IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs November 2015, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 12th November, 2015

ECONOMICS

TOPIC:

- General Studies 2: Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, challenges

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- General Studies 3: Indian Economy and issues relating to mobilization of resources, growth, development; Government Budgeting.

Goods and Service Tax (GST) Logjam: GST by another name

What is the issue?

GST is an expected tax reform that overhauls the current indirect tax regime to new system that can have a significant impact on the economy as a whole. However the bill has been facing hurdles in the upper house after it is passed by Lok Sabha. With recent defeat of ruling party in Bihar the passage of the bill in Rajya Sabha looks increasingly uncertain. The time available does not permit implementation of the GST from April 1, 2016. This impasse provides an opportunity for the Centre to initiate the GST incrementally by taking three steps

So what is GST?

GST is a expected tax reform that streamlines the present indirect tax regime. It contains all indirect taxes levied on goods, including central and state-level taxes. Billed as an improvement on the VAT system, a uniform GST is expected to create a seamless national market.

What are the Features of GST?

- It will be collected on VAT method i.e tax at every stage of value addition.

- It will be imposed at an uniform rate @ 20% (Centre state share = 12 and 8 percent respectively)

Why there is Apprehensions behind the proposal?

- The States feel that when 246A is there, then the Centre should not have to incorporate GST into the Union List. Clause 246A proposes additional powers to the Centre to tax sale of goods and for the States (to tax services).At present, the Centre can tax services but not sale and distribution of goods. The States can now tax sale and distribution of goods but not services. Including GST in the Union List will imply that in case of any disagreement between the Centre and the States, Parliament’s decisions will be overriding and binding on the States.

- So taking away the power of the states to tax items under the state list is tantamount to infringing upon the basic structure of the Constitution.

- Administrative mechanism: In India, a merger between two government agencies is next to impossible, as long as appraisals and promotions are linked to seniority and regretfully, not performance. And integrating the revenue collection services of all states and an extremely powerful Central Service into one GST collection agent.

- The governments of Madhya Pradesh, Chhattisgarh and Tamil Nadu say that the “information technology systems and the administrative infrastructure will not be ready by April 2016 to implement GST”

- Some States fear that if the uniform tax rate is lower than their existing rates, it will hit their tax kitty. However the central government has offered to compensate in case there is a loss in revenues of state.

What is the current scenario with present taxation system?

The present taxation system is shrouded with ambiguous definitions, a highly complex web that is hurting both the consumer and the producer, and finally Services remain outside the scope of state taxation powers.

GST aims to improve above issues appropriately considering all the stake holders involved.

So what are the benefits of GST

- Under GST, the taxation burden will be divided equitably between manufacturing and services, through a lower tax rate by increasing the tax base and minimizing exemptions.

- GST will be is levied only at the destination point, and not at various points (from manufacturing to retail outlets).

- Currently, a manufacturer needs to pay tax when a finished product moves out from a factory, and it is again taxed at the retail outlet when sold.

- It is expected to help build a transparent and corruption-free tax administration.

- It is estimated that India will gain $15 billion a year by implementing the Goods and Services Tax as it would promote exports, raise employment and boost growth.

- It will divide the tax burden equitably between manufacturing and services.

- In GST system both the central and state taxes are collected at point of sale

- Both the components (central and state GST)will be charged on the manufacturing cost This will bring down the prices and will lead to increased consumption ,there by helping companies.

Despite all this benefits due to lack of political will and vested interests the bill is stuck in Rajya sabha.

So lets analyse what we can do to get this bill passed.

- First, mimic the GST at the Central level from April 1.

- Second, rework the GST bill.

- Third, integrate the GST implementation experience from Malaysia. By doing so, the Centre can bolster the confidence of industry while signalling to the states its commitment towards the GST.

How to mimic?

The Centre is empowered to impose a Central GST by merging the excise and service tax regimes. Without comprehensively revising these laws, their levy can be made consistent with each other and the requirements of the GST through simple amendments by way of money bills and notifications. The various levies that are collected now should be consolidated. The impact of this mimicry would be that a de facto Central GST (hereafter DGST) would be in place.

What to rework?

Four important changes required for the DGST (Director general of service tax) are identified below.

