The Big Picture- RSTV, UPSC Articles

Oil Price War Implications

Archives

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

- Energy Security

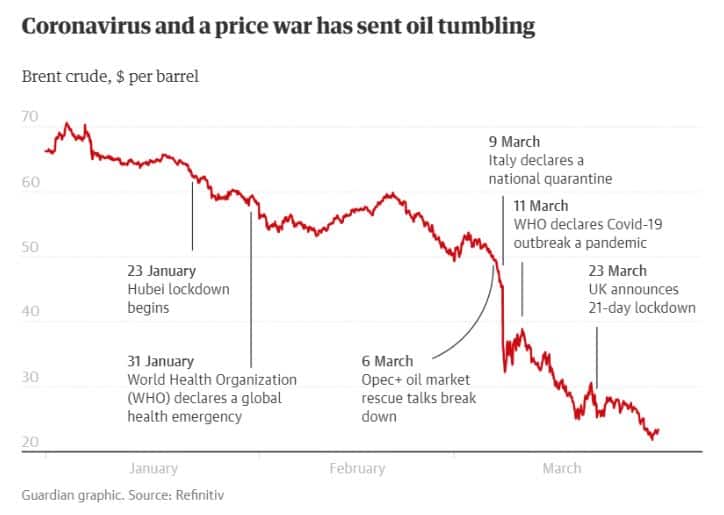

In News: Global oil consumption is in free-fall, heading for the biggest annual contraction in history, as more countries introduce unprecedented measures to fight the coronavirus pandemic.

Travel bans, work-from-home policies, cancelled vacations and disrupted supply chains all mean reduced demand for fuel. As societies respond to the virus, oil demand — already hammered by China’s decision to shut down swaths of the economy — is falling further.

Geopolitically,

- Leaders from Russia, Saudi Arabia and the Organization of the Petroleum Exporting Countries (OPEC) announced a production cut of nearly 10 million barrels a day in hopes it would end an ongoing oil price war as oil consumption has plummeted worldwide amid the coronavirus pandemic.

- U.S. Energy Secretary Dan Brouillette in a tweet called it a “historic deal” that will end “a price war that has caused unprecedented uncertainty in global oil markets.” President Donald Trump tweeted that the deal “will save hundreds of thousands of energy jobs in the United States.”

- Reductions of 5m bpd are expected to come from other nations to help navigate the deepest oil crisis in decades.

Oil has been “disproportionately hit” by the coronavirus outbreak

Oil prices have been forced downward due to major influences from both the demand and supply sides. The economic impact of the coronavirus outbreak will be “extremely negative” for oil prices, given it is “impossible to shut down a vast amount of demand without large and persistent ramifications to supply.”

Oil Price War: The market has had to contend with the twin shocks of the demand destruction caused by the coronavirus pandemic and the unexpected oil price war that erupted between producers Russia and Saudi Arabia (Click on the link under Must Read).

The Pandemic: Demand for crude oil and petroleum fuels has fallen worldwide because of the coronavirus pandemic across the world. China, the globe’s largest oil importer and a major driver of global demand, had been the worst affected until now. A global downturn in demand from transportation, not least in air travel, has eroded demand further.

Storage issue: The storage is also going to be an issue as there is small and limited spare capacity to contain it – contained within its production infrastructure, which for oil includes pipelines, ships, terminals, storage facilities, refineries, and distribution networks.

Employment in the times of Corona: Many oil companies have rushed to cut spending and some producers have already begun putting employees on furlough.

Global Policy: The demand shock has become so large and a balanced market would require a coordinated global production cut — a policy which appears impossible at this point, too late to stop the current surplus and far below other initiatives on the agenda right now

Must Read: Oil Market meltdown

Connecting the Dots:

- Carbon-based industries like oil today, sit in the cross-hairs as they have historically served as the cornerstone of social interactions and globalization, the prevention of which are the main defense against the virus. Critically comment.

- Will the coronavirus kill the oil industry and help save the climate? Discuss.

- What are the factors influencing the pricing of oil? Discuss.