IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 14th May 2020

Archives

(PRELIMS + MAINS FOCUS)

Atma-Nirbhar Bharat Abhiyaan announced

Part of: GS Prelims and GS-III – Economy

In News:

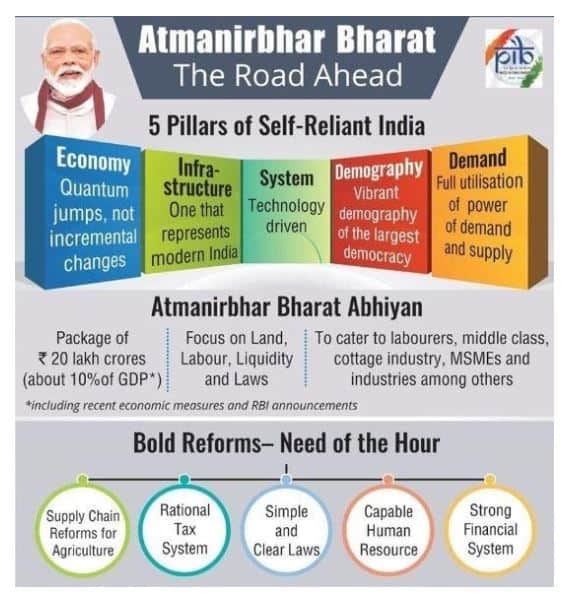

- The Indian Prime Minister recently announced a special economic package worth ₹20 lakh crore known as Atma-Nirbhar Bharat Abhiyaan.

- The aim of the abhiyan is to make India self- reliant.

Key takeaways:

The abhiyan shall include:

- new economic package (recently announced by the Finance Minister)

- earlier government announcements during COVID crisis

- decisions taken by RBI

This is equivalent to almost 10% of India’s GDP

India’s self-reliance will be based on five pillars –

- Economy

- Infrastructure

- Technology driven system

- Vibrant demography

- Demand

Image source: Click here

Major stimulus package for MSMEs and other sectors announced

Part of: GS Prelims and GS-III – Economy

In News:

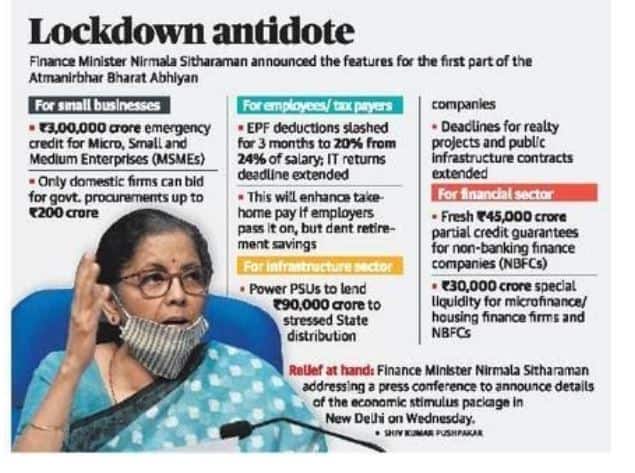

Several relief measures and packages were announced for MSMEs, salaried workers, contractors recently as part of Atma-Nirbhar Bharat Abhiyaan.

Key takeaways:

- ₹3 lakh crore collateral free loan schemes for businesses, especially MSMEs.

- For 2 lakh NPAs/stressed MSMEs, ₹20,000 crore as subordinate debt will be facilitated.

- A ₹50,000 crore equity infusion through an MSME fund of funds with a corpus of ₹10,000 crore.

- The definition of an MSME is being expanded to allow for higher investment limits and the introduction of turnover-based criteria.

For salaried workers and taxpayers

- Income tax returns for financial year 2019-20 have been extended with new due date being November 30, 2020.

- The rates of tax deduction at source (TDS) and tax collection at source (TCS) have been cut by 25% for the next year.

- Statutory provident fund (PF) payments have been reduced from 12% to 10% for both employers and employees for the next three months.

NBFCs, housing finance companies and microfinance institutions

- ₹30,000 crore investment scheme fully guaranteed by the Centre.

- Partial credit guarantee scheme worth ₹45,000 crore. First 20% of losses will be borne by the Centre.

- ₹90,000 crore liquidity injection

Contractors

- 6 month extension from all Central agencies

- Partial bank guarantees to ease cash flows

Registered real estate projects

- 6-month extension, with COVID-19 to be treated as a “force majeure” event

Employee Provident Fund

- EPF provided to low-income organised workers under the PMGKY will be extended for another three months.

