IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 27th January, 2016

NATIONAL

TOPIC: General studies 2

- Indian Constitution, significant provisions and basic structure.

- Separation of powers between various organs dispute redressal mechanisms and institutions.

- Structure, organization and functioning of the Judiciary

Article 356—Arunachal Pradesh: Is President’s rule being misused?

Article in part XVIII (Articles 352-360); among the Emergency provisions of the Indian Constitution

Sections 93 of the Government of India Act, 1935:

- Provided that if a Governor of a province was satisfied that a situation had arisen in which the government of the province cannot be carried on in accordance with the provisions of the said Act, he could assume to himself all or any of the powers of the government and discharge those functions in his discretion.

- The Governor, however, could not encroach upon the powers of the high court.

- British dominated viewpoint is thus, prevalent here and it is this element that has led the authorities to question its suitability to the Indian climate of ‘cooperative federalism’

Sarkaria Commission Report (1988):

- While in the first few years after the Constitution, it was invoked only thrice; between 1975 and ‘79, it was invoked 21 times; and between 1980 and ‘87, 18 times.

- SR Bommai Govt dismissal: In 1989, SC had upheld the validity of a proclamation for President’s rule can be subjected to judicial review

Stories of dismissal of State Government—

- By Jawaharlal Nehru-EMS Namboodiripad government in Kerala in 1959

- By Indira Gandhi– imposition of President’s Rule in Punjab; Punjab Chief Minister Darbara Singh was battling militancy in 1983

- Delhi, 2014-15: President’s Rule was in force in Delhi with the Assembly in suspended animation from February 14, 2014, to February 11, 2015

- Maharashtra: Imposed from September 28, 2014, to October 31, 2014, after Prithviraj Chavan resigned following the break-up of the 15-year-old Congress-NCP alliance in the state.

- Andhra Pradesh: From February 28, 2014, to June 8, 2014, due to a political crisis caused by the resignation of CM N Kiran Kumar Reddy and other Congress legislators on February 19, protesting against the Andhra Pradesh Reorganisation Bill that bifurcated the state and created a separate state of Telangana

- Jharkhand: From January 18, 2013, to July 12, 2013, as the Arjun Munda-led BJP government was reduced to a minority after the Jharkhand Mukti Morcha withdrew support (Munda resigned and sought dissolution of the state Assembly)

Arunachal Pradesh: Rebellion spinning out of control

What happened—

- December 9: A group of rebel Congress MLAs approached Governor J P Rajkhowa, seeking to impeach Assembly Speaker NabamRebia

- So, the Assembly is not is session (slated to convene on January 14) but Governor Rajkhowa agreed it was an urgent matter and called for an emergency session of the Assembly on December 16, 2015, to take up the impeachment motion.

- As the Congress approached the High Court and later the Constitution bench of the Supreme Court against the Governor’s convening of the special session, the Centre called for President’s rule in the state under Article 356 of the Constitution.

The foul cry- First instance of Article 356 being imposed while the case was being heard in court

During the special Assembly session—

Special session also moved a no-confidence motion against CM Tuki and at the end of the session;Tuki was ‘defeated’ in a floor test and the ‘House’ ‘elected’ KalikhoPul as the new Leader of the House

Also,

- Speaker issued an order disqualifying 14 rebel Congress MLAs

- Speaker Rebia moved the High Court

- Justice B K Sarma of the Gauhati High Court stayed the disqualification of the 14 Congress MLAs

- The Speaker’s plea for his case to be heard in another court was turned down, prompting him to approach the Supreme Court.

