savings Certificates, etc), provident funds

- Net receipts obtained from the sale of shares/Disinvestment in Public Sector Undertakings (PSUs)

Hence option c is correct.

Incorrect

Solution (c)

Explanation:

- The Capital Budget is an account of the assets as well as liabilities of the central government, which takes into consideration changes in capital.

- It consists of capital receipts and capital expenditure of the government.

The main items of Capital Receipts are:

- Loans raised by the government from the public are called market borrowings

- Borrowings by the government from the Reserve Bank of India and commercial banks through the sale of treasury bills

- Loans received from foreign governments and international organizations

- Recoveries of loans granted by the central government

- Small savings (Post-Office Savings Accounts, National Savings Certificates, etc), provident funds

- Net receipts obtained from the sale of shares/Disinvestment in Public Sector Undertakings (PSUs)

Hence option c is correct.

-

Question 4 of 35

4. Question

Which of the following statements is true regarding the Rolling Plan?

Correct

Solution (d)

Explanation:

Rolling Plan in India was started in 1978. It was a concept coined by Gunnar Myrdal. A rolling plan is one in which the effectiveness of the plan is evaluated annually and a new plan is prepared based on this evaluation the following year. As a result, both the allocation and the targets are modified throughout this plan. The main advantage of the rolling plans is that they are flexible. Hence option d is correct.

Incorrect

Solution (d)

Explanation:

Rolling Plan in India was started in 1978. It was a concept coined by Gunnar Myrdal. A rolling plan is one in which the effectiveness of the plan is evaluated annually and a new plan is prepared based on this evaluation the following year. As a result, both the allocation and the targets are modified throughout this plan. The main advantage of the rolling plans is that they are flexible. Hence option d is correct.

-

Question 5 of 35

5. Question

Consider the following statements:

- The Lorenz Curve represents the wealth distribution of the nation.

- The Gini Coefficient can be represented graphically through the Lorenz curve.

Which of the above statements is/are incorrect?

Correct

Solution (d)

Explanation:

Here the question is asking for an incorrect option.

- The Lorenz curve is the graphical representation of wealth distribution developed by American economist Max Lorenz in 1905. Hence statement 1 is correct.

- On the graph, a straight diagonal line represents perfect equality of wealth distribution; the Lorenz curve lies beneath it, showing the reality of wealth distribution.

- The Gini Coefficient is often represented graphically through the Lorenz curve, which shows income (or wealth) distribution by plotting the population percentile by income on the horizontal axis and cumulative income on the vertical axis. Hence statement 2 is correct.

- The Gini coefficient is equal to the area below the line of perfect equality minus the area below the Lorenz curve, divided by the area below the line of perfect equality.

Incorrect

Solution (d)

Explanation:

Here the question is asking for an incorrect option.

- The Lorenz curve is the graphical representation of wealth distribution developed by American economist Max Lorenz in 1905. Hence statement 1 is correct.

- On the graph, a straight diagonal line represents perfect equality of wealth distribution; the Lorenz curve lies beneath it, showing the reality of wealth distribution.

- The Gini Coefficient is often represented graphically through the Lorenz curve, which shows income (or wealth) distribution by plotting the population percentile by income on the horizontal axis and cumulative income on the vertical axis. Hence statement 2 is correct.

- The Gini coefficient is equal to the area below the line of perfect equality minus the area below the Lorenz curve, divided by the area below the line of perfect equality.

-

Question 6 of 35

6. Question

The National Planning Committee (NPC) was set up to work out concrete programmes for the development of the Indian economy in October 1938. Who among the following was the Chairperson of the NPC?

Correct

Solution (c)

Explanation:

The National Planning Committee (NPC) was formed in October 1938 on the initiative of the then Indian National Congress President Subhash C. Bose. It was set up under the Chairmanship of Jawaharlal Nehru to work out concrete programmes for development encompassing all major areas of the economy. Hence option c is correct.

Incorrect

Solution (c)

Explanation:

The National Planning Committee (NPC) was formed in October 1938 on the initiative of the then Indian National Congress President Subhash C. Bose. It was set up under the Chairmanship of Jawaharlal Nehru to work out concrete programmes for development encompassing all major areas of the economy. Hence option c is correct.

-

Question 7 of 35

7. Question

With reference to Imperative Planning, consider the following statements:

- Under this approach, the government has complete control over economic operations.

- In the case of imperative planning, the market mechanism is replaced by a common economic plan.

- The private sector is neither tightly monitored nor directed to meet the plan’s aims and priorities.

Select the correct answer using the codes below:

Correct

Solution (a)

Explanation:

- The Central Planning Authority decides on every aspect of the economy in Imperative Planning.

- The aims stated and the processes specified to attain them must be strictly followed. This sort of planning is primarily used in socialist economies.

- In imperative planning, the government has complete control over all economic operations. Hence statement 1 is correct.

- The government has complete control over the production factors. Even the private sector is required to follow the government’s strict policies and choices.

- In the case of imperative planning, the market mechanism is replaced by a common plan. Hence statement 2 is correct.

- In imperative planning, all the decisions and planning are done by the government, and the private sector is tightly monitored and controlled. Hence statement 3 is incorrect.

- There is no role of market mechanism in imperative planning.

Incorrect

Solution (a)

Explanation:

- The Central Planning Authority decides on every aspect of the economy in Imperative Planning.

- The aims stated and the processes specified to attain them must be strictly followed. This sort of planning is primarily used in socialist economies.

- In imperative planning, the government has complete control over all economic operations. Hence statement 1 is correct.

- The government has complete control over the production factors. Even the private sector is required to follow the government’s strict policies and choices.

- In the case of imperative planning, the market mechanism is replaced by a common plan. Hence statement 2 is correct.

- In imperative planning, all the decisions and planning are done by the government, and the private sector is tightly monitored and controlled. Hence statement 3 is incorrect.

- There is no role of market mechanism in imperative planning.

-

Question 8 of 35

8. Question

Consider the following statements regarding the Gandhian Plan:

- It was propounded by Acharya Vinoba Bhave.

- It articulated a centralised economic structure for India.

- It emphasized agriculture and cottage industries.

How many of the statement/s is/are correct?

Correct

Solution (a)

Explanation:

- Sriman Narayan Agarwal formulated The Gandhian Plan in 1944 by espousing the spirit of Gandhian economic thinking. Hence statement 1 is incorrect.

- The plan articulated a decentralised economic structure for India with ‘self-contained villages. Hence statement 2 is incorrect.

The plan laid more emphasis on agriculture. Even if he referred to industrialization, it was to the level of promoting cottage and village-level industries. Hence statement 3 is correct.

Incorrect

Solution (a)

Explanation:

- Sriman Narayan Agarwal formulated The Gandhian Plan in 1944 by espousing the spirit of Gandhian economic thinking. Hence statement 1 is incorrect.

- The plan articulated a decentralised economic structure for India with ‘self-contained villages. Hence statement 2 is incorrect.

