- Home

- UPSC Mains

- Daily Free Initiatives

- Courses

- KPSC / KAS

- हिंदी

- Centres

- Contact Us

Dear Students

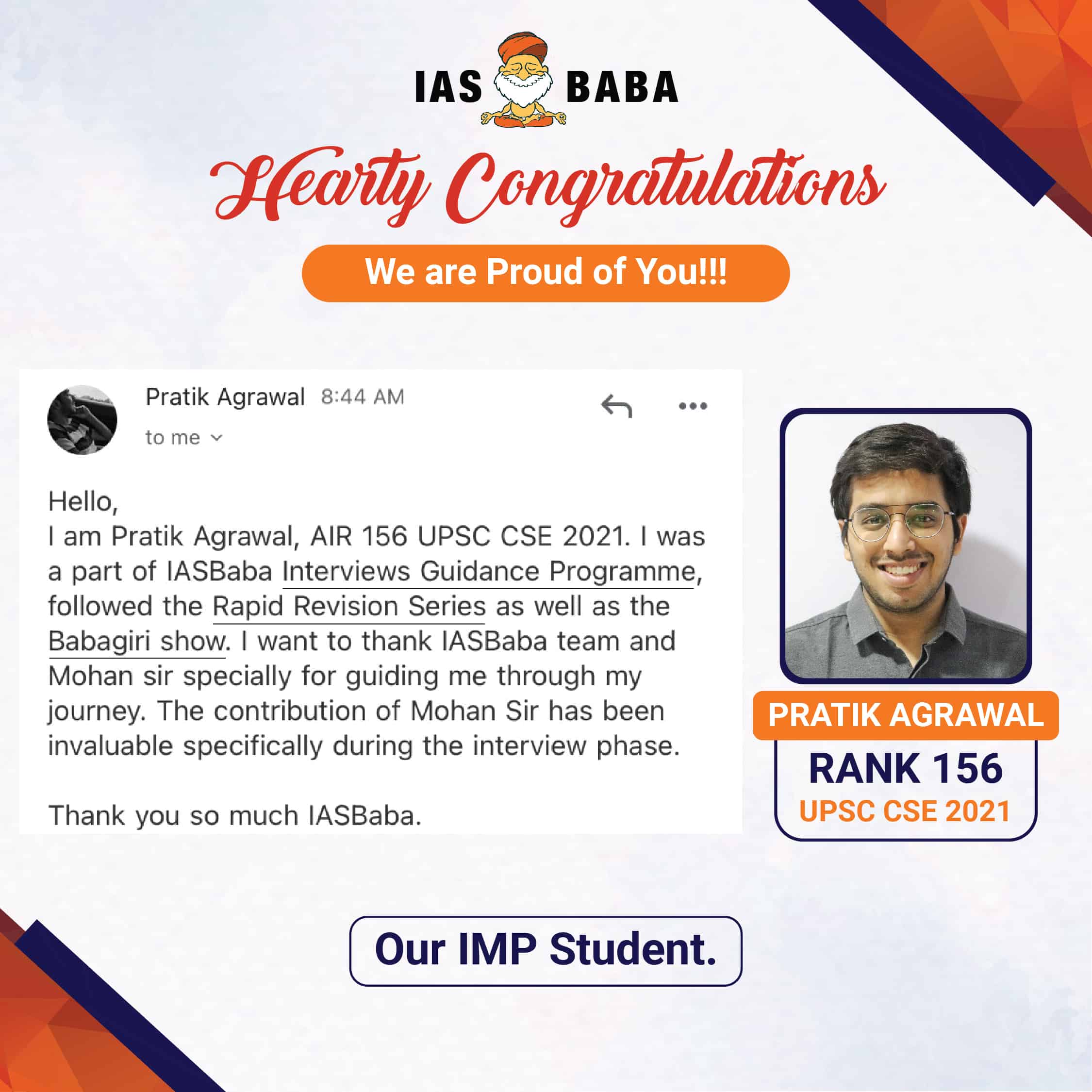

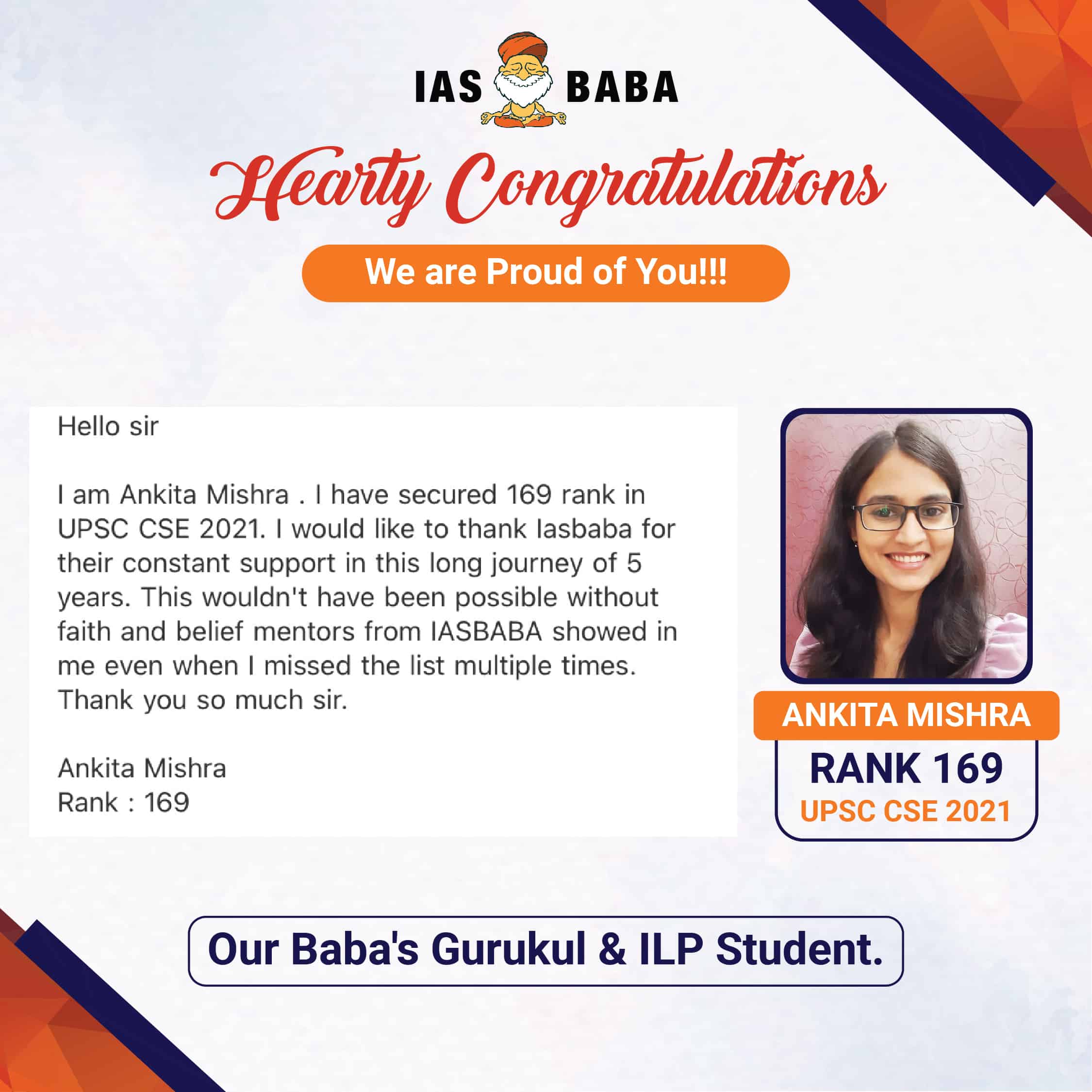

Thank You for the Overwhelming Response and Heartwarming Feedback on our Interview Mentorship Program (IMP) and the DAF -II Sessions with Serving IAS Officers and One-One DAF Sessions with Mohan Sir (Founder IASbaba).

The Personality Tests/Interview is set to start very soon and one should start with the Interview Preparation right away without wasting any more time.

Before you start your journey, please understand that your personality is composed of many aspects – your confidence, knowledge, way of talking, ability to handle pressure, being precise in your response, even your way of seating, and so on. While preparing for the personality test, it is critical that you focus on each of these components. We are happy that we have an initiative that places you in the right spot with respect to your preparation.

