IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, International, UPSC

P.S: Sorry the Current Affairs could not be published on Saturday 16th Jan, 2015 as we were busy with the Workshop. Thank you for your patience and support.

Archives

IASbaba’s Daily Current Affairs – 16th January, 2016

ECONOMICS

TOPIC:

- General studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

India’s investment anaemia

- 12th five year plan (2012-17) envisaged a target of around one trillion dollars to enable a growth rate of around 8%.

- The new government which was formed in 2014, focussed much more on investment led growth.

- Sadly, investment has not grown.

- More disturbing, several obstacles blocking the investment revival remain in place.

Domestic resource mobilization:

- Private-sector fixed-capital investment, as a share of gross domestic product, peaked at 33.6% in 2011-12 and has since trended down to the current low of 28.7% in 2014-15.

Performance at state level:

- The above weakness in capital formation is a nationwide phenomenon, with all major states registering a decline in ongoing projects over the period between 2011-12 to 2014-15.

- Maharashtra and Karnataka, for example, both experienced a cumulative decline of about 15% in projects; the declines in Gujarat and Tamil Nadu were sharper, at more than 20%.

Underperformance of manufacturing sector:

- As for ‘Make in India’, the reality is that capacity creation in manufacturing has suffered a cumulative decline of 35% from its peak in 2011.

- The cumulative decline in services, at 13%, looks moderate in comparison.

Factors that are holding back investments:

- Failure of major reforms like land acquisition etc:

- Given parliamentary gridlock, the prospect of pushing through tough reforms appears bleak.

- As a result, the central government has preferred simply to delegate some of the task to states.

- As a part of 14th finance commission recommendations, centre devolved around 42% of net tax proceeds to state governments.

- But while there are several benefits to be derived from strengthening India’s fiscal federalism, an important downside is that it signals a dilution of the central government’s ambition at the state level.

- Continuing financial problems of Indian banks and of many large corporations.

- Despite significant action by the present government—for example, in auctioning coal licences—corporations and banks exposed to the mining and infrastructure sectors still have stressed balance sheets.

- In fact, the problem is broader.

- According to a recent report by Credit Suisse, 17% of Indian bank loans are stressed, a significant share of which may not be repaid.

- Just as the process of land acquisition needs major reform, bankruptcy reform will be essential to place the corporate and financial sectors on a sound footing.

- Real cost of borrowing is high in India

- Despite the Reserve Bank of India (RBI)’s success in taming inflation—with help from falling commodity prices—nominal interest rates have not fallen in line.

- In terms of the Consumer Price Index (CPI), the real cost of borrowing (cash credit) from public sector banks rose from 0.75% in the first quarter of 2012 to 5.24% in the third quarter of 2015.

- This increase is larger when measured using wholesale manufacturing inflation.

- As a consequence of stressed balanced sheets, and anxious to rebuild their strength, banks are reluctant to pass through to their customers the RBI’s recent rate cuts.

- External factors

- External conditions will also hold down investment in 2016.

- The US economy has recovered, but the Chinese motor has slowed markedly, and growth in Japan and much of Europe remains sluggish.

- That inevitably means fewer incentives in India to invest in export-oriented sectors.

Way ahead:

- However, whatever the state of the global economy, the bottom line is that India cannot attain its potential without a strong revival in investment.

- If the economy is to achieve the double-digit growth rates that China once boasted, India will need to build much more production capacity and infrastructure.

Connecting the dots:

- Critically examine the various mechanisms available in India for domestic resource mobilization.

- Critically analyse the importance foreign investment in promoting GDP and economic growth in India.

INTERNATIONAL

TOPIC:

- General studies 2:

- India and its neighborhood- relations.

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

- Important International institutions, agencies and fora- their structure, mandate.

