(Economic and Social Development-Sustainable, Development, Poverty, Inclusion, Demographics, Social Sector Initiatives, etc.)

4. Economic Survey

5. Social Development, Poverty and Inclusion

6. Demographics

7. Social Sector initiatives

Economy may be daunting to some, but the questions are based on your conceptual understanding of macroeconomics. No matter how many times you read and mug-up the data, you are bound to falter in the exam. Conceptual clarity is what matters the most in Economics.

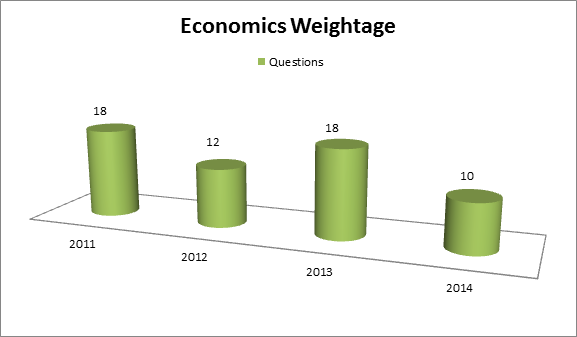

Weightage given to Economics (since 2011)

On an average around 14-15% weightage is given to Economics.

If your basic funda’s of Economics is sound, then you will even be able to get all answers right in Prelims . So our sincere advice to you is to invest more time in understanding the concepts and analyzing how one concept is linked to another.

For Example:

| If the interest rate is decreased in an economy, it will (2014)(a) decrease the consumption expenditure in the economy

(b) increase the tax collection of the Government (c) increase the investment expenditure in the economy (d) increase the total savings in the economy Solution (c)

|

| Under which of the following circumstances may ‘capital gains’ arise? (2012)

1. When there is an increase in the sales of a product2. When there is a. natural increase in the value of the property owned 3. When you purchase a painting and there is a growth in its value due to increase in its popularity Select the correct answer using the codes given below : (a) 1 only (b) 2 and 3 only (c) 2 only (d) 1, 2 and 3 Solution (b) |

How to Study Economics?

Some of them have misconceptions that Economics is only about ‘money’. No its about choices. Choices or decisions made based on the resource available (time, capability, money, interest etc.)

Decisions made in midst of alternatives at the National level is known as ‘Macroeconomics’ (Government making a decision to blend 10% Ethanol in petrol) and if the same choices/decisions are made at the individual level, it is known as ‘Micro-economics’.

Economics has so much of relevance to our day-to-day lives. Be it the choice that you make to take-up this exam or even choose or website ‘IASbaba’ for your preparation. It’s all about making choices suiting to your needs and available resources.

This makes reading Economics enjoyable and meaningful !!

Once you get hold of this subject, it will take very less time to revise and also more accuracy can be achieved in the exam.

Basic Economic and Indian Economy:

Focus:

Understanding the basic concepts of:

Note: Don’t just read definitions, analyze! For example: When do we use GDP for measurement of Growth and not GNP? Which method is followed in India and why?

When we say ‘why’ a particular method was adopted- it means that, one has to understand both positives and negatives of the method.

Example: 2013 Previous Year Question

The national income of a country for a given period is equal to the:(a) total value of goods and services produced by the nationals(b) sum of total consumption and investment expenditure(c) sum of personal income of all individuals (d) money value of final goods and services produced Solution (a) |

2011 Previous Year Question

| A “closed economy” is an economy in which(a.) the money supply is fully controlled

(b.) deficit financing takes place (c.) only exports take place (d.) neither exports nor imports take place Solution (d) |

Focus:

Note: Make a note of the Government Schemes, Committees related to growth, development, eradication of Poverty, Employment, Labour issues etc. like MGNREGA, National Rural Livelihood Mission, Bharat Nirman etc.

Initiatives like ‘Make in India’, Innovation Council, Skill Development Initiative Scheme (SDIS)

Example: 2013 Previous Year Question

| Disguised unemployment generally means (2013)(a) large number of people remain unemployed

(b) alternative employment is not available (c) marginal productivity of labour is zero (d) productivity of workers is low Solution (c) |

| Economic growth in country X will necessarily have to occur if (2013)(a) there is technical progress in the world economy

(b) there is population growth in X (c) there is capital formation in X (d) the volume of trade grows in the world economy Solution (c) |

Focus:

Example: 2013 Prelims Question

| Consider the following statements : (2013)1. Inflation benefits the debtors. 2. Inflation benefits the bond-holders.Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2Solution (a) |

| A rise in general level of prices may be caused by: (2013)1. an increase in the money supply 2. a decrease in the aggregate level of output 3. an increase in the effective demandSelect the correct answer using the codes given below. (a) 1 only (b) 1 and 2 only (c) 2 and 3 only (d) 1, 2 and 3Solution (d) |

2011 Prelims Question

| A rapid increase in the rate of inflation is sometimes attributed to the “base effect”. What is “base effect”?(a.) It is the impact of drastic deficiency in supply due to failure of crops (b.) It is the impact of the surge in demand due to rapid economic growth (c.) It is the impact of the price levels of previous year on the calculation of inflation rate (d.) None of the statements (a), (b) and (c) ‘given above is correct in this contextSolution (c) |

Focus:

Few Example’s from Previous Year’s Prelims Questions Paper

| If the interest rate is decreased in an economy, it will (2014)A. decrease the consumption expenditure in the economy B. increase the tax collection of the Government C. increase the investment expenditure in the economy D. increase the total savings in the economySolution (c) |

| The Reserve Bank of India regulates the commercial banks in matters of (2013)1. liquidity of assets 2. branch expansion 3. merger of banks 4. winding-up of banksSelect the correct answer using the codes given below. (a) 1 and 4 only (b) 2, 3 and 4 only (c) 1, 2 and 3 only (d) 1, 2, 3 and 4Solution (d) |

| What is/are the facility/facilities the beneficiaries can get from the services of Business Correspondent (Bank Saathi) in branchless areas? (2014)1. It enables the beneficiaries to draw their subsidies and social security benefits in their villages. 2. It enables the beneficiaries in the rural areas to make deposits and withdrawals.Select the correct answer using the code given below.A.1 only B.2 only C.Both 1 and 2 D.Neither 1 nor 2 Solution (c) |