Much More than Mock Interviews; The Most Comprehensive Interview Mentorship Programmme!

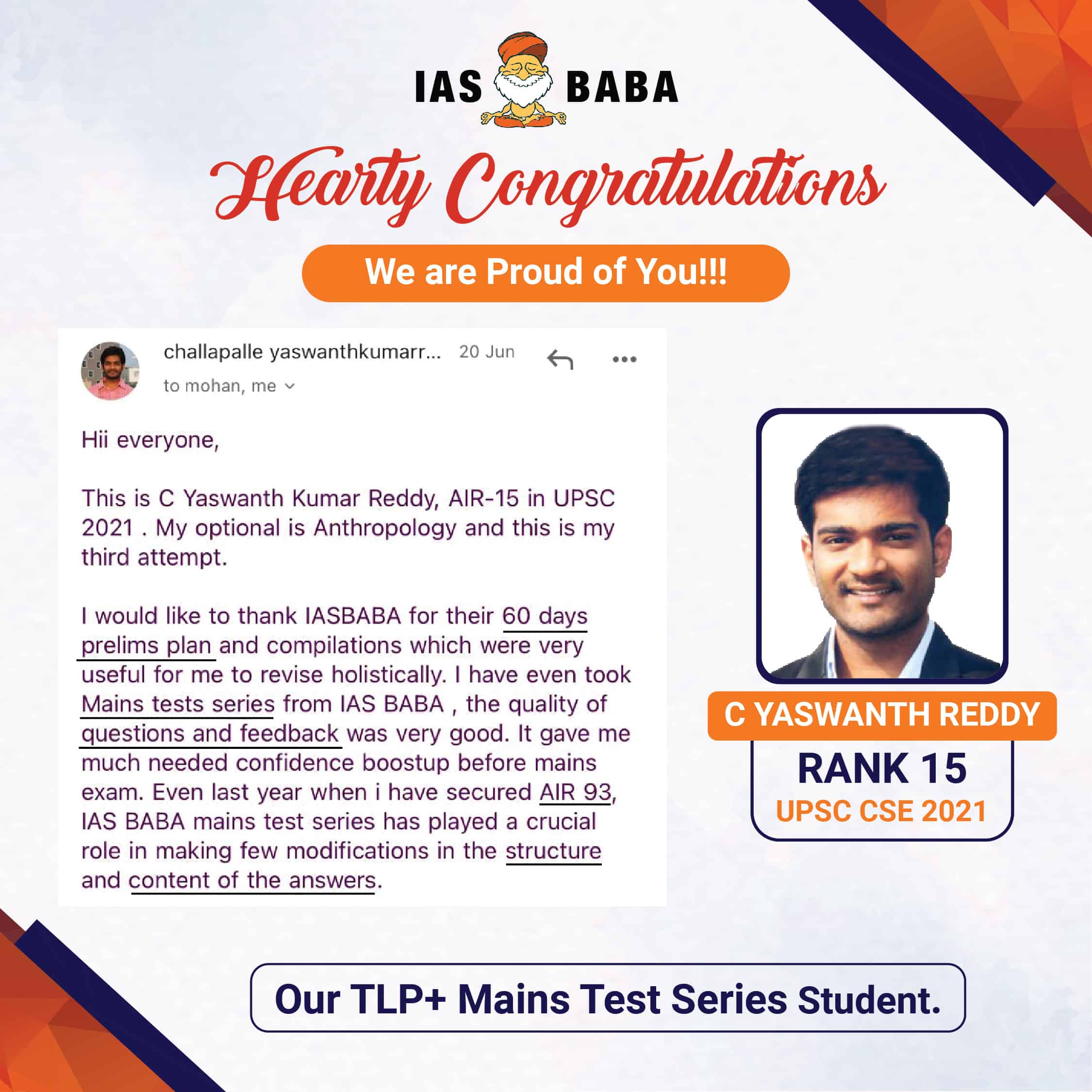

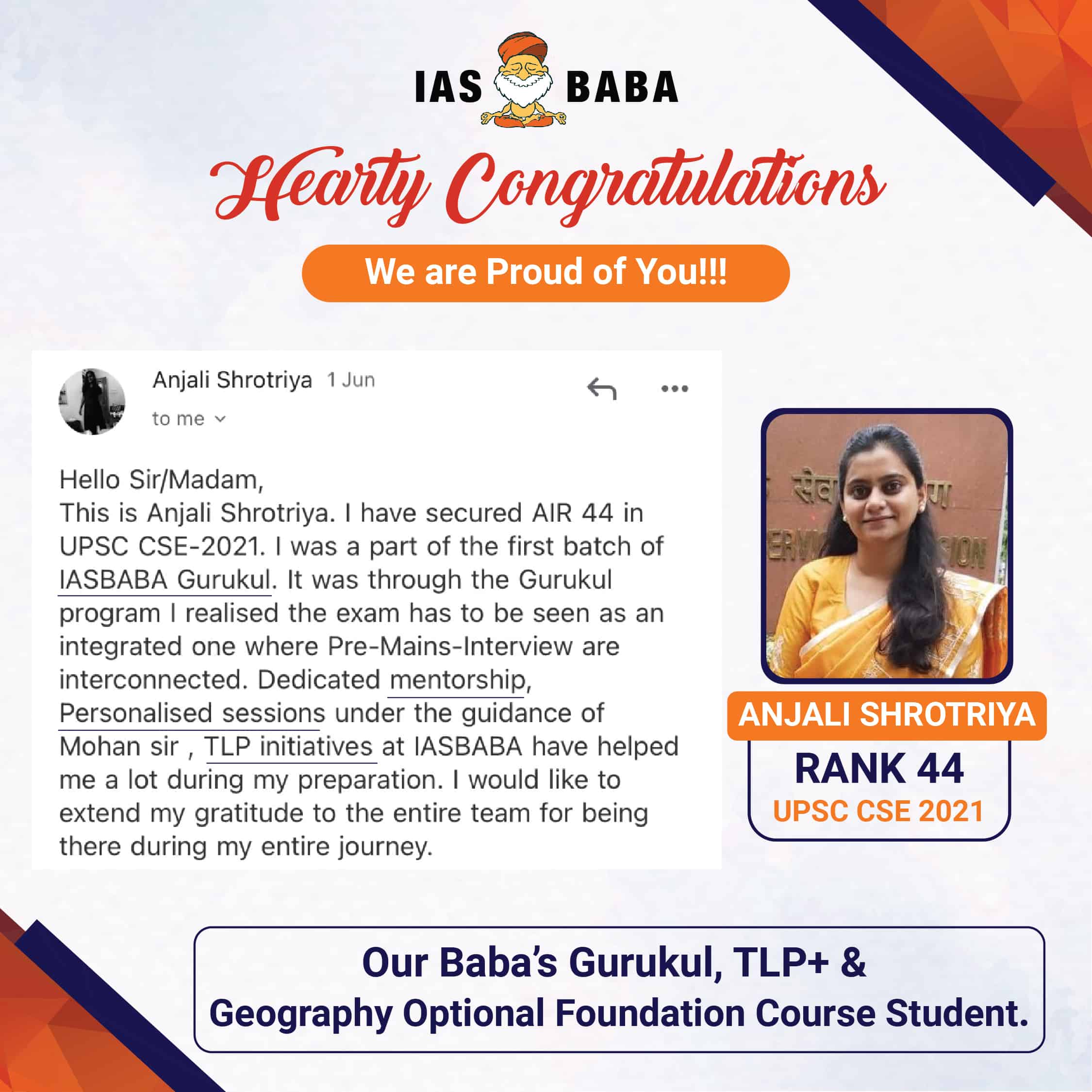

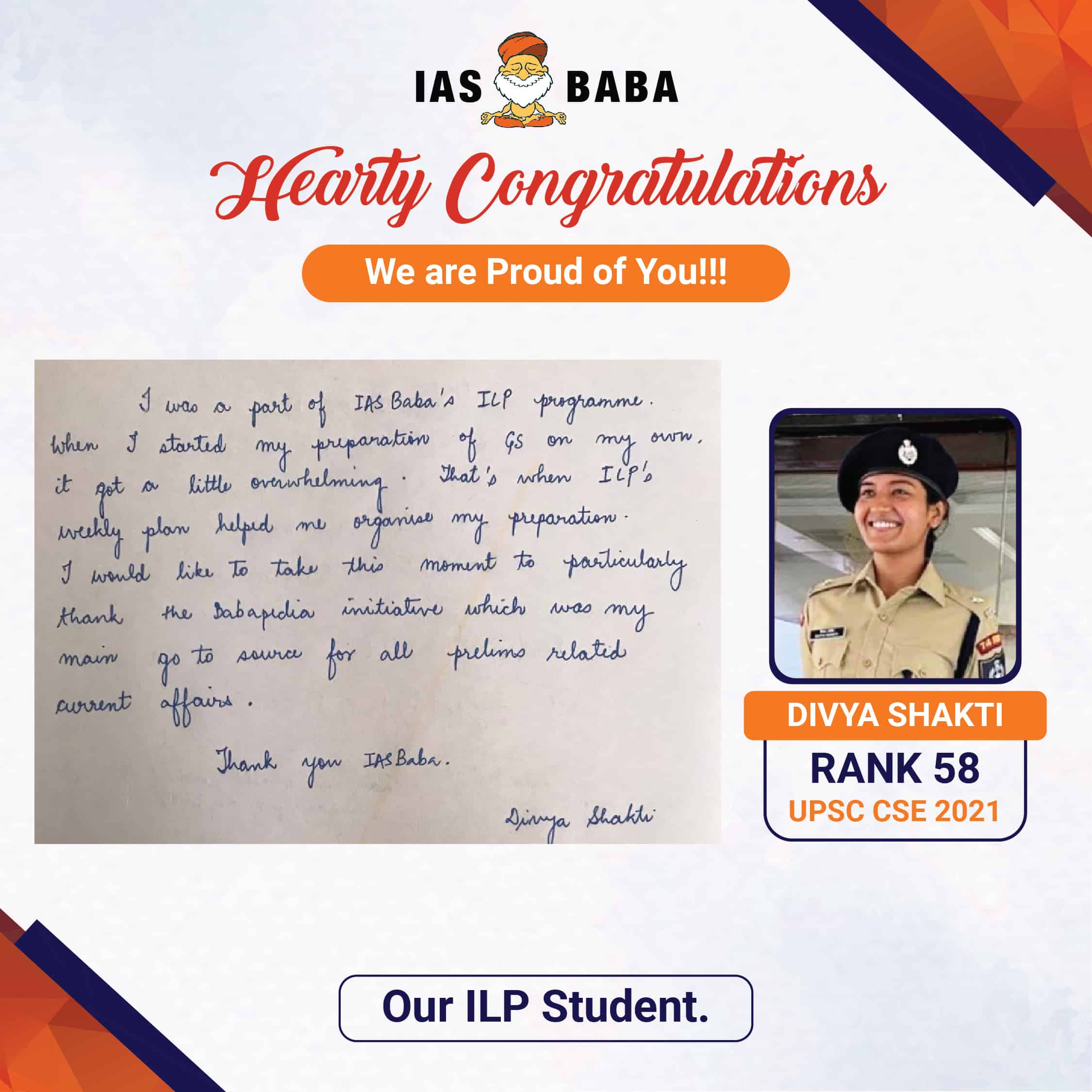

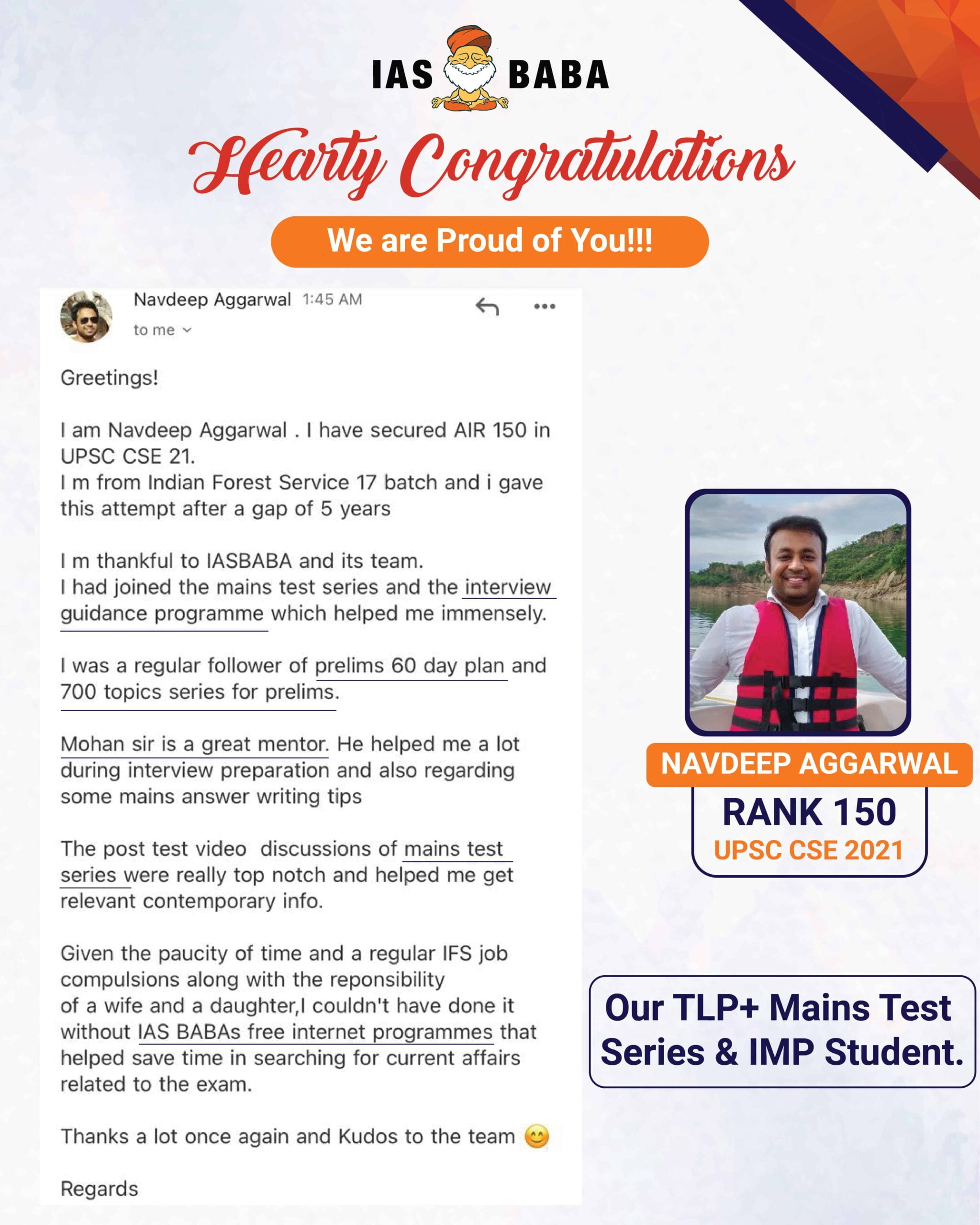

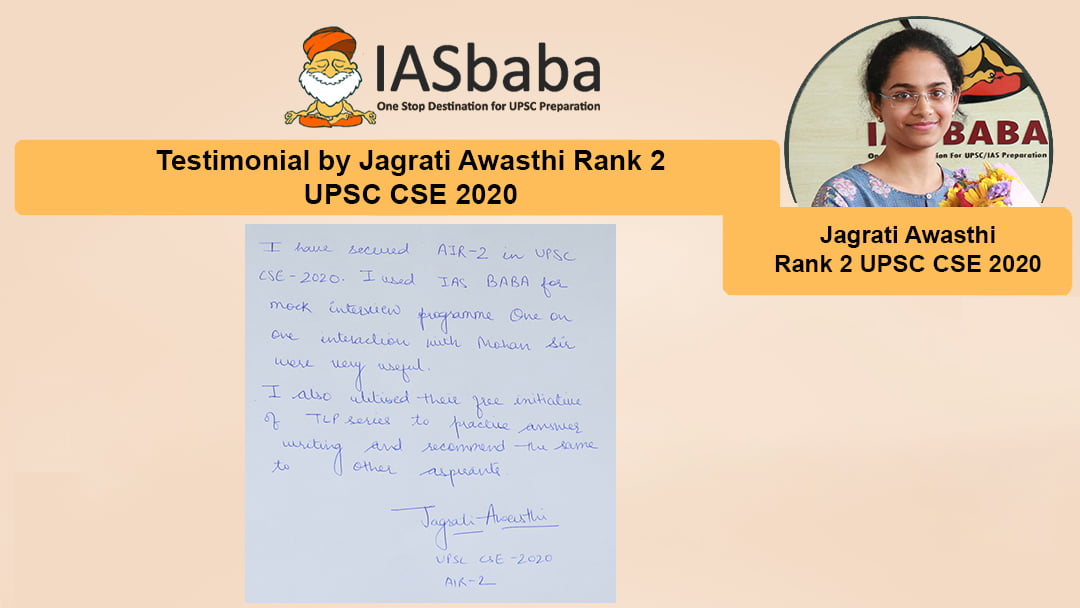

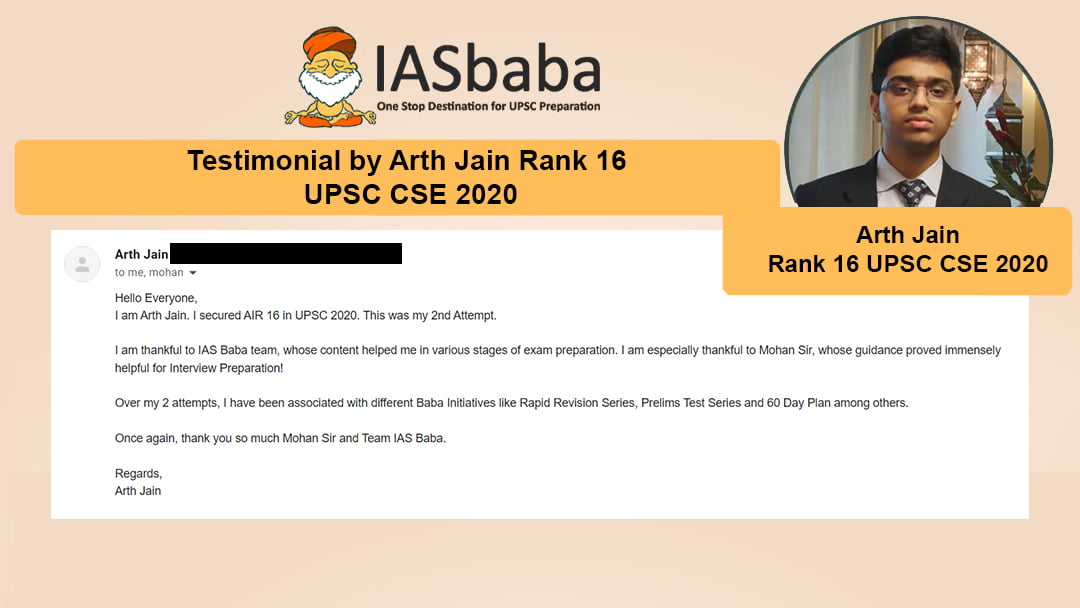

