IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Aug 2016, UPSC

Archives

IASbaba’s Daily Current Affairs – 8th August, 2016

ENVIRONMENT

TOPIC: General Studies 3

- Conservation, environmental pollution and degradation, environmental impact assessment

Walking into an ecological wilderness

The use of renewable energy has to be balanced with the generation of renewable energy for a sustainable future.

Global Footprint Network

- On a particular day the natural resources earmarked for an entire year are used up before time. Such day is called ‘Earth Overshoot Day’

- August 8, 2016 marks the Earth Overshoot day when the world operates to overshoot for the rest of year by exerting excess pressure on Earth for any resources drawn

- Global Footprint network calculates the overshoot data. Every year, the day come around earlier than the previous year.

- Earth Overshoot Day has moved from late September in 2000 to August 8 in 2016

- Reason: Population growth and increased consumption levels of renewable natural resources.

Take note of the gap

- The world is going to consume resources allotted by nature for 2017

- At present, the population demands 64% than what Earth can renew

- This is visible through overfishing, overharvesting forests and emitting more carbon in atmosphere than what can be absorbed

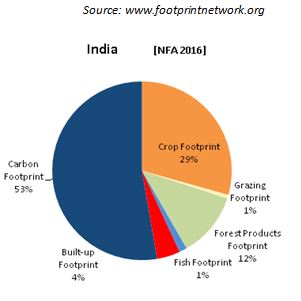

Photo credit: http://www.thehindu.com/multimedia/archive/02964/india_carbon_footp_2964226a.JPG

Ecological footprint

- The scale of ecological overshoot is measured by comparing

- Human ecological footprint= human demand for renewable natural resources

- Biocapacity= nature’s ability to regenerate renewable resources

- China, USA and India have highest ecological footprint

- India has the 25th lowest ecological footprint per person.

- It would take 6 Indias to support the population demand on nature

- India follows the global trends wherein India is expanding its ecological footprint by burning excess fossil fuels

- There has been 100% increase in India’s ecological footprint level from 1961 to 2012

- Reason: India consumes fossil fuels which is 53% of the country’s demand for natural resources

- India has an increasing ecological deficit, the main culprit being the increasing carbon footprint as natural ecosystems within the boundaries fulfil the demands dependent on nature.

- Earlier: cropland and forest footprints were the largest components of India’s overall ecological footprint

- Impact of ecological footprint: ecological overspending is noticeable in soil erosion, desertification, reduced cropland productivity, overgrazing, deforestation, rapid species extinction, fisheries collapse and increased carbon concentration in the atmosphere

- Ray of hope:

- The greatest success story is that national supply of biological resources has remained constant.

- The agricultural productivity has increased at par with increasing population

Understanding natural resources

- It is necessary to understand that natural resources are not unlimited

- Though crisis around the world is frequently framed as ethnic or religious conflicts, the real reason is the erosion of resources needed for surviving. It includes erosion of natural resources security, than economic and social and then political hardship

- It is required to recognize such patterns and take appropriate actions

Change is possible

- The Sustainable Development Goals- adopted in September

- The Paris Climate Agreement- signed in December

-are the hope giving frameworks which take all possible measure to save the natural resources and reduce ecological footprint

- If world adheres to Paris climate goals, which is adopted by 190+ countries, the carbon emissions will fall to zero by 2050

Conclusion- Change is must

- The Paris Accord highlights the new way of living for the world

- And fortunately, the current and emerging technologies make the new way possible

- As per an economic analysis, the benefits of following the new way exceeds the costs involved

- How: the emerging sectors like renewable energy are simulated and risks and costs associated with stranded assets are reduced

- The responsibility to protect the nature and thereby ourselves is not the responsibility of only governments

- Every single person has the opportunity to participate by determining the choices made in everyday lives and actively contribute to the world that will be left for future generations

- A sustainable world is possible through transforming individual and collective mindsets

Connecting the dots:

- “We can be the saviour or destroyer of ourselves”. Explain in terms of ecological footprint.

- The world has adopted encouraging frameworks to mitigate and then fully eliminate climate change disasters. Analyse such international initiatives.

ECONOMY

TOPIC:

General Studies 3

- Indian Economy and issues relating to mobilization of resources, growth, development

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation; Important aspects of governance, transparency and accountability

NPAs: Banks alone are not to blame

The non-performing assets (NPAs) in the Indian banking system have become a big concern – posing a threat to the stability of the country’s financial system and the economy as such.

- The share of NPAs in banks’ total advances is moving close to the double-digit level.

- The percentage of stressed assets has already crossed 11 per cent.

This has created heated discussions in the Parliament, media and the financial markets at home and abroad.

Realising the severity of the problem and the ineffectiveness of the Debt Recovery Tribunals (DRTs) or the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, the Centre now proposes to enact a new debt recovery bill.

