IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Feb 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 25th February, 2016

NATIONAL

TOPIC:

General Studies 1:

- Salient features of Indian Society, Diversity of India.

- Social empowerment, communalism, regionalism & secularism.

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Development processes and the development industry- the role of NGOs, SHGs, various groups and associations, donors, charities, institutional and other stakeholders.

Patriotism without nationalism

The recent events in New Delhi’s Jawaharlal Nehru University (JNU) and Patiala House courts have deepened the state of tension, suspicion and discord that has afflicted the country over the past several years.

The questions which arise?

- At one level, the events bring to sharp focus the mindset of the present government, the partisanship of university and law enforcement authorities, the shock from lawbreakers, the nature of student politics, and the inflammatory role of some television channels.

- At another level, the events call upon us as citizens to reflect on our relationship with the entity that we call India; to reflect on the nature of the feeling we have for India, and indeed, what is the “India” that we have feelings for.

- Every one of the above aspects demands serious debate, review and a new broad consensus if we are to retain our hard-won and hard-preserved freedoms.

What does the JNU incident denote?

- Anti-India slogans at JNU is a symptom of lack of a clear personal understanding of our own feelings of love, patriotism, nationalism, civic responsibility and devotion.

- Having not reflected on this, we fall for the seductive tunes of entrepreneurs of emotion, who often use our feelings to promote their own political ambition.

The nature of democratic politics for ambitious politicians:

- The nature of democratic politics for ambitious politicians is to use emotions to climb up the ladder of power.

- The problem is not manipulativeness or political ambition, it is the willingness with which otherwise sensible citizens allow themselves to follow the Piper.

- These are times when outrage broadcasts from television studios merge with the echo chambers of social media and break into violence on our streets.

The question of Liberalism vs. Nationalism:

- If we go by much of the public debate playing out in the media, we are asked to choose between liberalism and nationalism.

- If we support the right of the JNU students to shout anti-India slogans, as long as there is no violence, we are automatically seen as supporting their slogans and stand for liberalism.

- Similarly, if we support the Indian nation state, we are perforce deemed a right-wing nationalist.

- Further, ideologues will tell you that nationalists cannot be liberal, and liberals cannot be nationalist. We have to choose one side.

The nature of Indian nationalism:

- From its earliest origins, Indian nationalism has been liberal in nature.

- The signature of the freedom movement was to expel the British, without hatred.

- The setting up of a secular state with a liberal constitution, in the face of a violent demand for and reaction to the creation of a Muslim Pakistan, is a remarkable monument to that national sentiment.

- This is consistent with India’s civilizational ethos and daily practice as well.

- We are liberal to varying degrees. We are nationalistic and patriotic to varying degrees.

- Some may be more liberal, others might be more nationalistic, but most of us are both.

Way ahead:

- The way to manage these tensions is not to give up one for the other, as the left and the right wing demand of us, but to insist on both.

- Individual liberty is mere theory unless the state protects it and makes it real.

- We have to understand that Nationalism without liberalism is a monster.

Connecting the dots:

- What do you understand by the terms liberalism and nationalism in Indian civilization?

- “Nationalism without liberalism is a monster”, critically examine the above statement wrt recent JNU protests.

ECONOMICS

TOPIC:

General Studies 3:

- Inclusive growth and issues arising from it; Banking; Taxation

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation; Governance

Transforming India into a cashless economy

Government has been contemplating on having RBI on board with its idea of going cashless by enabling more free ATM transactions.

- When we view the argument with a balanced outlook; at one hand we do see that this move will definitely cost bank less than encashment at the bank branch but at the same time, it does reduce the cash flow in the economy.

- Also, while India is still clueless about the ‘black’ intention of some of her fellow countrymen and their ‘black money’ stashed at an unknown place (or rather known)—this cashless transaction can go a long way in making the very same people accountable for their spending’s as well as savings (additional sales tax, service tax and other forms of tax collections)

Incentivising Cashless Transactions

Seller of goods—You got a lot to lose?

- Now, if the seller of goods accepts a debit card— He will have to

- Pay a merchant discount rate (varying from 0.75 per cent to 1 per cent)- eating up his margin comfortably

- Since each transaction would be accounted for- he is liable to be taxed

- For example, if a sales tax concession is offered for such point-of-sale payments to go electronic, then the shopkeeper would not be motivated — he’d much rather save the entire tax than claim a small indirect tax rebate for supporting the cashless drive

Is there any solution to buffer the loss?

‘Providing a small incentive to the taxpayer to use his card or his mobile’

- For example, the government could grant a 5 per cent income tax rebate for taxpayers who make more than 85 per cent of their payments in cashless mode

- What happens next—The required percentage of cashless transactions for rebate eligibility could be even higher for very high income groups

- To claim the rebate—A routine bank statement/certificate stating percentage of cash debits separately while personal banking statements usually show interest income accrued and tax payable/deducted (no extra burden)

Loss to the exchequer?

