IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2015, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 23rd July, 2015

NATIONAL

How bad is the SECC data?

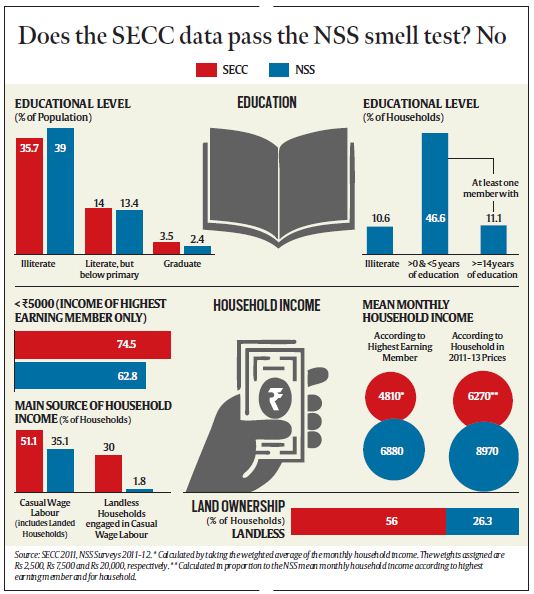

- The Socio Economic and Caste Census (SECC) 2011 data, released partially by the central government, has shown worrying levels of rural poverty.

- The NDA has signalled that this data would be the basis for targeted allocation of entitlements under various poverty alleviation programmes.

- Several economists and census experts, however, worry that the SECC data itself might be unreliable or incomplete.

What is missing in it?

- The final data is still missing for over half the districts, and the draft list has gaps and inaccuracies,” says economist Jean Dreze.

- Of 640 districts covered, data for 628 is in a draft list and only 277 in the final list.

- Of the 35 states and Union territories, 21 are yet to publish their final list.

- The PDFs released online are of the draft list, with missing households or even hamlets, and sometimes handwritten information that may or may not be in the digitised dataset.

- It is hard to judge the integrity of the data until samples of the dataset are released for independent scrutiny.”

Why do we need authentic data?

- It’s used for targeted allocation of entitlements under various programmes.

- Welfare schemes flounder because they are scatter-shot. As a result, sections of society who don’t need a leg-up end up cornering welfare, at the cost of other less politically represented sections which need them the most.

- Caste-based socio-economic backwardness is a reality.

- To work towards ending it beyond making pious gestures, one needs caste-based data that is empirically correct.

Why is there so much debate on Caste data?

- Caste is the other set of data which is yet to be released.

- We are now told that the NitiAayog will compile and put out the information.

- Census information on caste should have been canvassed by the agency with the best skills for the purpose— the Office of the Registrar General and Census Commissioner, India (ORGI).

- However, the ORGI baulked at collecting this information as part of the Census of 2011.

Will SECC serve the purpose?

- In the end, the SECC will turn out to be most useful only if the socio-economic component of the data is used for the specific purposes for which it was collected.

- The Indira AwaasYojana could, for instance, cover only households living in one room or kutcha houses as identified in the SECC.

- It would be a case of overreach if the finance ministry sees the SECC as providing it an opportunity to reduce coverage and slash welfare expenditure.

IAS BABA’s View

- As the rather politically incorrect but well-meaning saying goes, it’s better to have no uncle than a blind uncle.

- Add to that the fact that vote-bank politics has been responsible for development being more uneven than equitable,

- Let the government first set up a panel of experts that includes those critics of the current methodology.

- Let it then agree upon a set of SECC data within a timeframe. Armed with that data, let the welfare schemes reach their targeted destinations.

Connecting the Dots:

- Could the central government then be thinking of cutting back on its food security obligations by restricting (National food security act) NFSA coverage to 40% of the population?

- Write a note on N.C. Saxena committee appointed by the ministry of rural development.

ECONOMICS

Why is gold falling, and where is it headed?

When the Gold prices are in rise generally?

- Gold prices have gone up whenever public confidence in the dollar — the world’s reserve currency — has suffered erosion.

- This is hardly the case today, with the US economy recovering from a recession even with low inflation — defying dire predictions of an imminent dollar collapse.

- The best proof of it is the US dollar index, which measures the value of the greenback relative to a basket of six other global currencies.

- The dollar index (base: March 1973 = 100) is currently close to 98, compared to the low of 72.93 on April 29, 2011 when the American economy was still sputtering.

- A strong dollar has made the world somewhat less pessimistic about fiat currencies, while reducing the allure of gold as a safe haven asset.

- The dollar index and gold prices generally move in opposite directions.

What about India? Why are prices falling here?

- With a strong rupee in combination with relatively low inflation making the yellow metal not a very good investment. (The huge outflows from gold exchange-traded funds would testify to this.)

- Gold ultimately has very little utility other than being raw material for jewellery and a store of value (though perhaps not over the long run).

- Nor does it generate any income — unlike rentals from land, dividends from shares or interest from bonds.

But can the shiny metal rally again?

- And as far as India goes, a big negative for gold is diminished rural purchasing power.

- Given that an estimated two-thirds of India’s gold demand comes from rural areas, lower crop prices and a not-so-good monsoon so far is not good news for bullion traders and jewellers.

- But it isn’t bad for the country’s balance of payments.

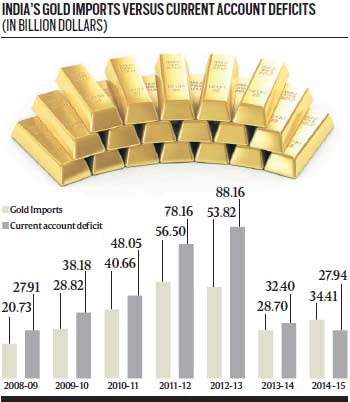

- Gold imports peaked at $ 55-56 billion in 2011-12 and 2012-13 and, along with oil, were the primary source of current account deficits, before falling to $ 29-34 billion in the last two years. And they could fall further this year.

Connecting the Dots:

- Write a note on reason behind falling prices of gold, oil and copper.

- Why have gold prices crashed to more than five-year lows globally, and to near four-year lows in India?