IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs May 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 2nd May, 2016

ECONOMICS

TOPIC: General studies 3

- Government Budgeting, Taxation & its impact

The curious case of the missing Indian taxpayers

A central but neglected problem in Indian political economy— Too many people, too few taxpayers–

- Around 48 million people filed income tax returns in fiscal year 2015

- Effective Number: Lesser than the above-stated as many of them had zero tax liabilities

- Data to be compared with: 814 million people eligible to vote in the 2014 Lok Sabha election (one taxpayer for every 16 voters—an asymmetry that has profound consequences for national policy)

Why is there a need to pay taxes—

To fund an effective state that protects national security, administers justice, builds infrastructure and funds a social security net to protect people against sudden shocks to their income

Present: Flawed social contract between the Indian people and the Indian State (a political system that cares more about spending to buy votes rather than building a more effective tax system that will spur economic growth)

Massive Tax evasion

- Very few admit to having an annual income of more than Rs.10 lakh a year (an incorrect number)

- More concentration on chasing the black money stashed away abroad instead of cracking down on domestic tax evasion— an explanation could be- the way political parties are funded as well as the cash that needs to be dispensed at every election

Matter of Concern

A call for Strong State: The state of illusion with which this demand is demanded to be fulfilled—a strong state that can deal with threats to national security or for a redistributionist state that will fund lavish social security programmes— paying little attention to the source of its becoming a reality (Where will the fund come from?)

Poor and unhappy: The larger share of dependence upon indirect taxes is considered to be regressive rather than progressive as they put a higher burden on the poor.

- Due to the failure in bringing enough well-off Indians into the direct tax net, the country has been mobilising revenue through indirect tax collection

- 2015-16- direct taxes contributed only 51 per cent of the tax revenue, lower than in recent years (and even the government’s expectations) and the lowest since 2007-08.

- An increasing share of indirect taxes in total revenue collection is cause for alarm because indirect taxes affect all Indians alike, rich and poor; given that the poor generally spend a greater fraction of their income on essentials than the rich do, with wider indirect taxation, they end up paying a higher individual tax rate than people considerably wealthier.

IASbaba’s Views:

As the Indian state is fiscally constrained because of inadequate direct tax collections, the future tax reforms need to be a combination of better tax administration (for more Indians pay income tax)

- The direct tax revenue base needs to be made broader so as to encompass the various developments that the economy is trying to bring about—by scaling up social and infrastructure investments while maintaining a semblance of fiscal discipline

- The time series data need to nudge policymakers to reframe tax governance priorities and rejig the direct-indirect tax ratio more equitably and progressively.

- Meaningful reforms need to be pushed further (taxing large farm incomes and rationalising bounties enjoyed by the well-off) to widen the base

- An effective political will always be the final answer to matching the databases already available for preventing tax evasion—both domestically as well as internationally.

Connecting the Dots:

- What do you mean by direct and indirect taxes? Present your views on the importance of their existence in the workings of the world economy.

NATIONAL

TOPIC: General studies 2:

- Indian Constitution- special provisions

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Time to put an end to Film Censorship

Why in news?

- Recently Shyam Benegal committee submitted its report to Ministry of Information & Broadcasting regarding revamping of central board of film certificate (CBFC) and also wrt Cinematograph Act/ Rules.

Why was the committee set up?

Committee was set up to

- Lay down norms for film certification that take note of best practices in various parts of the world and give sufficient and adequate space for artistic and creative expression.

- Lay down procedures and guidelines for the benefit of the CBFC Board to follow and examine staffing patterns with a view to recommending a framework that would provide efficient and transparent user friendly services.

Major recommendations of the commission:

- CBFC should only be a film certification body whose scope should be restricted to categorizing the suitability of the film to audience groups on the basis of age and maturity except in the following instances to refuse certification

In what instances the certificate for the film can be refused?

- When a film contains anything that contravenes the provisions of Section 5B (1) of the Cinematograph Act, 1952.

Section 5B in the Cinematograph Act, 1952

5B. Principles for guidance in certifying films.—

- A film shall not be certified for public exhibition if, in the opinion of the authority competent to grant the certificate, the film or any part of it is against the interests of article 19 [the sovereignty and integrity of India] the security of the State, friendly relations with foreign States, public order, decency or morality, or involves defamation or contempt of court or is likely to incite the commission of any offence.

- When content in a film crosses the ceiling laid down in the highest category of certification.

- The applicant must specify the category of certification being sought and the target audience.

Why were these guidelines given by the committee?