- The discretionary power of the Governor was being examined when the Centre moving to impose Article 356

Approval of the imposition of Central rule

- The proclamation will have to be approved by both Houses of Parliament

- Plus, the validity of President’s Rule may be considered by the Supreme Court

An established pattern: A political pattern behind the crisis that led to the current situation

The pattern involves dissidence within the ruling party, the opposition joining hands with the rebels, confusion over the likelihood of a floor test, and the Governor intervening in a partisan manner

Supreme Court declared in 1994, that the only place for determining whether a Chief Minister has lost or retained majority is the floor of the House

Sad spectacle of partisan politics overshadowing constitutional propriety—

BJP: Instead of finding ways to facilitate a floor test it has imposed President’s Rule in the midst of an ongoing hearing before a five-member Constitution Bench of the Supreme Court

Congress in the State Failed to address the dissidence in its camp against Chief Minister NabamTuki and now, avoiding a floor test as it has not sought interim orders to that effect from the court.

BUT- Six months have elapsed since the last time the Arunachal Pradesh Assembly met and this itself is a valid ground for Central rule

Also, the past crisis has led us to seek a constitutional question of whether the Governor can summon the legislature on his own and whether he can send a message to the Assembly on what motion it should take up is now before the Supreme Court.

Facts- President’s Rule

President administers the state through the governor and the Parliament makes laws for the state

Maximum period: Three years

44th Amendment Act, 1978: Beyond one year, the President’s rule can be extended by six months at a time only when-

- A proclamation of National Emergency should be in operation in the whole of India, or in the whole or any part of the State

- Election Commission must certify that the general elections to the legislative assembly of the State cannot be held on account of some difficulties

Resolution: Should be passed by simple majority

IASbaba’s Views:

- The centre’s move is a hasty one when a Constitution bench of the SC is set to hear a petition related to the political crisis in the state and thus look like a throwback to the ‘Indira-Gandhian’ era.

- Arunachal Pradesh has a history of politicians switching sides or splitting parties for office and this lack of political fidelity among legislators can undermine the democratic practice in the state and lead to a crisis of faith among the electorate.

- Here, we witness the focus upon short-term gains dictating priorities when the procedures are clearly laid out for settling disputes over House Majority. Therefore, this growing instability and intolerance should be acknowledged and worked upon to uphold constitutional morality and democratic traditions.

Connecting the Dots:

- Has the ‘dead-letter’ become a ‘deadly-weapon’? Critically examine

- Explain the valid situations under which President’s Rule in a state would be proper

ECONOMICS

TOPIC:

- General studies 3: Indian Economy and issues relating to planning, mobilization of resources, growth, development ; Banking & related issues

- General studies 2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

‘A solution, with its own problems’- Strategic Debt Restructuring Scheme

(The ‘opinion’ is lucid and in a narrative style- Covered under proper headlines)

Strategic Debt Restructuring (SDR) Scheme-

- Enables a consortium of lenders to convert a part of their loan in an ailing company into equity, with the consortium owning at least 51 per cent stake

- Provides banks significant relaxation from the RBI rules for 18 months

- Loans restructured under the scheme are not treated as non-performing assets (NPAs) and banks have to make low provisions of 5 per cent in most cases

- Allows banks to recognise interest accrued, but not due/paid as income enabling banks to report lower NPAs and higher profits for 18 months

For Lenders—

- Power to turnaround the ailing company, make it financially viable and recover their dues by selling the firm to a new promoter

- If banks are unable to sell to a new promoter within 18 months, then all regulatory relaxations cease to exist and lenders have to treat these assets as NPAs and make 100 per cent provisioning for these assets in majority of the cases

Effectiveness of the Scheme—

Case of postponing banks’ NPAs to later years: Increased risks, therefore!

- As the lenders may find it tough, in most cases, to sell their stake in these companies, or be able to sell at steep losses within the 18-month window

- Marks more deterioration for Indian banks’ deteriorating asset health, exacerbating the risk by deferring an estimated (Rs 1.5 lakh crore) of NPA formation from (2015-16/2016-17) to later years(Religare Analysis)

- No clarity on the seriousness of the buyers and the valuation that they seek as attempts to restructure the SDR cases under the Corporate Debt Restructuring (CDR) mechanism, from the past two years, have been unable to yield positive results.

