IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs April 2016, International, Science and Technology, UPSC

Archives

IASbaba’s Daily Current Affairs – 8th April, 2016

INTERNATIONAL/ECONOMICS

TOPIC: General studies 3:

- Challenges to internal security through communication networks, role of media and social networking sites in internal security challenges, basics of cyber security; money-laundering and its prevention.

The panama papers explained

What are panama papers?

- The Panama Papers are an unprecedented leak of 11.5m files from the database of the world’s fourth biggest offshore law firm, Mossack Fonseca.

- The records were obtained from an anonymous source by the German newspaper Süddeutsche Zeitung, which shared them with the International Consortium of Investigative Journalists (ICIJ).

- The ICIJ then shared them with a large network of international partners, including the Guardian and the BBC.

Why the name panama?

Mossack Fonseca, the law firm is based in panama, hence the name panama papers.

Mossack Fonseca provides services like incorporating companies in offshore jurisdictions such as the British Virgin Islands, it also administers offshore firms for a yearly fee and also wealth management.

What do The Panama Papers reveal?

The documents show the myriad ways in which the rich can exploit secretive offshore tax regimes.

Twelve national leaders are among 143 politicians, their families and close associates from around the world known to have been using offshore tax havens.

The papers reveal that

- Individuals have set up offshore entities through the Panama law firm.

- Some of the Indians floated offshore entities at a time when laws did not allow them to do so;

- some have taken a technically convenient view that companies acquired is not the same as companies incorporated;

- some have bunched their annual quota of remittances to subscribe to shares in an offshore entity acquired at an earlier date.

- Still, some others have received income earned abroad and deposited it in the entity to avoid tax.

- Some have opened a bank account to keep payoffs in government contracts, or held “proceeds of crime” or property bought with money made illegally in Trusts/ Foundations.

Why float a foreign company, why go all the way to Panama to register it?

The two big draws that offshore entities in jurisdictions such as British Virgin Islands, Bahamas, Seychelles and more specifically Panama, offer are:

Secrecy of information relating to the ultimate beneficiary owner and zero tax on income generated.

One more advantage:

- In fact, in Panama, individuals can ask for bearer shares, where the owner’s name is not mentioned anywhere.

- Besides, it costs little or nothing to set up an entity abroad.

- The Registered Agent charges a few hundred dollars to incorporate an entity. It doesn’t take much time to incorporate one either.

- Companies are available off-the-shelf and can be registered in a couple of days.

What’s the kind of secrecy that the Panama agent offered?

- The offshore entity need not appoint natural persons as directors or have individuals as shareholders.

- The Registered Agent, Mossack Fonseca in this case, offers its own executives to serve as shareholders or directors.

- Sometimes, an intermediary law firm or a bank acts as a director or a nominee shareholder. So the real beneficiary remains hidden.

- The registered agent provides an official overseas address, a mail box, etc, none of which traces back the entity to the beneficial owner.

- In many cases, the shareholding of these entities is vested in a Panamanian Trust or Foundation.

- The Foundation further masks beneficial ownership.

- A professional trustee is often the nominee shareholder of the Foundation.

- The beneficiaries of the Foundation’s assets are mentioned in the Regulations, and these Regulations do not form part of the Public Deed executed by the trustee.

Couldn’t those in the list argue that when they set up these companies, FERA was a draconian law and they had to do this to go around it?

Foreign Exchange Regulation Act severely restricted even current account transactions, forget those on capital account. Since India’s foreign exchange holdings were low or inadequate in the 1980s and 1990s, the law was aimed at preventing an outflow of foreign exchange.

- In those days of controls, many secretly opened Swiss bank accounts and offshore entities by sending money abroad through hawala.

- It was to these offshore accounts that money flowed in several cases of over invoicing or under-invoicing of trade transactions.

- But progressively, after liberalisation in 1991, and with an improvement in macro economic indicators, FERA was replaced with FEMA in 1999.

- And as India’s foreign exchange reserves rose and topped $100 billion in 2004, in January 2004, RBI allowed companies to invest up to 100 per cent of their net worth (now it’s 400 per cent of net worth) abroad by doing away with the $100 million cap and started its experiment with limited capital account convertibility by introducing the Liberalised Remittance Scheme (LRS) in February 2004 which permitted resident individuals to remit up to $25,000 a year.

This was increased in phases to $200,000 by September 2007, but was reduced to $75,000 in August 2013 to arrest a sharp slide in rupee.

The LRS limit was subsequently increased again in phases and now stands at $250,000 a year. This means, an Indian resident individual can invest $250,000 abroad in buying shares or property or gift or donate to anyone living abroad up to this limit every year.

- But RBI’s intent and internal understanding in opening the LRS windows was to allow resident individuals in the spirit of liberalisation to diversify their assets, promote trade and boost exports and earnings, but not to let them set up companies, which could be put to misuse.

So what’s the next step once these names are out?

- For the Reserve Bank of India, this issue has been work-in-progress.

- It will have to take a call whether they can allow compounding (recognising that an individual has erred bona fide and regularising the investment in the offshore entity post facto by imposing a penalty) or insist that individuals wind up these investments made prior to August 2013.

- The Income Tax department will have to probe if there has been ‘round tripping’ of funds i.e. routing of funds invested in offshore entities back to India, and where required, refer the cases to the Enforcement Directorate.

- It will also have to see if the offshore entities have declared all their incomes and assets to the Income Tax department.

What’s the relevance of The Panama Papers to the black money debate?

- Offshore entities can be and have been used by individuals to remit funds abroad.