- Mandatory EPF contributions are also being reduced from 12% to 10% for both employees and employers in all other establishments.

Important value additions:

Employee Provident Fund

- It is a scheme for providing a monetary benefit to all salaried individuals after their retirement.

Tax deduction at source (TDS)

- As per the Income Tax Act, any company or person making a payment, is required to deduct tax at source if the payment exceeds certain threshold limits.

Tax collection at source (TCS)

- It is the tax payable by a seller which he collects from the buyer at the time of sale.

Collateral

- It means a property or something valuable that one agrees to give to somebody if he/she cannot pay back money that he/she has borrowed.

Subordinate debt

- It is debt which ranks after other debts if a company falls into liquidation or bankruptcy.

- Such debt is referred to as ‘subordinate’, because the debt providers have subordinate status in relationship to the normal debt.

Statutory provident fund

- It is meant for employees of Government or Universities or Educational Institutes affiliated to University.

Equity

- It is the value of the shares issued by a company.

Image source: The Hindu

(MAINS FOCUS)

ECONOMY

Topic: General Studies 3:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

- Indian economy and mobilization of resources

Atma-nirbhar Bharat Abhiyan (or Self-reliant India Mission)

Context:

In his address to the nation, PM Modi observed that –

- Country should view the Covid-19 crisis as an opportunity to achieve economic self-reliance.

- He stressed on the importance of promoting “local” products.

- He called it Atmanirbhar Bharat Abhiyan (or Self-reliant India Mission)

Indian government announced a special economic package — worth Rs 20 lakh crore or 10% of India’s GDP in 2019-20 — aimed towards achieving this mission.

It includes the measures earlier announced by the finance ministry and steps taken by the Reserve Bank of India.

5 pillars

According to the PM a self-reliant India should stand on 5 pillars –

- Economy

- Infrastructure

- 21st century technology driven arrangements and system

- Demand

- Vibrant Demography

About the package:

- As mentioned above, it is worth Rs 20 lakh crore or 10% of India’s GDP in 2019-20 — which is aimed towards achieving economic self-reliance.

- The package will focus on land, labour, liquidity and laws.

- It will cater to various sections including cottage industry, MSMEs, labourers, middle class, industries, among others.

- The package will also focus on empowering the poor, labourers, migrants, etc., both from organized and unorganized sectors.

Reforms needed for achieving economic self-reliance

Several bold reforms are needed to make the country self-reliant, so that the impact of crisis such as COVID, can be negated in future.

These reforms include –

- supply chain reforms for agriculture,

- rational tax system,

- simple and clear laws,

- capable human resource and

- a strong financial system.

These reforms are expected to promote business, attract investment, and further strengthen Make in India.

Also for India to be truly self-reliant and self-confident, public investment in education, human capability and research and development has to increase.

‘Coronavirus stimulus packages’

- The US has committed to the largest rescue package by any country in pure dollar terms of USD 2.7 trillion but as percentage of GDP it trails behind Japan. The US measures work out at an estimated 13 per cent of GDP.

- Japan has announced a package equivalent to 21.1 per cent of its GDP. It has outlined USD 1.1 trillion recovery package and plans for further spending.

- Sweden – stimulus equal to 12 per cent of its GDP and Australia (10.8 per cent).

- Germany has announced a spending of around USD 815 billion, equal to 10.7 per cent of its GDP.

Connecting the dots:

- Highlight the measures announced by the current government to help boost the economy during the COVID-19 crisis.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Which of the following is the basic aim of the Atma-Nirbhar Bharat Abhiyan?

- To make India self-reliant

- To increase FDI in the country

- To increase the export capacity of the country

- To enhance the quality of educational institutes

Q.2 With regard to Atma-Nirbhar Bharat Abhiyan, consider the following statements:

- The package would connstitute 10% of India’s GDP.

- It is based upon three pillars – infrastructure, economy and innovation

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3 With regard to the recent package announced for MSMEs, consider the following:

- ₹3 lakh crore collateral free loan scheme for businesses, especially MSMEs.

- A ₹50 crore equity infusion through an MSME fund of funds.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.4 Consider the following statements with regard to the recent announcements made under Atma nirbhar Bharat Abhiyan:

- EPF contributions have been reduced from 12 % to 10%.

- EPF provided to low-income organised workers under the PMGKY will be extended for another 5 months.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 13th May 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | D |

| 3 | C |

| 4 | D |

| 5 | A |

Must Read

Perilous state: On State finances

Liquidity lifeline: On Nirmala’s MSME package

The way forward is graded opening up, not an indefinite lockdown