UPSC Articles

ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development

Corporates as Banks

Context: Internal Working Group of RBI that was constituted to “review extant ownership guidelines and corporate structure for Indian private sector banks”, submitted its report.

A Brief History of Banking in India

- The banking system in any country is of critical importance for sustaining economic growth.

- India’s banking system has changed a lot since Independence when banks were owned by the private sector, resulting in a “large concentration of resources in the hands of a few business families”.

- To achieve “a wider spread of bank credit, prevent its misuse, direct a larger volume of credit flow to priority sectors and to make it an effective instrument of economic development”, the government resorted to the nationalisation of banks in 1969 (14 banks) and again in 1980 (6 banks).

- With economic liberalisation in the early 1990s, the economy’s credit needs grew and private banks re-entered the picture.

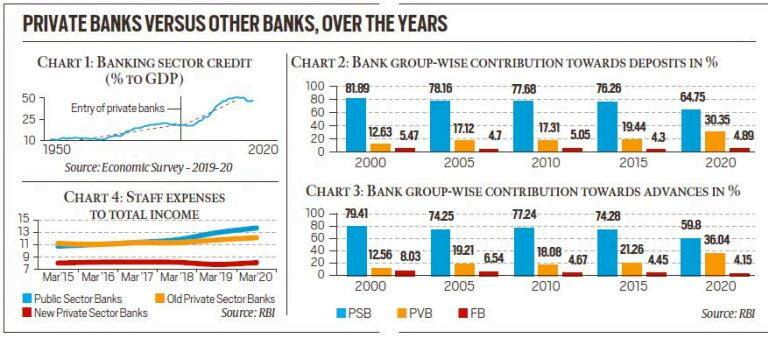

- As Chart 1 shows, the entry of Private sector post 1991 economic reforms had a salutary impact on credit growth.

Source: Indian Express

Why was the IWG constituted and what were its recommendations?

The below pointers provide the background in which the IWG was asked to suggest changes to boost private sector banking in India

- Low Balance Sheets of Banks: Even after three decades of rapid growth, “the total balance sheet of banks in India still constitutes less than 70 per cent of the GDP, which is much less compared to global peers” such as China, where this ratio is closer to 175%

- Inadequate Credit Flow to Private Sector: Moreover, domestic bank credit to the private sector is just 50% of GDP when in economies such as China, Japan, the US and Korea it is upwards of 150 per cent.

- Unable to meet Credit Demand of growing Economy: In other words, India’s banking system has been struggling to meet the credit demands of a growing economy.

- Need to bolster entire System: There is only one Indian bank in the top 100 banks globally by size. Further, Indian banks are also one of the least cost-efficient. Clearly, India needs to bolster its banking system if it wants to grow at a fast clip

- Merits of Private banks: Private banks are not only more efficient and profitable but also have more risk appetite. It is crucial to note that public sector banks have been steadily losing ground to private banks as Charts 2, 3 and 4 show.

Major Recommendation of IWG:

- Large corporate/industrial houses may be allowed as promoters of banks only after necessary amendments to the Banking Regulation Act, 1949 (to prevent connected lending and exposures between the banks and other financial and non-financial group entities); and strengthening of the supervisory mechanism for large conglomerates, including consolidated supervision.

- Well run large Non-banking Financial Companies (NBFCs), with an asset size of ₹50,000 crore and above, including those which are owned by a corporate house, may be considered for conversion into banks subject to completion of 10 years of operations and meeting due diligence criteria and compliance with additional conditions specified in this regard.

- For Payments Banks intending to convert to a Small Finance Bank, track record of 3 years of experience as Payments Bank may be considered as sufficient.

Why is the recommendation to allow large corporates to float their own banks being criticised?

- Historically, RBI has been of the view that the ideal ownership status of banks should promote a balance between efficiency, equity and financial stability.

- A predominantly government-owned banking system tends to be more financially stable because of the trust in government as an institution.

- Moreover, even in private bank ownership, past regulators have preferred it to be well-diversified — that is, no single owner has too much stake.

- More specifically, the main concern in allowing large corporates — that is, business houses having total assets of Rs 5,000 crore or more, where the non-financial business of the group accounts for more than 40% in terms of total assets or gross income — to open their own banks is a basic conflict of interest, or more technically, “connected lending”.

What is connected lending?

- Simply put, connected lending refers to a situation where the promoter of a bank is also a borrower and, as such, it is possible for a promoter to channel the depositors’ money into their own ventures.

- Connected lending has been happening for a long time and the RBI has been always behind the curve in spotting it.

- The recent episodes in ICICI Bank, Yes Bank, DHFL etc. were all examples of connected lending.

- The so-called ever-greening of loans (where one loan after another is extended to enable the borrower to pay back the previous one) is often the starting point of such lending.

- Therefore, it is prudent to keep the class of borrowers (big companies) apart from the class of lenders (banks).

- Past examples of such mingling — such as Japan’s Keiretsu and Korea’s Chaebol — came unstuck during the 1998 crisis with disastrous consequences for the broader economy.

Then why recommend it?

- The Indian economy, especially the private sector, needs money (credit) to grow. Far from being able to extend credit, the government-owned banks are struggling to contain their non-performing assets.

- Government finances were already strained before the Covid crisis. With growth faltering, revenues have plummeted and the government has limited ability to push for growth through the public sector banks.

- Large corporates, with deep pockets, are the ones with the financial resources to fund India’s future growth.

Conclusion

The dangers posed to overall financial stability by letting industrial houses have access to relatively inexpensive capital in the form of household savings through banks, howsoever legally regulated, are far too great to risk at the altar of liberalisation of ownership norms.

Connecting the dots:

- Twin Balance Sheet Problem

- Narasimham Committee Recommendations (1998)