IASbaba's Daily Current Affairs Analysis, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 03rd July, 2015

ECONOMICS

India is now a $2-trillion economy

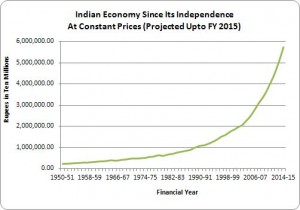

India’s GDP crossed the $2-trillion mark in 2014, according to data released by the World Bank in Washington late on Wednesday. After taking 60 years to reach the $1-trillion mark, India added the next trillion in just seven years.

Is India in the list of Fastest Growing Major Economy?

- India’s growth rate, at 7.4 per cent in 2014, makes it the fastest growing major

economy along with China’s, which is a whopping $10.4 trillion in size.

economy along with China’s, which is a whopping $10.4 trillion in size. - The Indian economy, at $2.06 trillion, has almost doubled in size since the financial crisis hit the country in 2008, and has more than quadrupled from the start of this millennium.

What does World Bank Data says?

- The World Bank’s data on gross national income per capita — the total value added by all producers within the country, plus income received from citizens working abroad, divided by the population of the country — show Bangladesh, Kenya, Myanmar, Tajikistan, Mongolia, Paraguay, Argentina, Hungary, the Seychelles and Venezuela have shifted their income categories for the better.

- For example, Bangladesh, Kenya, Myanmar, and Tajikistan are now ‘middle income’ countries from being ‘low income’ nations.

IAS BABA’S Views

- Little Research from India’s average annual growth rate over the last decade of 8.9 per cent and found that it would become an ‘upper middle income’ country ($4,126-$12,735) in 2026, a little more than a decade from now.

- This will put it in the category China occupies now.

Connecting the dots

- Write a note on different income categories

- How is development progress of a country measured?

NATIONAL

Government releases Socio-Economic and Caste census

- The percentage of Scheduled Caste (SC) households paying income tax was 3.49 per cent while Scheduled Tribe (ST) tax-paying rural households were mere 3.34 per cent, the Socio Economic and Caste Census 2011 said.

- Just 4.6 per cent of all rural households in the country pay income tax while such households with salaried income are close to 10 per cent, the first Socio-Economic and Caste Census released in eight decades.

What is Socio-Economic and Caste Census?

The SECC has the following three objectives:

- To enable households to be ranked based on their Socio- Economic status. State Governments can then prepare a list of families living below the poverty line

- To make available authentic information that will enable caste-wise population enumeration of the country

- To make available authentic information regarding the socio economic condition, and education status of various castes and sections of the population.

What is the use of this Census?

- The enormity of schemes and reaches that all governments have, this document will form a basis of helping us target groups for support in terms of policy planning,”

- The document will reflect the reality of India and be a very important input for all policymakers both for the central and state governments.

- It is also a document which contains various details … who are the ones who have qualitatively moved up in terms of life, which are the ones both in terms of geographical regions, social groupings which in future planning needs to be targeted

Connecting the dots

- Write a note on Housing and Urban Poverty Alleviation

- Is respondent based Input like SECC is really reliable?

Centre notifies rules for valuation of black money stashed abroad

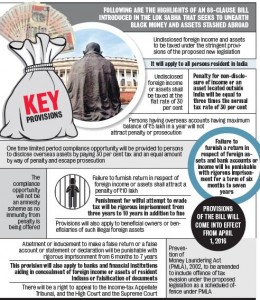

- Under the Black Money (Undisclosed Foreign Income and Assets) and

Imposition of Tax Act, 2015, the value of an overseas bank account will be the sum of all deposits made in the account since its opening.

Imposition of Tax Act, 2015, the value of an overseas bank account will be the sum of all deposits made in the account since its opening. - The Centre has notified the rules for calculating overseas income and assets under the stringent foreign black money law that came into force on July 1, 2015.

What are the new notified rules?

- The law provides for a total of tax and penalty of 120% on the income or assets held abroad after the expiry of a one-time 90-day “compliance window”, which ends on September 30.

- The rules notified provide for the way foreign income and assets would be valued for calculation of tax and penalty both for the compliance period and beyond its expiry.

- Any income or asset declared during this period, which ends on September 30, would attract a total of 60 per cent tax and penalty, without penal provisions like jail term. They will have time till December 31 to pay the levies.

What is the role of RBI?

- The rules said the Reserve Bank’s reference rate on the date of valuation should be used for converting the value of foreign assets and income into Indian rupee.

- Where the fair market value of an asset is determined in a currency other than one of the permitted currencies designated by the RBI, they should be converted into U.S. dollars on the date of valuation as per the rate specified by the central bank of that country.

- Thereafter, the value in dollar would be converted into rupee.

Connecting the Dots

- Is Foreign Black Money Law Stringent?

- What are the Features of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015?

- Write a note on Limited Liability Partnership (LLP).