The objective of these guidelines would be to ensure that

- Children and adults are protected from potentially harmful or unsuitable content

- Audiences, particularly parents are empowered to make informed viewing decisions

- Artistic expression and creative freedom are not unduly curbed in the process of classification of films

- The process of certification by CBFC is responsive, at all times, to social change

- The certification by CBFC keeps within the rights and obligations as laid down in the Indian Constitution.

For more details refer: http://pib.nic.in/newsite/PrintRelease.aspx?relid=142288

Way ahead:

- If the Shyam Benegal committee report’s recommendations are implemented, it will be a substantial step towards addressing the issues of state control over an individual’s freedom of expression.

Connecting the dots:

- Freedom of speech and expression is not absolute in India. Analyse. Should freedom of speech and expression be made absolute? Substantiate.

MUST READ

Parched earth, broken promises

Related Articles:

Permanently fighting drought in India

A National Court of Appeal? Aye.

Related Articles:

Modi launches LPG scheme for poor– During the launch, Modi said policies made by previous governments was not keeping in mind the welfare of poor but only ballot boxes

Related Articles:

The LPG reform – Pradhan Mantri Ujjwala Yojana (PMUY)

Band-aid solutions- India’s agriculture needs less regulation, greater play of market forces.

Over the barrel: In the right environment- The presentation concludes with a vision statement that the “way forward” will be linked to the attainment of “sustainable development goals”.

The AMU question- All possible readings of the law suggest a university can be a minority institution.

Game of visas- India comes across as trying to compete with China by being China. It’s not a winning strategy.

Isro: A world class Make in India example- The launch of a satellite for India’s own GPS shows Isro’s innovations are clearly the best Make in India products and, at the same, the most cost-effective space programme in the world

Related Articles:

All India Radio- LAUNCH OF IRNSS-1E

Over 6,000 personnel deployed to douse Uttarakhand forest fire- 3 NDRF companies, along with the State Disaster Response Force and the Indian Air Force are working to put out the fire

MIND MAPS

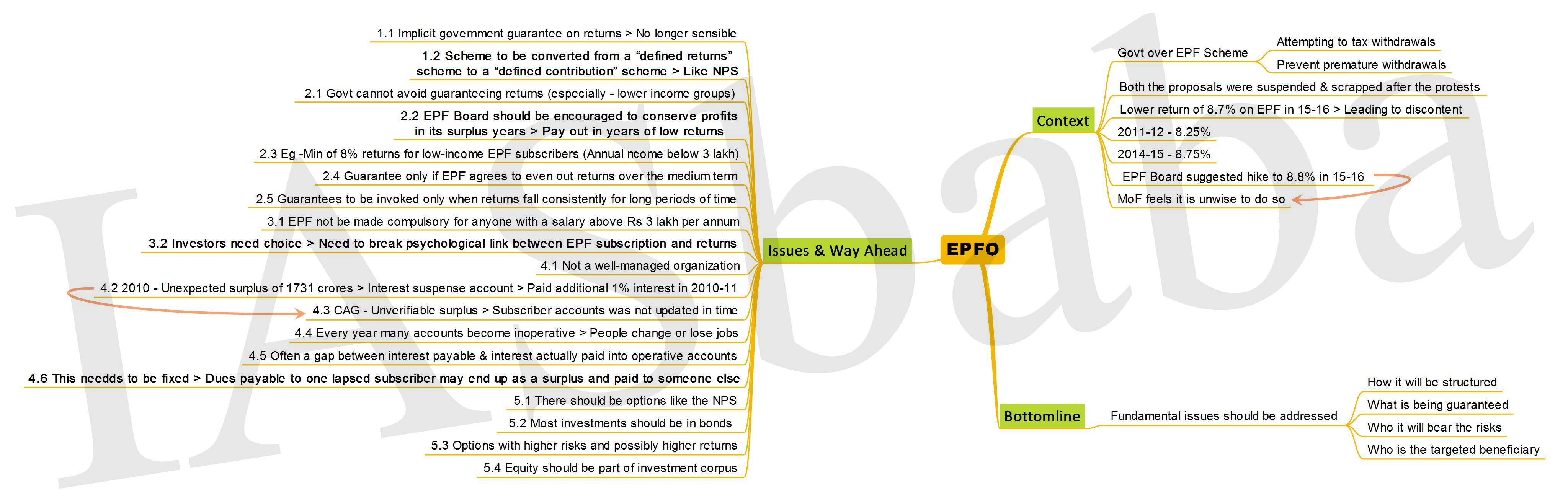

1. EPFO