IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2015, IASbaba's strategy International Relations Paper 2 IAS UPSC, International, UPSC

Archives

IASbaba’s Daily Current Affairs- 28th & 29th July, 2015

ECONOMICS

Ending round-tripping : Time for a road map on abolition of participatory notes

- The special investigation team (SIT) set up by the Supreme Court to unearth

black money has come up with recommendations to curb the menace of participatory notes or P-Notes, which are derivative instruments issued by Foreign Portfolio Investors (FPIs) against underlying Indian securities.

black money has come up with recommendations to curb the menace of participatory notes or P-Notes, which are derivative instruments issued by Foreign Portfolio Investors (FPIs) against underlying Indian securities. - The issue of promoters and market intermediaries aiding money laundering by rigging up stock prices of companies with no fundamental value is a genuine concern and needs to be addressed speedily.

Courtesy (image)- http://images.financialexpress.com/2015/02/Black-Money.jpg

The SIT committee has emphasised on 2 aspects:

- The role of the stock market in converting unaccounted black money into accounted money

- The role of ‘round tripping’ of unaccounted funds via participatory notes (P-notes) issued to offshore investors, as well as market manipulations by domestic entities.

Steps to curb the menace:

- Earlier, P-notes thrived and was seen as a major threat- in 2008, they accounted for over 50 % of the assets of foreign investors; but now they form just 11 % of these assets. This is due to the strict regulations – it has been mandated that, P-notes can be issued only to entities that are regulated in their country and those that have undergone know-your-client checks.

- In the recent report, SIT has suggested that P-notes should be made non-transferable, to further tighten this route.

- Money laundering through domestic companies is a greater concern than unaccounted funds via participatory notes. Hence more focus should be on the numerous small companies with unscrupulous promoters and dubious business models that populate the Indian stock market.

- These companies have largely proliferated due to the lax regulations governing primary market listings in the years prior to 2010. While tightening of IPO guidelines in recent years will ensure that such companies do not raise money from the public in the future, the regulator will have to devise a way to check malpractices by companies that are already listed.

- SEBI has taken some actions already on black money entering the country through the offshore derivative instrument (ODI) route. It has set out stringent eligibility requirements for buying ODIs; these instruments can only be issued to entities from countries that have signed a multilateral agreement to combat money laundering and for exchange of information with the International Organisation of Securities Commission.

- The fund structures need to be transparent, and two or more P-Notes subscribers with the same beneficiary would be considered as one subscriber and SEBI has to share information on such activities with both the tax authorities and the financial intelligence unit.

- Stringent punitive action – SEBI has been asked to launch prosecution under the SEBI Act, which can lead to imprisonment up to 10 years or fine up to 25 crores.

- Along with more stringent punitive action, speedier investigation and trial will also serve as a deterrent.

Background:

What is ‘Money laundering’?

- It is the generic term used to describe the process by which criminals disguise the original ownership and control of the proceeds of criminal conduct by making such proceeds appear to have derived from a legitimate source.

- However, in a number of legal and regulatory systems, the term money laundering has become conflated with other forms of financial crime, and sometimes used more generally to include misuse of the financial system (involving things such as securities, digital currencies, credit cards, and traditional currency), including terrorism financing and evasion of international sanctions.

- Money obtained from certain crimes, such as extortion, insider trading, drug trafficking and illegal gambling is “dirty”. It needs to be cleaned to appear to have been derived from legal activities so that banks and other financial institutions will deal with it without suspicion. Money can be laundered by many methods, which vary in complexity and sophistication.

Courtesy – Wikipedia

What are P-notes?

- Participatory Notes (P-Notes) are derivative instruments (with underlying Indian stocks, debt or derivatives instruments) issued by registered foreign institutional investors (FII) to overseas investors or hedge funds, who wish to invest in the Indian stock markets without registering themselves with the market regulator (SEBI).

How does it work?

- P-Notes are for individuals who do not want to disclose their identity for various reasons. Therefore, they put their money in foreign bank branches located outside India, which then issues participatory notes to them. The bank can then invest or bet in the Indian stock markets on behalf of those clients, without disclosing their identities to SEBI. (or)

- Indian-based brokerages buy India-based securities and then issue participatory notes to foreign investors. Any dividends or capital gains collected from the underlying securities go back to the investors.

- In many ways, this is similar to an informal ADR process, where brokerages hold on to stocks for foreign investors.

How does this affect Indian markets?

- Regulators fear that hedge funds acting through participatory notes will cause economic volatility in India’s exchanges.

- Recently, the BSE fell over 550 points and NSE’s Nifty by161 points. Indian stock markets are led by foreign money through FIIs and many choose to take the P-notes route to keep their identities a secret. If the government approves the SIT view and asks SEBI to curb black money via P-Notes, then this FII money will leave the Indian markets. This is precisely what happened recently, where markets lost Rs 1.5 lakh crore in value.

What is ‘Round-Trip Trading’?

- The act or practice of two or more companies trading assets or securities back and forth at approximately the same price.

