IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 8th June, 2016

INTERNATIONAL

TOPIC: General studies 2

- India and its extended neighborhood (Iran)- relations, International relations

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

India’s increased role in West Asia

India and Gulf countries:

In the last 10 months, the new government under PM Modi has engaged with almost all the Gulf countries and every interaction has yielded substantial agreements which will take bilateral relations into new areas and reshape ties to make them relevant to contemporary times.

Every country visited expressed its admiration for India’s economic achievements and pledged to become a partner in India’s development efforts.

Courtesy – http://www.rjgeib.com/biography/milken/crescent-moon/persian-gulf/gulf-states/gulf-states.jpg

Economic and cultural ties

- central importance to boosting energy and economic ties

- commitment on both sides to upgrade the existing buyer-seller relations to long-term partnerships based on investments and joint ventures

- historic and civilisational links

- enhancing people-to-people links

- work closely with India to combat terrorism

- countering radicalisation through promotion of a moderate religious discourse espousing peace, tolerance, and inclusiveness

- enhancement of defence ties and cooperation in defence and intelligence

- cooperation in new frontier areas, such as space, telecommunications, renewable energy, food security, sustainable development, desert ecology, and advanced healthcare

India- Iran:

- The joint statement with Iran, titled ‘Civilisational Connect, Contemporary Context’, particularly focussed on sustaining historic cultural ties through interactions among scholars, authors, artists, filmmakers, the media, and sportspersons.

India-UAE:

- UAE has set aside a fund of $75 billion to invest in India’s infrastructure and developmental needs.

Joint statements: for Strategic Partnership

Most of the countries recognize India as their “strategic partner”, a status that represents a high degree of shared values, perceptions and approaches to matters of security concern.

- Joint statement with the UAE speaks of “shared threats to peace, stability and security”, and agrees to a “shared endeavour” to address these concerns, which is founded on “common ideals and convergent interests”.

- Joint statement with Saudi Arabia talks of the two countries’ responsibility to promote peace, security and stability in the region.

- Iran joint statement speaks of the strategic importance of regional connectivity linked with the development of Chabahar port.

Promoting regional stability

Every one of the joint statements between India and the Gulf countries contains a subtext that imposes a new responsibility on India: how to shape a role to promote security in the Gulf

- India and UAE statement speaks of the need for the two countries to establish a “close strategic partnership” for “these uncertain times”, and calls upon them to “work together to promote peace, reconciliation, stability… in the wider South Asia, Gulf and West Asia region”.

- India and Saudi joint statement notes “the close interlinkage of the stability and security of the Gulf region and the Indian subcontinent and the need for maintaining a secure and peaceful environment for the development of the countries of the region”.

- The joint statement with Iran speaks at length about the threat from terrorism for the peace, security, stability and development of the region.

It specifically refers to the peace and stability of the region being served by “a strong, united, and prosperous and independent Afghanistan” and their agreement to strengthen trilateral consultations and coordination.

Challenges:

West Asia today is in the throes (intense or violent pain and struggle) of the gravest crisis in its modern history.

- Besides two ongoing wars, there is the scourge of jihad, represented by the transnational al-Qaeda and the Islamic State.

- The two Islamic giants, Saudi Arabia and Iran, are locked in a competition in which each country sees the other as threatening its nationhood, regime, political order, and doctrinal standing in Islam.

- Saudi Arabia believes that Iran supports terror, interferes in the domestic politics of the neighbouring Arab states, and is a destabilising force that has regional hegemonic aspirations.

- Iran denies these allegations, arguing that the Saudi monarchy faces serious domestic economic and political challenges, particularly from its restless youth who chaff against an order that is on the wrong side of every issue in world affairs — constitutionalism, political participation, human rights, gender and minority sensitivity, and being unable to handle these challenges, the Kingdom is unfairly made a scapegoat by the Islamic Republic that has no regional territorial ambitions.

With the deep doctrinal and political divide between them (Iran and Saudi Arabia), the proxy wars in Syria and Yemen, and the attendant proliferation of jihad, the stage is set for their differences to escalate into direct conflict.

Responsibilities on India:

- India has every reason to be concerned: its energy security and its economic interests are linked with regional security, as is the welfare of its eight million-strong community.

- India’s abiding interests require that it get off the fence and contribute actively to regional stability by promoting engagement between Saudi Arabia and Iran, and

- India has to work with regional and extra-regional partners with a similar interest in regional security, to structure platforms for dialogue and confidence-building measures.

This is a daunting challenge, but India is fully equipped to handle it. India’s growing capabilities and stronger national branding, in fact, makes it a credible partner. The interplay among these nations actually offers India new avenues of cooperation. The time has come to live up to this commitment.