Gammon India, Mumbai based infrastructure company:

March, 2013: Approached CDR Cell as the company was stressed due to rising costs and mounting debt

June, 2013: Its debt restructuring package was approved, which provided a 10-year repayment plan and lowering of interest rate by 1 per cent for 15 months. Unable to revive the company via a CDR package, the lenders’ consortium evoked SDR in November 2015.

IVRCL, a Hyderabad-based infrastructure company:

January,2014: Approached the CDR Cell as there were losses emerging from debt-funded expansion projects

June, 2014: The package was approved, comprising of restructuring of term loans, working capital loans and fresh financial assistance by the banks. Failing to revive IVRCL through CDR, the banks invoked SDR in November 2015 with lenders owning 78 per cent equity in the company.

Increasing Failure Rate—

- Of CDR restructured cases has increased to 36 per cent in September 2015 from 24 per cent in September 2013 (Religare)

- CDR Cell data: Received 530 cases till March 2015 from banks seeking to restructure debt totalling Rs 4.03 lakh crore without classifying these accounts as NPAs

- Debt burden of these companies have been mounting since 2013 when they went for restructuring to the CDR Cell

- Upon conclusion of the SDR, debt level of these companies are expected to rise by 70 per cent since the date of first restructuring

Need to solve the debt issue–

- To encourage banks to look for good enterprise value for these assets

- Slowdown in the economy coupled with the crash in commodity prices and weak private investment paves way for rocky path in selling their SDR stakes

- If we have a look at the sectors, ‘metals’ is the most difficult to find buyers and ‘power’ poses questions of viability

Key issues with the SDR mechanism:

Lenders’ Consortium-

- Having to find a new promoter within 18 months of having acquired the company and in these 18 months, banks have to wrap up the entire process of initiating the SDR process, running the business and finding a new buyer.

- Formulating a plan right from invoking the SDR, valuing the company to the conversion of debt to equity, etc., as well as taking approval by all members of the lenders’ consortium is not an easy task to be performed within the given stipulated time

- Plus working on identifying a new promoter, who has to complete his due diligence, valuation and acquisition documentation of the company would be a very tiring never-ending circle

- A toll on Bank’s profitability can occur if, at the end of 18 months, banks are not able to find a new buyer- Will have to provide for the loan outstanding from the date of the first restructuring (over the past 3-4 years in one quarter)

- SDR rules do not explicitly provide for a partial stake sale and banks have to sell their entire stake in the company to the new buyer

RBI- Banks’ stressed advances ratio increased to 11.3 per cent in September 2015 from 11.1 per cent in March 2015

Management post becoming majority owners- Banks are currently using the existing managements to run the company, but with greater external monitoring and oversight thereby, over-stretching their own limitations.

The new promoter may have to delist the company upon acquiring 51 per cent shares from the banks;

SDR rules: Upon finding a new promoter, lenders must exit the firm

- The new buyer will take a 51 per cent stake and, in line with the Securities and Exchange Board of India rules, make an open offer for a further 25 per cent stake

- If the open offer is fully subscribed, the buyer will own 76 per cent. Sebi rules mandate that any holding above 75 per cent must trigger a delisting.

Not a long-term solution for resolving asset quality issues: Norms addresses only a small section of the borrowers as well as many of the borrowers are genuine, and have not been able to service their debt obligations for external reasons. Many of them are willing to cooperate with banks to change the management but have been unable to find suitable buyers/investors (as mentioned above)

Implementation issues as most of the existing debt may not be sustainable, that is, not serviceable over the long run even if the economy revives. (Sector like metal)

IASbaba’s Views:

- It is not advisable for banks to go for the SDR route unless they are certain of a sale as well as RBI should bring about a concept of sustainable debt. Quick decision-making within defined time-lines will be central to the effectiveness of such a framework.