- For example, Company A may sell securities to Company B and agree to buy them back at the same price at a later time. Round-trip trading creates the impression of a high trading volume, suggesting interest in assets or securities that may not actually be there. It also increases a firm’s earnings and expenses without increasing or decreasing its net income. It is a form of market manipulation.

What are Tax Havens?

- A country that offers foreign individuals and businesses little or no tax liability in a politically and economically stable environment.

- Tax havens also provide little or no financial information to foreign tax authorities. Individuals and businesses that do not reside a tax haven can take advantage of these countries’ tax regimes to avoid paying taxes in their home countries.

- Tax havens do not require that an individual reside in or a business operate out of that country in order to benefit from its tax policies.

Connecting the dots:

- Critically examine the role of SEBI in curbing the Money laundering as a menace?

- Money laundering is the hand in the gloves behind the terrorism? Comment.

INTERNATIONAL

Food subsidies still haunt India at WTO

What are India’s concerns?

- India is concerned over the delay in reaching a ‘permanent solution’ to the problem of dealing with food procurement subsidies.

What does Agreement on Agriculture (AoA) say?

- Under Agreement on Agriculture (AoA), developing countries can give agricultural subsidies or aggregate measurement support (AMS) up to 10 % of the value of agricultural production.

- AMS has two components:

- ‘Product-specific’ or the excess of price paid to farmers over international price or ERP (external reference price) multiplied by quantum of produce;

- ‘Non-product specific’ or money spent on schemes to supply inputs such as fertilisers, seed, irrigation, electricity at subsidised rates.

Peace clause :

- For calculating AMS, support on inputs to resource poor farmers was ‘excluded’ under the AoA. The rationale for this was that such support does not have any ‘trade-distorting’ effect. The same logic applied to product specific subsidies.

- However, it was not explicitly incorporated in the agreement as the minimum support price (MSP) given to farmers then was substantially lower than ERP, resulting in negative ‘product-specific’ AMS. Indeed, this position continued till 2004-06.

- Thereafter, due to significant increase in MSP, things have changed. For instance, at present for wheat, MSP at $226 per tonne (corresponding to Rs. 1,450 a quintal) is higher than 1986-88 based ERP of $130 per tonne. In view of product-specific subsidy going into positive territory and subsidies on agricultural inputs also increasing substantially, there is a real risk of AMS exceeding the 10 % ceiling.

How can this issue be resolved?

The problem can be solved by amending the AoA to –

- Update ERP to current level and

- Exclude purchases from resource poor farmers for calculating product-specific subsidies. This indeed is a permanent solution that India has been looking for.

Background:

- At Bali ministerial in December 2013, developed countries had agreed to a ‘peace clause’ (exemption from penal action for violations)

- Under the peace clause, if a developing country gives agricultural subsidies in excess of 10 % of its agri-GDP, no member can challenge this until 2017. In the meanwhile, WTO would look for a permanent solution to address the developing countries food security concerns. This meant that while peace clause would go till 2017, there was no guarantee that permanent solution would be in place by then.

- The peace clause too came with a plethora of conditions, such as submission of data on food procurement, stockholding, distribution and subsidies (including their computation), etc. These also included establishing that subsidies are not ‘trade distorting’ which is nearly impossible to comply. In other words, even in the interim, any member can challenge farm support measures.

India’s intervention: Why India resisted rich nations in WTO trade talks?

- India recognised that Bali agreement was flawed. So, in the meeting of the WTO-General Council (GC) in Geneva (July 31, 2014), it insisted on a time bound action plan to address the food procurement subsidy issue.

- That was considered too demanding by US. However, the WTO-GC in its meeting held on December 2014, approved extension of peace clause till such time a permanent solution is put in place.

- On the face of it, it might appear that India is in a safe zone. But, it is not so. This is because the conditions appended to peace clause have not been dropped and the search for a permanent solution has been deferred for an ‘indefinite’ period. The fear is of the US asking for all sorts of data to deny India, the benefit of peace clause even in the interim.

Way forward:

- At the next WTO meeting, to be held in Nairobi this December (2015), India should insist on getting a permanent solution by (i) updating ERP to the current level and (ii) excluding purchases from resource poor farmers for calculating product-specific subsidies under AoA.

- The developed countries should recognise that a three-decade old ERP cannot be compared with today’s MSP in India to compute the current level of subsidy.

- If resource poor farmers can get exemption on input subsidies, how can they be denied exemption on product subsidies?

- If, the developed countries do not agree to the above solution, then India should insist on ‘unconditional’ availability of interim ‘peace clause’ till such time a permanent solution is found. This must not be linked to any other issue in the discussion such as industrial tariff or services.

What is Minimum support price (MSP) ?

- Minimum Support Price (MSP) is a form of market intervention by the Government of India to insure agricultural producers against any sharp fall in farm prices.

- The minimum support prices are announced by the Government of India at the beginning of the sowing season for certain crops on the basis of the recommendations of the Commission for Agricultural Costs and Prices (CACP).

- MSP is price fixed by Government of India to protect the producer – farmers – against excessive fall in price during bumper production years. The minimum support prices are a guarantee price for their produce from the Government.

