UPSC Articles

ECONOMY/ GOVERNANCE

Topic:

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation

RBI’s Financial Stability Report

Context: Recently, RBI released its latest Financial Stability Report (or FSR).

- Published twice each year, the FSR is one of the most crucial documents on the Indian economy as it presents an assessment of the health of the financial system.

What is the utility of Financial Stability Report?

- The data in FSR helps assess the state of the domestic economy, especially in a fast-changing global economy.

- The FSR also allows the RBI to assess the macro-financial risks in the economy.

- Ripple Effect of Crisis: RBI tries to understand how a shock in one part of the financial system — say the banks — is affecting another part of the system — say the companies that finance housing loans.

- Health of Banking System: As part of the FSR, the RBI also conducts “stress tests” to figure out what might happen to the health of the banking system if the broader economy worsens.

- External Risks: Similarly, it also tries to assess how factors outside India — say the crude oil prices or the interest rates prevailing in other countries — might affect the domestic economy.

Key Concerns highlighted in the recently released FSR Report

- Non-Performing Assets (NPA) of Banks

- The actual level of bad loans as of March 2021 is just 7.5% but RBI had cautioned that GNPA ratio of Scheduled Commercial Banks may increase between 9.80% to 11.22% by March 2022

- In other words, while relief provided by the RBI in the past year — cheap credit, moratoriums and facilities to restructure existing loans — has contained NPA problem and things could get worse once relief measures starts to be withdrawn.

- Credit Growth Rate

Source: Indian Express

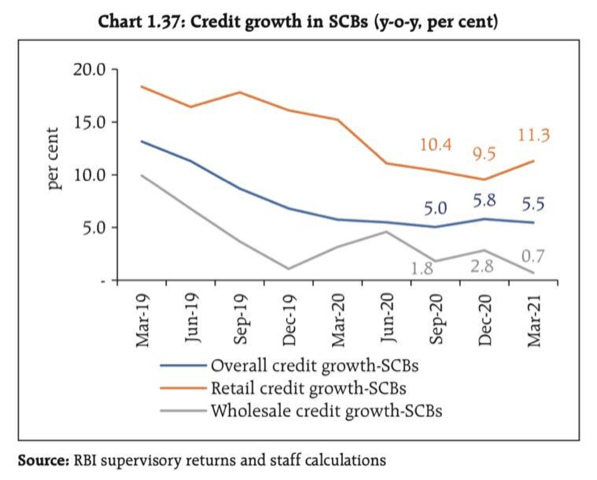

- At less than 6%, the overall rate of credit growth (blue line) is quite dismal.

- What is particularly worrisome is the negligible growth rate in wholesale credit (grey line). Wholesale credit refers to loans worth Rs 5 crore or more.

- Looking at the blue line, it is obvious how the sharp fall in credit growth happened much before the Covid pandemic hit India.

- This points to a considerable weakness in demand even before the pandemic and, in turn, suggests that recovery in credit growth may take longer than usual.

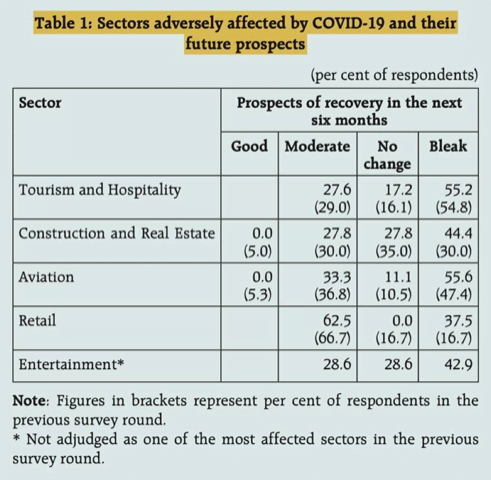

- Sectors with the bleakest prospects in the first half of this year are given in the below table

Conclusion

- Not everyone or every sector will recover at the same pace. most experts expect a K-shaped recovery from the second Covid wave.

Connecting the dots: