IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Feb 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 24th February, 2016

INTERNATIONAL

TOPIC: General studies 2

- India and its neighborhood- relations.

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

- Important International institutions, agencies and fora- their structure, mandate.

Bringing India’s growth online

- On February 29, observers around the world will be watching as India’s government presents its 2016-2017 Budget.

- They will be looking for signs that India, today the world’s fastest expanding major economy, will continue to grow at pace, and help shore up a slowing global economy.

- But until India is more integrated with the global economy, its potential to push up domestic as well as global growth will remain limited.

The case of APEC:

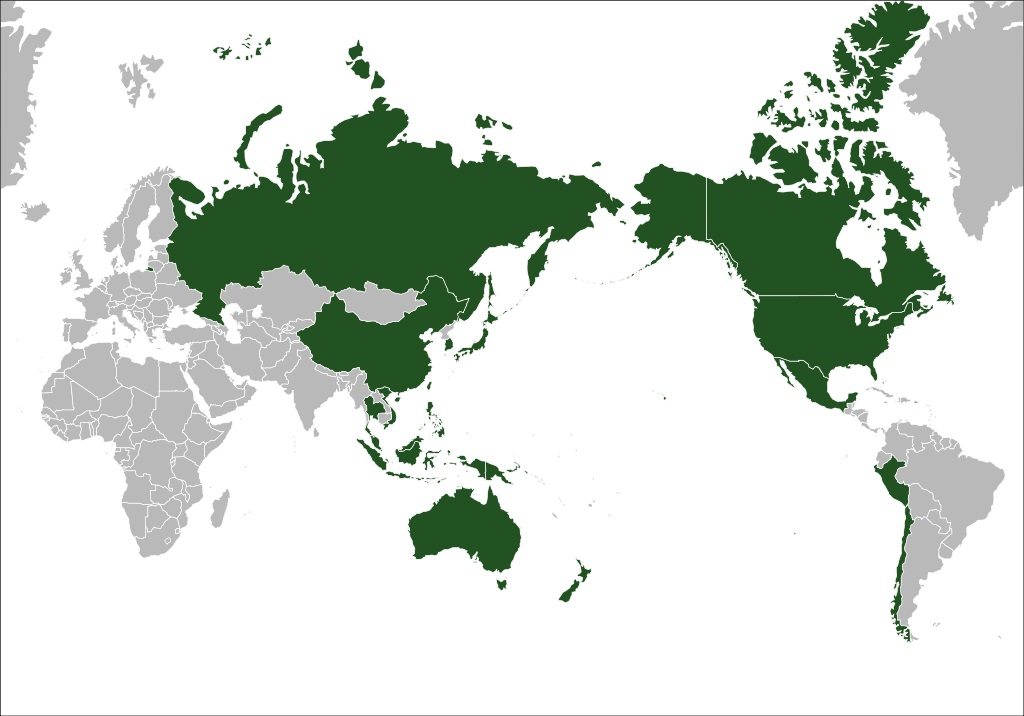

The first and necessary step toward greater Indian participation in Asian and global trade and investment flows is membership in the Asia-Pacific Economic Cooperation (APEC) forum, a step whose time has come, for India, for APEC, and for the international economy.

- Asia-Pacific Economic Cooperation (APEC) is a forum for 21 Pacific Rim member economies that promotes free trade throughout the Asia-Pacific region.

- It was established in 1989 in response to the growing interdependence of Asia-Pacific economies and the advent of regional trade blocs in other parts of the world

Courtesy (image)- https://en.wikipedia.org/wiki/Asia-Pacific_Economic_Cooperation#/media/File:APEC_memberstates(Pacific).svg

Why APEC matters?

- For 26 years, the APEC has served as the key driver of Asian regional economic integration by developing habits of economic dialogue and cooperation and facilitating market opening and trade expansion.

- Today the 21 APEC member economies account for approximately 60 per cent of global GDP and 40 per cent of global trade.

- APEC membership is also a facilitating condition for Trans-Pacific Partnership (TPP) membership.

What TPP can do?

- With the advent of the TPP, the great unfinished task of Asian economic integration is India’s closer involvement.

- The potential gain for the regional and global economies is significant.

- As growth in China and the rest of Asia slows, the Asian region and Western economies are in search of new markets for trade and investment, access to new consumers and workers, and new sources of innovation.

Why the world economy needs India?

- India, today Asia’s third largest economy, is projected by the US Department of Agriculture to be the world’s third largest by 2030.

- Its burgeoning middle class, expected to number 450 million by 2030, will be a major contributor to global demand if it is better connected to other markets.

- India’s rapidly increasing workforce could help offset aging populations and labour shortages in other Asian and developed economies.

- India’s huge infrastructure needs could offer favourable opportunities for international investment if India’s markets are better aligned with global standards.

India gains from APEC:

- India has even more to gain from the APEC, which would help India boost its long-term growth.