- Under the SDR scheme, banks are exempted from making an open offer while acquiring majority stake in a stressed company. But such exemption is not available to the new promoter, who may have to delist the company. To make the SDR mechanism successful, banks should discuss this with SEBI and seek an exemption from open offer for the new promoter

MUST READ

Sril Lanka : ‘Need safeguards against majoritarianism’

A ringside view of the proposed GST

Related Articles:

http://iasbaba.com/2015/11/iasbabas-daily-current-affairs-12th-november-2015/

http://iasbaba.com/2015/07/iasbabas-daily-current-affairs-18th-july-2015/

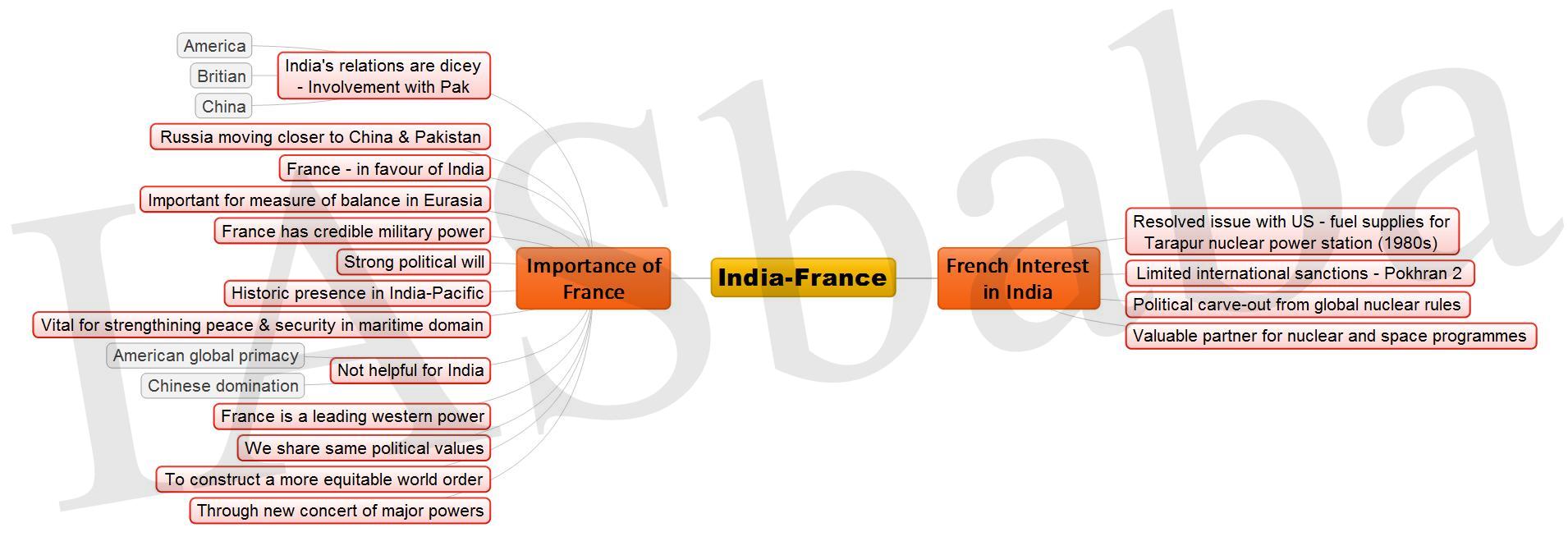

Consolidating ties with France

Related Articles:

Fulfilling the potential of India-France ties

Minority status?- If we accept the reasoning of the apex court in the AMU case, it means that a religious minority is debarred from establishing a university inasmuch as a university can only be established by a legislature