- First, excise duties applied today range between 1 per cent and 14 per cent. Service tax are applies at 14 %. Thus, both taxes are effectively applied at multiple rates. It should be possible to put in place a three-rate structure — 1 per cent for precious metals, a concessional rate (say 4 per cent), and the standard rate.

- Second, presently there is an asymmetry in the application of input tax set off between excises paid and service tax paid. Service tax paid can generally be set off against excise dues. The converse is not true. This assymmtery needs to be addressed so that both excise duty and service tax are treated comparably.

- Third, the excise tax base is determined through a positive list, while service tax depends on a negative list. Service tax, which was originally on a positive list basis, shifted to the negative list only in 2014. There is no reason why the excise also cannot follow suit.

- Fourth, the Central government has in place a number of cesses on excise and service taxes to fund special initiatives. A cess is an anathema to the GST. The Centre may need to withdraw the cesses and seek additional resources by suitably adjusting the tax rate.

Best Practices: What to learn from Malaysia?

- Malaysia implemented the GST on April 1 this year (2015). The most significant lesson that India can learn is the importance of undertaking a comprehensive information, education and communication programme on the GST directed at the tax department staff, trade and industry representatives and consumers, prior to implementation. In India, too, thorough and effective preparation is necessary to ensure that the DGST is implemented from April 1, 2016 and the GST is implemented from April 1, 2017.

IAS babas view:

- In democracy achieving consensus is a difficult task. But the process of achieving the consensus should not stop seeing the enormity of the task ahead. Accommodating all the stake holders in the process is essential and must.GST can bring a new lease of life for our economy that will have a huge impact in long run. We have to show some political willingness and courage and see the prospects of the bill in long run.

Connecting the dots:

- Asses the reason for logjam of GST bill? Can u think of some potential solutions to solve the issue? Critically examine

- GST is dubbed as a potential tool to push Ease of doing business factor. Comment

NATIONAL

TOPIC:

- General Studies 3: Indian Economy and issues relating to growth, development and employment.

- Issues related to Agriculture- Transport and marketing of agricultural produce and issues and related constraints; e-technology in the aid of farmers; Issues related to direct and indirect farm subsidies and minimum support prices; Public Distribution System

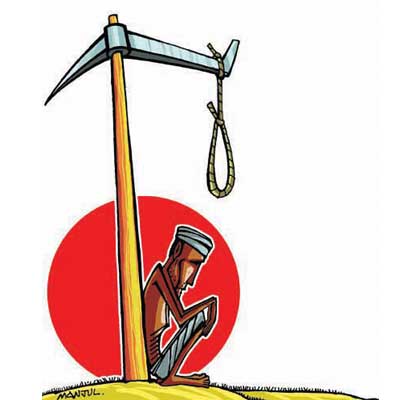

Income-less Bharat: Age of Dark Development

- In India, agricultural risks are exacerbated by a variety of factors, ranging from

weather variability, frequent natural disasters, uncertainties in yields and prices, weak rural infrastructure, imperfect markets and inadequate and sub-optimal financial services. These factors not only endanger the livelihoods and incomes of small farmers but also undermine the viability of the agriculture sector and its potential to become a part of the solution to the problem of the endemic poverty of Indian farmers.

weather variability, frequent natural disasters, uncertainties in yields and prices, weak rural infrastructure, imperfect markets and inadequate and sub-optimal financial services. These factors not only endanger the livelihoods and incomes of small farmers but also undermine the viability of the agriculture sector and its potential to become a part of the solution to the problem of the endemic poverty of Indian farmers. - Agriculture engages almost half of India’s workforce and, supports around 60 % of its population. 2015 hasn’t been a great year based on the agriculture-front with the rain deficit at (-14%), made worse with frequent droughts and lowered level of water stored.

- Thus, policymakers need to interrogate into the policies that are hampering the transition from a poverty-struck farm sector to an affluent class of food providers that can chart the development path of the country.

Policy Tools

Agricultural Credit: India has a dense network of rural financial institutions and Government with the objective of providing adequate credit to the agriculture sector framed rules stipulating that some percentage of each bank’s net credit should be given to the agriculture sector. But

- Difficult credit procedures,

- Illiteracy of the farmer and

- Ignorance on the part of bank personnel makes it a tough task.

Therefore, procedures should be simplified and proper facilitation of funds should be provided for mitigating their losses in a bad agricultural year.

