IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs March 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 18th March, 2016

NATIONAL

TOPIC:

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Issues relating to development and management of Social Sector or Services relating to Health, Education, Human Resources.

General Studies 3:

- Environmental pollution and degradation, Government Budgeting.

A coffin named Tobacco

Tobacco consumption in the global world today, forms one of the most preventable causes of morality. Tobacco and its products are made entirely or partly of leaf tobacco as raw material and all of them contain the highly addictive ingredient, nicotine.

Total health expenditure burden from all diseases due to tobacco use: Amounts to more than Rs.1,00,000 crore (12 per cent more than the combined State and Central government expenditure on health in 2011-12)

Revenue earned through tobacco excise duty during the same period was a paltry 17 per cent of the health burden of tobacco

WHO:

- Almost around 6 million people die from tobacco use and exposure to tobacco smoke

- One death in every six seconds

- 22% of the world’s population aged 15+ is smokers

Global Youth Tobacco Survey (2009)

Nearly 15 per cent of children in India in the 13-15 age group who used some form of tobacco:

- Only 4.5 per cent smoked cigarettes;

- 5 per cent used other forms of tobacco such as bidis and chewing tobacco

Case of adults in India, of the nearly 35 per cent tobacco users in 2009-2010:

- only 5.7 per cent smoked cigarettes

- Bidi and chewing tobacco users were 9.2 per cent and nearly 26 per cent, respectively.

Tobacco Fiscal Policy in India

- Tax hikes do not match increase in real income

- Multiplicity of tobacco taxes: Makes administration difficult and provides opportunities for tax avoidance and tax evasion

- Differentials in tax rates on cigarette, bidis and smokeless products provide consumers flexibility to shift to cheaper products when higher taxes are imposed

- Multiple slabs: Allows manufacturers to keep prices intact despite tax raises thereby defeating the very purpose of putting up hikes in the first place

Bidi-smokers Value chain:

- Bidi consumers are more responsive to tobacco price increases than cigarette consumers

- Excise on bidis can be increased by 100 percent of current excise, without any loss of revenue

- Bidi VAT rates vary greatly across states and rationalization and equalization of bidi taxes across the states is imperative to minimize adverse health costs and effects

Case of pictorial warnings—

India: Ranked 136 among 198 countries in terms of prominence of pictorial health warnings on tobacco packaging

- Of that covering 85 per cent of the principal display area on both sides of all tobacco products

- Hit a roadblock by mentioning that increasing the size of the warning from the current 40 per cent on only one side of the packet to 85 per cent on both sides would be “too harsh” on the tobacco industry

- Alternative: Increasing the size to just 50 per cent with warning on just one side of it going against the grain of introducing larger pictorial warnings

- Arguments:

- Tobacco consumption in India has increased and not declined after pictorial warnings were introduced in 2009

- Claimed that pictorial warnings would encourage illicit trade (sale of illicit tobacco products is more likely to be linked to cost of tobacco products than larger pictorial warnings)

Why is there a need for pictorial warnings—

- Poor and illiterate people are unaware of all the risks associated with tobacco use

- Less exposed to awareness campaigns

Larger images on both sides of the packet—

- Most effective and powerful way to communicate health risks to this population

- provoke a greater emotional response,

- decrease tobacco consumption and

- increase motivation to quit

IASbaba’s Views:

- There is an urgent need to consolidate voices to

- Expose industry tactics,

- Spread the truth about tobacco harm,

- Creating social movements,

- Litigate against industry violations and interference,

- Taxation:

- Tax increases on tobacco products should be indexed to both consumer price indices/inflation and rise in incomes, to reduce the affordability of tobacco products and to minimize incentives for tobacco users to switch consumption to lower priced brands or products in response to tax increases

- Urgent reforms in removing the multiplicity of tax structure for improved tax administration and regulation

- Introduce uniform value-added taxes on cigarettes and bidis across states

- Impose a special surcharge on their sales/profits and make them compulsorily contribute towards cost of treatment of cancer in the public hospitals

- Use of alternative products (water pipes, smokeless tobacco & electronic nicotine delivery system) are gaining in popularity and should be addressed by introducing some control or regulation measures

- Crack down of cigarette smuggling (digital tax stamp using invisible ink, barcodes or a security mark- to keep illicit trade under check

- Behavioural Approach needs to be developed to bring about an opposite trend of staying away from it

Connecting the Dots:

- ‘The future of tobacco control rests on successfully enacting comprehensive tobacco control measures’. Do you think steps taken by India can serve the purpose presented by WHO incorporating a larger perspective?

NATIONAL

TOPIC: General studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Statutory, regulatory and various quasi-judicial bodies.

- Issues relating to development and management of Social Sector or Services relating to Health, Education, Human Resources.

Getting Medical Education on track

Why in news?

- Recently Parliamentary Standing Committee (PSC) submitted its report to the parliament which stressed on the need to reform the Medical Council of India (MCI).

Background of MCI:

- The MCI was established in 1934 under the Indian Medical Council Act, 1933, as an elected body for maintaining the medical register and providing ethical oversight, with no specific role in medical education.

Amendment act of 1956:

The Amendment of 1956, however, mandated the MCI

- To maintain uniform standards of medical education, both under graduate and postgraduate.

- Recommend for recognition/de-recognition of medical qualifications of medical institutions of India or foreign countries.

