IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2015, International

Archives

IASbaba’s Daily Current Affairs – 3rd June, 2016

ECONOMICS

TOPIC:

General studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

General studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Public Sector Enterprises

- The Central Public Sector Enterprises (CPSEs) have been a strategic lever for Indian economic development in both pre-independence and post-independence era.

- With the opening of the economy and changes in the market dynamics, with private sector playing a greater role in shaping the industrial landscape— it has been a key imperative for the government to initiate structural changes in the CPSEs in terms of organization, financials and operations in order to narrate a turnaround story.

- However, even post certain reforms, many CPSEs are still facing several issues such as financial autonomy, bureaucracy, corruption, risk aversion, ineffective governance, political interference, inability to recruit the right talent, and corruption.

In this article we would draw your attention towards the “financial aspect of these CPSEs”

Challenges Faced:

While CPSEs have started witnessing considerable rebound and are poised for growth, there are still some roadblocks (w.r.t the financial aspect) which may restrict their full throttle growth, some of these include:

- Lack of proper governance structure often inhibits the transparency and free functioning of these enterprises

- Lack of financial autonomy leads to them not being able to enjoy financial independence unlike their private counterparts which often lead to delays in decision making

- Lack of a robust ecosystem as the PSUs face difficulties in attracting private investments

- Political interference leads to a clash between agenda of political parties and objectives of CPSEs which may impair their growth and autonomy

- Lack of proper governance, transparency, etc. may translate into bureaucratic and corrupt environment within some CPSEs, leading to a tarnished image of the entire set of CPSEs.

Comprehensive guidelines on crucial areas of capital restructuring to spur economic growth by the Govt. — (addressing resource management issues of PSUs)

- Impose rigid financial formulae to ensure frequent dividend pay outs, share buybacks, bonus issues and stock splits

- Profit-making PSUs: Required to part with at least 30 per cent of their net profits or 5 per cent of net worth (whichever is higher) as annual dividends

- Firms with a net worth of Rs. 2,000 crore and cash balances of Rs. 1,000 crore: Should initiate share buybacks

- Consider bonus issues if their reserves top ten times equity capital and stock splits, if their market price/book value exceeds 50 times face value

Indian government has always been the promoter of PSUs and have looked out for them, but with both global and perspective changes, they should adopt a proper manner for the required corrections—

The one-size-fits-all criteria:

- Requiring minimum pay outs from PSUs irrespective of their own investment needs are regressive

- Private sector firms vary with their dividend/buyback, and their policies are based on business conditions and ROI (return on investment) on new projects

There is a need to grant the same treatment to PSUs as well. Also, return on equity benchmarks for PSUs are better than mandated dividends and bonuses based on rigid formulae.

Over-confidence w.r.t. minor adjustments:

Stock markets take a favourable view of a bonus issue if a firm is able to sustain it’s per share earnings on the expanded equity. Thus, putting ones stakes high on mandatory bonuses or stock splits (mere book adjustments) to deliver the required sustainable boost to shareholder returns, is a myth.

Tightened Screws:

The Centre has, without much deliberations, have always adopted the top-down approach with respect to the PSUs, irrespective of their demands and commercial interests. This just exclaims the lack of autonomy that the PSU faces. Moreover, the high focus on profit-making PSUs should be balanced out by extending the focus towards those, who are easily written off because of their loss making qualities. The approach should be based upon simply seeking returns.

For a start—

- Set up overall ROE (return on equity) benchmarks for individual PSUs based on the metrics for the sector and efficient private sector peers

- Specify the minimum accountability

- Focus on the strategy employed for achieving targets

Time to take a realistic view (For PSUs):

- Expansion needs need to be finalised and dividend pay outs to shareholders should be stepped-up, bolstering the Centre’s efforts and allowing re-routing of capital to the sectors that needs it.

- Government needs to grant the Central PSUs with greater autonomy in managing their treasury for optimal returns— should have autonomy in day-to-day financial decision making which may include low-cost purchases, cost allocations, evolving price structures, etc.

- Developing a sustained infrastructure to register rapid growth requires both public as well as private sector participation. Thus, attracting private investments through appropriate public private partnership models is of paramount importance for meeting investment requirements and henceforth inclusive growth.

- A development path that is ‘sustainable’ should take into consideration, institutions that will be conducive for greater participation of stakeholders at various levels. This may require continuous dialogue and action focusing on key sustainable development issues.

- To solve the problem of accountability, the pay revision committee headed by Justice S. Mohan recommended that employee salary should be linked to the performance of the company— function of profitability of enterprise and emoluments at the level of the individual employee.

Connecting the Dots:

Discuss the various issues that need to be addressed for efficient management of investment in CPSEs.

INTERNATIONAL

TOPIC:

- General Studies 1: Effects of globalization on India; Distribution of key natural resources across the world (including South Asia and the Indian subcontinent);

- General Studies 2: Indian Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests; Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora; Important International institutions, agencies and fora- their structure, mandate.

OPEC oil drama continues

OPEC fails to agree on a production cap:

- Global oil prices have fallen sharply over the past seven months, leading to significant revenue shortfalls in many energy exporting nations

- Brent crude oil had dipped below $50 a barrel for the first time since May 2009 and US crude was down to below $48 a barrel

- The reasons for this change are twofold – weak demand in many countries due to insipid (dull) economic growth, coupled with surging US (shale) production

- A way out for OPEC countries to overcome the problems resulting from falling oil prices was to have an effective agreement on limiting their oil production or ‘production cap’ (which they didn’t)

Risks with the Global Oil Economy:

- Macroeconomic uncertainties

- Heightened risks surrounding the international financial system

- Escalating social unrest in many parts of the world

- Speculation and oversupply

Oil market scenario at present:

- Oil prices have gained more than 30% so far this year

- Signs of stable oil market have emerged

- The higher prices have removed some of the pressure on OPEC, which now wants to act coming together to prop up prices

- World oil demand had risen by 1.4 million bpd in 2016’s first quarter

However, this doesn’t mean that these major oil producers can sit back and relax as the realities are not quite so kind

- Oil market supply and demand haven’t fully stabilized and there are lot of factors than can, and probably will, rock OPEC’s boat

- The reason for recent rise in oil prices can be attributed to the falling global production as the number of active-drilling rigs have been in a steady state of decline and oil-company spending cuts, oil-and-gas sector bankruptcies, and recent outages in Africa and North America

- In other words, due to exogenous factors such as the wildfires in Canada, militant activity in Nigeria and Venezuela’s economic and political crisis

Oil market scenario in future:

There are no signs of any stability in oil market and following are the 4 key issues OPEC must wrestle with

- Competition from African countries:

- Some of the above said situations will evolve and change. For instance, Venezuela’s more than three billion barrels are currently out of the market because of such factors. When they return, so will the uncertainty.

- Competition from Iran:

- OPEC countries are pushing the idea of production freeze in order to increase the price. However, Iran has refused to entertain the idea of such production cap.

- In addition, Iran is not yet at full capacity and it has given every indication to keep going until it hits pre-sanction levels.

- Uncertainty in market due to US shale oil boom

- US is unlikely to decrease its production and in coming years we can expect surge in its shale production

- Much of the price fall has been a deliberate move by OPEC’s strongest member, Saudi Arabia, to combat the US suppliers—deliberately pushing supply to price marginal producers out. This has worked to an extent, as some estimates have shown that as many as 77% of US producers have been hit hard.

- Once the North America is out from the outage, shale companies will boost output again. And some US producers have already indicated that $50 a barrel is good enough to entice them (hurting the strategy of Saudi Arabia)

- Geostrategic and economic rifts within OPEC:

- The market is eager to hear about a viable agreement between the OPEC producers and [non-OPEC] Russia to limit production.

- However, Saudi Arabia, Russia, Qatar and Venezuela said that they wouldn’t increase oil production above January’s levels, but only if other major oil producers followed suit.

- OPEC member Iran was very clear, then and now, that it will continue to raise its output to presanction levels before it’ll even consider such a move.

- Other OPEC members too have failed to agree on a production cap as they don’t want to lose their market share.

- Especially, Russia and Saudi Arabia could increase output in the next few months to maintain market share as Iran ramps up its production.

Conclusion: Still a dead end

- From above factors we can conclude that – ‘For now, there is no evidence that such production freezing or capping deals are near at hand’. And that, in turn, means a lower chance of working effectively to push up prices.