A big worry

NPAs, which started as an issue concerning public sector banks (PSBs) alone, has now engulfed the entire industry. It has led to continued high interest rates, poor investments and low credit off take – thus has threatened the entire economy itself.

Industries and enterprises, however big or small, have become sick, with exceptions such as consumer goods, pharmaceuticals and utilities such as telecom and transport.

Banks alone are not to blame for the mounting NPAs

- prolonged downturn in the world economy,

- falling commodity prices,

- complex workings of the bureaucracy,

- typical bureaucratic red tape,

- long delays and gestation periods of several infrastructure projects,

- delays in land acquisition and

- politically inspired agitations

-have caused distress in the banks’ assets and have played part in the mounting NPAs.

However, the failure of the road, bridge, coal and power projects, accounting for a major chunk of the NPAs can’t be blamed on the world economy. The reasons are homegrown and the governments can’t absolve themselves of their responsibility.

If on one hand, the inadequate and poor risk assessment of the proposals by the banks began increasing the NPAs, while on the other hand, the policies and procedures pursued by governments and their bureaucracies too played a significant role.

Poor Politics

- Political groups in conflict with each other create hurdles in the smooth implementation of decisions taken.

- Both, the enactment of legislation and its implementation was never smooth.

- Policies kept changing with changes in governments. Worse, the governments did not even assume responsibility for the about-turns that crippled many a project.

- Resistance to toll collection in road and bridge projects became a political weapon forcing some States to stop collections altogether. In such cases, compensation to promoters was neither adequate nor timely.

- Continuous tinkering with tariffs or collection of user development charges in case of rail and airport projects left both the project promoters and the lenders in a quandary, upsetting the revenue projections.

Poor Bureaucracy

- The bureaucracy and tax authorities operate in a world of their own, oblivious to the market realities.

- Their interpretation of law is always aimed at meeting their targets for filling coffers of governments.

- Violation of law or well-settled decisions or awards of the arbitrators, tribunals and courts, is carried out routinely. Valid precedents are ignored as well.

- Appeals against adverse awards and judgements are made without proper examination of the merits; nor are they based on sound legal advice.

- Some cases are taken right up to the Apex Court, leading to accumulation of a large number of cases and taking unduly long time for settling claims/payments.

- In the face of such unpredictable and uncertain delays, the debt burden only mounts. The promoters fail to service the debt or honour their commitments for repayment of the loans.

The ban in mining projects, delay in environmental related permits affecting power, iron and steel sector, volatility in prices of raw material and the shortage in availability of power have all impacted the performance of the corporate sector. This has affected their ability to pay back loans.

The way ahead

Strict timelines for decisions by various authorities including arbitrators or tribunals should be in place.

The simplest approach to cut down NPAs is to recover the bad loans. Government of India has promulgated the following Acts to recover the bank dues and institutions.

- The Securitization Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002

- The Recovery of Debts Due to Banks and Financial Institutions Act, 1993

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002

- The Act empowers Banks / Financial Institutions to recover their non-performing assets without the intervention of the Court, through acquiring and disposing of the secured assets in NPA accounts with outstanding amount of Rs. 1 lakh and above.

- The banks have to first issue a notice. Then, on the borrower’s failure to repay, they can:

- Take possession of security and/or

- Take over the management of the borrowing concern.

- Appoint a person to manage the concern.

Recovery of Debts Due to Banks and Financial Institutions (DRT) Act, 1993

- The Act provides setting up of Debt Recovery Tribunals (DRTs) and Debt Recovery Appellate Tribunals (DRATs) for expeditious and exclusive disposal of suits filed by banks/FIs for recovery of their dues in NPA accounts with outstanding amount of Rs. 10 lac and above. Government has, so far, set up 33 DRTs and 5 DRATs all over the country.

Lok Adalats

- Section 89 of the Civil Procedure Code provides resolution of disputes through ADR methods such as Arbitration, Conciliation, Lok Adalats and Mediation. Lok Adalat mechanism offers expeditious, in-expensive and mutually acceptable way of settlement of disputes.

Government has advised the public sector banks to utilize this mechanism to its fullest potential for recovery in Non-performing Assets (NPAs) cases.

It is hoped that the policy and legislative initiatives taken by the present government will, to some extent, mitigate the problems. But much depends on the spirit with which bankers, the promoters and the bureaucracy respond to the concerns and bring about the necessary changes in the environment.

Connecting the dots:

- How does NPA affect Indian economy? How can Government, Banks and RBI work in sync in reducing NPA and reduce its effects on economy?

- Critically examine why NPA has become a major threat to the stability of the country’s financial system and the economy as such and steps needed to address this issue.

MUST READ

Not a full-fledged State

Golden rice isn’t ready yet

Andhra Pradesh wants Special treatment: Why, and why the Govt isn’t keen

TA, a back-up for the Army

The Royal Canvas

When is a 4% inflation target really 4%?

India’s next challenge: building state capacity

GST and caveats for the IT and e-commerce sectors