The Big Picture- RSTV

RBI Policy Review and Demonetisation fallout

TOPIC:

General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Despite the possibility of growth being impacted due to the crippling cash crunch due to the currency ban, the RBI left the main repo rate interest rate unchanged at 6.25% to keep inflation in check. Most analysts had expected a rate cut of 25bps to 6%. The banks got a major liquidity boost with central bank withdrawing the 100% incremental CRR which was imposed on November 26. The RBI also forecasted the inflation to be about 5% for Q4 stating that some of the price reduction resulting out of demonetisation could be temporary.

RBI’s monetary policy review after currency ban

The major takeaways are:

- Reversal of incremental 100 percent Cash Reserve Ratio (CRR)

- No change in policy rates

- The cash that will not be deposited in bank post the demonetisation decision will not be taken as surplus. Instead, the liability will reside on its book.

- Reduced GVA forecast from 7.6% to 7.1%

- The inflation forecast has been predicted at 5%

The concern about inflation is much appreciated as there has been oil price increase. Food prices are going up and then the rupee is weakening. So, from those perspectives, there were risks to inflation.

The growth estimates have been put forward very optimistically with projections of 7.1% growth.

RBI’s view on growth and inflation is consistent with minimal damage to the economy on account of demonetisation. This can mean that perhaps RBI is going to re-monetise very quickly which is not known.

Reasons for keeping repo rate unchanged

There were expectations from the government for lowering of interest rates but it seems that RBI has chosen to be guided by other macroeconomic indicators for its decisions. RBI has clearly said that the reduction in inflation rate would be temporary 10-15 bps, so demonetisation is not addressing the root causes. Therefore, they are concerned about the inflationary pressures that are good enough not to guide for a repo rate reduction.

Also, many felt that US fed rate hike is one of the bearing on their decision. But this reason was previously factored in and there was not much room for it to be mentioned again. So, this time RBI has been guided totally by what it sees on inflation front to keep the repo rate unchanged.

Relief for banks

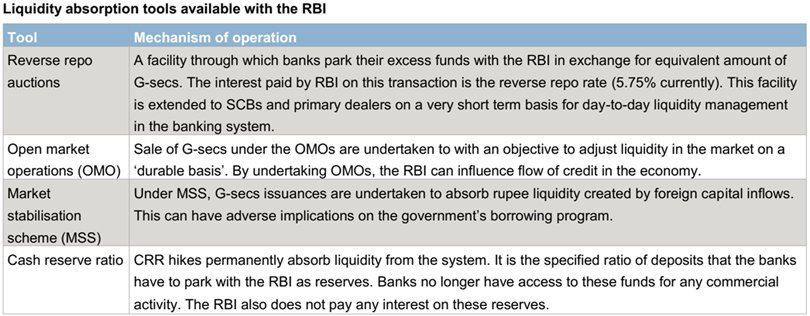

In an attempt to absorb some of the surplus liquidity available in the banking system, RBI had asked banks to maintain an incremental cash reserve ratio (CRR) of 100%. The move was estimated to suck out around Rs 3.24 lakh crore excess liquidity from the system and was applicable on deposits between September 16 and November 11 fortnights. It is a tool to check inflation as well as meet the credit needs of the productive sectors of the economy.

The incremental CRR has been withdrawn which has been big relief for the bank. RBI has said that it is going to be more accommodative towards growth. The banks are in dire state due to uncertainty caused by demonetisation and then when all this becomes incremental CRR, the cost of banking is increasing over a period of time. In this sense, the major policy decision is removal of incremental CRR and moving towards Market Stabilisation Scheme where banks are not going to lose much out of it. This will give some boost to bank industry per se and help improve the bank balance sheet to some extent.

Now the onus is on bank to further the benefits of lower repo rate which they have not done yet with past reductions done by RBI. Therefore there should be greater scope for transmission which should be certainly be helped by the enormous liquidity that has come into the banking system all of sudden.

Picture Credit: http://www.moneylife.in/site/userimage/image/1480332641_liquidity_rbi2811.jpg

The major contribution of policy in levitating some of the uncertainty is regarding dispelling any kind of expectation that there is going to be a windfall gain for the government on account of reduced liabilities because of currency with the public in the central bank’s balance sheet. RBI made it very clear that their liabilities does not get extinguished because it still owes them and new notes have been printed.

The expectation was that the public investment would push the growth but it is not going to be there. The focus now is that what is going to drive growth ahead given that consumption will be temporarily hit. As per RBI’s calculations currently, they are expecting a sharp rebound, a V shape which is bit surprising considering that evidence on consumption of demand is severe.

Also focus will be on the tax disclosures and taxation gains to the government from the income disclosure scheme. The government has said that it is expecting somewhere between Rs. 1.3-1.5 lakh crore. It means that if the upper bound gets realised then the government gets Rs. 75000 crore of increased tax revenues. However, what actually materialises has to be seen.

That is one side of story. Now the growth is going to be decelerated, RBI said 7.1% but it should be about 6.5% given the situation. There will be a dent on the revenue also. The cost of MSS should be financed by budget. So, if all these things are taken, the net gain is not going to be substantial in the overall exercise. The cost of exercise is touted at Rs. 55000 crore.

Change in goals

The top objective of demonetisation was bring forth black money and one of the assumptions that even the debate of RBI’s liability getting reduced, were expectations. The current scenario has to be seen in respect of RBI’s policy. Now the finance secretary says that he expects all money to come back. So now the objective of black money is gone. Instead, the focus has been shifted to cashless economy.

The second rationale cited was that it will lower interest rate. Therefore it will facilitate growth. The RBI’s stand of fear of inflation was known in latest policy. By taking away incremental CRR, there might be reduction in banking cost, but also the liquidity may push banks to lower the cost as lower the rates, the holding cost comes down.

In past one month, there are costs that the banking system has incurred because they have just handled the cash chaos and that has bearings on banks’ productivity, output and output of overall financial system.

So, whatever was aimed when demonetisation was announced, nothing of such is happening. In the end, there is lower growth rate forecasts, inconvenience caused among citizens and the rural migrants are going back as there is no work and no money. So it cannot be said if the exercise was worth it at this point of time.

Significance of policy

The RBI monetary policy is always forward looking. Given the uncertainty in the domestic economy where the severity is not known, outcomes is not known, RBI is staying the same. In addition to this domestic uncertainty, there is external uncertainty coming out from industrialised countries. So RBI is following a wait and watch approach.

The credit demand is low from industries- large, small and medium. Whatever lending was taking place was on retail loans like vehicle and housing loans that was driving bank credit, even that has been dented now. But RBI thinks it is temporary and it should rebound.

Conclusion

The informal sector has been badly hit and the growth has come a halt. There is no clear picture on the Indian economy. In such uncertain situations, the central bank behaves such and holds status quo. The budget will show what the next steps to be taken are. The focus ought to be at the increase at the economic activities. In that light, RBI has taken an optimistic view on growth and they expect the disruption to be temporary. But considering the latest data on state of economy, it has been only consumption demand that is driving growth. Investment has been weak and in last three quarters it was negative. The break up of investment profile on production side tells that private corporate balance sheets are laden with debt, the de-leveraging is slow and that is mirrored in banking sector whose balance sheets are equally weakened with inadequate capital. Huge burden of NPAs and resolution of it is proving difficult. This is a current status of fragile balance sheets of corporates and banks. When a financial shock of this nature hits, then the disruption can be more damaging than when the balance sheets are healthy.

Connecting the dots:

- How does the central bank plays a decisive role in determining the path of economic growth? Critically examine.