IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Sep 2017, IASbaba's Daily News Analysis, National, UPSC

IASbaba’s Daily Current Affairs – 25th Sep 2017

Archives

NATIONAL

TOPIC

General Studies 3:

- Issues related to direct and indirect farm subsidies and minimum support prices

- Inclusive growth and issues arising from it.

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and bodies constituted for the protection and betterment of these vulnerable sections

Strengthening the agricultural sector

Background:

Last month, the NITI Aayog released the Three-Year Action Agenda (TYAA) for the government, a roadmap for reforming the various sectors of the economy.

Its agenda for the agriculture sector, and how best it can rescue the sector has been discussed in this article.

The TYAA:

It talks of action pertaining to-

- Increasing productivity of land and water.

- Reforming agri-markets on the lines of e-NAM,

- Reforming tenancy laws.

- Relief measures during natural disasters.

The recommendations are good and have been suggested by earlier committees like the High Level Committee (HLC) on Management of Foodgrains and Restructuring FCI (headed by Shanta Kumar), the Task Force on Agriculture headed by the Vice-Chairman of the NITI Aayog (May 2016), the four volumes (out of 14) of the Committee on Doubling of Farmers’ Income etc. The government, thus, has ample reference points for reforming the food and agriculture sector.

Issue: The TYAA, however, does not prioritise policy actions, nor does it talk about the role of trade policy in agriculture, or reforming the massive system of food and fertiliser subsidies.

5-Point action plan based on priority:

- First, the government needs to improve the profitability of cultivation by “getting markets right”.

- Second, it needs to invest in water to fulfil its slogan of “har khet ko pani” and “more crop per drop”.

- Third, should be providing Direct Benefit Transfer (DBT) of food and fertiliser subsidies to the accounts of targeted beneficiaries, which can release resources for investments.

- Fourth it should ensure that the new Pradhan Mantri Fasal Bima Yojana (PMFBY) delivers compensation to farmers in time.

- Finally, it should free up land lease markets. Let us elaborate on these points a bit.

Ensuring profitability of cultivation:

Issue:

- The policy of minimum support prices (MSPs) has not improved profitability of cultivation. In fact, farmers’ returns have gone down in the case of most crops. The situation is worse for producers of basic vegetables like potatoes, onions and tomatoes. Prices of these crops during harvest time plunged to about Rs 2 per kg in the last season while the consumers were still paying Rs 15 to Rs 20 per kg.

- Attempts to reform the Agricultural Produce Marketing Committee (APMC) markets on the lines of the model act of 2003, and now through the Agricultural Produce and Livestock Marketing Act, 2017, have not achieved much success.

AMUL model:

India has shown in the case of milk, through Operation Flood — a la the AMUL model — that farmers can get 70-80 per cent of the price paid by consumers.

We can have “Operation Veggies” on similar lines. A beginning can be made with at least onions, potatoes and tomatoes.

That would require buying directly from farmers’ groups (FPOs), setting up logistics from grading, storage to movement, and linking them to organised retail (including e-retail), large processors and exporters.

The government must commit enough resources as it did for Operation Flood and also change certain laws, including the Essential Commodities Act (ECA).

Issue:

The e-NAM scheme, which is supposed to create an all India market, in order to ensure better prices to farmers, has not succeeded in its endeavour so far. Software is still being installed in mandis to enable them to switch auctions from the shouting platform to the electronic ones. Inter-mandi and inter-state transactions are very rare.

Solution:

An easier way to improve farmers’ profitability is to open up exports of all agri-products, without any restrictions, and allowing private trade to build global value chains, keeping the ECA in abeyance. This would require a change from the current pro-consumer approach to one that is focussed on farmers.

Issue of investments:

Especially in water. The Pradhan Mantri Krishi Sinchayee Yojana is mandated to complete 99 irrigation projects by 2019, which will bring 76 lakh ha additional area under irrigation. NABARD, with Rs 40,000 crore as Long-Term Irrigation Fund, is to help states in completing these projects. It would be a commendable achievement for the government if it can complete these projects as planned. But open canal systems with flood irrigation don’t give high water-use efficiency.

Solution:

