IASbaba's Daily Current Affairs Analysis

IASbaba’s Daily Current Affairs (Prelims + Mains

Focus)- 26th December 2017

Archives

(PRELIMS+MAINS FOCUS)

LIGO-India

Part of: Mains GS Paper III- Science & Technology

Key pointers:

- A new gravitational wave detector to measure ripples in the fabric of space and time is set to be built in India by 2025, in collaboration with universities from across the globe.

- The new Laser Interferometer Gravitational-Wave Observatory (LIGO) detector will add to the two already operational in the US.

- A third LIGO detector will help pinpoint the origin of the gravitational waves that are detected in future.

- The Inter-University Centre for Astronomy and Astrophysics (IUCAA) Pune will run the detector.

- The LIGO India partnership is funded by the Science and Technology Facilities Council (STFC) through its Newton-Bhabha project on LIGO. The Raja Ramanna Centre for Advanced Technology in Indore and Institute for Plasma Research in Ahmedabad are in charge of building various parts of the system.

IndIGO:

- IndIGO, the Indian Initiative in Gravitational-wave Observations, is an initiative to set up advanced experimental facilities, for a multi-institutional Indian national project in gravitational-wave astronomy.

- The IndIGO Consortium includes Indian Institutes of Technology (IIT), Indian Institutes of Science Education and Research (IISER) and Delhi University, among others.

- Since 2009, the IndIGO Consortium has been involved in constructing the Indian road-map for Gravitational Wave Astronomy and a strategy towards Indian participation in realising the crucial gravitational-wave observatory in the Asia-Pacific region.

Gravitational waves:

- The existence of these waves were first predicted by Albert Einstein 100 years ago in his general theory of relativity.

- Massive accelerating objects – such as neutron stars or black holes orbiting each other – would disrupt space-time in such a way that ‘waves’ of distorted space would radiate from the source. These ripples travel at the speed of light through the universe, carrying with them information about their origins, as well as invaluable clues to the nature of gravity itself.

Article link: Click here

Reservoir computing system

Part of: Mains GS Paper III- Science & Technology

Key pointers:

- Scientists have developed a new type of neural network chip that can dramatically improve the efficiency of teaching machines to think like humans.

- The network, called a reservoir computing system, could predict words before they are said during conversation, and help predict future outcomes based on the present.

- Reservoir computing systems, which improve on a typical neural network’s capacity and reduce the required training time, have been created in the past with larger optical components.

Article link: Click here

(MAINS FOCUS)

INTERNAL SECURITY/NATIONAL

TOPIC:

General Studies 3:

- Security challenges and their management in LWE areas; linkages of organized crime with terrorism.

- Role of external state and non-state actors in creating challenges to internal security.

General Studies 2:

- Development processes and the development industry the role of NGOs, SHGs, various groups and associations, donors, charities, institutional and other stakeholders

Maoist Problem: A permanent solution

Introduction:

The Central Reserve Police Force lost 40 personnel in two Maoist attacks in the first half of 2017 in Sukma, the most severely Maoist-affected district of Chhattisgarh. Though the forces were jolted by these attacks, their spirit to fight back has not dampened. Rather, they continue to undertake challenging development work in the red corridor areas.

This shows how the paradigm on tackling Maoism has changed over time.

The government’s response has matured in terms of deliverance — from reactive it has become proactive, and from localised it has become holistic.

Background:

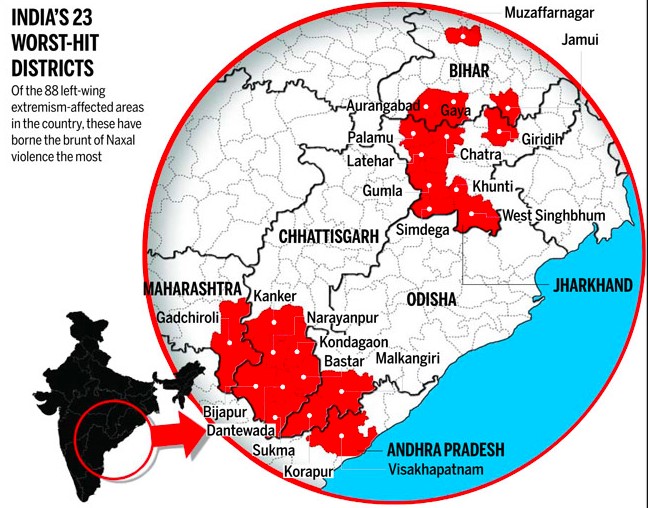

The Red Corridor is the region in the eastern, central and the southern parts of India that experience considerable Naxalite–Maoist insurgency. These are also areas that suffer from the greatest illiteracy, poverty and overpopulation in modern India, and span parts of Andhra Pradesh, Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Telangana, and West Bengal and eastern Uttar Pradesh states.

Pic credit: http://indpaedia.com/ind/images/6/61/Districts_affected_by_naxal_violence.jpg

Proactive policing:

Security forces are no longer reactive.

- When the Maoists decided to deepen their roots into Gariaband, the State government notified this division as a new district, which gave a fillip to development work.

Many new police stations and security camps were set up to prevent any major Maoist attack.

The cadre strength of the Maoists has consequently reduced. - Similarly, a police action in Raigarh district eventually forced the Maoists to abandon their plan of expansion.

The Ministry of Home Affairs, too, subsequently removed Raigarh from its Security Related Expenditure scheme. - When the Maoists decided to create a new zone in Madhya Pradesh, Maharashtra and Chhattisgarh, the target districts were immediately put on alert, so as not to allow them to gain ground.

Security forces were redeployed to ensure better territorial command. - As the Chhattisgarh police have experience in tackling Maoists in Bastar, they are now coordinating with the bordering States to strengthen intelligence and ground presence. Such coordinated proactive policing will dampen the Maoists’ plans.

Steps taken: Finding a permanent solution

The Maoist problem is not merely a law and order issue.

A permanent solution lies in eliminating the root cause of the problem that led to the alienation of tribals in this area.

- The focus now is to build roads and install communication towers to increase administrative and political access of the tribals, and improve the reach of government schemes.

- The government has enhanced the support price of minor forest produce like imli(tamarind).

- More bank branches have been opened to ensure financial inclusion.

- All India Radio stations in the three southern districts of Bastar will now broadcast regional programmes to increase entertainment options.

- And a new rail service in Bastar is set to throw open a new market for wooden artefacts and bell metal.

- Despite the Maoists not wanting their children to study and get government jobs, remarkable work has been done in the field of school education and skill development.

- The government has opened up livelihood centres, known as Livelihood Colleges, in all the districts.

If the youth are constructively engaged by the government, the recruitment of youth by the Maoists will slowly stop.

Path ahead:

Winning a psychological war – Role of civil society

Winning a psychological war against the Maoists remains an unfinished task.

Though the government’s rehabilitation policies have helped the surrendered cadres turn their lives around, security personnel are still accused of being informers and are killed. A permanent solution lies in reversing the alienation of tribals.

To end this, civil society must join hands with the government in realising the villagers’ right to development.

Loopholes in implementing government schemes must not be used as a tool to strengthen the hands of the Maoists. Indian democracy is strong enough to absorb even its adversaries if they abjure violence.

Conclusion:

The two-pronged policy of direct action by the security forces combined with development is showing results — the government has already made a dent in most of the affected districts and is determined to check the expansion of Maoists. The paradigm of proactive policing and holistic development should ensure more such significant results in the future.

However, for the success of Winning Hearts and Minds (WHAM) strategy it is essential that the civil society is roped in.

Connecting the dots:

- The two-pronged policy, of the government, of direct action by the security forces combined with development in Maoist-affected areas is showing results. Discuss.

NATIONAL

TOPIC: General Studies 3:

- Inclusive growth and issues arising from it.

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Promoting financial Inclusion: Moving beyond BC model

Background:

Since Independence, several attempts have been made towards financial inclusion of the poor, particularly in rural areas.

The initiatives include the cooperative movement, followed by priority sector lending, lead bank scheme, service area approach, creation of National Bank for Agriculture and Rural development, introduction of regional rural banks/ local area banks, microfinance, kisan credit cards, business correspondence and finally Pradhan Mantri Jan-Dhan Yojana.

It is time to introspect as to why these programmes have not been effective in improving economic conditions of the poor people.

Poor success:

The outcome of earlier financial inclusion programmes has been much below expectations.

- According to NSSO reports, the share of institutional credit to farmers declined from a peak of 69.4 per cent in 1991 to 56 per cent in 2012.

Farmers’ dependence on non-institutional credit has gone up from 30.6 per cent in 1991 to 44 per cent in 2012. - According to the 70th Round of National Sample Survey, among the institutional agencies, the share of commercial banks’ lending to agriculture was the highest at 25.1 per cent, followed by co-operatives at 24.8 per cent in 2012 due to their low cost.

- Self-help groups contributed only 2.2 per cent of total institutional credit.

- Micro finance institutions (MFIs) continue to charge poor borrowers 24-34 per cent, close to the usurious interest rates charged by village money lenders.

Issue:

- All the above initiatives are supply driven — supply of banking services to the poor people at their doorstep.

Availability of finance is a means to an end, but not an end in itself. The ultimate objective is to provide a constant source of income to the poor so that they will demand financial services. If banks do not wish to penetrate into remote rural areas, other service providers could surely do so, provided there is a genuine demand for it.

Supply-driven financial inclusion does not work. - The RBI has nudged banks to open a brick and mortar branch in every village with a population of 2,000 or more. However, according to the 2011 Census, 96 per cent of Indian villages have a population of less than 1,000.

The BC model:

In order to provide banking services at reasonable costs to the poor people, the business correspondents model was introduced in 2006.

Being technology driven, the BC model played a critical role in opening large number of Jan-Dhan accounts during the recent period, but was unable to provide basic banking services to them for several reasons.

Why BC model failed?

- The BC model is similar to the agency model followed by insurance companies and pension funds. Out-sourcing of financial services through agents for a commission has been somewhat successful in case of other financial services, as the agents get a constant flow of income.

The compensation in the case of the BC model is awfully inadequate compared to the services expected from them. - Banks’ lending activities through BCs are negligible. The activities of BCs are typically limited to opening new deposit accounts for a commission. The opportunity of opening new deposit accounts is quickly exhausted, particularly after the success of Jan-Dhan Account scheme.

- BCs are expected to provide small withdrawal and deposit facilities besides remittance service to all deposit holders. He is all in one — a clerk, cashier, branch manager, financial adviser and agent for rural digitization. BCs either neglect these activities, or are not in a position to do justice to them due to the sheer workload.

- Some BCs do agency functions for mutual funds or sell small savings instruments as they get a fair amount of commission. Hence, it is natural for them to ignore basic banking activities that are less lucrative.

- Handling cash is also risky, particularly where the base branch is far away. BCs have limited overdraft facility that may not be sufficient for daily requirement of the account holders.

Way forward:

- As highlighted in Economic Survey 2015-16, the centre can invest in last-mile financial inclusion via further improving BC networks. Regulations governing the remuneration of BCs may need to be reviewed to ensure that commission rates are sufficient to encourage BCs to remain active.

- The commission-based BC model is not working well for the banking system, unlike for other financial services. Thus, all ultra-small branches with a BC model with more than 1,000 accounts may be immediately converted into brick and mortar branches.

- Alternatively, for every 1,000 Jan-Dhan accounts in a locality, there should be a physical branch.

Accounts from multiple banks may be shifted to the bank ready to open a brick and mortar branch to serve 1,000 such account holders.

Conclusion:

The Government should pool all resources under several rural development schemes and provide a scheme-based permanent source of income through gainful employment to the rural people. Although, schemes may vary from state-to-state, it would provide a constant source of income and make the financial inclusion truly demand-driven.

Connecting the dots:

- What do you understand by the term BC model for financial inclusion? The model has failed to promote financial inclusion. Critically analyze.

MUST READ

This year on Jerusalem

The rise and fall of the WTO

A glimmer of hope

Catching up on information statecraft

For kinder smart cities