All India Radio, UPSC Articles

MSME sector issues and concern

Search 1st May, 2020 Spotlight here: http://www.newsonair.com/Audio-Archive-Search.aspx

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

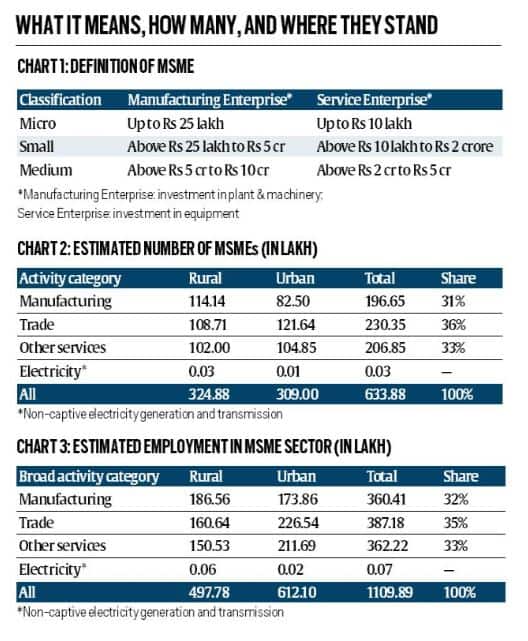

The Covid-19 pandemic has left its impact on all sectors of the economy but nowhere is the hurt as much as the Medium, Small and Micro Enterprises (MSMEs) of India. MSMEs, which make up for about 45 per cent of the country’s total manufacturing output, 40 per cent of exports, almost 30 per cent of the national GDP are stressed due to depleting internal reserves and low visibility of demand for next six months at least.

Source: Indian Express

Challenges faced by MSMEs in India

- Too small to be registered

- Even GST has its threshold and most micro enterprises do not qualify. Being out of the formal network, they do not have to maintain accounts, pay taxes or adhere to regulatory norms etc. This brings down their costs. But, in a time of crisis, it also constrains a government’s ability to help them.

- Lack of financing – Most of the MSME funding comes from informal sources. This is the reason why the Reserve Bank of India’s efforts to push more liquidity towards the MSMEs have had a limited impact.

- Banks dither from extending loans to MSMEs – because of the high ratio of bad loans; data show higher slippage for relatively bigger enterprises.

- Delays in payments to MSMEs — be it from their buyers (which includes the government also) or things like GST refunds etc.

Has Covid-19 made things worse?

MSMEs were already struggling — in terms of declining revenues and capacity utilisation — in the lead-up to the Covid-19 crisis –

- Firms do not have too much cash to wait out the crisis. This leads to job losses.

- And a big hurdle to restarting now is the lack of labour availability.

The government can provide tax relief (GST and corporate tax), give swifter refunds, and provide liquidity to rural India (say, through PM-Kisan) to boost demand for MSME products.

Credit guarantees

Loans to MSMEs are mostly given against property (as collateral) — because often there isn’t a robust cash flow analysis available — but in times of crisis, property values fall and that inhibits the extension of new loans. A credit guarantee by the government helps as it assures the bank that its loan will be repaid by the government in case the MSME falters.

In other words, instead of directly infusing money into the economy or giving it directly to MSMEs in terms of a bailout package, the government has resorted to taking over the credit risk of MSMEs should they want to remain in business. These credit guarantees should help the formal banking system meet the credit demand of the MSME sector

For instance, if the government provides say a 100% credit guarantee up to an amount of Rs 1 crore to a firm, it means that a bank can lend Rs 1 crore to that firm; in case the firm fails to pay back, the government will make good all of Rs 1 crore. If this guarantee was for the first 20% of the loan, then the government would guarantee to pay back only Rs 20 lakh.

Why: Banks had the money but were not willing to lend to the credit-starved sections of the economy, while the government itself did not have enough money to directly help the economy.

- Rs 3-lakh crore emergency credit line for MSMEs

For this purpose, a corpus of Rs 41,600 crore shall be provided by the central government spread over the current and the next three financial years to provide guarantee against loan losses.

It is for MSMEs that have an already outstanding loan of Rs 25 crore or those with a turnover less than Rs 100 crore. The loans will have a tenure of 4 years and they will have a moratorium of 12 months (that is, the payback starts only after 12 months). The loan should be taken before October 31, 2020.

Why Rs 3 lakh crore: The total outstanding loan to MSMEs by the banking and NBFC sector would be around Rs 16 to 18 lakh crore. Assuming that 80% of these loans are working capital loans where there would be a 20% incremental funding needs, that gives an amount of approximately Rs 3 lakh crore. So the government is hoping that this credit guarantee will help those MSMEs take out another loan and recover: The hope is that since these MSMEs were able to pay back before the crisis, there is no reason why they cannot after the crisis, provided they are given some extra money to survive this period.

- Subordinate debt scheme: It is worth Rs 20,000 crore, which will allow loans to MSMEs that were already categorised as “stressed”, or struggling to pay back. In this case, the government’s guarantee is not full, but partial.

- Creation of a fund with a corpus of Rs 50,000 crore to infuse equity into “viable” MSMEs, thus helping them to expand and grow. The government intends to put in Rs 10,000 crore and get others, possibly institutions like LIC and SBI, to fund the remaining amount.

- Change of definition

The government has broadened the definition of Micro, Small and Medium Enterprises (MSMEs) by revising the limit of investment in machinery or equipment and introducing a “turnover” criteria — a reform measure that seeks to reverse the traditional policy bias in favour of units staying small in order to qualify for benefits.

Now MSMEs will be judged on turnover and there will be no difference between a manufacturing MSME and a services MSME. The change in definition of MSMEs will also help because “turnover” is the more efficient way to identify an MSME and it also allows a lot of firms, especially in the services sector like mid-sized hospitals, hotels and diagnostic centres to be eligible for benefits as an MSME.

Note: New definition of MSME – U.K. Sinha committee

Connecting the Dots:

- What makes them MSMEs vulnerable to Covid-19 disruptions? Discuss long-term solutions.

- What are credit guarantees? Explain the downsides to resorting to credit guarantees.

- Essay: The biggest casualty of COVID-19 in India: MSMEs