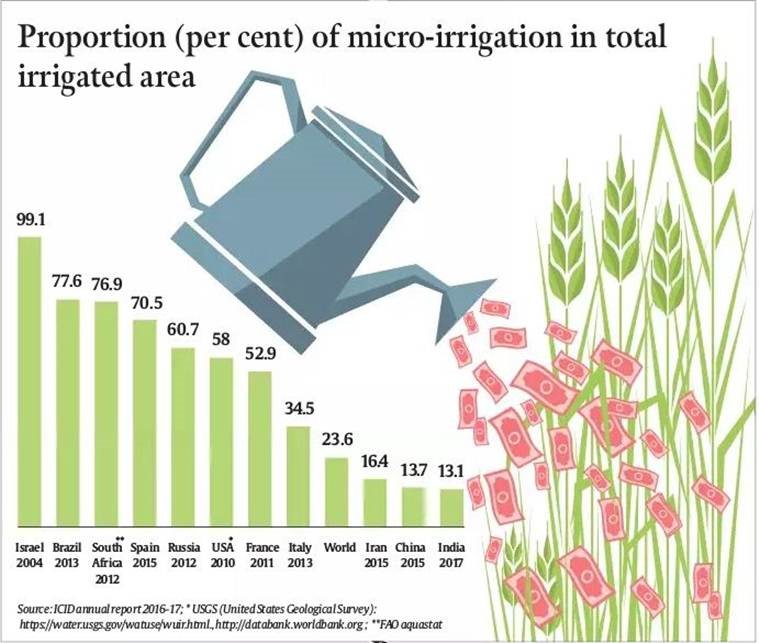

- According higher priority to micro-irrigation (drip and sprinklers) to achieve the objective of “more crop per drop”.

Israel and the US could be good examples to follow: Israel has the highest proportion (99 per cent) of its irrigated area under micro-irrigation while the US has largest absolute area (15 m ha) under micro-irrigation.

Pic credits: A sketchy roadmap

http://images.indianexpress.com/2017/09/chart-roadmap-759.jpg

- Providing DBT of food and fertiliser subsidies. A report estimates that Rs 30,000 to Rs 50,000 crores can be saved each year, which can be invested in water resources and upgrading marketing infrastructure.

- Ensuring that the Pradhan Mantri Fasal Bima Yojana (PMFBY) delivers.

Currently, several states don’t pay premium in time, don’t conduct crop cutting experiments, and as a result, farmers suffer long delays in getting any compensation.

These lacunae can be fixed through modern technology and better governance, provided there is a champion in the government to deliver. - Free up land lease markets for long periods. China allows land lease for 30 years so that corporate bodies can work with farmers, bringing in their best expertise, inputs and investments.

Connecting the dots:

- For reforming agricultural sector, India needs an action plan based on priority. Ensuring profitability of cultivation should be at utmost priority. Discuss.

ECONOMY

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

- Effects of liberalization on the economy, changes in industrial policy and their effects on industrial growth.

Structural reforms and not fiscal stimulus is what Indian economy requires

Background:

The government of India is working on a plan to revive the economy after growth slipped to a modest rate of 5.7% in the first quarter of the current fiscal compared with 7.9% in the same quarter last year.

Media reports suggest that it is mulling a fiscal stimulus to boost growth, which could increase the fiscal deficit.

The idea is that in the absence of sufficient investment demand from the private sector, higher government expenditure will help boost gross domestic product (GDP) growth.

Providing fiscal stimulus- Not a good option:

There are sound economic reasons why the government should adhere to its fiscal commitments.

- The deceleration in growth is partly being explained by the lingering impact of demonetisation and destocking before the implementation of the goods and services tax (GST).

The impact will peter out and output affected by these events doesn’t need fiscal support.

Opening the fiscal tap at the moment would mean that crucial reforms in areas such as improving the ease of doing business might get postponed. - There is no guarantee that expanding the deficit will take India to a higher sustainable growth path. In fact, the economy already has a fair amount of fiscal support with the combined fiscal deficit running in excess of 6% of GDP.

Expanding the deficit by another half a percentage point, for instance, is unlikely to change things materially on the ground.

Furthermore, the government has exhausted over 90% of the estimated fiscal deficit for the year in the first four months, but it has not resulted in the desired level of growth.

All this shows that increasing government spending may not be sufficient to boost growth in a sustainable manner. - Expanding the deficit can complicate policy choices for the Reserve Bank of India (RBI).

It can affect RBI’s target of keeping inflation around 4% on a durable basis. - If the government decides to expand the deficit in the current year, a reversal will be unlikely in the next fiscal, as it will end close to the general election. This means that the deficit will remain elevated for a considerable period and would affect investor sentiment.

It is in India’s own interest to keep its house in order and minimize risk from external shocks.

Interventions that go beyond stimulus are required:

Economic growth has slowed considerably and the economy needs policy intervention that goes beyond running a bigger deficit.

What the economy needs is deeper and broader structural reforms that will help attain sustainable higher growth in the medium to long run.

- Proper implementation of big-ticket reforms like GST and the bankruptcy code.

- Factor markets such as for land and labour, and public sector banks need immediate attention.

- On the fiscal front, government should address all the issues in the functioning of GST. If revenue gets affected because of operational issues, fiscal management will become extremely difficult. Higher tax revenue from GST will help push public expenditure.

- The government should also aggressively pursue disinvestment and privatization, which will help augment resources.

Conclusion:

Irrespective of the slowdown, the Indian economy needs higher public investment, but it need not come at the cost of fiscal discipline.

Connecting the dots:

- The India economy is not performing well as suggested by GDP growth data. In this light the government is planning to provide fiscal stimulus. Discuss the rationale behind. Also, critically analyze how the need of the hour is structural reforms and not fiscal stimulus.

MUST READ

Turn the economic ship around

A fight against prejudice

Afghan overture

Recognizing alzheimers

A blinkered justice

Be with Warren Buffet not against him

Making the most of industrial policy

Banks need a stiff dose of competition