The plan laid more emphasis on agriculture. Even if he referred to industrialization, it was to the level of promoting cottage and village-level industries. Hence statement 3 is correct.

-

Question 9 of 35

9. Question

With reference to the planning in India, consider the following statements:

- Instead of having a Five-Year Plan, we had three consecutive Annual Plans during 1966-69.

- The Sixth Five Year Plan for the period 1978-83 was launched as a Rolling Plan.

Which of the above statements is/are correct?

Correct

Solution (c)

Explanation:

- The plans which are formulated by the central government and financed by it for implementation at the national level are known as Central Plans.

- The period of the three consecutive Annual Plans was 1966-69. Hence statement 1 is correct.

- Though the Fourth Plan was ready for implementation in 1966 because of the weak financial situation the government decided to go for an Annual Plan for 1966-67.

- Due to the same reasons the government went for another two such plans in the forthcoming years.

- Some economists as well as the opposition in the Parliament called this period a discontinuity in the planning process, as the Plans were supposed to be for a period of five years. They named it a period of “Plan Holiday”, i.e., the planning was on a holiday.

- The Fifth Five Year Plan (1974-79) was cut short by a year ahead of its terminal year, i.e., by fiscal 1977-78, in place of the decided 1978-79.

A fresh plan, the Sixth Plan for the period 1978-83 was launched by the new government which called it the Rolling Plan. Hence statement 2 is correct.

Incorrect

Solution (c)

Explanation:

- The plans which are formulated by the central government and financed by it for implementation at the national level are known as Central Plans.

- The period of the three consecutive Annual Plans was 1966-69. Hence statement 1 is correct.

- Though the Fourth Plan was ready for implementation in 1966 because of the weak financial situation the government decided to go for an Annual Plan for 1966-67.

- Due to the same reasons the government went for another two such plans in the forthcoming years.

- Some economists as well as the opposition in the Parliament called this period a discontinuity in the planning process, as the Plans were supposed to be for a period of five years. They named it a period of “Plan Holiday”, i.e., the planning was on a holiday.

- The Fifth Five Year Plan (1974-79) was cut short by a year ahead of its terminal year, i.e., by fiscal 1977-78, in place of the decided 1978-79.

A fresh plan, the Sixth Plan for the period 1978-83 was launched by the new government which called it the Rolling Plan. Hence statement 2 is correct.

-

Question 10 of 35

10. Question

In the context of Indian Economy, consider the following statements about the Bombay Plan:

- It gave a call for agrarian reforms by abolishing zamindari.

- It advocated for the government to refrain from intervening in the economy.

- It advised future governments to protect indigenous industries.

- It proposed a comprehensive framework for mass education and vocational education.

How many of the above statement/s is/are correct?

Correct

Solution (c)

Explanation:

- In January 1944, a group of businessmen and technocrats launched the Bombay Plan as an economic plan for India. It was published by a group of Indian entrepreneurs, and it strongly endorsed state economic involvement and planning.

- The Bombay Plan called for abolishing the Zamindari system, which it felt led to absentee landlordism. Hence statement 1 is correct.

- It also laid great stress on cooperative farming.

- It advocated that the shares of agriculture, industry, and services in the total production be changed from 53, 17, and 22 percent, respectively, to 40, 35, and 20 percent.

- The Bombay Plan envisaged a major role for the state in the economy and the need for a central planning authority. Hence statement 2 is incorrect.

- The Bombay Plan’s central principle was that the economy could not grow without government participation and regulation.

- The Plan recommended that the future government defend indigenous companies against foreign competition in local markets, based on the idea that young Indian industries would be unable to compete in a free-market economy. Hence statement 3 is correct.

- The plan offers a comprehensive program of mass education, including primary, secondary vocational, and university schooling. Hence statement 4 is correct.

- It also made provision for adult education scientific training and research.

Incorrect

Solution (c)

Explanation:

- In January 1944, a group of businessmen and technocrats launched the Bombay Plan as an economic plan for India. It was published by a group of Indian entrepreneurs, and it strongly endorsed state economic involvement and planning.

- The Bombay Plan called for abolishing the Zamindari system, which it felt led to absentee landlordism. Hence statement 1 is correct.

- It also laid great stress on cooperative farming.

- It advocated that the shares of agriculture, industry, and services in the total production be changed from 53, 17, and 22 percent, respectively, to 40, 35, and 20 percent.

- The Bombay Plan envisaged a major role for the state in the economy and the need for a central planning authority. Hence statement 2 is incorrect.

- The Bombay Plan’s central principle was that the economy could not grow without government participation and regulation.

- The Plan recommended that the future government defend indigenous companies against foreign competition in local markets, based on the idea that young Indian industries would be unable to compete in a free-market economy. Hence statement 3 is correct.

- The plan offers a comprehensive program of mass education, including primary, secondary vocational, and university schooling. Hence statement 4 is correct.

- It also made provision for adult education scientific training and research.

-

Question 11 of 35

11. Question

With respect to Tax to GDP Ratio, consider the following statements:

- The Tax to GDP ratio in India has consistently increased in the past decade.

- A high Tax to GDP ratio shows strong tax buoyancy in the economy.

Which of the given statement/s is/are correct?

Correct

Solution (b)

Explanation:

- A Tax-to-GDP Ratio is a measure of a nation’s tax revenue relative to the size of its economy as measured by gross domestic product (GDP).

- The Tax to GDP ratio in India has not consistently increased in the last few years.

- Gross tax-to-GDP which was 11% in FY19, fell to 9.9% in FY20 and marginally improved to 10.2% in FY21 (partly due to decline in GDP) and is around 11% in FY22. Hence statement 1 is incorrect.

- A higher Tax-to-GDP Ratio means that an economy’s tax buoyancy is strong as the share of tax revenue rises in sync with the rise in the country’s GDP. Hence statement 2 is correct.

- A lower Tax-to-GDP Ratio constrains the government from spending on infrastructure and puts pressure on the government to meet its fiscal deficit targets.

Incorrect

Solution (b)

Explanation:

- A Tax-to-GDP Ratio is a measure of a nation’s tax revenue relative to the size of its economy as measured by gross domestic product (GDP).

- The Tax to GDP ratio in India has not consistently increased in the last few years.

- Gross tax-to-GDP which was 11% in FY19, fell to 9.9% in FY20 and marginally improved to 10.2% in FY21 (partly due to decline in GDP) and is around 11% in FY22. Hence statement 1 is incorrect.

- A higher Tax-to-GDP Ratio means that an economy’s tax buoyancy is strong as the share of tax revenue rises in sync with the rise in the country’s GDP. Hence statement 2 is correct.

- A lower Tax-to-GDP Ratio constrains the government from spending on infrastructure and puts pressure on the government to meet its fiscal deficit targets.

-

Question 12 of 35

12. Question

With reference to the Goods and Services Tax (GST), consider the following statements:

- Recently, the union excise duty on petroleum products has been subsumed under GST.

- Under the present system of GST, the same tax rate is applied to all goods.

- The recommendations made by the GST Council in relation to tax rates are binding upon the state governments.