This program is the most comprehensive initiative for the personality test available today. Not only it has helped many previous year rankers to qualify for the Civil Services Exam, but it has also guided them to adopt the mindset of a Civil Servant too.

We believe that IMP with its ingredients can dramatically enhance your chances. The trick is to start early and start strongly. Our team is working really hard to make IMP your best companion. Please join us to start a challenging yet exciting journey towards success.

An expert panel of retired and serving civil servants, subject matter experts, and other distinguished personalities from varied fields to give you a near real feel of the interview board, complemented with detailed feedback and recordings.

Please find the TIME SLOTS available for PANEL MOCK INTERVIEW (Available Both ONLINE & OFFLINE – DELHI & BANGALORE) below:

The Mock Interviews will be followed by One – One Mentorship with Mohan Sir (Founder, IASbaba).

Those who are interested in the IMP Programme, please fill out the Registration Form below:

Please fill up the Google form given below. Students who fill out the form will be added to a telegram group so that there can be healthy discussions with other students who will be appearing for the Interview/Personality Test (UPSC 2022). Also, Mohan sir will be interacting one on one with all the students who will be appearing for the same.

For further queries with regard to the IMP Programme, you can mail us at imp@iasbaba.com or call us on 80770 36613(10 am to 5:30 pm).

All the Best

IASbaba Team