IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 3rd February 2020

Archives

(PRELIMS + MAINS FOCUS)

Coronavirus: India temporarily suspends e-visa facility for Chinese and foreigners residing in China

Part of: GS Prelims –Sci & tech and GS-II – Health

In news:

- India temporarily suspended e-visa facility for Chinese travellers and foreigners residing in China in view of the coronavirus

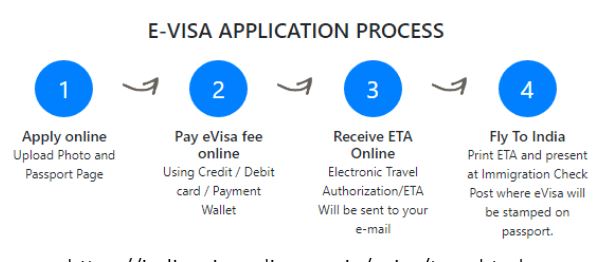

From Prelims Point of View

e-Visa:

- The India e-Visa is an electronic authorization to travel to India for business, tourism, or medical visits.

- When applying for an e-Visa, it is not necessary to submit your passport or other personal documents to the consulate.

- The e-Visa approval will be issued in advance electronically before your departure to India.

- At the immigration checkpoint the actual visa will be placed inside your passport.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 3rd February 2020

Money earned in India by NRIs will be taxed

Part of: GS Prelims –Economy and GS-III – Budget

In news :

The Finance Bill has proposed three major changes to prevent tax abuse by citizens that don’t pay taxes anywhere in the world —

- reducing the number of days that an Indian citizen can be granted non-resident status for tax purposes from 182 to 120;

- citizens who don’t pay taxes anywhere will be deemed to be a resident;

- The definition of ‘not ordinarily resident’ has been tightened.

Non-Resident Indian

- An Indian citizen who is ordinarily residing outside India and holds an Indian Passport.

- A person is considered NRI if She is not in India for 182 days or more during the financial year Or;

- If he/she is in India for less than 365 days during the 4 years preceding that year and less than 60 days in that year.

Coronavirus : Study on bats and bat hunters in Nagaland

Part of: GS Prelims –Sci & Tech and GS-II – Health

In news:

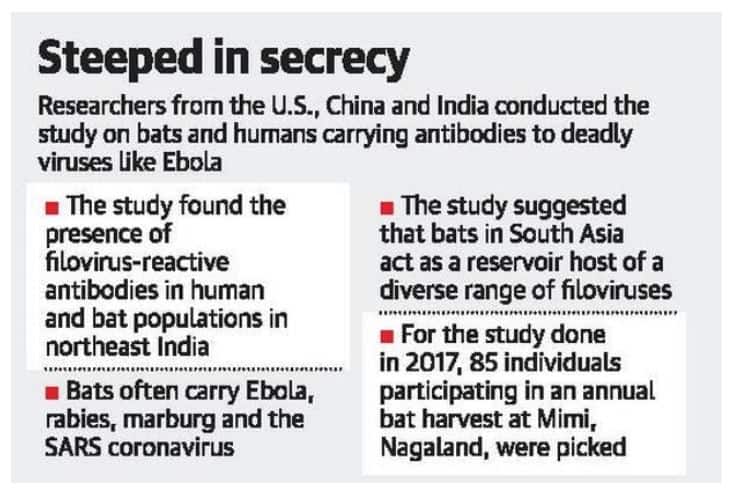

- The government has ordered an inquiry into a study conducted in Nagaland by researchers from the U.S., China and India on bats and humans carrying antibodies to deadly viruses like Ebola.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 3rd February 2020

From Prelims Point of View:

- Filoviruses are a family of non-segmented negative-stranded RNA viruses, with Marburg virus and Ebola virus constituting two different species.

In Kerala, 2,130 islands brought under CRZ regime

Part of: GS Prelims –Environment and GS-III – Conservation

In news:

- 2,130 backwater islands of Kerala, including Maradu, have been brought under the Coastal Regulation Zone (CRZ) regime thereby imposing curbs on development activities.

- This is for the first time that the list of the Kerala islands is being drawn up.

- The list of the islands was prepared by the National Centre for Earth Science Studies

Coastal Regulation Zones (CRZ)

CRZ Notification 2018 is based on the recommendations of Shailesh Nayak committee.

- Coastal stretches of seas, bays, estuaries, creeks, rivers, and backwaters were declared as CRZs under coastal zone regulation notification in 1991.

- CRZs have been classified into 4 zones for the purpose of regulation:

- CRZ-I: includes ecologically sensitive areas, where no construction is allowed except activities for atomic power plants, defense.

- CRZ-II: includes designated urban areas that are substantially built up. Construction activities are allowed on the landward side only.

- CRZ-III: includes relatively undisturbed areas, mainly rural areas. No new construction of buildings allowed in this zone except repairing of the existing ones. However, constructions of dwelling units in the plot area lying between 200-500m of the high tide line is allowed.

- CRZ-IV: includes the water area covered between Low Tide Line and 12 nautical miles seaward. Except for fishing and related activities, all actions impugning on the sea and tidal water will be regulated in this zone.

Miscellaneous

National Centre for Biological Sciences (NCBS)

- Research centre specialising in biological research (Bangalore)

- Under the Department of Atomic Energy

- Basic and interdisciplinary research in the frontier areas of biology.

- The research interests of the faculty are in four broad areas ranging from the study of single molecules to systems biology.

(MAINS FOCUS)

Indian Economy

Topic: General Studies 3:

- Government Budgeting.

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Key Highlights of the Economic Survey 2019-20 – Part 2

TARGETING EASE OF DOING BUSINESS IN INDIA

- A jump of 79 positions to 63 in 2019 from 142 in 2014 in World Bank’s Doing Business rankings.

- India still trails in parameters such as Ease of Starting Business, Registering Property, Paying Taxes and Enforcing Contracts.

- Electronics exports and imports through Bengaluru airport illustrate how Indian logistical processes can be world class.

- The turnaround time of ships in India has almost halved to 2.48 days in 2018-19 from 4.67 days in 2010-11.

Suggestions for further Ease of Doing Business:

- Close coordination between the Logistics division of the Ministry of Commerce and Industry, the Central Board of Indirect Taxes and Customs, Ministry of Shipping and the different port authorities.

- Individual sectors such as tourism or manufacturing require a more targeted approach that maps out the regulatory and process bottlenecks for each segment.

2019 GOLDEN JUBILEE OF BANK NATIONALISATION: TAKING STOCK

- Since 1969, India’s Banking sector has not developed proportionately to the growth in the size of the economy.

- India has only one bank in the global top 100 – same as countries that are a fraction of its size: Finland (about 1/11th), Denmark (1/8th), etc.

- The onus of supporting the economy falls on the PSBs accounting for 70 % of the market share in Indian banking:

- In 2019, investment for every rupee in PSBs, on average, led to the loss of 23 paise, while in NPBs (New Private Banks) it led to the gain of 9.6 paise.

Solutions to make PSBs more efficient:

- Employee Stock Ownership Plan (ESOP) for PSBs’ employees

- Representation on boards proportionate to the blocks held by employees to incentivize employees and align their interests with that of all shareholders of banks.

- Creation of a GSTN type entity that will aggregate data from all PSBs and use technologies like big data, artificial intelligence and machine learning in credit decisions for ensuring better screening and monitoring of borrowers, especially the large ones.

FINANCIAL FRAGILITY IN THE NBFC SECTOR

- Survey investigates the key drivers of Rollover Risk of the shadow banking system in India in light of the current liquidity crunch in the sector.

- Key drivers of Rollover Risk:

- Asset Liability Management (ALM) Risk.

- Interconnectedness Risk.

- Financial and Operating Resilience of an NBFC.

- Over-dependence on short-term wholesale funding.

- Analysis of a diagnostic (Health Score) by quantifying the Rollover risk provides an early warning signal of impending liquidity problems.

- The Survey prescribes to efficiently allocate liquidity enhancements across firms (with different Health Scores) in the NBFC sector, thereby arresting financial fragility in a capital-efficient manner.

Privatization and Wealth Creation

- Survey examines the realized efficiency gains from privatization in the Indian context and bolsters the case for aggressive disinvestment of CPSEs.

- Strategic disinvestment of Government’s shareholding of 53.29 per cent in HPCL led to an increase of around Rs. 33,000 crore in national wealth.

- Likewise an analysis of the before-after performance of 11 CPSEs which underwent strategic disinvestment from 1999-2000 to 2003-04 show Privatized CPSEs have been able to generate more wealth from the same resources

THALINOMICS: THE ECONOMICS OF A PLATE OF FOOD IN INDIA

- An attempt to quantify what a common person pays for a Thali across India.

- A shift in the dynamics of Thali prices since 2015-16.

- Absolute prices of a vegetarian Thali have decreased significantly since 2015-16 across India; though the price has increased during 2019-20.

Post 2015-16:

- Average household gained close to Rs. 11, 000 on average per year from the moderation in prices in the case of vegetarian Thali.

- Average household that consumes two non-vegetarian Thalis gained close to Rs. 12, 000 on average per year during the same period.

From 2006-07 to 2019-20:

- Affordability of vegetarian Thalis improved 29 %.

- Affordability of non-vegetarian Thalis improved by 18 %.

INDIA’S ECONOMIC PERFORMANCE IN 2019-20

GDP growth pegged at 6-6.5% in fiscal year starting April 1, up from 5% in current fiscal

To achieve GDP of $5 trillion by 2024-25, India needs to spend about $1.4 trillion over these years on infrastructure

Current Account Deficit (CAD) narrowed to 1.5 % of GDP in H1 of 2019-20 from 2.1 % in 2018-19

India’s BoP position improved from US$ 412.9 bn of forex reserves in end March, 2019 to US$ 461.2 bn as on 10th January, 2020.

Net FDI inflows was US$ 24.4 bn in the first eight months and Net FPI in the first eight months of 2019-20 stood at US$ 12.6 bn.

External Debt Rremains low at 20.1% of GDP as at end September, 2019.

The Gross Non performing Advance Ratio:

- Remained unchanged for Scheduled Commercial banks at 9.3% between March and September 2019

- Increased slightly for the Non-Banking Financial Corporations (NBFCs) from 6.1% in March 2019 to 6.3% in September 2019.

Bank Credit growth (YoY) moderated from 12.9% in April 2019 to 7.1% as on December 20, 2019.

Total formal employment in the economy increased from 8 % in 2011-12 to 9.98 % in 2017-18.

About 76.7 % of the households in the rural and about 96 % in the urban areas had houses of pucca structure

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 When the annual Union Budget is not passed by the Lok Sabha ?

- The Budget is modified and presented again

- The Budget is referred to the Rajya Sabha for suggestions

- The Union Finance Minister is asked to resign

- The Prime Minister submits the resignation of Council of Ministers

Q 2. What is the difference between “vote-on-account” and “interim budget” ?

- The provision of a “vote-on-account’’ is used by a regular Government, while an “interim budget’’ is a provision used by a caretaker Government

- A “vote-on-account’’ only deals with the expenditure in Government budget, while an

“interim budget’’ includes both expenditure and receipts

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q 3. Under which one of the following Constitution Amendment Acts, Bodo language was added to the list of languages under the Eighth Schedule of the Constitution of India, thereby raising their number to 22?

- Constitution (Ninetieth Amendment) Act

- Constitution (Ninety-first Amendment) Act

- Constitution (Ninety-second Amendment) Act

- Constitution (Ninety-third Amendment) Act

ANSWERS FOR 01 FEB 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | A |

| 2 | C |

| 3 | A |

| 4 | C |

MUST READ

About Analysis Budget

https://www.thehindu.com/todays-paper/tp-opinion/falling-short-of-aspirations/article30722733.ece