How many of the above given statement/s is/are incorrect?

Correct

Solution (c)

Explanation:

Here the question is asking for an incorrect answer.

- The Goods and Service Tax (GST) is primarily devised to maintain a uniform indirect tax structure across the country and as such it subsumed almost all indirect taxes previously levied.

- It aims to eliminate the cascading effect of central and state taxes that were levied previously.

- Petroleum products like petrol and diesel, so far, are not subsumed under the GST (Goods and Services Tax) regime. Hence statement 1 is incorrect.

- Currently, fuels like petrol, diesel, and natural gas are covered under VAT (Value-Added Tax), central excise duty, and central sales tax.

- The Goods and Services Tax (GST) system does not propose the same tax rate for all products. The GST system has different slabs – 5%,12%,18%, and 28% that apply to different Goods and Services. Hence statement 2 is incorrect.

- Items of need are taxed at a lower rate while items of luxury are taxed in the higher bracket.

- The recommendations given by the GST Council are not binding upon states. Hence statement 3 is incorrect.

- Recently the Supreme Court held that Article 246A of the Constitution gives both parliament and state legislatures a power to legislate on GST. The Supreme Court has observed that recommendations of the Council as the product of a collaborative dialogue between the union and states and as such it is not binding upon states.

Incorrect

Solution (c)

Explanation:

Here the question is asking for an incorrect answer.

- The Goods and Service Tax (GST) is primarily devised to maintain a uniform indirect tax structure across the country and as such it subsumed almost all indirect taxes previously levied.

- It aims to eliminate the cascading effect of central and state taxes that were levied previously.

- Petroleum products like petrol and diesel, so far, are not subsumed under the GST (Goods and Services Tax) regime. Hence statement 1 is incorrect.

- Currently, fuels like petrol, diesel, and natural gas are covered under VAT (Value-Added Tax), central excise duty, and central sales tax.

- The Goods and Services Tax (GST) system does not propose the same tax rate for all products. The GST system has different slabs – 5%,12%,18%, and 28% that apply to different Goods and Services. Hence statement 2 is incorrect.

- Items of need are taxed at a lower rate while items of luxury are taxed in the higher bracket.

- The recommendations given by the GST Council are not binding upon states. Hence statement 3 is incorrect.

- Recently the Supreme Court held that Article 246A of the Constitution gives both parliament and state legislatures a power to legislate on GST. The Supreme Court has observed that recommendations of the Council as the product of a collaborative dialogue between the union and states and as such it is not binding upon states.

-

Question 13 of 35

13. Question

In the context of the Indian Economy, which of the following best describes the term Tax Buoyancy?

Correct

Solution (d)

Explanation:

- Tax buoyancy refers to the responsiveness of tax revenue growth to changes in Gross Domestic Product (GDP) or the national income of the country. Hence option d is correct.

- A tax buoyancy greater than 1 signifies that tax revenues grow at a faster rate than the growth in national income.

- Tax Buoyancy = Change in tax revenue/ Change in GDP

Incorrect

Solution (d)

Explanation:

- Tax buoyancy refers to the responsiveness of tax revenue growth to changes in Gross Domestic Product (GDP) or the national income of the country. Hence option d is correct.

- A tax buoyancy greater than 1 signifies that tax revenues grow at a faster rate than the growth in national income.

- Tax Buoyancy = Change in tax revenue/ Change in GDP

-

Question 14 of 35

14. Question

Counter Vailing Duty (CVD) is often imposed on imports to offset the impact of

Correct

Solution (c)

Explanation:

Counter Vailing Duty (CVD) is a tariff imposed on imported commodities to compensate for subsidies given to producers of these goods in the exporting country. It is a specific form of duty that the government imposes to protect domestic producers by countering the negative impact of export subsidies. Hence option c is correct.

Incorrect

Solution (c)

Explanation:

Counter Vailing Duty (CVD) is a tariff imposed on imported commodities to compensate for subsidies given to producers of these goods in the exporting country. It is a specific form of duty that the government imposes to protect domestic producers by countering the negative impact of export subsidies. Hence option c is correct.

-

Question 15 of 35

15. Question

Which of the following is not an example of Pigouvian Tax?

Correct

Which of the following is not an example of Pigouvian Tax?

Incorrect

Which of the following is not an example of Pigouvian Tax?

-

Question 16 of 35

16. Question

With reference to the Budget, consider the following statements:

- Revenue Receipts mean all the income which does not increase the liability for the government.

- Capital Receipts include all revenue and non-revenue receipts of the government.

Which of the above statements is/are correct?

Correct

Solution (a)

Explanation:

- The constitution of India has provided for the Annual Financial Statement, which is to be presented in the Parliament before the commencement of every new fiscal year. It is popularly called the Union Budget.

- Revenue receipts mean every form of money generation which do not increase the financial liabilities of the government, i.e., the tax incomes, non-tax incomes along foreign grants. Hence statement 1 is correct.

- Capital receipts include non-revenue receipts for the government.

- Every form of money generation which is not income or earnings for a firm or a government (i.e., money raised via borrowings) is considered a non-revenue source if they increase financial liabilities.

All non-revenue receipts of a government are known as capital receipts. Such receipts are for investment purposes and are supposed to be spent on plan development by the government. Hence statement 2 is incorrect.

Incorrect

Solution (a)

Explanation:

- The constitution of India has provided for the Annual Financial Statement, which is to be presented in the Parliament before the commencement of every new fiscal year. It is popularly called the Union Budget.

- Revenue receipts mean every form of money generation which do not increase the financial liabilities of the government, i.e., the tax incomes, non-tax incomes along foreign grants. Hence statement 1 is correct.

- Capital receipts include non-revenue receipts for the government.

- Every form of money generation which is not income or earnings for a firm or a government (i.e., money raised via borrowings) is considered a non-revenue source if they increase financial liabilities.

All non-revenue receipts of a government are known as capital receipts. Such receipts are for investment purposes and are supposed to be spent on plan development by the government. Hence statement 2 is incorrect.

-

Question 17 of 35

17. Question

Consider the following pairs:

Cut Motion Purpose 1. Token Cut It intends to reduce the demand by RS. 100 2. Economy Cut It intends to reduce the demand by a specified amount 3. Policy Cut It intends to reduce the demand to Re. 1 How many of the above-given pair/s is/are correctly matched?

Correct

Solution (c)

Explanation:

A cut motion is a special power vested in members of the Lok Sabha to oppose a demand being discussed for specific allocation by the government in the Finance Bill as part of the Demand for Grants.

Cut Motion Purpose 1. Token Cut It intends to reduce the demand by RS. 100 2. Economy Cut It intends to reduce the demand by a specified amount IASBABA’S DAY 33-60 DAY PLAN

3. Policy Cut It intends to reduce the demand to Re. 1 Hence option c is correct.

Incorrect

Solution (c)

Explanation:

A cut motion is a special power vested in members of the Lok Sabha to oppose a demand being discussed for specific allocation by the government in the Finance Bill as part of the Demand for Grants.

