IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 20th June, 2016

NATIONAL/HEALTH

TOPIC: General Studies 2

- Issues relating to development and management of Social Sector or Services relating to Health, Education, Human Resources.

Vaccine Derived Polio Virus (VDPV) and its concerns:

In India, several states have reported cases of Vaccine Derived Polio Virus (VDPV)

In November 2015, the Delhi government reported the case of VDPV and now, a surveillance study conducted by the World Health Organisation (WHO) found traces of vaccine-derived polio virus in Telangana.

Article below discusses about – What is a vaccine-derived polio virus and why is it a threat?

What is polio?

- Poliomyelitis or polio is a highly infectious disease caused by a virus.

- It invades the nervous system, and causes paralysis, medically known as an acute flaccid paralysis (AFP), which is characterised by sudden muscle weakness and pain in the limbs.

- The disease is transmitted from person to person, mainly through the faecal-oral route, affecting children under five years of age. In the absence of wild polio virus (WPV) transmission,

- India was declared a polio-free country in March 2014, after years of relentless vaccination.

What does the World Health Organisation (WHO) study reveal?

- For maintenance of polio eradication in polio-free countries, WHO conducts surveillance for cases of AFP and collects samples of sewage water to find any traces of polio viruses.

- In one such study in Hyderabad in April, out of 30 samples collected, one sample from Amberpet nala (sewage) contained traces of type-2 VDPV.

- Lab tests have revealed that the virus has passed through human body and has undergone mutation or nucleotide change.

- Similar virus strains were detected in Delhi, Bihar and Gujarat.

What is a vaccine-derived polio virus?

- In a vaccine-derived polio virus (VDPV), the source of the virus is the vaccine itself.

- The oral polio vaccine called polio drops, which India deployed extensively to fight against polio, contain a live, attenuated or weakened polio virus.

- When a child is vaccinated, the weakened vaccine-virus replicates in the intestine and enters into the bloodstream, triggering a protective immune response in the child. Like wild poliovirus, the child excretes the vaccine-virus for a period of six to eight weeks.

- Importantly, as it is excreted, some of the vaccine-virus may no longer be the same as the original vaccine-virus as it gets genetically altered during replication.

- In areas of inadequate sanitation, this excreted vaccine-virus can quickly spread in the community and infect children with low immunity.

Why is VDPV a matter of concern?

- The cases of paralysis due to VDPV are rare as the virus has to circulate for a long time in the community of under-immunised population before it can infect and cause paralysis in someone.

- Vaccine-associated paralytic poliomyelitis (VAPP) occurs in an estimated 1 in 2.7 million children receiving their first dose of oral polio vaccine, according to the Global Polio Eradication Initiative, a public-private partnership of national governments and WHO.

- The aspect that is a matter of concern is that India reports high number of non-polio—AFP or paralytic—cases in children who are less than 15 years of age, which the study links to the VDPV.

- According to WHO, more than 50,000 AFP cases are investigated in India every year as a part of its surveillance system.

OPV vs IPV

- The detection of VDPV in Hyderabad and other places has intensified the discussion on replacing oral polio vaccine (OPV) with inactivated polio vaccine (IPV).

- IPV given through an injection contains inactivated virus, considered to be safer than OPV that contains live virus.

- WHO has been advocating IPV over OPV as part of its global endgame strategy on polio eradication.

- India introduced IPV in the mandatory immunization programme on 1 December in six states. For the time being, IPV will be given in addition to the existing OPV.

- OPV has its strong advocates who believe that the vaccine is best suited for countries such as India due to its low cost, high efficacy and ease of administering, and argue that the safety concerns are overstated compared to the benefits of the vaccine.

Connecting the dots:

- Still the fight against polio is not complete in India. Examine the above statement with respect to recent incidents of vaccine derived polio virus cases reported in several states.

- What is vaccine derived polio virus? Is VDPV a threat to our country? What strategies can India adopt to fight these strains?

Also Read:

Is India actually free of polio?

NATIONAL

TOPIC:

General studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation; Important aspects of governance, transparency and accountability, e-governance-applications, models, successes, limitations and potential

General studies 3:

- Science and Technology- Developments and their applications and effects in everyday life, Achievements of Indians in Science & Technology; indigenization of technology and developing new technology

Era of Digitisation in the Insurance Sector

- Digital transformation addresses disruptive changes occurring in the economic, social and technological environments; and has become a top business priority enabling firms to achieve business growth, efficiency and effectiveness closely driving profitability and growth.

- Right from determining the key political outcomes, it has increasingly influenced buying behaviour— every product purchase across every industry is preceded by a quick online research which includes other customers’ reviews and comparisons.

Digital transformation in the Insurance Industry

Core challenges addressed:

- Difficulty in purchasing life insurance on their own

- Break-up and a proper understanding of the engagement

- Face to face decision-making can wait— a customer can as per his schedule, research-compare-evaluate and then go ahead without being bogged down by the traditional sale of policies or products

Consumer-focused product approach

- Earlier, the investment decision largely depended upon an agent (a profiteer) who used to sell products in order to drive profit home rather than selling products that were beneficial to the customer. Core insurance products like term and health insurance were never recommended upfront due to their small premium size and low recurring value to the agent.