- The APEC’s institutional processes of trade facilitation, consultation on standards, and sharing of best practices will help India improve its regulatory regime and business environment.

- This, in turn, helps make India more attractive to investors and more competitive in international markets.

- The APEC would help India access the transnational supply chains that increasingly dominate the global economy, an objective critical for the present Prime Minister’s plan to create 100 million manufacturing jobs by 2022.

Way ahead:

- Throughout its history, the APEC has included economies that have varied widely in their size, stage of development, and trade policy orientation.

- China was an APEC member for 10 years before making the reform commitments that brought it into the WTO.

- When Vietnam joined, its economy and policies were very different from those of most APEC members. Now, it is a TPP member.

- One of APEC’s most important contributions has been to assist the gradual opening of emerging economies.

The time to bring India into APEC is now – 2016. For the first time in 20 years, India is actively seeking to join.

The APEC’s major economies – the US, China, Japan and Russia – have all recently welcomed India’s interest in joining APEC.

US President has developed a close relationship with the present Prime Minister, and has the opportunity in his final year in office to help deliver APEC membership for India.

Connecting the dots:

- Critically examine the importance of regional trade blocs in promoting global economic growth with special reference to APEC.

ECONOMICS

TOPIC: General studies 3

- Agriculture & related issues- Major crops cropping patterns in various parts of the country, different types of irrigation and irrigation systems storage, transport and marketing of agricultural produce and issues and related constraints; e-technology in the aid of farmers

- Inclusive growth and issues arising from it.

- Government Budgeting.

Let us talk about taxing agricultural income at minimal rates

The burgeoning farmer distress, despite the various measures and initiatives being taken and those already taken, still paints a dismal picture of India’s success in this field.

Finance—The lending to the underserved by the banks (priority sector lending programme for more than three decades), has also not reaped much benefits and the JAM-Trinity still remains largely on a test-based platform. The fact that access to formal finance remains a challenge even after decades of implementation of such policies demonstrates that such coercive policies have borne little fruit

Education— A large portion of Indian farmers are illiterate or semi-literate and no maintenance of systematic books of accounts regarding their:

- production and income,

- assessing their true income

- Income-earning potential, takes place

This in turn leads to issues for the bank loan officers as most of them rely on informal networks created by social affiliations to gain information about the borrowers. Thus, only those borrowers who are “connected” to the loan officers obtain optimal credit.

The rotation of loan officers every three years ends in making matters worse from a borrower’s point of view as—

- A new loan officer would then again take time to get accustomed to the people and the ground-reality of the particular place

- A research has also shown that a new loan officer entering a branch after job rotation restricts credit to borrowers who borrowed from the previous loan officer

Taxing Agricultural Income:

- Has the potential to improve access to finance to a large section of farmers because verified income tax returns can provide a credible signal of the earnings potential of a farmer

- Verifiable information- Helps separate conscientious and productive farmers from the unscrupulous or unproductive farmers, which in turn, will be very useful in enabling access to finance as well as enter the cost of credit borne by farmers

For example (LiveMint):

- Suppose a loan officer has Rs.100 to lend. Suppose there is a good farmer whose expected revenue for a Rs.100 investment is Rs.125. Also consider that in the same village, there is a bad farmer whose expected revenue for the same investment is Rs.75. Clearly, the bad farmer is better off doing something else other than farming, such as working as a security guard or a factory worker.

- Factors owing to the differences in farmer productivity—Differences in talent, motivation, quality of land, cultivation methods used, training received, etc.

- The bad farmer could also be a strategic defaulter intending to exploit the lax enforcement standards prevalent in the country. In an ideal world, the loan officer would possess the ability to distinguish the good farmer from the bad one. In this ideal scenario, the loan officer can lend Rs.100 to the good farmer and none to the bad farmer.

- The case— Higher productivity of the farmer +well-directed agricultural loans

à Enhancement of agricultural productivity + Hastening of the movement of unproductive agricultural workers to the manufacturing sector

Indian agriculture—Becomes difficult for the loan officers to differentiate between the good and the bad farmers where a genuine farmer may be starved off the funds and the defaulter farmer easily obtains credit

Consequences—

- Low agricultural productivity,

- High default rates on agricultural loans leading to farmer distress

- Lack of mobility from agriculture to other sectors

Here comes the Income Tax Returns—

Let both the farmers (Genuine + Defaulter) file income tax returns every year

GF: Presents his income tax return to the loan officer in order to demonstrate his earning potential

Case of small farmers (G)- Income tax returns can provide a reasonably credible measure of earnings potential because they would neither have the high income nor the incentives to hide such high levels of income

Signal of earnings potential- Credible because declaring higher income results in payment of higher taxes and hence is costly to the farmer

Loan officer-Uses the credible basis to distinguish between the borrowers

Borrower (G)—

- They can easily move from bank to bank and need not depend upon a particular loan officer as well

- Improves the bargaining power of the borrowers by enabling them to tap multiple sources for financing

IASbaba’s Views:

- The concern regarding the range of benefits to the bigger and the smaller farmers can be put to rest with the argument that big farmers are less likely to be credit-restrained but for the small farmers it becomes imperative to be distinguished and be recognised as a genuine farmer for the credit to flow.