- The major objectives are to support the farmers from distress sales and to procure food grains for public distribution. In case the market price for the commodity falls below the announced minimum price due to bumper production and glut in the market, government agencies purchase the entire quantity offered by the farmers at the announced minimum price.

Courtesy – http://vikaspedia.in/

More about Doha round

- The Doha Development Agenda, more often referred to as the Doha round trade talks, is the latest cycle of negotiations under the umbrella of the World Trade Organisation (WTO), the Geneva-based arbiter of global trade.

- There have been nine rounds of multilateral trade talks since the end of the second world war, but the Doha round is the first to focus on helping developing countries join the global marketplace, and boost their economies as a result. The round was launched in November 2001 – and it’s still not over.

What are they negotiating?

- Broadly speaking, the goal of any trade talks is to make it easier for goods and services to be bought and sold across national borders. In the case of the Doha round, that means cutting import taxes (tariffs) on everything from wheat to cars to lingerie; restricting countries’ use of subsidies for farmers and fishermen; lowering taxes and regulatory barriers that affect the cross-border trade in services(such as banking and consulting); negotiating new intellectual property rules on things such as drugs and copyrighted works.

- The Doha development round of trade talks is all but dead, and only two issues have survived to merit serious consideration at Bali.

- Trade facilitation – the harmonising and standardising of customs rules and procedures that is an agenda of the global north to ease import practices across the world. The developed countries have argued that, this will dramatically increase both trade and employment worldwide, on the basis of spurious empirical exercises.

- Agricultural subsidies – which affects the livelihoods and food security of more than half the world’s population. Unfortunately, some wealthy countries have demanded acceptance of the former while refusing to make even the most obvious adjustments to meet the latter.

Courtesy – http://www.theguardian.com/

Connecting the Dots:

All possible dimensions relating to the Doha issue have been covered comprehensively in this article. So we advice you to read this article 2-3 times, this will give not only give you complete analysis and multi-dimensional view point, but also bring in more clarity.

Also think over these issues:

- India has faced criticism for stonewalling global trade deal. Is it justified?

- Is WTO facing a crisis? Is WTO still relevant as a forum for conducting global trade talks?

NATIONAL

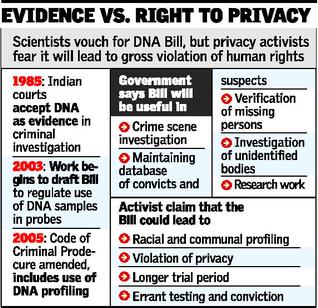

DNA profiling Bill triggers debate

- The DNA profiling Bill will allow the government to establish a National DNA

Data Bank and a DNA Profiling Board, and use the data for various specified forensic purposes.

Data Bank and a DNA Profiling Board, and use the data for various specified forensic purposes. - The data is collected and stored under indices including, crime scene index, suspects index, offender’s index, missing persons index, unknown deceased persons’ index, volunteers’ index, and such other DNA indices as may be specified by regulations made by the Board.

- The government is planning to pass the DNA profiling Bill in the current session (Monsoon) of Parliament. However, the Bill has raised many issues especially with regard to privacy of an individual.

Supporters of the Bill:

- Scientists who have supported the DNA Bill have given a go ahead for the Bill, while disregarding the privacy concerns and fear of social and political misuse of the data.

- They have said, the country should not be worried about the privacy concerns since, ‘the DNA profiling is being done legally in various Western countries and it was successful in solving a large number of crime cases. And regarding privacy concerns, there are enough safeguards for the misuse of the data.

Issues: Potential for misuse

- Those opposing the legislation fear that the bill could result in large scale violation of human rights. DNA can reveal very personal information about people. And biometric data collection of the scale of this kind has a high potential for misuse and hence the bill itself should have powerful safeguards for privacy that it currently lacks.

- Legal experts have said that the scope of the Bill was too wide to be implemented in India. As it allowed the use of DNA data in relation with offences including abortions, paternity disputes and crimes against the law of nature, it could make the databank too large for any sort of use.

- DNA fingerprinting experts found that the whole process could further slow down the legal framework in the country. In India, where the conviction time for major offences is anywhere between 10 to 20 years, this will only make the legal process cumbersome and add on to people’s misery.

What can be the Safeguards against the potential misuse?

- Limiting the scope of the DNA database to include only samples from a crime scene for serious crimes and not minor offenses

- Destruction of DNA samples once a DNA profile is created

- Clearly defining when a court order is needed to collect DNA samples, defining when consent is required and is not required from the individual for a DNA sample to be taken, and ensuring that the individual has a right of appeal.

For more information regarding the provisions of the Bill, refer the below link –

http://www.prsindia.org/theprsblog/?tag=dna-profiling

Connecting the Dots:

- Does the DNA profiling Bill mean to say that once a criminal always a criminal? Will the Bill affect the future of these individuals?

- What are the pros and cons of the Bill? Will this Bill reduce the crime rate in India?

- Is India well equipped to implement such a Bill?