Connecting the dots:

- Explain the ongoing conflict between Saudi Arabia and Iran in West Asia. What will be the impact of this conflict on India?

- A peaceful West Asia is a necessity for India to maintain its energy security. Critically examine the above statement with respect to the ongoing conflicts in West Asia.

Related Articles:

West Asia: Saudi Arabia’s deadly gamble

OPEC & the present Global Order

India’s ties with West Asia : An analysis (Part I)

The sprouting of the “ look west” policy (Part III)

ECONOMICS

TOPIC: General studies 3:

- Banking & related Issues; Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it

The path named Financial Inclusion

Financial Inclusion (FI) is the process of ensuring access to appropriate financial products and services needed by all sections of the society in general and vulnerable groups such as weaker sections and low income groups in particular at an affordable cost in a fair and transparent manner by mainstream institutional players.

- Mid-2000s: India embarked on an ambitious programme to ensure universal coverage of all households by financial institutions.

- 2006: Reserve Bank permitted banks to utilise the services of non-governmental organizations (NGOs), micro-finance institutions (other than Non-Banking Financial Companies) and other civil society organisations as intermediaries in providing financial and banking services through the use of business facilitator and business correspondent (BC) models. The BC model allows banks to do “cash in-cash out” transactions at a location much closer to the rural population, thus addressing the last mile problem

- 2014: Prime Minister’s Jan Dhan Yojana (PMJDY) was introduced which intends all households to have at least one savings account at a financial institution. One year after the PMJDY’s initiation, more than 21 crore bank accounts have been opened, utilizing a network of more than one lakh business correspondents (BCs).

Issues being faced—

Surveys that we are currently running in Bihar suggest that, even now, moneylenders represent the major source of loans for rural households, accounting for 35% of total loans:

- Family members account for 26% of loans

- Commercial banks for just 10%

- The primary reason for borrowing is ill-health: 38% of loans (48% of the loans from moneylenders) are for health-related expenses

Not treated as an Efficient Business Model:

Banks are pursuing FI as a regulatory requirement rather than treating it as a business model.

Solutions—

- Banks have to realize that the bankability of the poor holds a major opportunity for the banking sector in developing a stable retail deposit base and in curbing volatility in earnings with the help of a diversified asset portfolio. Therefore, Financial Inclusion programmes should be implemented on commercial lines as a sustainable and viable business model

- Ensure that poor people who deserve credit are provided access to timely and adequate credit in a non-exploitative manner

Geographic Limitation (Rural areas)

- Higher non-performing loans in rural areas because rural households have irregular income and expenditure patterns—compounded by the dependence of the rural economy on monsoons, and loan waivers driven by political agendas

- Low Ticket Size: The average ticket size of both a deposit transaction and a credit transaction in rural areas is small. This means that banks need more customers per branch or channel to break even. Considering the small catchments area of a branch in rural areas, generating a customer base with critical mass is challenging.

- High Transaction Cost: due to small loan sizes, the high frequency of transactions and at a higher frequency, the large geographical spread, the heterogeneity of borrowers, and widespread illiteracy

- Higher risk of credit: Rural households may have highly irregular and volatile income streams. Irregular wage labour and the sale of agricultural products are the two main sources of income for rural households.

- Information Asymmetry: Since many rural people do not have bank accounts, there is a lack of information on customer behaviour in rural India

Government’s policies:

Duplicate accounts with zero balances represent a high percentage of the total accounts

- High fiscal deficits and statutory pre-emptions imposed on banks

- Persisting interest rate restrictions—“floors” on short-term deposit rates and lending rates, “caps” on small loans

- Government’s domination of and interference in rural banks, particularly RRBs and cooperative banks, further distort bankers’ incentives;

- Inefficiencies arising from weak governance & poor management,

- Weak regulatory standards & Lack of supervision

- Political pressure on banks to achieve programme targets

BC Model – Viability issues:

- Scarcity of staff

- Inadequate commissions

- Accounts opened have remained non-operational

- Though BCs have increased savings for poor households, this increase is not primarily held in savings accounts

BCs should be selected on the basis of their residence as research has proven that BCs, who reside in the vicinity of their clients and are often from the same community, can more easily address such constraints—

- Reminders or “nudges” to save and contracts that commit households to save can be utilized.

