UPSC Articles

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

One-person Companies and why we need it

Context: In her Budget speech, Union Finance announced measures to ease norms on setting up one-person companies (OPCs).

What is an one-person company?

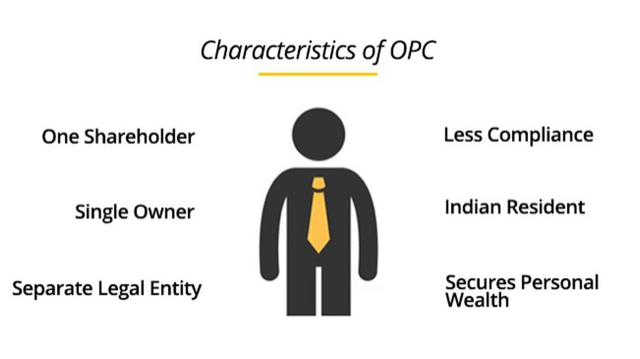

- As the name suggests, an one-person company is a company that can be formed by just one person as a shareholder.

- These companies can be contrasted with private companies, which require a minimum of two members to get going.

- However, for all practical purposes, these are like private companies.

- However, the regulatory procedures for single-person company is much more simplified in comparison to a normal company

- It is not as if there was no scope for an individual with aspirations in business prior to the introduction of OPC as a concept.

- As an individual, a person could get into business through a sole proprietorship mode, and this is a path that is still available.

What is the difference between single-person and sole proprietorship company?

- A single-person company and sole proprietorship differ significantly in how they are perceived in the eyes of law.

- For single-person company, the person and the company are considered separate legal entities.

- In sole proprietorship, the owner and the business are considered the same.

- This has an important implication when it comes to the liability of the individual member or owner. In a one-person company, the sole owner’s liability is limited to that person’s investment.

- In a sole proprietorship set-up, however, the owner has unlimited liability as they are not considered different legal entities.

Is this a new idea?

- No. Such a concept already exists in many countries.

- In India, the concept was introduced in the Companies Act of 2013.

- Its introduction was based on the suggestions of the J.J. Irani Committee Report on Company Law, which submitted its recommendations in 2005.

- Pointing out that there was a need for a framework for small enterprises, the committee said small companies would contribute significantly to the Indian economy, but because of their size, they could not be burdened with the same level of compliance requirements as large public-listed companies.

- The report, while talking about giving entrepreneurial instincts of the people an outlet in the age of information technology, said, “It would not be reasonable to expect that every entrepreneur who is capable of developing his ideas and participating in the marketplace should do it through an association of persons.”

- While making a case for one-person companies, the committee also said, “Such an entity may be provided with a simpler regime through exemptions so that the single entrepreneur is not compelled to fritter away his time, energy and resources on procedural matters.”

What was the follow up on the committee report?

- The law on one-person companies that took shape, as a result, exempted such companies from many procedural requirements, and, in some cases, provided relaxations.

- For instance, such a company does not need to conduct an annual general meeting, which is a requirement for other companies. A one-person company also does not require signatures of both its company secretary and director on its annual returns. One is enough.

- There was, however, criticism that some rules governing a one-person company were restrictive in nature. This year’s Union Budget has dealt with some of these concerns.

How many OPCs does India have?

- The number of OPCs was 2,238 (out of a total of about 1 million companies) as on March 31, 2015.

- According to data compiled by the Monthly Information Bulletin on Corporate Sector, there were 34,235 one-person companies out of a total number of about 1.3 million active companies in India, as on December 31, 2020.

- Data also show that more than half of the OPCs are in business services.

What has changed for these companies with the new measures in this year’s Budget?

- One of the measures that the Finance Minister has announced in the Budget pertains to the removal of restrictions on paid-up capital and turnover.

- The 2014 rule, which stated that a one-person company would cease to have that status once its paid-up share capital exceeds ₹50 lakh or its average turnover for the preceding three years exceeds ₹2 crore, has been lifted.

- The proposals also include, “reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days and also allow non-resident Indians (NRIs) to incorporate OPCs in India.” Earlier, only an Indian citizen and an Indian resident could start a single-person company.

- These changes come alongside a proposal to increase the capital base and turnover threshold for companies that can be classified as ‘small’, which means they can enjoy easy compliance requirements a bit longer.

- The capital base limit has been increased from ₹50 lakh to ₹2 crore, and the turnover limit has been increased from ₹2 crore to ₹20 crore.

Conclusion

- The government’s proposal is seen as a move to encourage corporatisation of small businesses.

- It is useful for entrepreneurs to have this option while deciding to start a business.