Input subsidies: Important subsidies for inputs to the agriculture sector are with respect to fertilizers; power; irrigation; credit; and agricultural price guarantees.

- Capping input subsidies and a phased programme of progressive withdrawal of them

- Strengthening rural infrastructure, research and extension;

- Well-defined and effective measures to improve efficiency + lug leakages in input supplies

Crop Insurance: Area yield–based crop insurance and Weather-based crop insurance can go a long way in securing risk-free steps to be taken by the farmer. But the success depends upon:

- The product design;

- Steps taken to minimize the base risk;

- Adoption of reliable and sustainable pricing mechanisms

- Resolving issues of product servicing and timely pay-out

Some major constraints include:

- A sparse network of weather stations and the lack of high quality weather data for locations smaller than the district level;

- High premium rates for farmers;

- Limited scope of weather insurance compared to the ‘all risk’ nature of ‘area yield’ insurance, etc.

Renewed efforts by government in terms of designing appropriate mechanisms and providing financial support for agricultural insurance are the need of the hour. Livestock insurance is an important source of rural livelihoods in India and can be encouraged as an additional source of income for the farmers.

Direct Income Support: While minimum support prices (MSPs), announced by various State governments, have traditionally been the instrument used to fight declining prices; they have scarcely been effective at the farm level.

In the current globalised market with widely varying market prices, the scheme is unable to protect farmers against price fluctuations. Therefore, ‘Direct Income Support’ mechanism can prove to be a major game changer and will inject a fresh lease of life among the Indian farmers.

- Potential to reverse the city bound distressed migration

- Insulate the farmers from the vagaries of the market demand

- Location specific support: Depending upon the geographic area and factors such as the land size, soil quality, water availability

Farm Income Insurance Scheme (FIIS):Aims to ensure guaranteed income by insuring the difference between the farmer’s predicted income and the actual income and any decrease in the predicted income due to yield fluctuations or market fluctuations is insured under the scheme.

- Reliable yield and Price Data

- Considering yield losses only from natural perilsàFarmers are incentivised to produce more + Inefficiency in farming is not rewarded

- Usage of satellite-based yield monitoring systems,

- Integration of agricultural markets in India,

- Leveraging mobile phone penetration levels and ICTà Ensure the availability of real time data

- Streamlining initiatives:

- Assessing soil health through soil health cards,

- Rationalising fertilizer and water usage by insuring only the efficient cost of production

- Encouraging usage of the available agriculture markets

- Increased engagement with formal markets to take advantage of insurance in case of income decline

IASbaba’s Views:

- The income guarantee must

- Reflect “inter-sectoral parity”

- A commission for determining Farmer’s Income can be set up to involve the farmers themselves in coming up with a proper formula guaranteeing minimum livelihood income for farmers

- Consists of impetus to

- ecologically sustainable farming systems,

- community control over agricultural resources and

- ensuring non-toxic, nutritious and adequate food for all

- There should take place a reduction in the number of people dependent upon agriculture, and improvement in the productivity of agriculture through technology and partnerships is a must. Rural education, provision of jobs to rural youths with other sectors and expanding per capita farm holdings is a positive way ahead.

- A major limitation has been the supply-driven nature of the government interventions, which has overlooked the need for building a commensurate social and economic infrastructure so that the target beneficiaries are equipped to take advantage of these interventions. Greater representation of relevant stakeholders in the design, implementation and evaluation of these measures can ensure the more effective inclusion of farmers’ demands and a higher level of responsiveness, in turn.

Connecting the Dots:

- Analyse the scope of Micro-Insurance in Agro-India

- Weather Based Crop Insurance: Panacea or Providence?

- Examine the various components of Agricultural Price Risk Management

MUST READ

Reforms redux: a welcome signal

A checklist for success in Paris

Ode to the happy country

http://www.thehindu.com/todays-paper/tp-opinion/ode-to-the-happy-country/article7867638.ece

False sunrise- The Central government’s relief scheme for discoms falls short of addressing the problem.

Right to equality- Discrimination on the basis of caste is a continuing reality. State cannot shirk its responsibility of addressing it

Five-pronged plan for agri revival- Two veterans of India Inc suggest setting up of Krishi Aayog on the lines of NITI Aayog