- Economically, it might not create much of a difference but in the longer run it does carry the promise of bringing in more substantial returns for the small farmers. (‘Jaanhai to jahaanhai’ funda) Taxing them at minimal rate of about 5% can be the way ahead.

Connecting the Dots:

- PMJDY has been touted as one of the torchbearers in curbing the gap that the present-day government seeks to fill. What are the challenges that a scheme like this encounter in an economy likes India?

- Even when the farm sector remains a major employer of the country’s total workforce, all efforts from the governments end to tackle the current slide have failed. Critically examine the causes and suggest a road ahead for the same.

MUST READ

Clean air agenda for the cities

We need a liberal arts revolution

What Apple versus FBI means for India

No option but to engage – Having committed to attending the SAARC summit in Islamabad which is only months away, the Prime Minister must know that talks with Pakistan will have to resume well before that

Demarcating a safe threshold- Rules on suspension of internet would allay concerns on individual rights.

Flying against logic- The government should scrap the anti-competitive 5/20 rule in the aviation sector that hurts consumer interests.

It’s time for smart villages-To allow our cities to thrive, we must look after our villages

In the interests of public order- Systemic flaws enable political parties to selectively enforce fundamental rights to further their own interests

MIND MAPS

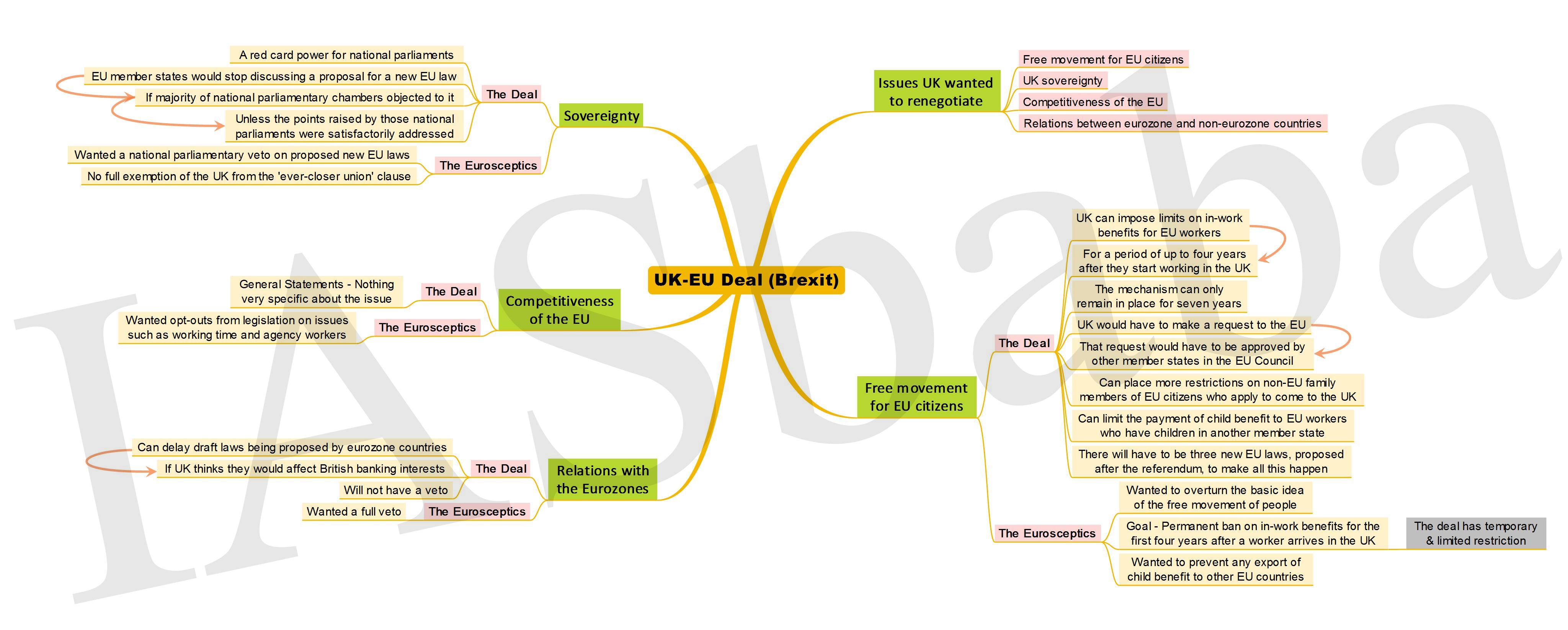

1. UK-EU Deal (Brexit)