- Insurance digitisation will pave way for information-on-demand (product charges, where the premium goes, how much is actually invested and how much goes into expenses or distributor commissions) — thus leading to a calculated and an informed decision.

Enabling direct B2C connect

Customers are today enabled to evaluate thoroughly with a finger-tip before making the final purchase— has led to an evolution in one’s online ecosystems and an increased digital footprint ensuring that they provide customers with the right kind of planning tools, easy-to-decipher product content and simple selling.

In a nutshell—Enhanced Customer Experience

Simplified & informed product buying—

- Simple application process—minimal medical examination via declarations or previous records

- Queries can be handles online

- Fixing of medical appointments online

- Ease of document submission and online underwriting

Post-purchase—

- Easy access of all their information via the Internet— at one go

- Value-added features and information to be revisited in case of doubts

- Simplified online claims process: improves customer experiences on product delivery

NOTE:

Digital India

- DI is an amalgam of three ongoing programmes: the National Optical Fibre Network (NOFN), the National Knowledge Network and the E-Governance initiative.

- It’s being implemented through a PSU, Bharat Broadband Network Limited (BBNL), supervised by the ministries of telecom, power and railways.

- USOF (Universal Service Obligation fund) has the responsibility to finance the DI scheme.

National Optical Fibre Network

- A part of the Digital India initiative of the Government of India, NOFN is envisaged as a non- discriminatory Telecom infrastructure which will bridge the gap in rural access.

- NOFN is being funded by the Universal Service Obligation Fund (USOF), Department of Telecom, Ministry of Communications & IT, Govt. of India—to provide non-discriminatory access to bridge the digital divide across rural India.

IASbaba’s Views:

- While government has given a push to the digital path via various initiatives like Unified Payment Interface, e-KYC and digitising insurance policies as well as improvement in the digital literacy of the country by launching the Digital India programme that aims at transform India into a digitally empowered society and a knowledgeable economy—more infrastructural efforts need to be made to increase the digital hold over people countrywide:

- Availability of the spectrum: Adequate access spectrum is the basic ingredient of mobile communications.

- Back haul spectrum: Essential to haul communication from the fringe of a network to the main pipe.

- Sufficient number of Towers and quality network & connectivity

- Investor friendly and Customer prioritised policy

- The insurance regulator, Insurance Regulatory and Development Authority of India, through the iTrex platform, has taken a positive step ahead by instructing insurers to upload KYC information of their policyholders as well as to do away with multiple KYC formalities—ensuring consumers to have electronic insurance accounts; leading to an easier life of a policyholder and transforming the work of insurers to becoming simpler, more cost effective and efficient.

Connecting the Dots:

- Will Digital India reduce the gap regarding access of information in rural and urban India? Will this make service delivery system accountable and transparent?

- What are the economic implications of consumer behaviour? Is the consumer behaviour reshaping the insurance industry? Discuss.

MUST READ

India and the Brexit forecast

Related Articles:

EU referendum: the big questions for Britain

The cost of nuclear diplomacy

Related Articles:

Quest for another Holy Grail – Nuclear Suppliers Group (NSG)

Nuclear Suppliers Group – Mind Map

Hypocritical to block India at the NSG

His voyage to America

From Plate to Plough: With humility, on farmer income

P2P lending: towards easy funding

Hypocritical to block India at the NSG

Modern lending

The fig-leaf revelations and the reality

MIND MAPS

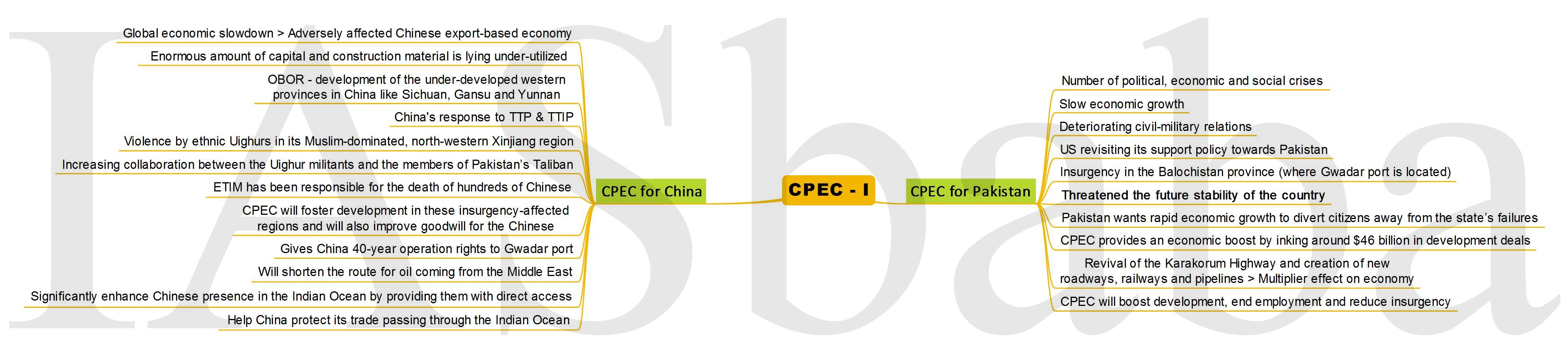

1. CPEC – I (Part II to updated tomorrow)