All India Radio

Ban on Crypto Currency

Search 23rd July, 2019 Money Talk here: http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3

- Indian Economy, Banking

- Development in IT

In News: A government panel had proposed a draft bill titled Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019. The move will make it illegal to deal in any cryptocurrency in India, which is not regulated by the government. That will include currencies such as Bitcoin, Ethereum, Ripple and more.

Cryptocurrencies enable some level of anonymity in transactions, operate on decentralised networks outside central banking systems, and are subject to fluctuation. Naturally, consumer and market protection, and lack of accountability of users and exchanges are relevant triggers for regulation. While the recommendations elaborate on some of these concerns, they make a limited case for regulation and not a blanket ban.

What are cryptocurrencies?

Cryptocurrencies are digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds.

Cryptocurrency has been defined as “any information or code or number or token not being part of any official digital currency, generated through cryptographic means or otherwise, providing a digital representation of value which is exchange with or without consideration, with the promise or representation of having inherent value in any business activity which may involve risk of loss or an expectation of profits or income, or functions as a store of value or a unit of account and includes its use in any financial transaction or investment, but not limited to, investment schemes.”

Benefits

- Reduces administration and transaction costs

- Obviates duplication and improves accuracy of data

- Improves the speed and efficiency of transactions and detecting fraud

Potential use cases for blockchain technology

- Payments systems including cross-border and small value payments

- Data identity management or know-your-customer requirements by various financial entities

- Insurance

- Collateral and ownership (including land) registries

- Loan issuance and tracking

- E-stamping

- Trade financing

- Post-trade reporting

- Securities and commodities

- Internal systems of financial service providers

Problems plaguing the cryptocurrency and blockchain industry

- Lack of regulations

- Illegitimate transactions

- Evasion of taxes

- Lack of talent

Certain justifications provided by the committee merit scrutiny. Excessive power consumption for cryptocurrency mining has been provided as a reason for the ban. The total global power consumption of banks and the internet is approximately 100 TWh and 2,500 TWh per year, respectively. Bitcoin uses 66.7 TWh per year globally. Therefore, this claim appears to be conjecture and perhaps merits a separate evaluation for India. Similarly, the committee points out China as an example that has banned the use of cryptocurrencies. Recently, a Chinese court recognised cryptocurrency as digital property. While countries such as China have adopted harsher regulation in the past, their changing approach to cryptocurrencies cannot not be ignored.

The Case against Cryptocurrencies

- All the cryptocurrencies have been created by non- sovereigns and are in this sense entirely private enterprises.

- There is no underlying intrinsic value of these cryptocurrencies back they lack all the attributes of a currency.

- There is no fixed nominal value of these private cryptocurrencies i.e. neither act as any store of value nor are they a medium of exchange.

- Since their inceptions, cryptocurrencies have demonstrated extreme fluctuations in their prices.

- These crytocurrencies cannot serve the purpose of a currency. The private cryptocurrencies are inconsistent with the essential functions of mon- ey/currency, hence private cryptocurrencies cannot replace fiat currencies.

- A review of global practices show that they have not been recognised as a LEGAL tender in any jurisdiction.

- Committee also recommends that all exchanges, people, traders and other financial system participants should be prohibited from dealing with cryptocurrencies.

The committee proposes a new form of digital currency — the Digital Rupee — which will be the only digital currency permitted under Indian law. The recommendations lack clarity on its implementation, scaling for billions of Indians, inclusion of the unbanked, and whether India possesses the necessary infrastructure for rolling out a digital currency of this magnitude.

Against the Bill

- The draft law proposed by the committee raises significant questions of implementation and enforcement. Policymakers must first assess whether the police and traditional investigation tools are equipped to investigate crimes of this nature.

- Crypto is just one manifestation of the technology. The regulation takes India away from speculative use of technology and paves the way for beneficial use of technology and thereby propagates auditable, secure digital business ecosystem.

- The blockchain technology adopted in these virtual currencies was not disputed and, therefore, a blanket ban was “arbitrary, unfair and unconstitutional”.

The Way Forward

- In order to address concerns regarding protection of users and fraud prevention, existing laws can be revisited.

- Cryptocurrency exchanges, users and other market players can be brought under the purview of anti-money laundering laws or KYC norms.

- Like the US, sectoral regulators can monitor aspects of cryptocurrency for the purpose of taxation or monitoring large transactions.

- The government should work towards developing a risk-based framework to regulate and monitor cryptocurrencies and tokens. A ban would inhibit new applications and solutions from being deployed and would discourage tech startups. It would handicap India from participating in new use cases that cryptocurrencies and tokens offer.

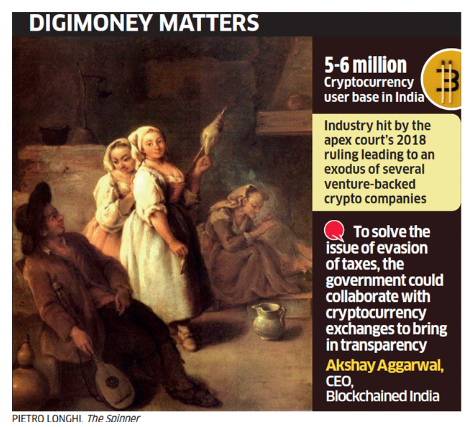

- To solve the issue of evasion of taxes, the government could collaborate with cryptocurrency exchanges to bring in transparency. All legitimate cryptocurrency exchanges would be ready to collaborate with the government.

- To address consumer protection concerns, cryptocurrency-based businesses can be tested in the regulatory sandboxes being launched by the financial sector regulators across the country. We should work towards creating a regulatory framework that will constantly monitor and prevent illegal activities. Regulating would allow the law enforcement agencies to be better equipped to understand these new technologies, enable them to gather intelligence on criminal developments and take enforcement actions

Undoubtedly, a case can be made for making reasonable regulation to ensure that block chain-based cryptocurrencies don’t upend the existing financial security of the country, but the way forward isn’t a ban. As the government mulls its next move, it is important to consider a reasonable policy that suitably balances technological innovation and protection of users and economic interests.

Do you know?

Facebook’s own cryptocurrency: Libra

Must Read: Virtual Currencies

Connecting the Dots:

- What are Cryptocurrencies? How Do Cryptocurrencies work? Are there risks involved in cryptocurrencies? Examine