UPSC Articles

ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

- Indian economy and mobilization of resources

Calibrated Economic Package (Atmanirbhar Bharat 3.0) – Part 1

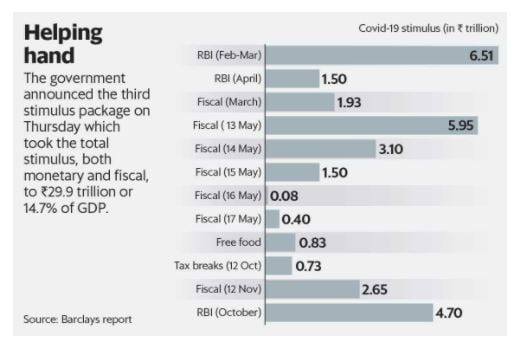

Context: On 12th November, the Union Finance Ministry made a series of announcements comprising the third stimulus package that includes additional expenditure of Rs 2.65 lakh crore.

About Previous Packages

- The first stimulus focused on containing the damage of the lockdowns by addressing the cash-flow mismatch. This was done using emergency credit facilities, macro-prudential policies, deferred taxes and regulatory forbearance. The objective was to prevent massive bankruptcies

- The second stimulus was given to primarily the government employees as they did not witness an income shock as such, with the objective of incentivising them to spend.

- Additionally, the government reiterated its commitment towards maintaining its expenditure and pushed state governments to keep up with their expenditure commitments, including those on capital outlays.

Image Source: Livemint

About the Third Package

- Atmanirbhar Bharta Rozgar Yojana: The new employees hired by the EPFO-registered organisations will receive benefits during COVID-19. If the EPFO registered establishments take in new employees or those who lost jobs earlier will get benefits from government.

- Emergency Credit Line Guarantee Scheme (ECLGS) for MSMEs, businesses, MUDRA borrowers and individuals (loans for business purposes), has been extended till March 31, 2021.

- New Credit Guarantee Scheme: A credit guarantee support scheme for health care sector and 26 sectors stressed due to COVID-19 pandemic was also launched. Under this new credit scheme, banks will be able to lend to stressed companies from 26 sectors identified by the K.V. Kamath committee earlier this year.

- Production-Linked Incentive: The PLI scheme worth ₹ 1.46 lakh crore is being offered to 10 champion sectors which will help boost the efficiency and competitiveness of domestic manufacturing. A total amount of ₹ 1.5 lakh crore has been earmarked across sectors, for the next five years.

- Pradhan Mantri Awaaz Yojana Urban: An additional outlay of ₹ 18,000 crore over budget estimate towards PM Awaaz Yojana Urban has been announced which will help ground 12 lakh houses and complete 18 lakh houses. This will create additional 78 lakh jobs and improve the production and sale of cement and steel.

- Income Tax Relief for Developers and Home Buyers for houses up to ₹ 2 crore which provides an incentive to the middle class to buy homes.

- Equity Investment in Debt Platform by NIIF: The government will make ₹ 6,000 crore equity investment in debt platform of National Investment and Infrastructure Fund (NIIF), which will help NIIF raise ₹ 1.1 lakh crore by 2025 for financing infrastructure project

- Total Support: It comes at a time when the worst seems to be over and the economy seems to be transitioning from the normalisation of economic activity stage to the growth recovery stage. The support totalled ₹2.65 trillion.

The analysis of the package will be covered in Part-2 of the article.