- Peer pressure through social networks will lead to enhanced savings

- Proven results—

- Increased total savings of both landowning and landless households

- Savings of the landless increased more than those of landowning households

- Tie-up between the financial system and Mahatma Gandhi National Rural Employment Guarantee Act— access to a BC increased the wage income and hours of work of landless households, particularly that of women

Infrastructure:

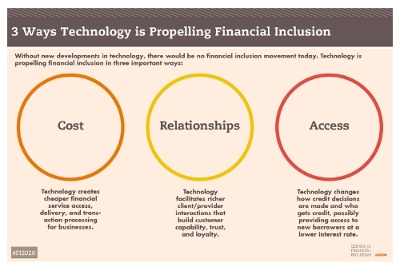

- Technology issues: Non-availability of physical and digital connectivity as well as low rural television-density

- Solution: Technological improvements allowing financial transactions through point-of-service instruments; enabling a model based on local bank agents significantly lowering the costs of serving the poor

- Lack of Bank branches—Limited delivery capability as ATM penetration is low and other channels such as Phone and Internet Banking are non-existent in rural areas

- Poor physical and social infrastructure—unpaved roads and limited access to modern transportation

IASbaba’s Views:

Financial Inclusion and Financial Literacy are two sides of the same equation—

Financial Inclusion acts from supply side by providing financial market/services that people demand whereas Financial Literacy stimulates the demand side by making people aware of what they can demand. Therefore, access to financial services and Financial Education must happen simultaneously and must be a continuous, an ongoing process and must target all sections of the population.

Need to-

- Create awareness of basic financial products through dissemination of simple messages of financial prudence in vernacular language—activities included publication of comic books on banking and RBI; games on Financial Education; arranging school/college visits for creating financial awareness; participation in exhibitions/fairs/melas at the State & District levels; conducting essay competitions and quizzes in schools to create awareness about banking and RBI; outreach programmes undertaken by the Top Management and Regional Offices; RBI’s Young Scholars Scheme, etc.

- Loans for education should be seen as an investment for economic development and prosperity, since knowledge and information would be the principal driving force for economic growth in the coming years. Facilitation of economically weaker sections of the society to avail educational loans from scheduled banks with modified easier norms should be made a priority.

- Digitisation of banking: will help access a wider range of customers in rural India; Digital applications (wallets, mobile-to-mobile payments) are adding to transaction traffic

- Inculcate saving & banking habit: Critical to conduct financial literacy and credit counselling programmes, offer skills training to enhance income generation, form self-help groups and fund these groups for income-generating activities thereby enabling the delivery of viable credit to the rural poor in a sustainable manner

Connecting the Dots:

- The future of India is dependent upon the triad of financial inclusion, financial literacy and financial stability. Discuss

MUST READ

A cautionary note

Controversy over Karnataka RS polls is an opportunity to bring in crucial electoral reforms

House matters

For Criminal Defamation

MIND MAPS

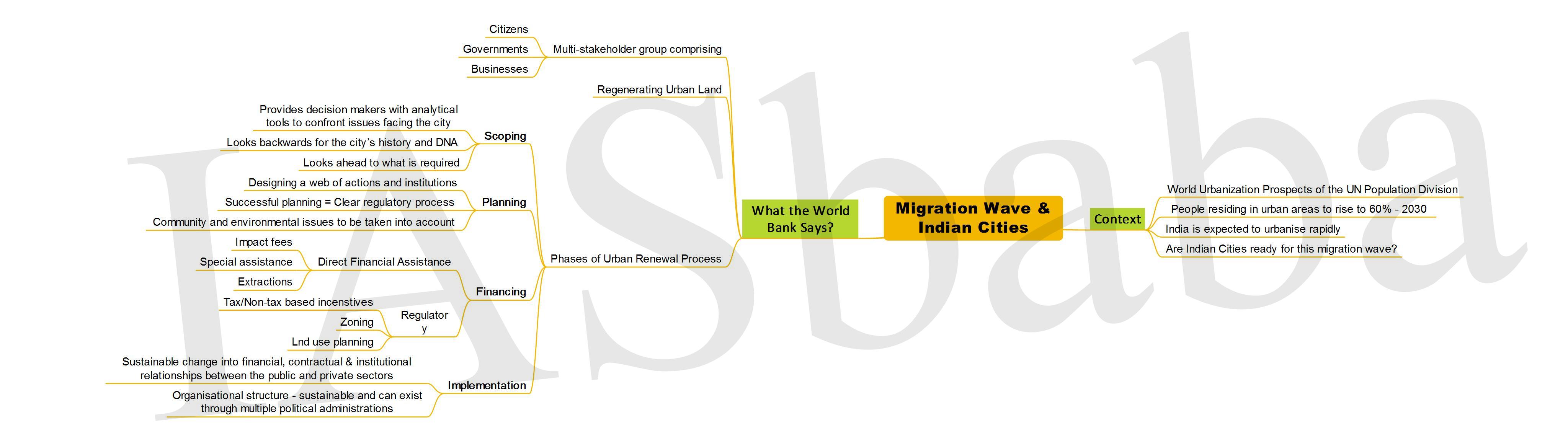

1. Migration Wave & Indian Cities