IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 6th February 2020

Archives

(PRELIMS + MAINS FOCUS)

Trust formed

Part of: GS Prelims and GS Mains II – Polity

In news:

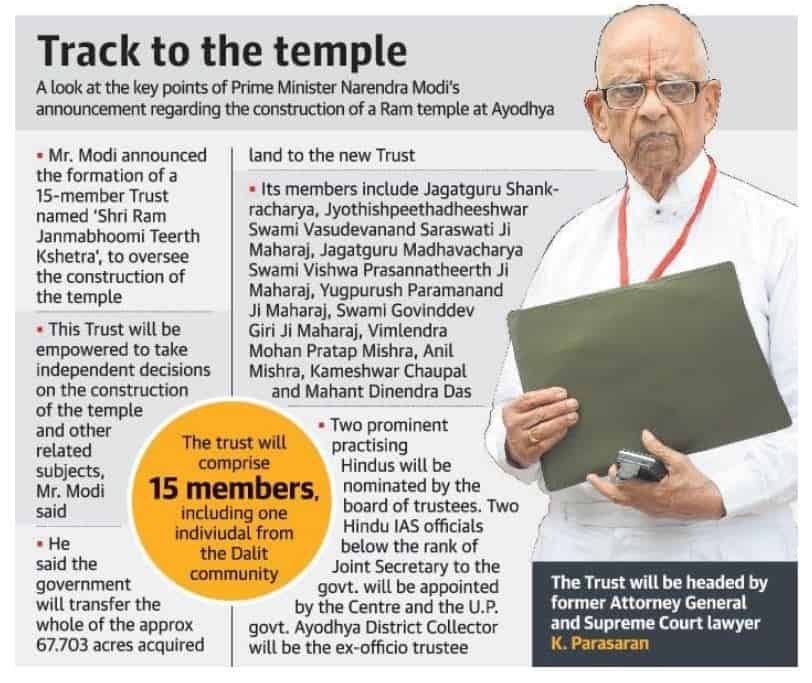

- Cabinet had approved construction of a grand Ram temple in Ayodhya

- Setting up an autonomous trust, the Shri Ram Janmabhoomi Teerth Kshetra,

- There would be 15 trustees, out of which one would always be from the Dalit society.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 6th February 2020

CPCB pulls up 14 coal plants

Part of: GS Prelims and GS Mains II – Polity

In news:

- Central Pollution Control Board (CPCB) has pulled up 14 thermal power plants for not complying with a December 31, 2019 deadline to limit sulphur dioxide emissions.

From Prelims Point of view :

CPCB :

- CPCB has the power to impose steep fines or shut a unit under the provisions of the Environment Protection Act.

- Central Pollution Control Board (CPCB) of India is a statutory organisation under the Ministry of Environment, Forest and Climate Change (MoEF&CC).

- Established in 1974 under the Water (Prevention and Control of Pollution) Act, 1974.

- CPCB is also entrusted with the powers and functions under the Air (Prevention and Control of Pollution) Act, 1981

PM pitches for boost to defence exports

Part of: GS Prelims and GS Mains II – Polity

In news:

- India became the world’s largest arms importer as it did not utilise its capacities to full potential after Independence.

- India was looking to achieve defence exports worth ₹35,000 crore in the next five years.

From Prelims Point of vew:

DefExpo

- The DefExpo is biennial event organized by Ministry of Defence. The 11th edition of the event promises to bring in new technological solutions.

- Defence Ministers from 40 countries are attending the event.

Navy will have its third Scorpene sub this year

Part of: GS Prelims and GS Mains II – Polity

In news:

- The third Scorpene submarine, Karanj, will be delivered to the Indian Navy by December and all six submarine deliveries would be completed by 2022

- The first Scorpene, Kulvari, was commissioned in 2018.

- The second Scorpene Khanderi was inducted in September last year.

From Prelims Point of vew:

Scorpene-class submarines:

- These are a class of diesel-electric attack submarines jointly developed by the French Direction des Constructions Navales (DCN) and the Spanish company Navantia, and now by Naval Group.

- It features diesel propulsion and an additional air-independent propulsion (AIP)

‘LIC IPO will certainly happen next year’

Part of: GS Prelims and GS Mains II – Polity

In news:

- The Centre has indicated that it may need to push through an amendment in the LIC Act, 1956 before the stake sale.

- Currently, the government owns 100% of LIC, the country’s largest insurer.

- Opposition parties have objected to the divestment plan, while LIC’s employee unions have claimed that it would be “against national interest.”

Life Insurance Corporation:

- Life Insurance Corporation of India (abbreviated as LIC) is an Indian state-owned insurance group and investment corporation owned by the Government of India.

- The Life Insurance Corporation of India was founded in 1956 when the Parliament of India passed the Life Insurance of India Act that nationalised the insurance industry in India.

- Over 245 insurance companies and provident societies were merged to create the state-owned Life Insurance Corporation of India.

- As of 2019, Life Insurance Corporation of India had total life fund of ₹28.3 trillion.

- The total value of sold policies in the year 2018-19 is ₹21.4 million.

- Life Insurance Corporation of India settled 26 million claims in 2018-19. It has 290 million policy holders.

(MAINS FOCUS)

Indian Polity & Federalism

Topic: General Studies 2:

- Constitutional bodies and their responsibilities

Topic: General Studies 3

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Government Budgeting

Fifteenth Finance Commission (15th FC)

Context

15th FC (Chair N.K.Singh) constituted by the President of India under Article 280 of the Constitution on November 27, 2017 was given an extension and recently submitted its first report

The commission was required to submit two reports, one for 2020-21 and the second covering the period of five years from 2021-22 to 2025-26

Basis for extension

- First, the abolition of Statehood to Jammu and Kashmir required the Commission to make an estimation excluding the Union Territory.

- Second, the deceleration in growth and low inflation has substantially slowed down the nominal GDP growth making projections for medium term risky.

- Finally, poor revenue performance of tax collection and more particularly Goods and Services Tax combined with the fact that the compensation agreement to the loss of revenue to the States was effective only two years of the period of 15FC posed uncertainities

If not for extension, making medium-term projections in the current scenario would have entailed serious risks.

Key Recommendations include:

Devolution of taxes to states: The share of states in the centre’s taxes is recommended to be decreased from 42% during the 2015-20 period to 41% for 2020-21. The 1% decrease is to provide for the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the central government.

Criteria for Devolution

| Criteria | 14th FC

2015-20 |

15th FC

2020-21 |

| Income Distance | 50.0 | 45.0 |

| Population (1971) | 17.5 | – |

| Population (2011) | 10.0 | 15.0 |

| Area | 15.0 | 15.0 |

| Forest Cover | 7.5 | – |

| Forest and Ecology (share of dense forest of each state in the aggregate dense forest of all the states) | – | 10.0 |

| Demographic Performance (based on Total Fertility rate) | – | 12.5 |

| Tax Effort | – | 2.5 |

| Total | 100 | 100 |

Grants-in-aid

In 2020-21, the following grants will be provided to states:

- Revenue deficit grants: In 2020-21, 14 states are estimated to have an aggregate revenue deficit of Rs 74,340 crore post-devolution. The Commission recommended revenue deficit grants for these states (see Table 4 in the annexure).

- Special grants: In case of three states, the sum of devolution and revenue deficit grants is estimated to decline in 2020-21 as compared to 2019-20. These states are Karnataka, Mizoram, and Telangana. The Commission has recommended special grants to these states aggregating to Rs 6,764 crore.

- Sector-specific grants: The Commission has recommended a grant of Rs 7,375 crore for nutrition in 2020-21.

- Performance-based grants: Guidelines for performance-based grants include: (i) implementation of agricultural reforms, (ii) development of aspirational districts and blocks, (iii) power sector reforms, (iv) enhancing trade including exports, (v) incentives for education, and (vi) promotion of domestic and international tourism. The grant amount will be provided in the final report.

- Grants to local bodies: The total grants to local bodies for 2020-21 has been fixed at Rs 90,000 crore (4.31% of divisible pool), of which Rs 60,750 crore is recommended for rural local bodies (67.5%) and Rs 29,250 crore for urban local bodies (32.5%).

- The grants will be divided between states based on population and area in the ratio 90:10. The grants will be made available to all three tiers of Panchayat– village, block, and district.

- Disaster Risk Management: For 2020-21, State Disaster Risk Management Funds have been allocated Rs 28,983 crore, out of which the share of the union is Rs 22,184 crore. The National Disaster Risk Management Funds has been allocated Rs 12,390 crore.

Recommendations on fiscal roadmap

- Centre should, in the coming year, rationalise centrally sponsored schemes

- Centre and states should fully reveal the extent of their off-budget borrowings, leading to accumulation of extra-budgetary liabilities

- Statutory framework for public financial management: The Commission recommended forming an expert group to draft legislation to provide for a statutory framework for sound public financial management system.

- Tax capacity: In 2018-19, the tax revenue of state governments and central government together stood at around 17.5% of GDP. India’s tax capacity largely remained unchanged since 1990s. The Commission recommended: (i) broadening the tax base, (ii) streamlining tax rates, (iii) and increasing capacity and expertise of tax administration in all tiers of the government.

- GST implementation: The Commission observed that the continuing dependence of states on compensation from the central government (21 states out of 29 states in 2018-19) for making up for the shortfall in revenue is a concern. Hence needed to have relook into the structure of GST.

- Separate defence and national security fund:It was mentioned in the terms of reference. However, 15 FC intends to constitute an expert committee to study such a proposal and will come out with its suggestions in second report.

Connecting the dots

- Concerns raised by Southern States with regard to considering 2011 population numbers, has it been addressed?

- FRBM changes recommended by N.K.Singh Committee.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q 1. Which one of the following was probed by the Liberhan Commission?

- Test Cricket Match Fixing

- Best Bakery Case

- Tehelka Tapes Case

- Demolition of the disputed structure at Ayodhya

Q 2. How is the National Green Tribunal (NGT) different from the Central Pollution Control Board

- The NGT has been established by an Act whereas the CPCB has been created by an executive order of the Government.

- The NGT provides environmental justice and helps reduce the burden of litigation in the higher courts whereas the CPCB promotes cleanliness of streams and wells, and aims to improve the quality of air in the country.

Which of the statements given above is/are correct:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 05 FEB 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | D |

| 2 | B |

MUST READ

About Speaker’s Office:

About Solution to Economic Crisis:

About Corona Virus: