All India Radio

Dissolution of FIPB

Search 25th May 2017 http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

TOPIC: General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Statutory, regulatory and various quasi-judicial bodies

Background

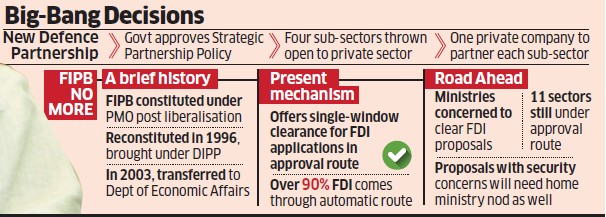

In the Union Budget of 2017-18, the government had indicated its decision to do away with Foreign Investment Promotion Board (FIPB). Acting on that, the Union Cabinet decided to abolish FIPB in 2017.

What is FIPB?

It was a gateway for 25 years to allow foreign investors in India. It was an inter-ministerial body housed in the Department of Economic Affairs in the finance ministry. Its members included Department of Industrial Policy and Promotion (DIPP), commerce secretary, economic relations secretary in the ministry of external affairs and overseas Indian affairs secretary.

The change– Now individual departments of the government have been empowered to clear FDI proposals in consultation with DIPP which will also issue the standard operating procedures for processing applications.

Significance

The present government has been open about Foreign Direct Investment and bringing it to maximum sectors. The FIPB was a procedural thing as it used to process FDI proposals and recommend for approval to appropriate body. Today for large number of sectors, FDI is allowed through automatic route. So FIPB doesn’t hold any relevance now.

However, there are still about 11 sectors which require government approval. The abolition has two important indication

- It signals foreign investors that government is going to any extent to ease the process of promotion of FDI within country

- The FIPB name is outdated. It was set when the Indian economy was open to promote foreign investment. But over the years, it became a clearance mechanism and not a promotional board. So it lost a great significance.

Thus, it was thought that the concerned ministry will do the clearances and approval rather than by a separate board. This will be a great boost to investments in those sectors where there is still government approval is required. In last financial year, India attracted $60 billion worth FDI and India continues to be attractive destination. So, it will further encourage foreign investors to come to India.

For the remaining sectoral permission mechanism, there will be a standard procedural guideline which will be announced by Departmental Industrial Policy Promotion. For example

- The defence and the pharma sector continue to be on approval route where investors require approval to bring foreign investments.

- In agriculture, 49% is for food processing and other sectors have 100% under automatic route subject to certain conditions.

- Print media has 26% but requires government approval. The sensitivity involved in the sector chosen for government approval has to be understood.

- In mining, there is automatic approval. But for mining of rare earth etc. which are crucial for country, prior approval is required.

- There is 100% FDI in retail food sector but it is through government approval.

Many of these sectors in due course might go into automatic route. Only the sectors where country’s strategic interest is involved will be kept for government approval.

However, if it takes long time to decide the guideline, then the purpose of removing FIPB will be lost.

The other thing is that guideline should be simpler. The DIPP should be proactive in educating other ministries in role of FDI and explaining guidelines so that it moves fast.

The new system

Post FIPB, the new system is expected to be reviewed on annual basis. Government will look at the system and may further liberalise the full system of FDI and evaluate how ministries are performing. It will be no good if FIPB is struck down and new system keeps proposals pending.

However, there is no change for FDI of more than Rs. 5000 crores, for which it will have to go through Cabinet Committee on Economic Affairs. This has been retained.

FIPB was not approval but an examining and recommending body. Upto Rs.5000 crores were approved by finance ministry and more than that was to CCEA. This process has not been changed.

They have removed examine and recommend mechanism and not the approval mechanism.

Sensitive FDI would require security clearance from home ministry. For eg. Telecom equipment has implication for national security or internal security. Government has taken care that national security is not compromised.

Challenges

Ease of doing business- starting the business is one important component which will be simplified. But there are certain constraints like enforcement of contract, registration of property, getting construction permit etc. At present, there is report of 20 years lag time in enforcing the contract. So further ease of doing business requires active support from state government. It also requires active support from judiciary and strengthening of local bodies.

Then only the global rank in ease of doing business can be expected to improve.

Impact on global trade

The make in india is not about manufacturing in domestic market. The government wants India to be a global player. Anything which enhances the ease of doing business, encourages global companies to set up manufacturing will provide that opportunity to India to manufacture in competitive way. India has the confidence that it doesn’t want to stay in domestic market but wants to be a global player.

Thus, Ease of doing business, Make In India, FDI are all interrelated.

Connecting the dots:

- Explain the significance of abolishing FIPB. What are the challenges that the new course of action can face. Describe.