- Accord permanent registration/provisional registration of doctors with recognised medical qualifications.

- Ensure reciprocity with foreign countries in the matter of mutual recognition of medical qualifications.

Second amendment act of 1993:

The second amendment came in 1993, at a time when there was a new-found enthusiasm for private colleges

Under this amendment, the role of the MCI was reduced to an advisory body with the three critical functions of

- Sanctioning medical colleges.

- Approving the student intake.

- Approving any expansion of the intake capacity requiring prior approval of the Ministry of Health and Family Welfare.

Criticisms against MCI which the PSC report highlighted:

- The Committee recommended that the Common Medical Entrance Test (CMET) held for admission to MBBS and PG courses to various medical colleges should be based on merit and not money, which it said has become the criterion in some colleges.

- The MCI was earlier also pulled up by the Central Information Commission over quacks issuing fake MBBS degrees and was directed to take strict action to ensure transparency in the establishment of medical colleges in the country as well as issuance of medical degrees.

- The parliamentary committee also took a dig at the composition of the MCI, describing it as opaque and skewed.

The committee called for scrapping of the Indian Medical Council Act, 1956, under which the apex body for medical education is currently functioning.

Recommendations of the PSC:

Explicitly acknowledging the deep tentacles of corruption and miss governance that have consumed the MCI, the PSC has made the following recommendations:

- To provide a new architecture that is more in tune with current needs of the country.

- To replace the principle of election with nomination.

- To replace the existing MCI with an architecture consisting of four independent boards to deal with curriculum development, teacher training, and standard setting for undergraduate and post-graduate education.

- Accreditation and assessment processes of colleges and courses for ensuring uniformity in standards.

- The registration of doctors, licensing and overseeing adherence to ethical standards.

Way ahead:

- The above stated reforms are expected to plan human resources required for primary care by promoting family medicine and general physicians alongside specialists.

- Rationalise standards to make medical education affordable.

- Enforce a uniform national entry and exit examination.

These are all critical recommendations that, if implemented, can have far-reaching consequences for the health sector.

Connecting the dots:

- Critically examine the various institutional and infrastructural drawbacks associated with health sector in India along with measures taken by the government to overcome the same.

- Critically examine the recommendations of high level empowered committee on health.

MUST READ

How to be free in the 21st century

Sebi seeks powers to conduct direct search– Currently, it has to obtain a court warrant for search and seizure operations

India’s carbon strategy to counter climate change- Low oil prices make it the right time to introduce a variable stabilizing carbon tax

Can monetary policy increase inequality?- Increase in money supply is likely to benefit those who are more connected to financial markets

Bitter pill – The ban on certain fixed dose drugs raises consumer and governance concerns

MIND MAPS

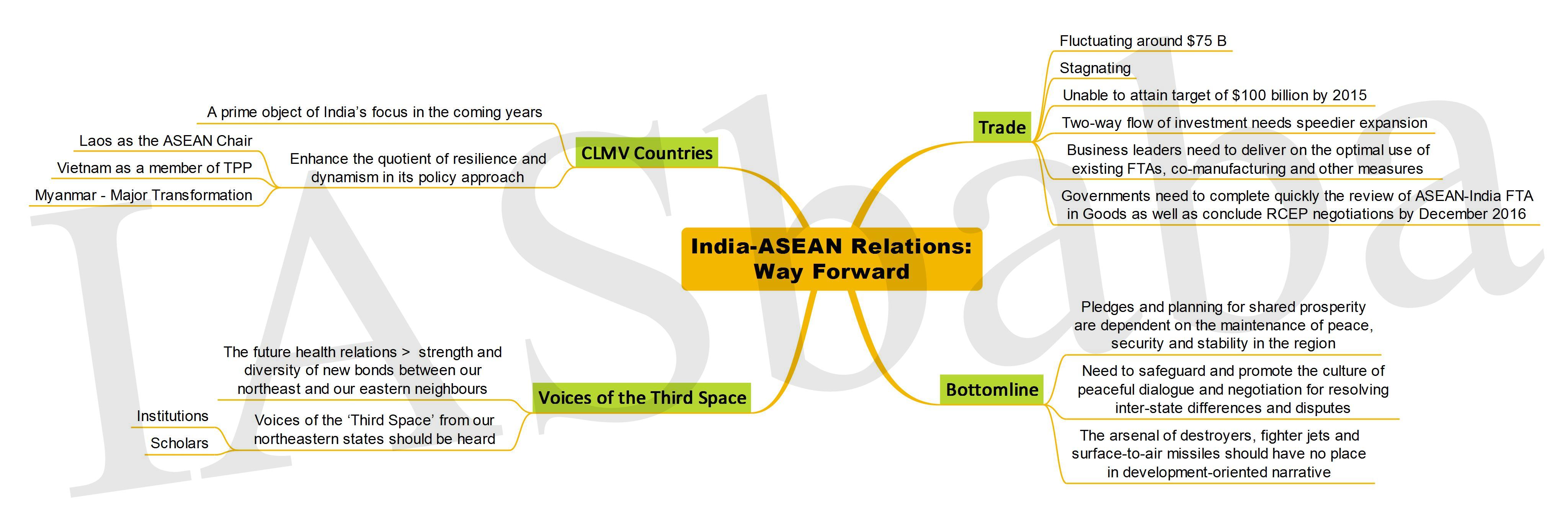

1. India-ASEAN Relations: Way Forward