BRICS— Performance Report

In 2003—Goldman Sachs Report:

Forecasted that the four Brics economies; namely

- Brazil,

- Russia,

- India and

- China

– would drive global growth for the next half century and that their combined GDP would exceed that of the G6 (the six largest economies of the time, led by the US) in less than 40 years

- Though these four BRICS economies were very different in key respects (like resource endowment and per capita income); all of them were relatively large (among top 12 in GDP) and populous (top nine) countries with large geographies (top seven)

- A key forecast had been that Brics taken together would equal half the GDP of the G6 by 2025 and it reached the desired number in double-quick time

- By 2014: The combined Brics GDP, at $16.6 trillion, was 49.1 per cent of the G6 total of $33.8 trillion— The comparison holding much importance as in 2003 the ratio had been just 15 per cent

And India—

Forecast: India’s GDP would become bigger than Italy’s (the smallest of the G6) in 2015

Reality: The International Monetary Fund’s forecast for 2015 put India’s GDP at $2.18 trillion, ahead of Italy’s $1.82 trillion

Let’s talk about China—

Brics Report: Had forecasted that Chinese GDP would match that of the US by 2040, helped along by currency appreciation

Yuan Devaluation:

- Economy is slowing down and there are serious structural issues confronting its economy

- To match up to USA—China needs to sustains 5 per cent annual growth sustainably

Relative Performance—

- With China being strong—both Brazil and Russia who were, until now, ahead of India have seemed to lose a bit of ground with the commodity cycle swinging sharply down

- Russia’s GDP (according to IMF) will shrink to $1.24 trillion in 2015, down sharply from $2.08 trillion in 2013, while Brazil’s GDP will have shrunk to $1.8 trillion from $2.39 trillion in 2013

- Currently, despite all the odds India is still walking on the GDP rope and is very much likely to do so in future if a robust economic roadmap be drawn and priorities in hindsight set right.

- With two of the four Brics members- not likely to be among the largest contributors to world growth in the foreseeable future, and with China and India being the largest and third largest contributors to global economic growth, there is a need to evaluate if both, India and China, can sail through the troubled BRICS-Water— with each other.

Facts

Headquarter: Shanghai, China

Members: Brazil, Russia, India, China, South Africa

Voting Power: Equal Voting Power

Broad Purpose:

- To extend loans for infrastructure and sustainable development projects

- To help other countries during Balance of Payment (BoP) Crisis

- Keep ready “patient money” to BRICS nations (RaghuramRajan-RBI Governor)

MUST READ

India- Israel: Driven by technology

Religious quagmires- Can elements of a secular morality be enforced in ways that don’t reinforce a sense of state arbitrariness?

For the farmer- The new crop insurance scheme may entail a cost that’s worth paying.

The irony in the start-up world- Global start-ups look at India, while Indian start-ups look outward