Department of Revenue’s website:

- 1.71 lakh crore was collected as personal income tax in 2011-12, registering an average compound annual growth rate of 14.81 per cent for the period between 2006-07 and 2011-12.

- Estimated collection in 2015-16: 2.96 lakh crore (Same growth rate applied)

- If Government chooses to pay 5 per cent rebate and 25 per cent of taxpayers qualify—Payout is still only Rs. 3,700 crore

Total cost for ATM operations— Roughly around Rs. 18,000 crore

Shift to cashless transactions:

Reduction of ATM transactions byjust 25 per cent— Savings of the banking sector would be around Rs. 4,500 crore in ATM costs

Plus

1 per cent resultant increase in sales tax/value-added tax revenues across States: Rs. 4,400-plus crore

IASbaba’s Views:

- Incentivising electronic transactions with income tax rebates instead of sales tax rebates will push India more towards a cashless economy and hopefully, the savings of the affluent would get effectively channelized for establishing an operating infrastructure in rural areas- for accepting electronic payments and providing cash-out facilities

- There does exist a need for a real comparison of debit card usage at ATMs and in electronic transactions and direct policy moves to be made out suitably- to transform the economy into a web of effective infrastructure for direct benefit transfers and financial inclusion.

- With a series of well-coordinated policy changes to suit the new ‘air’, the revenue and productivity of the economy might get a positive boost-up.

Connecting the Dots:

- Is a cashless economy directly related to a developed economy? Critically examine.

MUST READ

Restoring goodwill with Kathmandu

India- US: A partnership to Mars and beyond

A deep malaise-Pampore shows why India needs counter-terrorism institutions, not more martyrs

Section 124A should stay- It would be perilous to abolish it without analysing the empirical evidence on its implementation.

Disagree, Don’t Label- It is not anti-national to denounce a court judgment or ask for azaadi for Kashmir

WTO rules against India in solar power dispute- Supports US in saying power purchase agreements signed by govt ‘inconsistent’ with international norms

Focus on reviving agriculture needed- The crash in global commodity prices and deficit rainfall for two years in a row have affected farmers’ incomes

MIND MAPS

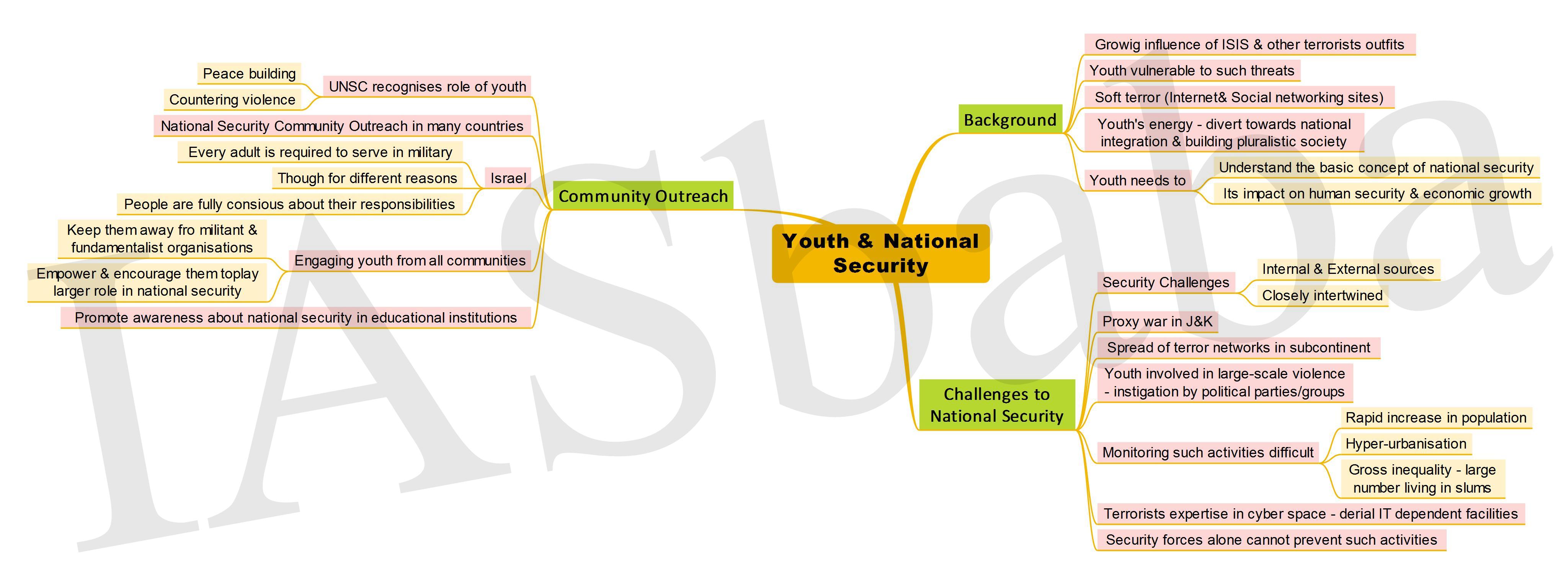

1. Exposing Youth to National Security