UPSC Articles

ECONOMY/ GOVERNANCE

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

K-shaped economic recovery

Context: Economists states the prospects of a K-shaped recovery from COVID are increasing both in India and across the world.

India’s economic recovery is being characterised by three distinct forces that need to be disentangled

- Controlling COVID-19 has led to better recovery

- Successful Controlling of Virus Spread: India has broken the link between virus proliferation and mobility earlier and more successfully than many countries. Rising mobility and normalising economic activity, rather than sparking another wave of infections, have coincided with COVID cases falling by 80 per cent since September.

- Recovery much sooner than expected: Consequently, the progressive return towards pre-COVID activity levels has occurred much sooner than expected. Activity jumped back up to 95 per cent of pre-COVID levels by October, and has been inching up since

- Supportive actions by Government: Sooner than expected recovery is being complemented by the much-awaited pick-up in central government spending, which surged in November and is expected to remain strong for the rest of the year

- Recovery not led by labour and wages

- Lingering Unemployment Problem: CMIE’s labour market survey still reveals 18 million fewer employed (about 5% of the total employed) compared to pre-pandemic levels. The employment rate gradually improved till September but has weakened since then, even as the economy has progressively opened up.

- This also shows up in the PMI surveys where employment is lagging activity, and in demand for MGNREGA jobs which are still 50 per cent higher than the previous year

- Impacts recovery prospects: These labour market pressures increase risks of medium-term economic scarring, and are not incompatible with a sharper near-term rebound because the recovery appears to be led by capital and profits, not labour and wages.

- Differential Impact on Labourers: Even within labour, blue-collar workers are likely to have been disproportionately impacted vis-à-vis their white-collar counterparts.

- Greater Scale and Formalisation

- Weak Resilience of Smaller Firms: A third phenomenon is large firms have endured the crisis better and are gaining market share at the expense of smaller firms. It’s, therefore, important to interpret the data carefully because some variables will reflect this substitution effect as much as the pace of the recovery.

- Benefits of having larger firms: To the extent there is a migration of activity from the informal/SME firms to larger firms, tax collections and Sensex/Nifty earnings should get a boost, even holding the economic pie constant.

- Associated Risks: Greater scale and formalisation undoubtedly augur well for medium-term productivity but could increase near-term labour market frictions and boost pricing power.

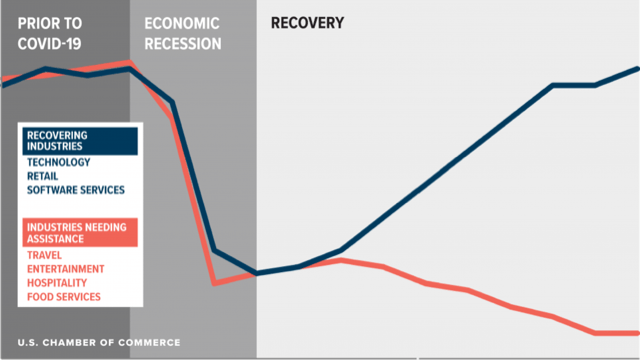

All this, therefore, increases prospects of a K-shaped recovery from COVID, a phenomenon playing out globally.

What is a K-shaped recovery?

- A K-shaped recovery happens when different sections of an economy recover at starkly different rates.

- Households at the top of the pyramid are likely to have seen their incomes largely protected, and savings rates forced up during the lockdown, increasing “fuel in the tank” to drive future consumption.

- Meanwhile, households at the bottom are likely to have witnessed permanent hits to jobs and incomes.

- Example: Passenger vehicle registrations (proxying upper-end consumption) have grown about 4 per cent since October while two-wheelers have contracted 15 per cent.

What are the macro implications of a K-shaped recovery?

- Recurring drag on the demand if labour market doesn’t heal faster

- With the top 10% of India’s households responsible for 25-30% of total consumption, one could argue consumption would get a boost as this pent-up demand expresses itself.

- But it’s important not to conflate stocks with flows, and levels with changes. Upper-income households have benefitted from higher savings for two quarters. What we are currently witnessing is a sugar rush from those savings being spent. This is, however, a one-time effect.

- To the extent that households at the bottom have experienced a permanent loss of income in the forms of jobs and wage cuts, this will be a recurring drag on demand, if the labour market does not heal faster.

- Marginal Propensity to consume if high at bottom

- To the extent that COVID has triggered an effective income transfer from the poor to the rich, this will be demand-impeding because the poor have a higher marginal propensity to consume i.e. they tend to spend (instead of saving) a much higher proportion of their income.

- Inequality and impact on productivity

- Third, if COVID-19 reduces competition or increases the inequality of incomes and opportunities, it could impinge on trend growth in developing economies by hurting productivity and tightening political economy constraints.

Way Ahead

- Plan ahead by incentivising Private Investment: Policy will, therefore, need to look beyond the next few quarters and anticipate the state of the macro economy post the sugar rush. The key, of course, is to incentivize the private sector to start re-investing and re-hiring, thereby setting the economy onto a more virtuous path.

- Manufacturing can benefit from export led growth: With manufacturing utilisation rates below 70 per cent pre-COVID, an investment revival, in turn, will depend crucially on the demand dynamics. Exports should benefit from strengthening global growth as the world gets progressively vaccinated

- Seize the Opportunity: It’s against this backdrop that the upcoming budget presents India with its New Deal moment. An unprecedented infrastructure push under the New Deal in 1935 created millions of jobs and regenerated regional economic development in the US. India must seek inspiration from this.

Conclusion

India’s faster-than-expected rebound is very encouraging. But given labour market pressures and prospects of a K-shaped recovery around the world, the economy will need to be carefully nurtured and stoked.