MIND MAPS

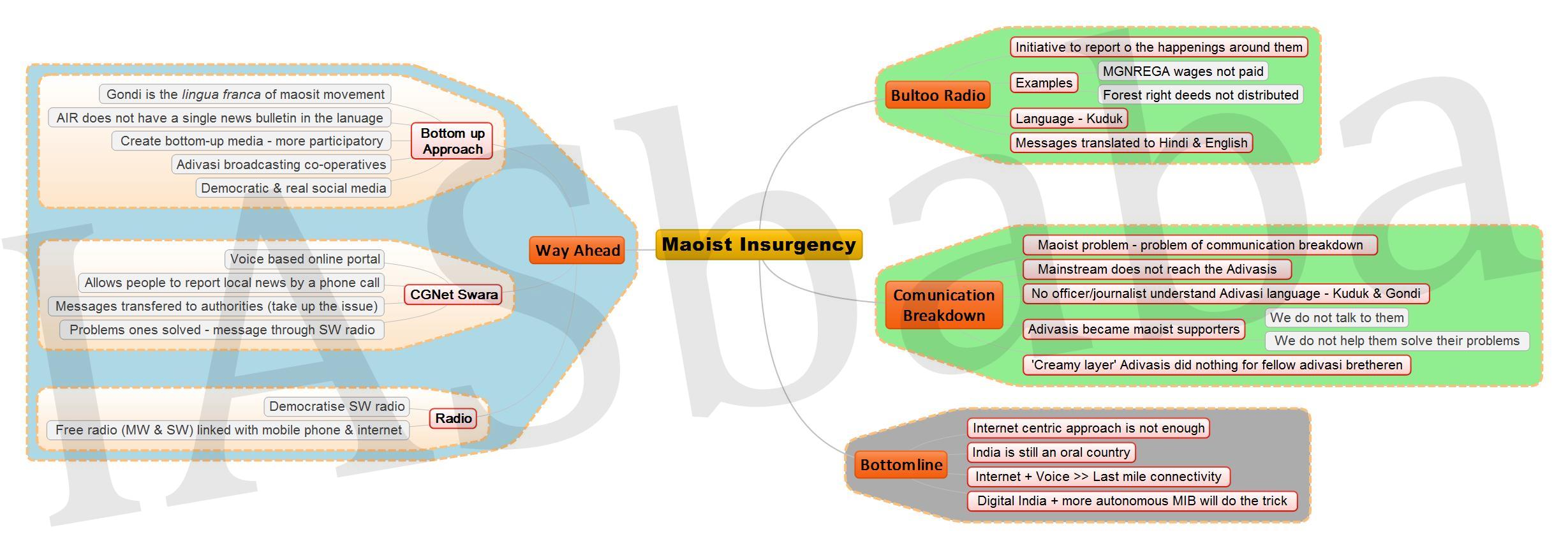

1. Maoist Insurgency

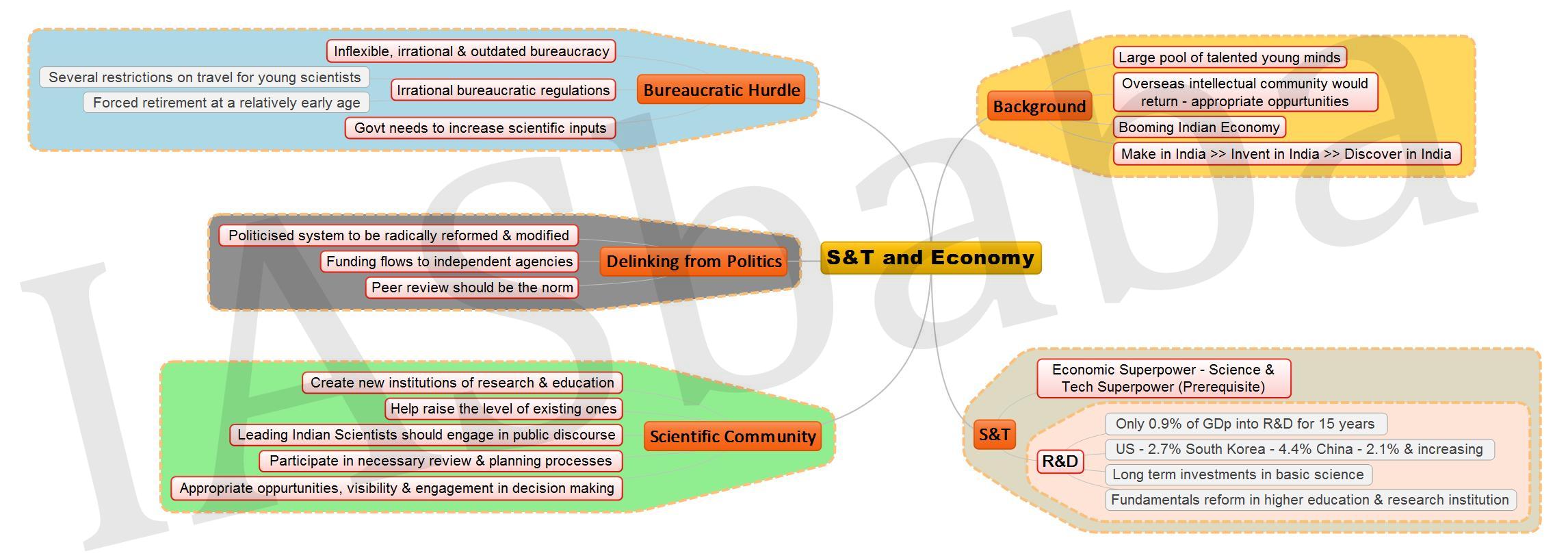

2. S&T and Economy