Cut Motion Purpose 1. Token Cut It intends to reduce the demand by RS. 100 2. Economy Cut It intends to reduce the demand by a specified amount IASBABA’S DAY 33-60 DAY PLAN

3. Policy Cut It intends to reduce the demand to Re. 1 Hence option c is correct.

-

Question 18 of 35

18. Question

Consider the following statements regarding the differences between the Planning Commission and the NITI Aayog:

- Unlike the Planning Commission, the NITI Aayog has participation from the states.

- Unlike the Planning Commission, the NITI Aayog does not have the power to allocate funds to states.

- Unlike the Planning Commission, the NITI Aayog is a statutory body established by an Act of the Parliament.

How many of the given statement/s is/are correct?

Correct

Solution (b)

Explanation:

- The Indian government established the NITI Aayog (National Institution for Transforming India), a policy think tank, on January 1, 2015. It has a “15-year road map” and a “7-year vision, strategy, and action plan” among its efforts.

- The Planning Commission was established on March 15, 1950, and it was dissolved on August 17, 2014. The Planning Commission was in charge of creating India’s Five-Year Plans.

- The erstwhile Planning Commission did not have any participation from the states.

- NITI Aayog has participation from the States. The Governing Council of NITI Aayog comprises the Prime Minister, the Chief Ministers of all the States, the Chief Ministers of Union Territories with Legislatures (i.e., Delhi, Puducherry and Jammu) and Lt. Governors of Union Territories without Legislature. Hence statement 1 is correct.

- The Planning Commission had the authority to allocate funding to state governments and several central government ministries for a variety of national and state-level programs and projects.

- The NITI Aayog has not been granted the authority to allocate funds. Hence statement 2 is correct.

- The Planning Commission was set up by a Resolution of the Government of India in March 1950.

- The NITI Aayog was set up by a Cabinet Resolution of the Government of India in January 2015. Hence statement 3 is incorrect.

Incorrect

Solution (b)

Explanation:

- The Indian government established the NITI Aayog (National Institution for Transforming India), a policy think tank, on January 1, 2015. It has a “15-year road map” and a “7-year vision, strategy, and action plan” among its efforts.

- The Planning Commission was established on March 15, 1950, and it was dissolved on August 17, 2014. The Planning Commission was in charge of creating India’s Five-Year Plans.

- The erstwhile Planning Commission did not have any participation from the states.

- NITI Aayog has participation from the States. The Governing Council of NITI Aayog comprises the Prime Minister, the Chief Ministers of all the States, the Chief Ministers of Union Territories with Legislatures (i.e., Delhi, Puducherry and Jammu) and Lt. Governors of Union Territories without Legislature. Hence statement 1 is correct.

- The Planning Commission had the authority to allocate funding to state governments and several central government ministries for a variety of national and state-level programs and projects.

- The NITI Aayog has not been granted the authority to allocate funds. Hence statement 2 is correct.

- The Planning Commission was set up by a Resolution of the Government of India in March 1950.

- The NITI Aayog was set up by a Cabinet Resolution of the Government of India in January 2015. Hence statement 3 is incorrect.

-

Question 19 of 35

19. Question

Which of the following statement is true with respect to Surcharge and Cess?

Correct

Solution (d)

Explanation:

- A surcharge is a tax on tax imposed for the purposes of the union. Cess is generally used when the levy is for some special administrative expense that the name (health cess, education cess, road cess, etc.) indicates.

- The revenues collected from both these sources are at the exclusive disposal of the union government. It is not necessary for the Centre to share these revenues with the states.

- A surcharge is discussed under Articles 270 and 271 of the Constitution. A surcharge is stated to be “an increase” in any of the duties and taxes referred to in Articles 269 and 270.

- A cess is described under Article 270 of the Constitution. Article 270(1) states All taxes and duties referred to in the Union List, except the duties and taxes referred to in Articles 268, 269, and 269A respectively, surcharge on taxes and duties referred to in Article 271, and any cess levied for specific purposes under any law made by Parliament shall be levied and collected by the Government of India and shall be distributed between the Union and the States in the manner provided in clause (2).

- Cess can be divided into two sub-categories: cess taxes and cess fees.

- The funds from a cess tax are to be credited into the Consolidated Fund of India. Once credited to the Consolidated Fund of India, proceeds of a cess tax can be withdrawn only when the Parliament passes suitable appropriation legislation.

- The funds from cess fees are to be credited to a special fund instituted for the said purpose and not to the Consolidated Fund of India. Proceeds from the surcharge go to the Consolidated Fund of India.

- A cess may be in the nature of a tax or a fee but it is imposed for a specific purpose, as pre-determined in the charging legislation.

- Cesses are named after the identified purpose; the purpose itself must be certain and for the public good. For example, Education cess.

Unlike a cess, in the case of a surcharge, there is no need to stipulate the purpose at the time of levy and it is the discretion of the Union to utilize the proceeds of the surcharges for whichever purpose it deems fit. Hence option d is correct.

Incorrect

Solution (d)

Explanation:

- A surcharge is a tax on tax imposed for the purposes of the union. Cess is generally used when the levy is for some special administrative expense that the name (health cess, education cess, road cess, etc.) indicates.

- The revenues collected from both these sources are at the exclusive disposal of the union government. It is not necessary for the Centre to share these revenues with the states.

- A surcharge is discussed under Articles 270 and 271 of the Constitution. A surcharge is stated to be “an increase” in any of the duties and taxes referred to in Articles 269 and 270.

- A cess is described under Article 270 of the Constitution. Article 270(1) states All taxes and duties referred to in the Union List, except the duties and taxes referred to in Articles 268, 269, and 269A respectively, surcharge on taxes and duties referred to in Article 271, and any cess levied for specific purposes under any law made by Parliament shall be levied and collected by the Government of India and shall be distributed between the Union and the States in the manner provided in clause (2).

- Cess can be divided into two sub-categories: cess taxes and cess fees.

- The funds from a cess tax are to be credited into the Consolidated Fund of India. Once credited to the Consolidated Fund of India, proceeds of a cess tax can be withdrawn only when the Parliament passes suitable appropriation legislation.

- The funds from cess fees are to be credited to a special fund instituted for the said purpose and not to the Consolidated Fund of India. Proceeds from the surcharge go to the Consolidated Fund of India.

- A cess may be in the nature of a tax or a fee but it is imposed for a specific purpose, as pre-determined in the charging legislation.

- Cesses are named after the identified purpose; the purpose itself must be certain and for the public good. For example, Education cess.

Unlike a cess, in the case of a surcharge, there is no need to stipulate the purpose at the time of levy and it is the discretion of the Union to utilize the proceeds of the surcharges for whichever purpose it deems fit. Hence option d is correct.

-

Question 20 of 35

20. Question

With reference to Non-Tax Revenue Receipts of the Union Government, consider the following statements:

- It creates no financial liabilities for the union government.

- Recovery of loans by the union government falls under the category of non-tax revenue receipts.

- In terms of value, it has increased steadily in the last five years.

