All India Radio

Surging Global Oil Prices

Search 17th September 2019 Spotlight here: http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

In news: Global oil prices surged the most on record after a strike on a Saudi Arabian oil facility removed about 5% of global supplies, an attack the US has blamed on Iran.

What happened?

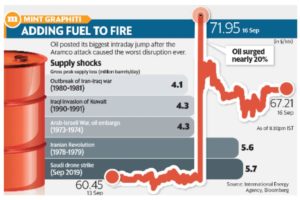

State energy producer Saudi Aramco lost about 5.7 million barrels per day of output after 10 unmanned aerial vehicles struck the world’s biggest crude-processing facility in Abqaiq and the kingdom’s second-biggest oil field in Khurais.

For oil markets, it’s the single worst sudden disruption ever, surpassing the loss of Kuwaiti and Iraqi petroleum supply in August 1990, when Saddam Hussein invaded his neighbor. It also exceeds the loss of Iranian oil output in 1979 during the Islamic Revolution, according to the International Energy Agency.

Impact

- Brent jumped more than 19% on ICE Futures Europe to $71.95 a barrel, its biggest gain in percentage terms since 1991

- Gold, the yen and Treasuries also surged on concern over the geopolitical fallout from the attacks

The vulnerability of Saudi infrastructure to attacks, historically seen as a stable source of crude to the market, is a new paradigm the market will need to deal with. Saudi Arabia is the world’s biggest oil exporter and, with its comparatively large spare capacity, has been the supplier of last resort for decades.

Saudi Arabia can restart a significant volume of the halted oil production within days, but needs weeks to restore full output capacity. The kingdom — or its customers — may use stockpiles to keep oil supplies flowing in the short term.

“No matter whether it takes Saudi Arabia five days or a lot longer to get oil back into production, there is but one rational takeaway from this weekend’s drone attacks on the Kingdom’s infrastructure — that infrastructure is highly vulnerable to attack, and the market has been persistently mis-pricing oil,” Citigroup Inc.’s Ed Morse wrote in a research note.

Concern for India

The surge in oil prices comes at a time when the Narendra Modi government is trying to boost the economy after GDP growth slumped to the slowest in more than six years. An increase in inflation stoked by higher fuel prices will also leave less space for RBI to cut interest rates to combat the slowdown.

All India Radio (AIR) IAS UPSC – Surging Global Oil Prices

a. Since India imports a large quantity of oil from Saudi Arabia, a spike in the rates could derail India’s path to economic recovery amid growth slowdown.

- India imports almost 80 per cent of its oil requirements. Saudi Arabia is India’s second-largest oil supplier of crude and cooking gas. Data from the oil ministry’s Petroleum Planning and Analysis (PPAC) shows that India’s dependence on oil has increased gradually since 2017. In 2018-19, India’s oil consumption increased to 211.6 million tonnes.

- A 10 per cent rise in global crude prices will widen India’s current account deficit by 0.4-0.5 per cent of the GDP. Every dollar move in the Brent Crude prices adds around $2 billion to India’s oil import bill.

- In case of an extended disruption, the two comparable events are the Iranian Revolution of 1979 and Iraq’s invasion of Kuwait in 1990. India suffered in both cases. In the case of the Gulf War, there was added impact of Indian workers returning home, worsening India’s balance of payments

b. Volatility in global crude oil prices during a period of weak demand could further weaken investor sentiments.

c. An inflated import bill could further widen the current account deficit, which has widened to $57.2 billion, or 2.1% of GDP, in 2018-19 from 1.8% a year ago.

d. A spike in crude oil price could also make chemicals used in production of plastics, tyres, paints and a host of other items costlier.

- Considering petrochemicals have wide applications, this could accelerate inflation. Higher fuel prices could affect energy-intensive manufacturing industries.

- A spike in jet fuel could put pressure on the margins of airlines, which have recently gained from a surge in airfares after bankrupt Jet Airways (India) Ltd suspended operations in April.

e. While refiners are expected to benefit from inventory gains in the short term due to higher crude prices, a sustained rise would lead to an increase in the working capital borrowings and interest expense of refining firms.

- Besides, the gain in crude prices would lead to an increase in under-recoveries on cooking gas and kerosene, delays in the reimbursement of which by the government, as had happened in FY19, will also lead to higher working capital borrowings.

Note:

World’s most important oil choke point: The Strait of Hormuz

- A strait between the Persian Gulf and the Gulf of Oman

- A third of the world’s liquefied natural gas and almost 25% of total global oil consumption passes through the strait, making it a highly important strategic location for international trade.

- The oil producing countries around the Gulf, including Kuwait, Saudi Arabia, Iraq and Iran, are crucial for supplying the world oil market. Most of their exports, about 18 million barrels a day or about 20% of world demand, travelS through the Strait of Hormuz.

All India Radio (AIR) IAS UPSC – Surging Global Oil Prices

Connecting the Dots:

- What are the factors influencing the pricing of oil? Discuss.