- The increased demand in the oil market (which was reported in 2016’s first quarter) is concentrated in a handful of pockets such as the US. A broader pickup in demand across Europe, Asia and Latin America is required for a sustainable balance.

- There is no telling when that will happen with the latter’s political travails and major European and Asian economies caught in a loop where higher oil prices would help deliver the inflation needed for growth, but growth and the subsequent rise in demand are required for higher oil prices.

MUST READ

The burden on the US’s conscience

Bridging the South China Sea divide

Related Article:

China factor in India Maldives relation: an analysis

The ECB’s illusory independence

Gorbachev: Both reviled and revered in Russia

Do not browbeat lawyers

Why go it alone?

Related Articles:

AIR Debate – India-Iran Relations

Apps within wheels

Indian obsession with fairness is the daily evidence of a deep-seated racism

Related Articles:

The Big Picture – Africans Under Attack: Racism or Law and Order Problem?

MIND MAPS

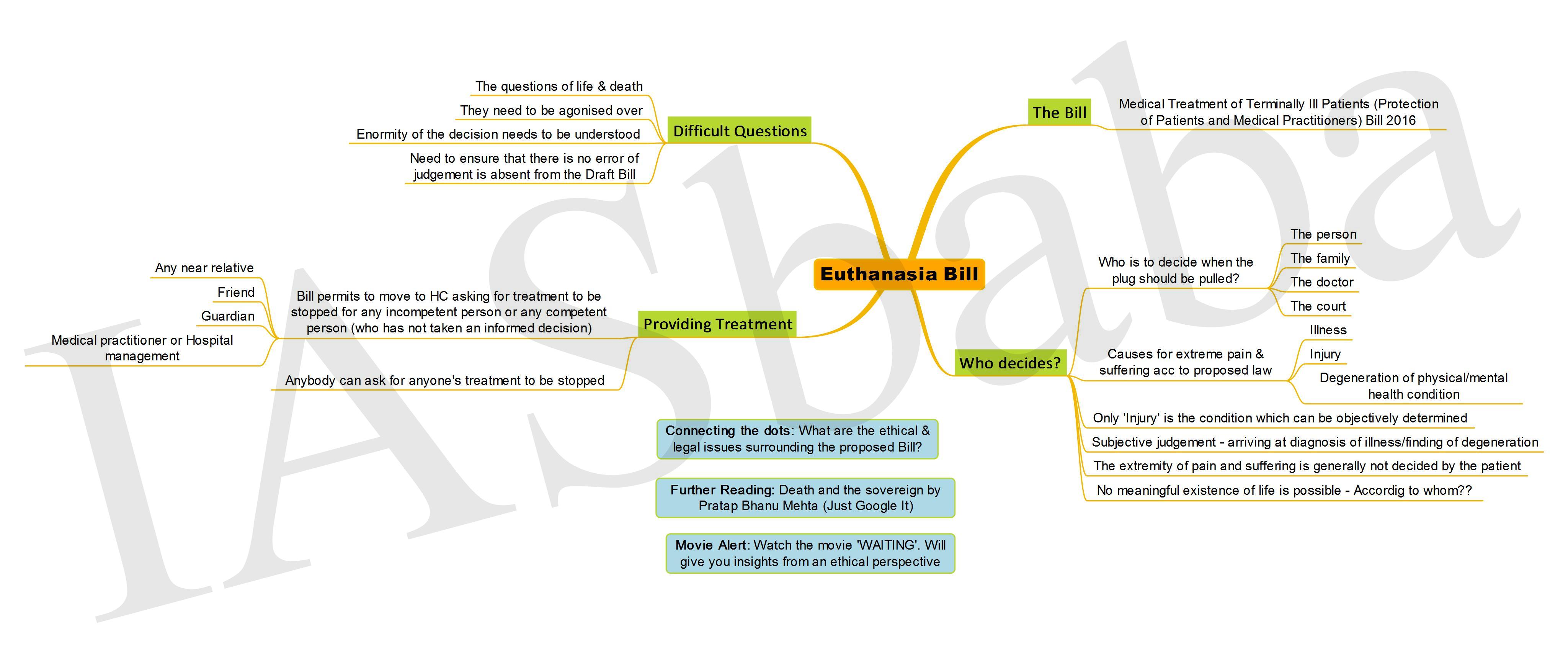

1. Euthanasia Bill