Select the correct answer using the codes below:

Correct

Solution (b)

Explanation:

- Every receiving or accrual of money to a government by revenue and non-revenue sources is a receipt. The revenue receipts of a government are of two kinds and they are Tax Revenue Receipts and Non-tax Revenue Receipts.

- It is true that Non-Tax revenue receipts create no financial liabilities for the union government meaning such revenues need not to be paid back by the Government eg. dividends from Public Sector Undertakings (PSUs). Whereas debt creating capital receipts creates financial liabilities e.g., external commercial borrowings. Hence statement 1 is correct.

- Interests received by the government out of all loans forwarded by it belong to Non tax revenue receipts. However, the recovery of loans forwarded by the Union Government belongs to non-debt-creating capital receipts. Also, grants that the Union Governments receive are the non-tax revenue receipts. Hence statement 2 is incorrect.

• Non-tax revenue receipts in terms of value have not steadily increased in the last five years. For instance, it dropped from the Financial year 2020 (3.27 lakh crores) to 2021 (2.08 lakh crores). Hence statement 3 is incorrect.

Incorrect

Solution (b)

Explanation:

- Every receiving or accrual of money to a government by revenue and non-revenue sources is a receipt. The revenue receipts of a government are of two kinds and they are Tax Revenue Receipts and Non-tax Revenue Receipts.

- It is true that Non-Tax revenue receipts create no financial liabilities for the union government meaning such revenues need not to be paid back by the Government eg. dividends from Public Sector Undertakings (PSUs). Whereas debt creating capital receipts creates financial liabilities e.g., external commercial borrowings. Hence statement 1 is correct.

- Interests received by the government out of all loans forwarded by it belong to Non tax revenue receipts. However, the recovery of loans forwarded by the Union Government belongs to non-debt-creating capital receipts. Also, grants that the Union Governments receive are the non-tax revenue receipts. Hence statement 2 is incorrect.

• Non-tax revenue receipts in terms of value have not steadily increased in the last five years. For instance, it dropped from the Financial year 2020 (3.27 lakh crores) to 2021 (2.08 lakh crores). Hence statement 3 is incorrect.

-

Question 21 of 35

21. Question

With reference to C. Subramania Bharati, consider the following statements:

- He was also known as Mahakavi Bharathiyar.

- He edited the Tamil weekly India and the English newspaper Bala Bharatham. 3. He translated Vedic hymns, Patanjali’s Yoga Sutra and Bhagavat Gita into Tamil.

Which of the above statements are correct?

Correct

Solution (d)

Context:

- A complete and annotated version of the works of C. Subramania Bharati will be released by Prime Minister in New Delhi. In this context, a question can be asked by UPSC about him.

Explanation:

- C. Subramania Bharati was a poet, freedom fighter, and social reformer from Tamil Nadu. He was known as Mahakavi Bharathiyar, and the laudatory epithet Mahakavi means a great poet. He was born in Ettayapuram, South India, in 1882, and died in Madras in 1921. Hence, statement 1 is correct.

- Bharathi joined as Assistant Editor of the Swadesamitran, a Tamil daily, in 1904. In 1907, he started editing the Tamil weekly India and the English newspaper Bala Bharatham with M.P.T. Acharya. He assisted Aurobindo in the Arya journal and later Karma Yogi in Pondicherry. Hence, statement 2 is correct.

• Bharathi was essentially a lyrical poet. Bharati’s best-known works included Kaṇṇan pattu (1917; Songs to Krishna), Panchali sapatham (1912; Panchali’s Vow), and Kuyil pattu (1912; Kuyil’s Song). He also translated Vedic hymns, Patanjali’s Yoga Sutra and Bhagavat Gita into Tamil. Hence, statement 3 is correct.

Incorrect

Solution (d)

Context:

- A complete and annotated version of the works of C. Subramania Bharati will be released by Prime Minister in New Delhi. In this context, a question can be asked by UPSC about him.

Explanation:

- C. Subramania Bharati was a poet, freedom fighter, and social reformer from Tamil Nadu. He was known as Mahakavi Bharathiyar, and the laudatory epithet Mahakavi means a great poet. He was born in Ettayapuram, South India, in 1882, and died in Madras in 1921. Hence, statement 1 is correct.

- Bharathi joined as Assistant Editor of the Swadesamitran, a Tamil daily, in 1904. In 1907, he started editing the Tamil weekly India and the English newspaper Bala Bharatham with M.P.T. Acharya. He assisted Aurobindo in the Arya journal and later Karma Yogi in Pondicherry. Hence, statement 2 is correct.

• Bharathi was essentially a lyrical poet. Bharati’s best-known works included Kaṇṇan pattu (1917; Songs to Krishna), Panchali sapatham (1912; Panchali’s Vow), and Kuyil pattu (1912; Kuyil’s Song). He also translated Vedic hymns, Patanjali’s Yoga Sutra and Bhagavat Gita into Tamil. Hence, statement 3 is correct.

-

Question 22 of 35

22. Question

Consider the following statements about ‘AgeXtend’:

- It is an artificial intelligence (AI)-powered platform designed to discover molecules that could slow down ageing and promote healthier lives.

- It utilises bioactivity data that slow ageing-to predict new molecules with similar properties.

- It was developed by researchers at the IIT Madras.

Which of the above statements are correct?

Correct

Solution (a)

Context:

- Researchers at IIIT-Delhi have developed AgeXtend, an artificial intelligence (AI)- powered platform designed to discover molecules that could slow down ageing and promote healthier lives. In this context, this platform becomes important from the perspective of UPSC.

Explanation:

- AgeXtend is an artificial intelligence (AI)-powered platform designed to discover molecules that could slow down ageing and promote healthier lives. It utilises bioactivity data from existing geroprotectors-substances that slow ageing-to predict new molecules with similar properties. Hence, statement 1 and 2 are correct.

• It was developed by researchers at the Indraprastha Institute of Information Technology Delhi (IIIT-Delhi). Its AI modules evaluate geroprotective potential, assess toxicity, and identify target proteins and mechanisms of action, ensuring both accuracy and safety in the discovery process. Hence, statement 3 is not correct.

Incorrect

Solution (a)

Context:

- Researchers at IIIT-Delhi have developed AgeXtend, an artificial intelligence (AI)- powered platform designed to discover molecules that could slow down ageing and promote healthier lives. In this context, this platform becomes important from the perspective of UPSC.

Explanation:

- AgeXtend is an artificial intelligence (AI)-powered platform designed to discover molecules that could slow down ageing and promote healthier lives. It utilises bioactivity data from existing geroprotectors-substances that slow ageing-to predict new molecules with similar properties. Hence, statement 1 and 2 are correct.

• It was developed by researchers at the Indraprastha Institute of Information Technology Delhi (IIIT-Delhi). Its AI modules evaluate geroprotective potential, assess toxicity, and identify target proteins and mechanisms of action, ensuring both accuracy and safety in the discovery process. Hence, statement 3 is not correct.