View From The Right: Red terror

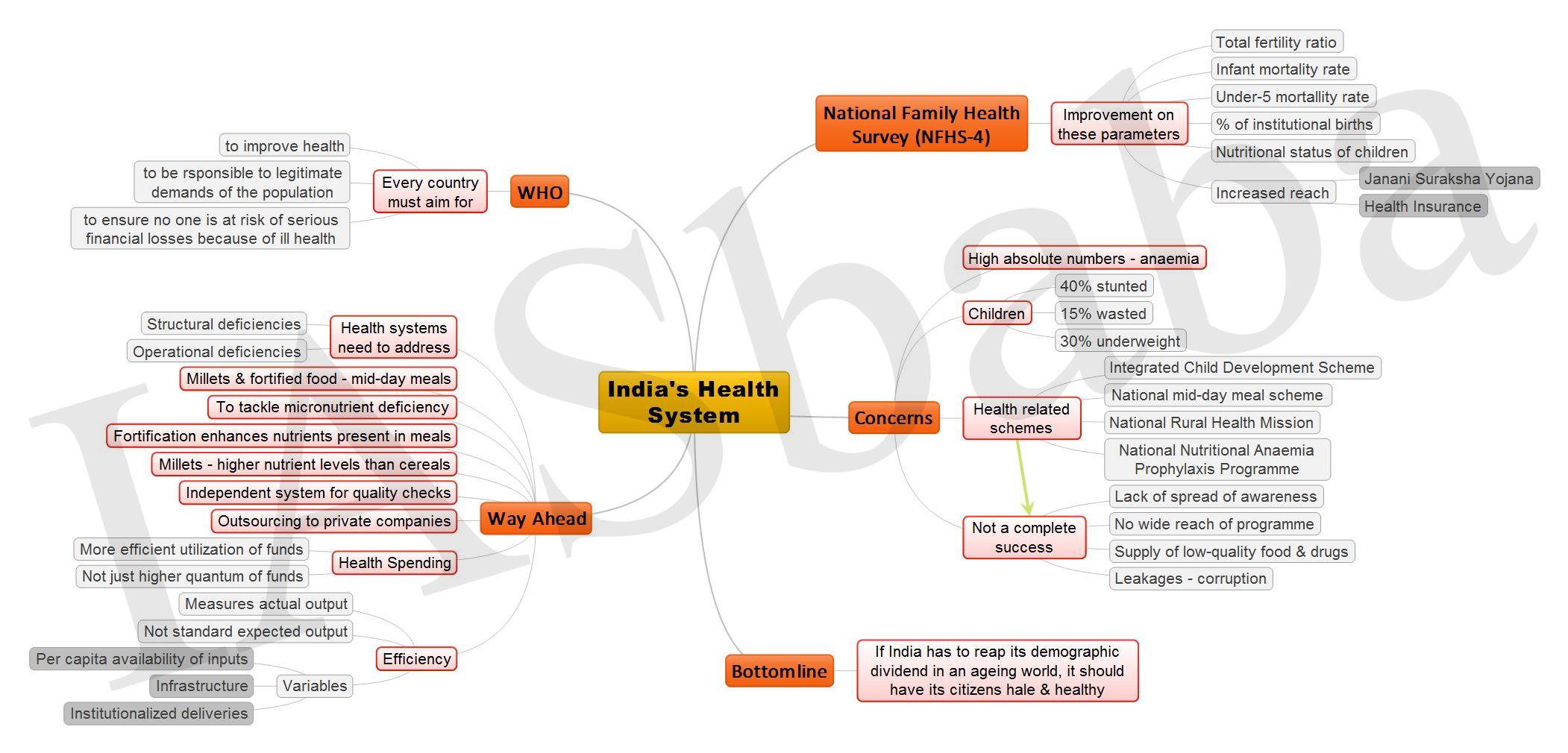

Hidden hunger and the Indian health story-India needs to find better value for money in the health sector

For Detailed Analysis ‘Healthcare issues & challenges’ refer the below links-

http://iasbaba.com/2015/08/iasbabas-daily-current-affairs-25th-august-2015/

http://iasbaba.com/2015/10/iasbabas-daily-current-affairs-5th-6th-october-2015/

http://iasbaba.com/2015/10/iasbabas-daily-current-affairs-11th-12th-october-2015/

http://iasbaba.com/2015/10/iasbabas-daily-current-affairs-22nd-october-2015/

MIND MAPS

1. India’s Health System

2. India – France