- Globally, they carry a reputation of being vehicles set up by individuals and corporations to evade or avoid tax.

- Companies call this tax planning, the tax man sees it as tax avoidance.

- With coordinated moves by G-20 countries to introduce stringent anti-money laundering measures, as part of a global crackdown on tax avoidance, there is rising international scrutiny over such jurisdictions and giant company incorporators such as Mossack Fonseca which facilitate setting up of offshore entities.

Connecting the dots:

- Critically examine the treats to internal security in India with special emphasis on economic security.

- Critically examine the various measures taken by the government to tackle money laundering in India.

SCIENCE & TECHNOLOGY

TOPIC: General studies 3

- Issues relating to intellectual property rights (IPR)

- Science and Technology – developments and their applications and effects in everyday life Achievements of Indians in science & technology; indigenization of technology and developing new technology.

Patents and Innovation

Computer Related Invention (CRI) guidelines— Only software involving novel hardware is patentable (will lead to speedy examination of eligible applications for patents)

Issues:

- Loss of legal business (no patents, no patent litigation)

- MNCs—result in the stifling of innovation

Is it really detrimental— No; patents make no sense in the world of software as the underlying platforms for all these areas are patent-safe, open-source software tools.

Open-source—The future

What is Open Source: software whose source code is available for modification or enhancement by anyone (design being publicly accessible), embracing and celebrating open exchange, collaborative participation, rapid prototyping, transparency, meritocracy, and community development

India: lack of distraction from patents

Government-funded SHAKTI processor programme at IIT-Madras: Creating open-source mobile and server processors to replace proprietary processors

Lack of clear boundaries in software: Even law-abiding software developers who intend not to violate another’s patent have no clear means of avoiding it and therefore, problem of software patents ends up increasing the cost of software for all of society

Existence of Web:

- Flexibility and sophistication today depends on freely available scripting languages, such as Perl and PHP, invented by developers who deliberately did not seek patent monopolies for them (Facebook runs on PHP)

- The current generation innovators — various open-source foundations like the Mozilla, Linux and Apache foundations, Facebook, eBay, LinkedIn, Tumblr and innumerable other start-ups — all share the same credo: royalty-free open source.

Connecting the Dots:

- Critically evaluate the CRI guidelines and its utility in India

For more information on Innovation & Patents refer the below links-

India lagging behind in Innovation

MUST READ

Lessons from the Chinese veto

Promoting equity with variable fees

A Friendly Force- Research on benign effects of bacteria on nutrition has policy implications.

Aadhaar project: Last chance for a welfare state- That’s what the Aadhaar Act is. It was rightly categorised as a money bill and is wrongly expected to double up as a privacy statute

India could be sitting on a gold mine and not know it- Only about 13% of India’s 575,000 square kilometers of land with geological potential has been explored in detail, says Indian Mineral Federation

Developed economies reap the whirlwind- They are starting to feel the pain of policy spillback from emerging markets

MIND MAPS

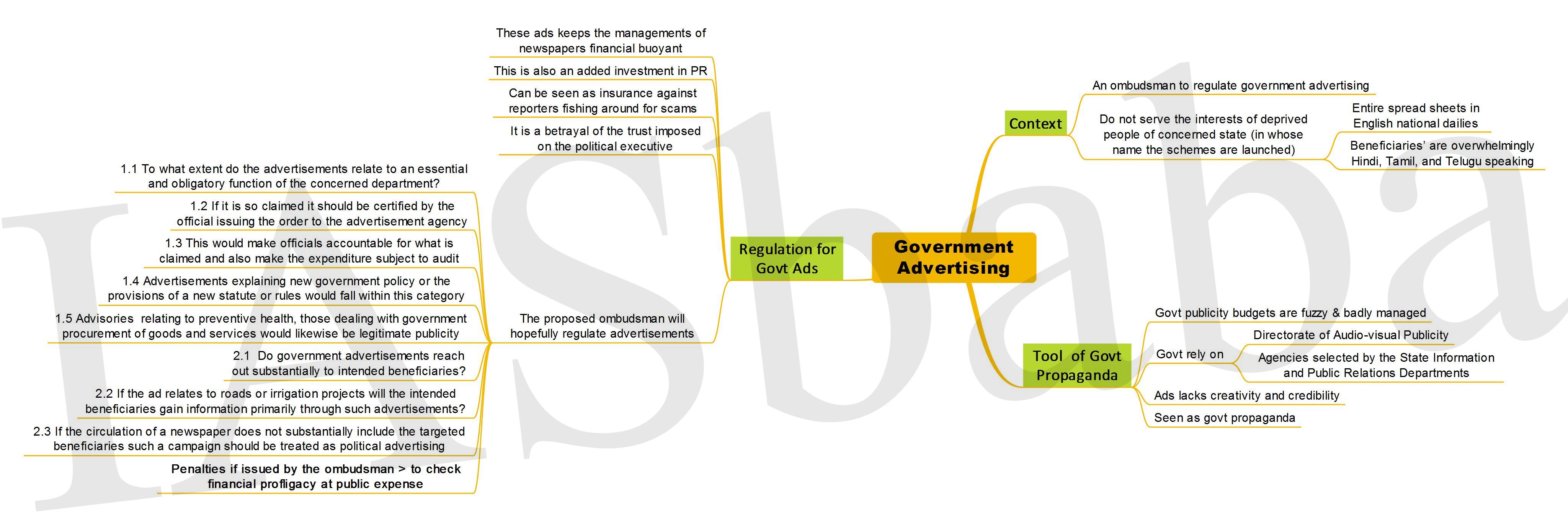

1. Government Advertising