-

Question 23 of 35

23. Question

The ‘Champions of the Earth award’ is given by?

Correct

Solution (a)

Context:

- India’s veteran ecologist, Madhav Gadgil has been named as one of the six ‘Champions of the Earth award’ for 2024. In this context, a question can be asked by UPSC about the award.

Explanation:

- The ‘Champions of the Earth award’ was established in 2005 and awarded by the United Nations Environment Programme (UNEP). It is the UN’s highest environmental

honour, recognises trailblazers at the forefront of efforts to protect people and the planet. Every year, UNEP honours individuals and organizations working on innovative and sustainable solutions to address the triple planetary crisis of climate change, nature and biodiversity loss, and pollution and waste. Hence, option a is the correct answer.

Incorrect

Solution (a)

Context:

- India’s veteran ecologist, Madhav Gadgil has been named as one of the six ‘Champions of the Earth award’ for 2024. In this context, a question can be asked by UPSC about the award.

Explanation:

- The ‘Champions of the Earth award’ was established in 2005 and awarded by the United Nations Environment Programme (UNEP). It is the UN’s highest environmental

honour, recognises trailblazers at the forefront of efforts to protect people and the planet. Every year, UNEP honours individuals and organizations working on innovative and sustainable solutions to address the triple planetary crisis of climate change, nature and biodiversity loss, and pollution and waste. Hence, option a is the correct answer.

-

Question 24 of 35

24. Question

Willow Chip, a new state-of-the-art quantum computing chip was recently developed by?

Correct

Solution (c)

Context:

- Recently, Google has announced a significant advancement in quantum computing as it unveiled its next-generation chip called ‘Willow’. In this context, some basic details about the chip can be asked by UPSC.

Explanation:

• Willow Chip is a new state-of-the-art quantum computing chip developed by Google. The components of the chip include single and two-qubit gates, qubit reset, and readout that have been engineered and integrated to ensure that there is no lag between any two components as that may adversely impact system performance. It was able to solve a complex mathematical problem in just five minutes- a task that would take classical computers longer than the history of the universe. It performed a standard benchmark computation in under five minutes that would take one of today’s fastest supercomputers 10 septillion (that is, 1025) years. Hence, option c is the correct answer.

Incorrect

Solution (c)

Context:

- Recently, Google has announced a significant advancement in quantum computing as it unveiled its next-generation chip called ‘Willow’. In this context, some basic details about the chip can be asked by UPSC.

Explanation:

• Willow Chip is a new state-of-the-art quantum computing chip developed by Google. The components of the chip include single and two-qubit gates, qubit reset, and readout that have been engineered and integrated to ensure that there is no lag between any two components as that may adversely impact system performance. It was able to solve a complex mathematical problem in just five minutes- a task that would take classical computers longer than the history of the universe. It performed a standard benchmark computation in under five minutes that would take one of today’s fastest supercomputers 10 septillion (that is, 1025) years. Hence, option c is the correct answer.

-

Question 25 of 35

25. Question

With reference to Indian Economy, consider the following statements:

- A surcharge is a tax on tax.

- A cess is charged on the income taxes paid.

- The proceeds collected from a surcharge and a cess levied by the union form part of the Consolidated Fund of India.

How many of the above statements is/are correct?

Correct

Solution (a)

Explanation:

- Cess and surcharges are levied by the Central government for the purposes of the Union under Article 271 of the Constitution of India. A cess is a tax on tax. The Indian government levies it on the tax liability, including surcharge, and it is used for a specific purpose. Cesses are named after the identified purpose; the purpose itself must be certain and for the public good. Hence, statement 1 is not correct.

- A surcharge is charged on the income taxes paid. It is usually paid by taxpayers, whether individuals, associations of persons, or companies, who fall in a particular tax bracket. It is not collected for any specific purpose but can be used for any reason as seen reasonable by the Central government. Hence, statement 2 is not correct.

• The proceeds collected from a surcharge and a cess levied by the union form part of the Consolidated Fund of India. The funds need not be shared with the State governments and are thus at the exclusive disposal of the union government. Hence, statement 3 is correct.

Incorrect

Solution (a)

Explanation:

- Cess and surcharges are levied by the Central government for the purposes of the Union under Article 271 of the Constitution of India. A cess is a tax on tax. The Indian government levies it on the tax liability, including surcharge, and it is used for a specific purpose. Cesses are named after the identified purpose; the purpose itself must be certain and for the public good. Hence, statement 1 is not correct.

- A surcharge is charged on the income taxes paid. It is usually paid by taxpayers, whether individuals, associations of persons, or companies, who fall in a particular tax bracket. It is not collected for any specific purpose but can be used for any reason as seen reasonable by the Central government. Hence, statement 2 is not correct.

• The proceeds collected from a surcharge and a cess levied by the union form part of the Consolidated Fund of India. The funds need not be shared with the State governments and are thus at the exclusive disposal of the union government. Hence, statement 3 is correct.

-

Question 26 of 35

26. Question

With reference to Guruvayur Temple, seen in news recently, consider the following statements:

- It is a Hindu temple dedicated to Lord Krishna.

- It is also known as the Dwarka of the South.

- The temple is built in the traditional Odisha architectural style.

How many of the above statements is/are correct?

Correct

Solution (b)

Context:

- The Supreme Court recently agreed to examine a plea against the Kerala High Court order in favour of the administration of the Guruvayur temple, which decided to discontinue the ancient ritual of “udayasthamana pooja” on Ekadasi, citing crowd management issues. In this context, a question about the temple can be asked by UPSC.

Explanation:

- Guruvayoor Sree Krishna Swamy Temple, also known as the Dwarka of the South, is a Hindu temple dedicated to Lord Krishna. The earliest temple records date back to the 17th century, but other literary texts and legends indicate that the temple may be around 5000 years old. Hence, statement 1 and 2 are correct.

• The temple is located in the small town of Guruvayur, in the Thrissur District of Kerala. The temple is built in the traditional Kerala architectural style. Structures like the Nalambalam (temple structure surrounding the sanctum sanctorum), Balikkal (sacrificial stone), and Deepastambam (pillar of lights) are situated on the temple premises. Hence, statement 3 is not correct.

Incorrect

Solution (b)

Context:

- The Supreme Court recently agreed to examine a plea against the Kerala High Court order in favour of the administration of the Guruvayur temple, which decided to discontinue the ancient ritual of “udayasthamana pooja” on Ekadasi, citing crowd management issues. In this context, a question about the temple can be asked by UPSC.

Explanation:

- Guruvayoor Sree Krishna Swamy Temple, also known as the Dwarka of the South, is a Hindu temple dedicated to Lord Krishna. The earliest temple records date back to the 17th century, but other literary texts and legends indicate that the temple may be around 5000 years old. Hence, statement 1 and 2 are correct.

• The temple is located in the small town of Guruvayur, in the Thrissur District of Kerala. The temple is built in the traditional Kerala architectural style. Structures like the Nalambalam (temple structure surrounding the sanctum sanctorum), Balikkal (sacrificial stone), and Deepastambam (pillar of lights) are situated on the temple premises. Hence, statement 3 is not correct.

-

Question 27 of 35

27. Question

Consider the following statements about Madhav National Park:

- Madhav National Park is located in Chhattisgarh.

- It is situated on the northern fringe of the Central Highlands of India forming a part of the Upper Vindhyan Hills.

Which of the above statements is/are correct?

Correct

Test explained

Solution (b)

Context:

- In a landmark conservation move, the National Tiger Conservation Authority has granted in-principle approval for the designation of Madhav National Park in Shivapuri district as tiger reserve. In this context, a question can be asked by UPSC about it.

Explanation:

- Madhav National Park is located in the state of Madhya Pradesh. Sakhya Sagar and Madhav Sagar are the two lakes in the southern part of the park, providing the aquatic biodiversity and lifeline for the terrestrial species. Hence, statement 1 is not correct.

• It is situated on the northern fringe of the Central Highlands of India forming a part of the Upper Vindhyan Hills intermixed with plateaus, and valley sections. The forests of the park fall within the category of Northern tropical dry deciduous mixed forests as well as Dry Thorn Forests typical of North-Western Madhya Pradesh. Hence, statement 2 is correct.

Incorrect

Test explained

Solution (b)

Context:

- In a landmark conservation move, the National Tiger Conservation Authority has granted in-principle approval for the designation of Madhav National Park in Shivapuri district as tiger reserve. In this context, a question can be asked by UPSC about it.

Explanation:

- Madhav National Park is located in the state of Madhya Pradesh. Sakhya Sagar and Madhav Sagar are the two lakes in the southern part of the park, providing the aquatic biodiversity and lifeline for the terrestrial species. Hence, statement 1 is not correct.

• It is situated on the northern fringe of the Central Highlands of India forming a part of the Upper Vindhyan Hills intermixed with plateaus, and valley sections. The forests of the park fall within the category of Northern tropical dry deciduous mixed forests as well as Dry Thorn Forests typical of North-Western Madhya Pradesh. Hence, statement 2 is correct.

-

Question 28 of 35

28. Question

Consider the following statements about Chakki River:

- It is one of the tributaries of the Beas River.

- It flows through Himachal Pradesh and Punjab.

Which of the above statements is/are correct?

Correct

Solution (c)

Context:

- A joint committee of officials has informed the National Green Tribunal (NGT) that stone-crushing units are even altering the course of the Chakki River at many places. In this context, a question can be asked by UPSC about the Chakki river.

Explanation:

• Chakki River is one of the tributaries of the Beas River. It flows through Himachal Pradesh and Punjab and merges with the Beas near Pathankot, Punjab. It is fed by snow and rain in the Dhauladhar mountains (part of a lesser Himalayan chain of mountains). Unregulated sand mining has been a major ecological issue, degrading the riverbed and banks. Hence, statement 1 and 2 are correct.

Incorrect

Solution (c)

Context:

- A joint committee of officials has informed the National Green Tribunal (NGT) that stone-crushing units are even altering the course of the Chakki River at many places. In this context, a question can be asked by UPSC about the Chakki river.

Explanation:

• Chakki River is one of the tributaries of the Beas River. It flows through Himachal Pradesh and Punjab and merges with the Beas near Pathankot, Punjab. It is fed by snow and rain in the Dhauladhar mountains (part of a lesser Himalayan chain of mountains). Unregulated sand mining has been a major ecological issue, degrading the riverbed and banks. Hence, statement 1 and 2 are correct.

-

Question 29 of 35

29. Question

Consider the following features:

- Pre-agricultural level of technology

- Low level of literacy

- Economic backwardness

- A declining or stagnant population

How many of the above is/are the criteria for identifying Particularly Vulnerable Tribal Groups (PVTGs)?

Correct

Solution (d)

Context:

- People belonging to the Birhor tribe, a PVTG in Jharkhand, have joined a movement against child marriage in Giridih for the first time, according to an organisation working in the field of protection of children’s rights. In this context, criteria for identifying PVTGs can be asked by UPSC.

Explanation:

- PVTGs are a more vulnerable group among tribal groups in India. Moreover, they are largely dependent on hunting for food and a pre-agriculture level of technology. Currently, there are 2.8 million PVTGs belonging to 75 tribes across 22,544 villages in 220 districts across 18 states and Union Territories in India. The criteria for identifying Particularly Vulnerable Tribal Groups include :-

o Pre-agricultural level of technology

o Low level of literacy

o Economic backwardness

o A declining or stagnant population. Hence, option d is the correct answer.

Incorrect

Solution (d)

Context:

- People belonging to the Birhor tribe, a PVTG in Jharkhand, have joined a movement against child marriage in Giridih for the first time, according to an organisation working in the field of protection of children’s rights. In this context, criteria for identifying PVTGs can be asked by UPSC.

Explanation:

- PVTGs are a more vulnerable group among tribal groups in India. Moreover, they are largely dependent on hunting for food and a pre-agriculture level of technology. Currently, there are 2.8 million PVTGs belonging to 75 tribes across 22,544 villages in 220 districts across 18 states and Union Territories in India. The criteria for identifying Particularly Vulnerable Tribal Groups include :-

o Pre-agricultural level of technology

o Low level of literacy

o Economic backwardness

o A declining or stagnant population. Hence, option d is the correct answer.

-

Question 30 of 35

30. Question

Consider the following statements about Abathsahayeswarar Temple:

- It is located in the state of Karnataka.

- It was constructed during the reigns of Kings Vikrama Chola and Kulothunga Chola.

Which of the above statements is/are correct?

Correct

Solution (c)

Context:

- The 1,300-year-old Abathsahayeshwarar Temple has been chosen by UNESCO to receive the Asia-Pacific Awards for Cultural Heritage Conservation award. So, a basic question about the temple can be asked by UPSC.

Explanation:

- Abathsahayeswarar Temple is located in Thukkatchi in Thanjavur district of Tamil Nadu. Historically, the village surrounding the temple was known as Vikrama Chozheeswaram and Kulothunga Chola Nallur, named after these illustrious rulers. Hence, statement 1 is correct.

• It was constructed during the reigns of Kings Vikrama Chola and Kulothunga Chola. This temple stands as a testament to the architectural brilliance and spiritual dedication of the Chola dynasty. The temple is home to numerous deities, including Soundaryanayaki Ambal and Ashtabhuja Durga Parameshwari. Hence, statement 2 is correct.

Incorrect

Solution (c)

Context:

- The 1,300-year-old Abathsahayeshwarar Temple has been chosen by UNESCO to receive the Asia-Pacific Awards for Cultural Heritage Conservation award. So, a basic question about the temple can be asked by UPSC.

Explanation:

- Abathsahayeswarar Temple is located in Thukkatchi in Thanjavur district of Tamil Nadu. Historically, the village surrounding the temple was known as Vikrama Chozheeswaram and Kulothunga Chola Nallur, named after these illustrious rulers. Hence, statement 1 is correct.

• It was constructed during the reigns of Kings Vikrama Chola and Kulothunga Chola. This temple stands as a testament to the architectural brilliance and spiritual dedication of the Chola dynasty. The temple is home to numerous deities, including Soundaryanayaki Ambal and Ashtabhuja Durga Parameshwari. Hence, statement 2 is correct.

-

Question 31 of 35

31. Question

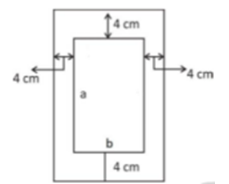

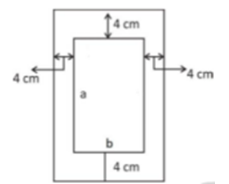

Ramesh and Ganesh bought a plot at a share of 50% each. Thereafter, they built a rectangular park at the middle of this plot, and a pathway all around it. The length and breadth of the park is a and b respectively, and it is surrounded by a pathway of width 4 m. What must be the share of Ganesh in the plot area-wise?

Correct

Solution (b)

Explanation:

The information provided in the question has been represented below:

Length of plot, including pathway = (a + 8) (Since, 4 m will be added on both sides) Breath of plot, including pathway = (b + 8)

So, area of plot including pathway = (a + 8) (b + 8) = ab + 8a + 8b + 64

This is the 100% area.

Ganesh‟s share is 50%.

∴ Area of Ganesh‟s share = (ab + 8a + 8b + 64)/2 = 4a + 4b + 32 + (ab/2) Hence, option (b) is the correct answer.

Incorrect

Solution (b)

Explanation:

The information provided in the question has been represented below:

Length of plot, including pathway = (a + 8) (Since, 4 m will be added on both sides) Breath of plot, including pathway = (b + 8)

So, area of plot including pathway = (a + 8) (b + 8) = ab + 8a + 8b + 64

This is the 100% area.

Ganesh‟s share is 50%.

∴ Area of Ganesh‟s share = (ab + 8a + 8b + 64)/2 = 4a + 4b + 32 + (ab/2) Hence, option (b) is the correct answer.

-

Question 32 of 35

32. Question

Which of the following is/are the most rational and logical Inference/Inferences that can be drawn from the passage?

- The young generation lacks respect for its own culture, reflecting the need for looking inwards and reversing globalization.

- Globalization promotes mixed cultures, but this negatively impacts local arts in a culture.

Select the correct answer using the code given below.

Correct

Solution (b)

Explanation:

Assumption 1 is incorrect. The given option is beyond the scope of the passage as the passage neither specifies the challenges posed by conventional study methods (not even categorized as such in the passage), nor does it mention how study technology will help in overcoming those hypothetical challenges of conventional study methods. So, this assumption is not correct.

Assumption 2 is correct. The given statement is a valid assumption as the passage in the lines, “The use of Study technology brings about in an individual an understanding of a subject coupled with the ability to apply what he has studied”, highlights that theoretical plus application knowledge is imparted using study technology. So, this assumption is correct.

Incorrect

Solution (b)

Explanation:

Assumption 1 is incorrect. The given option is beyond the scope of the passage as the passage neither specifies the challenges posed by conventional study methods (not even categorized as such in the passage), nor does it mention how study technology will help in overcoming those hypothetical challenges of conventional study methods. So, this assumption is not correct.

Assumption 2 is correct. The given statement is a valid assumption as the passage in the lines, “The use of Study technology brings about in an individual an understanding of a subject coupled with the ability to apply what he has studied”, highlights that theoretical plus application knowledge is imparted using study technology. So, this assumption is correct.

-

Question 33 of 35

33. Question

Some boys are sitting in a line. P is at 17th place from the left and Q is at 18th place from the right. There are 8 boys in between them. What is the total number of boys in the line?

Correct

Solution (b)

Explanation:

Inference 1 is incorrect. The given option is incorrect as it conveys a meaning which is contradictory to the initial statement of the given passage which reads “Today globalization is constant and even irreversible”. The first part of the option about the young generation lacking respect for their own culture is correct, but the solution of reversing globalization is not in line with the passage. So, this inference is not correct.

Inference 2 is correct. The lines “In addition, there is happening a mutual penetration of various trends in art and their exchange. Globalization contributes to the expansion of cultural ties between the peoples and human migration. But there is a disadvantage too. Preferring a unified type of art, unfortunately, sometimes leads to people forgetting their own culture”. can be used to infer the given statement, wherein the unified type of art means that diversity of art is threatened due to globalization. Also, the last statement “In addition, less attention is paid to the development of the art of the country in its unique way”, specify that due to

globalization, less attention is paid to the local arts and its unique aspects. So, this inference is correct.

Incorrect

Solution (b)

Explanation:

Inference 1 is incorrect. The given option is incorrect as it conveys a meaning which is contradictory to the initial statement of the given passage which reads “Today globalization is constant and even irreversible”. The first part of the option about the young generation lacking respect for their own culture is correct, but the solution of reversing globalization is not in line with the passage. So, this inference is not correct.

Inference 2 is correct. The lines “In addition, there is happening a mutual penetration of various trends in art and their exchange. Globalization contributes to the expansion of cultural ties between the peoples and human migration. But there is a disadvantage too. Preferring a unified type of art, unfortunately, sometimes leads to people forgetting their own culture”. can be used to infer the given statement, wherein the unified type of art means that diversity of art is threatened due to globalization. Also, the last statement “In addition, less attention is paid to the development of the art of the country in its unique way”, specify that due to

globalization, less attention is paid to the local arts and its unique aspects. So, this inference is correct.

-

Question 34 of 35

34. Question

HCF of two numbers is given to be 8 and their LCM is given as 1248. If one of the given numbers is 96, then what will be the other number?

Correct

Solution (a)

Explanation:

HCF of two numbers = 8

LCM of two numbers = 1248

One of the numbers is 96.

Let the other number be x.

Now, LCM × HCF = Product of numbers

⇒ 1248 × 8 = 96 × x

⇒ x = 9984/96

⇒ x = 104

∴ The other number is 104.

Incorrect

Solution (a)

Explanation:

HCF of two numbers = 8

LCM of two numbers = 1248

One of the numbers is 96.

Let the other number be x.

Now, LCM × HCF = Product of numbers

⇒ 1248 × 8 = 96 × x

⇒ x = 9984/96

⇒ x = 104

∴ The other number is 104.

-

Question 35 of 35

35. Question

Find the unit digit of (113)1003?

Correct

Solution (a)

Explanation:

Unit digit = (3)1003

=> Unit digit = 31000 x 33

=> Unit digit = (34)250 x 33

=> Unit digit = (81)250 x 27

=> Unit digit = 1 x 7 = 7

There the unit digit is 7

Incorrect

Solution (a)

Explanation:

Unit digit = (3)1003

=> Unit digit = 31000 x 33

=> Unit digit = (34)250 x 33

=> Unit digit = (81)250 x 27

=> Unit digit = 1 x 7 = 7

There the unit digit is 7

All the Best

IASbaba